Short Sale Contract Template free printable template

Show details

Este contrato describe los trminos y condiciones bajo los cuales el vendedor acepta vender y el comprador acepta comprar la propiedad, sujeta a la aprobacin del prestamista del vendedor para una venta

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

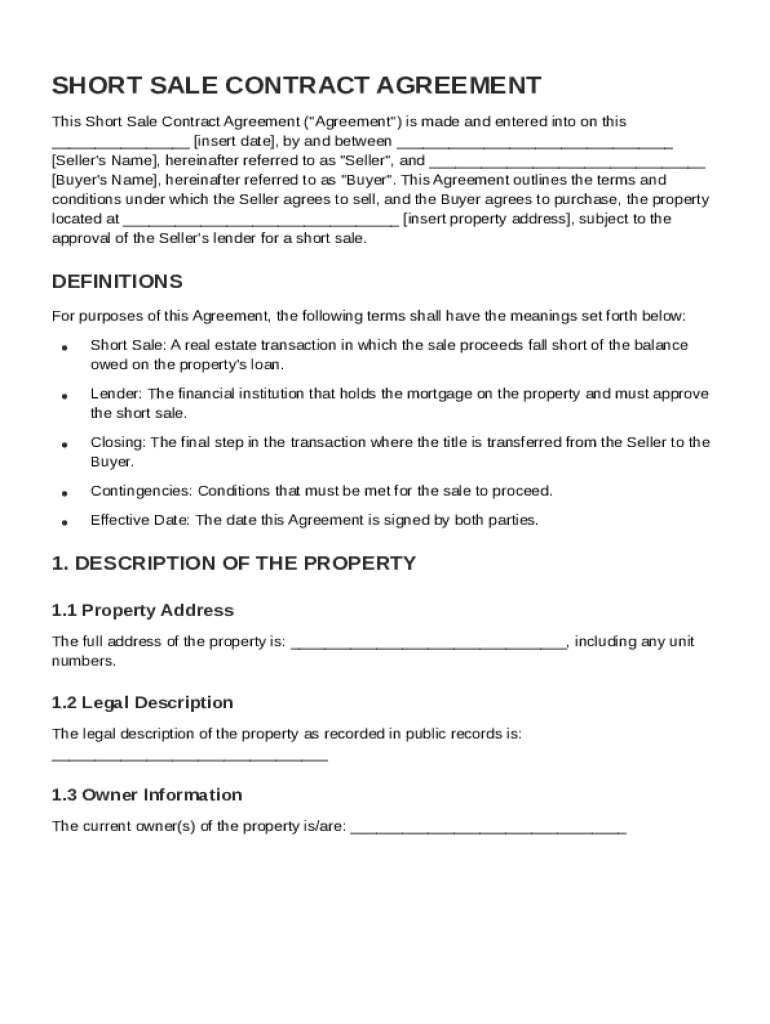

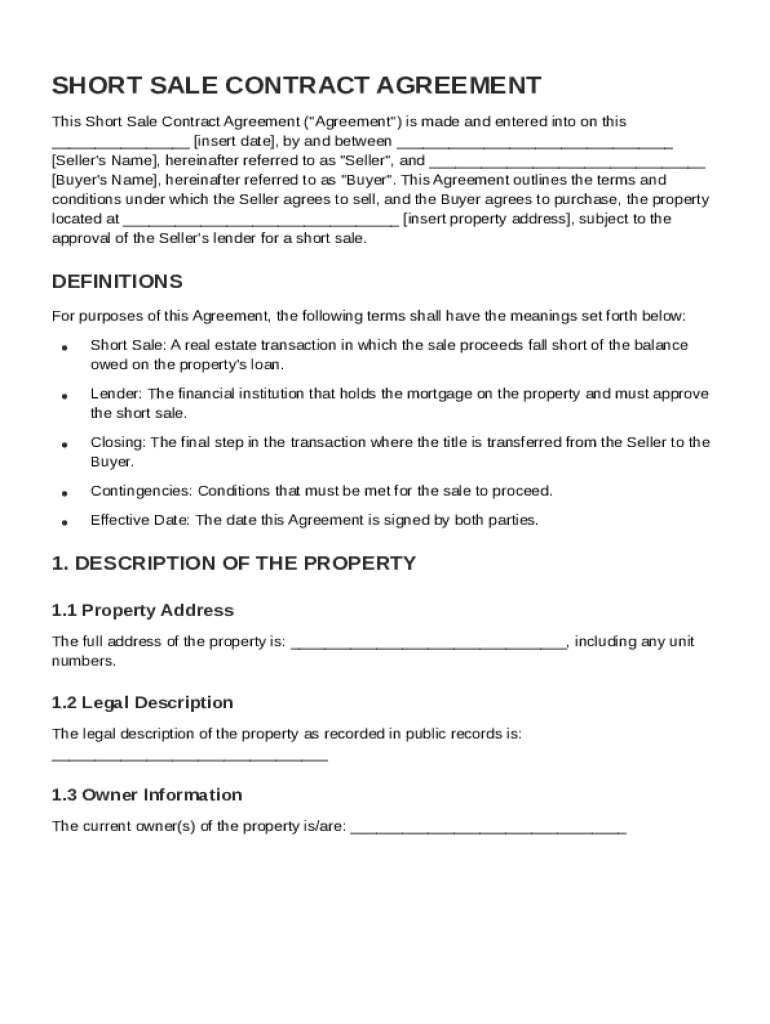

What is Short Sale Contract Template

A Short Sale Contract Template is a legal document used to outline the terms and conditions of a short sale transaction, allowing the homeowner to sell their property for less than the amount owed on the mortgage.

pdfFiller scores top ratings on review platforms

Great to have, makes PDF files easier to

edit and present when returning documents.

great service ...alittle pricey but im hoping i do enough .pdf filling out to make it payoff. either way really nice job so far, and im just starting. thanks!!

PDFFiller does the basic job of allowing one to type on a PDF file.

Love the signature… Very easy to understand and fill out - wish I found this site along time ago.

Not bad - just hard to navigate & type

onto the PDF form.

Pretty good. Like the alignment dots and lines to keep things even.

Who needs Short Sale Contract Template?

Explore how professionals across industries use pdfFiller.

Short Sale Contract Template Guide

Navigating the complexities of a short sale can be daunting, but utilizing a Short Sale Contract Template form can simplify the process significantly. This guide provides comprehensive insights into the essential components and instructions for effectively filling out this critical document.

Understanding the Short Sale Contract Agreement

-

A short sale occurs when a property is sold for less than the amount owed on its mortgage, typically requiring lender approval to proceed.

-

Each party plays a crucial role in negotiating terms, gathering documentation, and ensuring compliance with lender requirements.

-

Lender approval is critical; without it, the short sale transaction cannot be completed. It requires providing documentation that substantiates the seller's financial hardship.

What are the key components of the Short Sale Contract?

-

Understanding key terms is vital for clarity and compliance. This includes:

-

It’s crucial to know how short sales affect credit ratings and future financing.

-

Lenders must review and approve the sale while assessing the implications of accepting less than owed.

-

Understanding the closing process ensures all parties are prepared to finalize the transaction.

-

Contingencies outline the conditions which must be met for the contract to stay valid.

-

The effective date marks the official agreement commencement, influencing timelines for both buyers and sellers.

-

Accurate property information is essential. This encompasses:

-

Using correct formatting ensures identification and legal recognition in property records.

-

An accurate legal description prevents disputes over ownership and property boundaries.

-

Correct owner information verifies that the sale is conducted legally and ethically.

What are the sale terms and conditions?

-

Negotiating a sale price is crucial, as it directly influences lender approval and buyer satisfaction. Factors include market conditions and lender guidelines.

-

An earnest money deposit shows the buyer's serious intent and is usually held in escrow until closing.

-

Financing contingencies protect buyers by ensuring financing is in place before finalizing the sale, detailing conditions and timelines.

How do you fill out the Short Sale Contract Template?

-

Start by gathering necessary documents and ensuring all involved parties understand the terms before filling the template.

-

Avoid leaving fields blank and ensure all signatures are obtained. Review for typos and errors.

-

Leverage the interactive tools on pdfFiller for guidance and ease of use while filling the form.

How will you edit and manage your Short Sale Contract on pdfFiller?

-

Cloud-based editing eliminates the need for additional software, allowing users to make changes from any device.

-

eSignatures streamline the signing process, ensuring compliance and reducing the turnaround time for signatures.

-

Use collaboration tools to facilitate feedback and revisions among team members safely and effectively.

How to fill out the Short Sale Contract Template

-

1.Begin by downloading the Short Sale Contract Template from a reliable source.

-

2.Open the document in pdfFiller to access the editing features.

-

3.Fill in the date of the agreement at the top, clearly indicating when the contract takes effect.

-

4.Input the names and addresses of the seller (homeowner) and buyer, ensuring all parties are accurately identified.

-

5.Provide a detailed description of the property being sold, including the address and any relevant identifiers.

-

6.Specify the sale price that the buyer is offering, acknowledging that it is less than the remaining mortgage balance.

-

7.Include terms and conditions regarding the approval of the sale by the lender, as this is crucial for a short sale.

-

8.Indicate any contingencies, such as inspections or financing, that must be met for the contract to remain valid.

-

9.Review the completed contract for accuracy and completeness, making sure all parties agree on the terms.

-

10.Finally, have all parties sign the document to formalize the agreement, and save a copy for future reference.

How do you write a short contract?

How to draft a contract in 13 simple steps Start with a contract template. Understand the purpose and requirements. Identify all parties involved. Outline key terms and conditions. Define deliverables and milestones. Establish payment terms. Add termination conditions. Incorporate dispute resolution.

When forms of a sales contract other than those approved by the Colorado Real Estate Commission are used in a transaction, they may be prepared by?

An "Attorney Form" is a form drafted by a licensed Colorado attorney representing the Broker , the Employing Broker , or the Brokerage Firm . A Broker may only use an Attorney Form if a Commission -Approved Form does not exist or is not appropriate for the transaction.

How do you write a sales agreement?

How do I write a Sales Agreement? Specify your location. Provide the buyer's and seller's information. Describe the goods and services. State the price and deposit details (if applicable) Outline payment details. Provide delivery terms. Include liability details. State if there's a warranty on the goods.

How to set up a contract template?

How to write a contract agreement in 7 steps. Determine the type of contract required. Confirm the necessary parties. Choose someone to draft the contract. Write the contract with the proper formatting. Review the written contract with a lawyer. Send the contract agreement for review or revisions.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.