Venture Capital Contract Template free printable template

Show details

This document outlines the terms and conditions under which an investor commits capital to a company in exchange for equity interests, detailing the investment terms, representations, governance rights,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Venture Capital Contract Template

A Venture Capital Contract Template is a legal document outlining the terms and conditions between investors and startups regarding equity financing.

pdfFiller scores top ratings on review platforms

bruh

great experience

Thank you I appreciate the service

Thank you I appreciate the service

So Far, So Good!

So far everything I've needed I was able to do with the platform. I'm hoping to do more to get the full experience of this site.

I did what I needed to do and it works…

I did what I needed to do and it works 100%

Easy to Use!

Love that I can erase on pages, delete pages./reorder etc. Easy to use

The fact that you really can cancel

The fact that you really can cancel

Who needs Venture Capital Contract Template?

Explore how professionals across industries use pdfFiller.

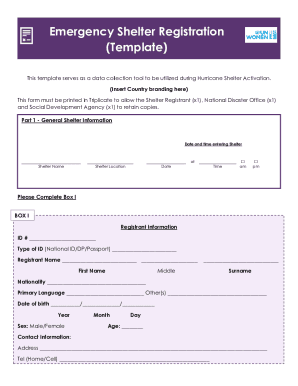

How to fill out a Venture Capital Contract Template form

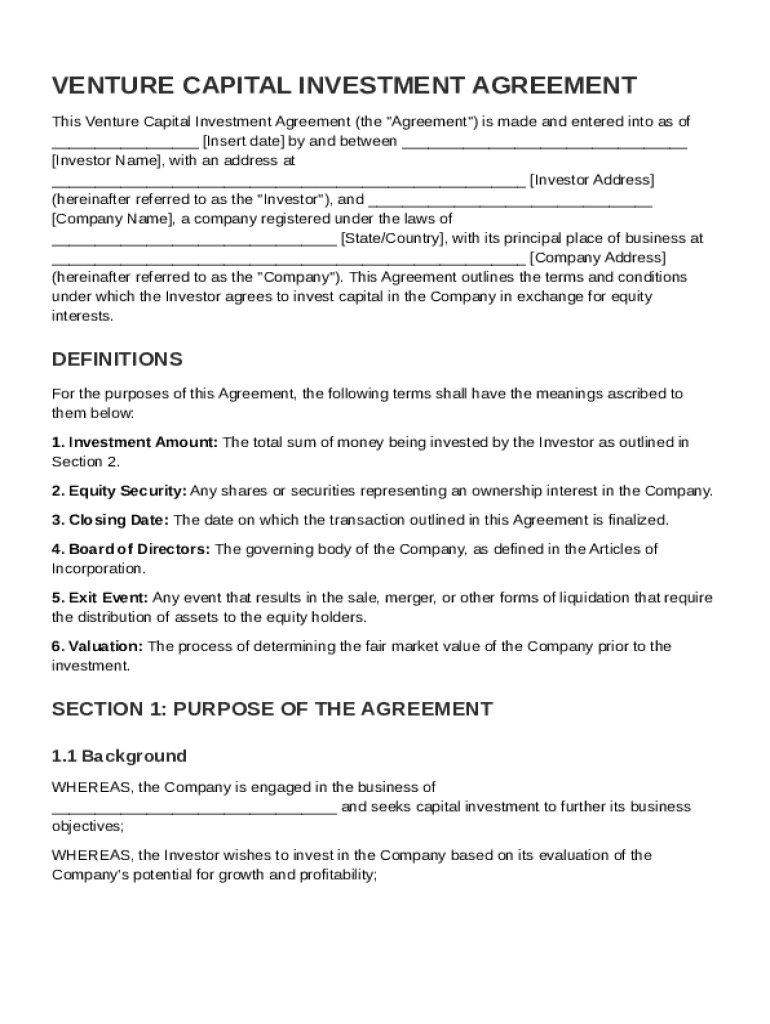

What is a Venture Capital Investment Agreement?

A Venture Capital Investment Agreement outlines the terms between investors and startups or small companies seeking funding. This document acts as a legally binding contract, detailing crucial elements like the investment amount, equity security, and closing dates. Having a formal agreement is essential for protecting both parties' interests and clarifying expectations.

-

The total money that the investor commits to invest in the company.

-

The type of ownership stake granted in exchange for the investment.

-

The date by which the investment transaction must be finalized.

What are the essential components of the agreement?

Understanding the essential components of a Venture Capital Investment Agreement is critical. In addition to standard sections, the agreement includes detailed information about all parties involved, the terms governing the investments, and clear exit strategies for potential future liquidations or sales.

-

Includes the name and address of the investor, ensuring proper identification and communication.

-

Captures the name, registration details, and address to formally recognize the entity receiving funding.

-

Breaks down the amount invested and explains the valuation process, clarifying how the investment figures were determined.

-

Defines exit events, outlining how and when investors can expect returns or liquidity.

How do you fill out the Venture Capital Investment Agreement?

Accurately filling out the Venture Capital Investment Agreement is paramount for its validity. Each field must be completed with thoroughness, ensuring all parties understand their obligations and rights.

-

Clearly state the total investment amount and the corresponding equity security to avoid ambiguity.

-

Incorporate all relevant company details to establish proper context for the investment.

-

Signify the closing date for the agreement and document all signatory dates to confirm acceptance of terms.

How can you edit and customize your agreement?

Having flexibility in modifying your agreement is critical as terms may shift based on negotiations. Using pdfFiller tools allows for seamless editing of pre-filled fields to better match individual circumstances.

-

Make adjustments to sections of the template that don’t accurately reflect your unique situation.

-

Utilize team collaboration tools to enable multiple stakeholders to review and edit the document simultaneously.

What best practices exist for managing your Venture Capital Agreement?

An effective management plan for your agreement enhances compliance and security. Regularly reviewing terms can help adapt to changes in the market or legal frameworks.

-

Use cloud platforms like pdfFiller for secure storage and easy access to your documents.

-

Conduct periodic assessments of your agreement to ensure it aligns with current business and legal needs.

-

Stay updated with compliance laws specific to your region to avoid legal pitfalls.

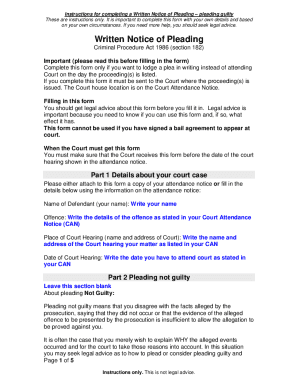

What legal considerations and compliance should you be aware of?

Legal compliance is foundational for any venture capital agreement. Ignoring regional laws can result in setbacks; thus, ensuring legal review is necessary before finalizing agreements.

-

Different countries have unique laws affecting investment agreements. Familiarize yourself with them for validity.

-

Seeking legal expertise can help interpret complex terms and ensure compliance with all obligatory regulations.

-

Access local or international compliance checks tailored to your investment nature.

How can pdfFiller’s features streamline document management?

pdfFiller provides various tools to enhance document management, ensuring streamlined processes for investment agreements. Features like electronic signatures and tracking capabilities can save time and help maintain organization.

-

Simplifies the signature process making it easy for all parties to finalize agreements.

-

Allows users to monitor the status of their agreements and any changes made for easy management.

-

Further enhances document management by collaborating with other platforms and services.

What can we learn from examples of successful Venture Capital Agreements?

Analyzing successful agreements can provide great insights into best practices and effective strategies. Case studies reveal how well-drafted agreements have significantly shaped investment outcomes.

-

Review specific cases that illustrate emotional and financial impacts of well-structured agreements.

-

Distill strategies and tactics from success stories that could apply to your investment opportunities.

-

Identify similarities between your own circumstances and those of successful ventures in the same sector.

How to fill out the Venture Capital Contract Template

-

1.Download the Venture Capital Contract Template from pdfFiller.

-

2.Open the template in pdfFiller's editing tool.

-

3.Begin by filling out the header section with the names and contact details of both parties.

-

4.Specify the investment amount being offered by the venture capitalist.

-

5.Outline the equity percentage that the startup will offer in return for the investment.

-

6.Include the valuation of the startup, if applicable, in the designated section.

-

7.Detail any special conditions or rights that are part of the investment, such as board seats or liquidation preferences.

-

8.Review the terms related to the use of funds to ensure clarity.

-

9.Add the signatures of all relevant parties at the end of the document for legal validity.

-

10.Save your completed Investment Contract and download it as a PDF.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.