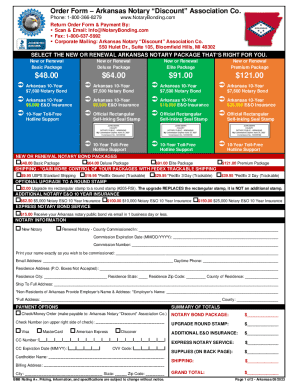

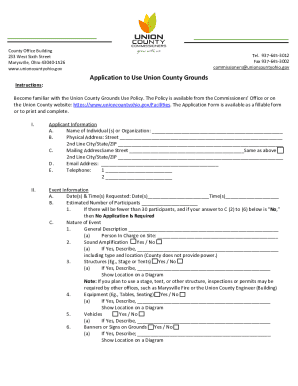

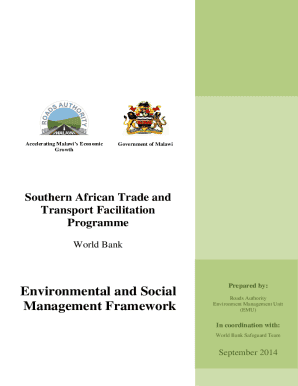

Small Business Loan Contract Template free printable template

Show details

This document outlines the terms and conditions for a loan agreement between a lender and a borrower for business purposes, including loan details, repayment terms, financial covenants, and default

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Small Business Loan Contract Template

A Small Business Loan Contract Template is a formal agreement detailing the terms of a loan between a lender and a small business borrower.

pdfFiller scores top ratings on review platforms

Outstanding product - very versatile and easy to use.

I love the program. The smart folder...not a fan. Do not like that we have to "tag" them and I would prefer to just make and name my own folders and move PDF docs into them as I wish (like windows mail).

Works perfectly; I can easily fill-in any PDF forms. This is especially handy for IRS tax forms.

Need an option to rotate the PDF like simple cropping functions on picture apps.

I like using the program the only downfall for me is unless I pay more for the subscription I'm not allowed to use the premier options. That is my opinion It's already expensive for me since I really only use it for tax returns.

Fastastic to be able to upload a form and fill it in on the screen. I like the fact that I can save it and go back to were I left off.

Who needs Small Business Loan Contract Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Small Business Loan Contracts on pdfFiller

This guide will provide you with essential insights on how to effectively use a Small Business Loan Contract Template form form. Whether you are looking to finance your venture or streamline your loan documentation, this resource is designed to help you navigate your options efficiently.

What is the importance of small business loans?

Small business loans play a crucial role in fostering entrepreneurship and sustaining growth. They provide the necessary capital to start or expand business operations, allowing entrepreneurs to seize market opportunities.

-

By obtaining financing, small businesses can invest in inventory, hire staff, or enhance their facilities, all of which are vital for expansion.

-

Loans can help cover day-to-day expenses such as rent, utilities, or payroll, ensuring smooth operations without financial strain.

-

Access to cash enables businesses to invest in marketing strategies, which is essential for attracting new clients and increasing revenue.

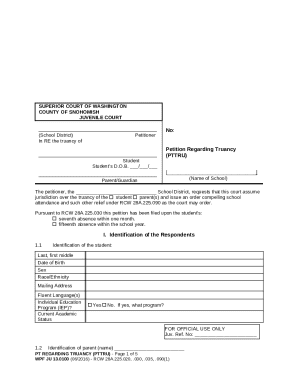

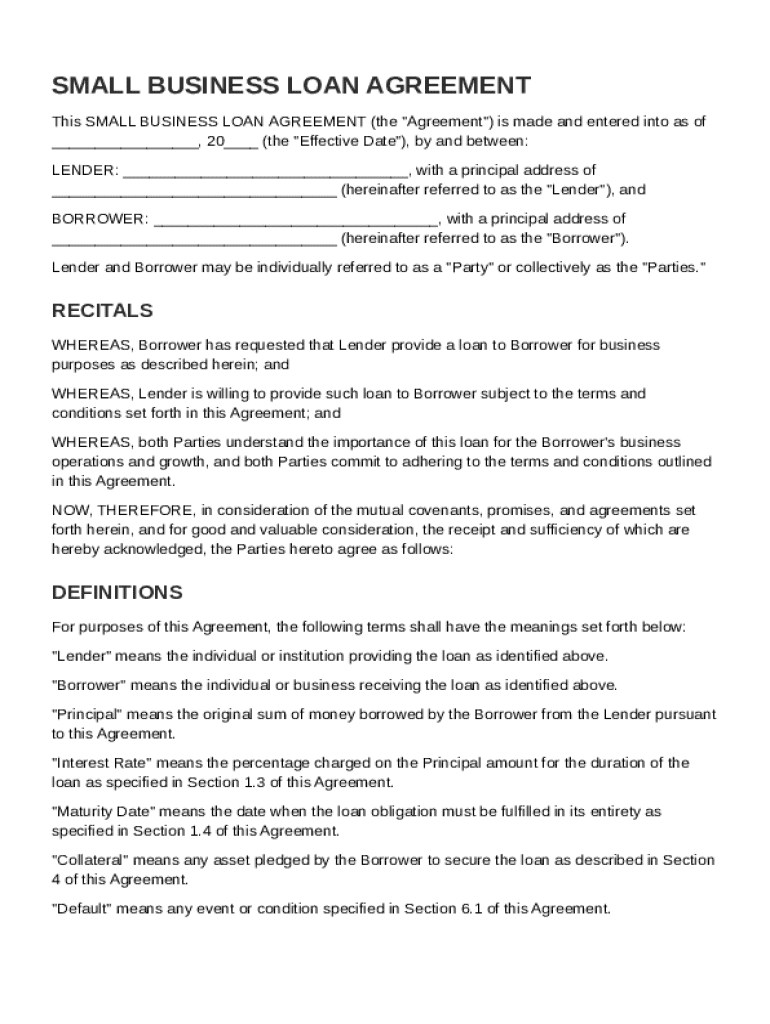

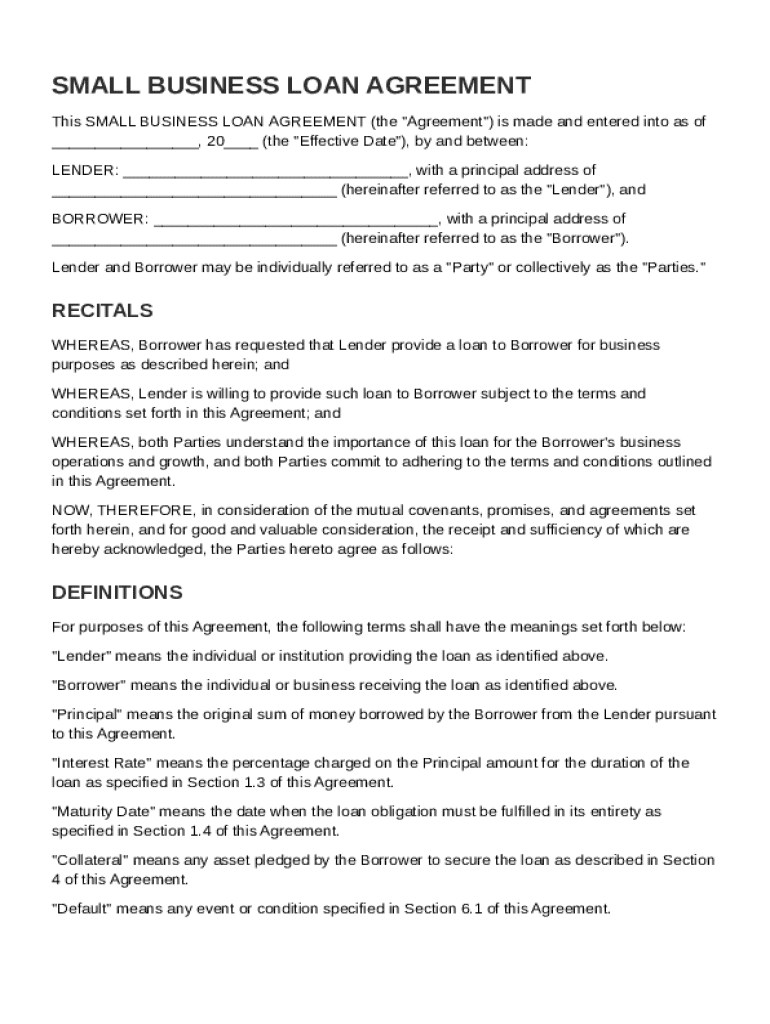

What are the key components of a small business loan contract?

A well-structured loan contract outlines all essential details of the borrowing agreement. Understanding these components can prevent misunderstandings and protect the interests of both the lender and borrower.

-

Clearly identify both the lender and borrower to avoid any legal confusion.

-

Specify the total amount borrowed and the repayment schedule, which clarifies the borrower's obligations.

-

The contract should stipulate the interest rate and any other payment structures agreed upon.

-

Indicates the final date for repayment, ensuring that both parties are aligned on timelines.

-

Identify any assets that will be held as security against the loan, adding a layer of protection for the lender.

-

Outline the circumstances that could lead to default, providing clarity on consequences for missed payments.

How can pdfFiller help you navigate the loan contract template?

Utilizing pdfFiller simplifies the process of filling and editing loan contracts. With a user-friendly interface, pdfFiller allows entrepreneurs to customize templates efficiently.

-

With pdfFiller, you can easily edit various sections of your loan agreement to fit your unique business needs.

-

Follow guided instructions on filling out the Small Business Loan Agreement form to avoid common pitfalls.

-

Interactive tools let you tailor the template, ensuring your contract accurately reflects your situation.

-

Once completed, you can save and share loan agreements directly from the platform, making collaboration seamless.

What legal considerations should you be aware of in loan agreements?

Understanding the legal framework surrounding loan agreements is paramount. Getting familiar with key legal terms empowers borrowers to navigate contracts effectively.

-

Terms like 'default', 'collateral', and 'interest rate' should be clearly understood to avoid legal complications.

-

Failing to understand the implications of violating contract terms can lead to serious legal repercussions.

-

It’s essential to remember that the content provided is not a substitute for legal counsel.

-

Consult with a legal professional before signing a loan agreement to ensure all aspects are clear and acceptable.

How do you fill out the loan agreement step by step?

Filling out a loan agreement properly ensures that all parties understand their obligations. This section outlines the process of completing the agreement from start to finish.

-

Begin by entering the parties involved and the effective date of the agreement.

-

Clearly state the principal amount being borrowed along with a breakdown of any fees.

-

Accurately declare the interest rate based on your agreement with the lender.

-

If applicable, declare any collateral that will secure the loan and outline its terms.

-

Conclude by setting the maturity date and any necessary closing statements.

How can you finalize and manage your loan document?

Once your loan document is filled, it's crucial to manage it properly. pdfFiller’s features make this process secure and user-friendly.

-

Always review your completed documents for accuracy before signing to avoid errors.

-

Utilize pdfFiller's eSigning tool for rapid and secure contract signing.

-

Share documents with team members for collaborative management, streamlining your workflow.

-

Adopt good practices for managing your loan documents post-signature, including secure storage and organization.

How to fill out the Small Business Loan Contract Template

-

1.Open the Small Business Loan Contract Template on pdfFiller.

-

2.Review the template to understand its sections, such as loan amount, interest rate, repayment period, and responsibilities.

-

3.Fill in the borrower's name and contact information in the designated fields.

-

4.Enter the lender's details including name and address.

-

5.Specify the loan amount being requested by the borrower.

-

6.Input the agreed-upon interest rate applicable to the loan.

-

7.Define the repayment schedule, including due dates and the total repayment amount.

-

8.Include any collateral or security details if required.

-

9.Review the terms for default and late payments, making necessary adjustments.

-

10.Verify all information is accurate before saving the document.

-

11.Provide space for both parties to sign and date the contract.

-

12.Finalize and save the completed contract, ready for distribution to involved parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.