VA 26-1805 2025-2026 free printable template

Get, Create, Make and Sign va form 26 1805

Editing va 1805 online

Uncompromising security for your PDF editing and eSignature needs

VA 26-1805 Form Versions

How to fill out va 1805 form

How to fill out va form 26-1805

Who needs va form 26-1805?

A Comprehensive Guide to VA Form 26-1805

Understanding VA Form 26-1805

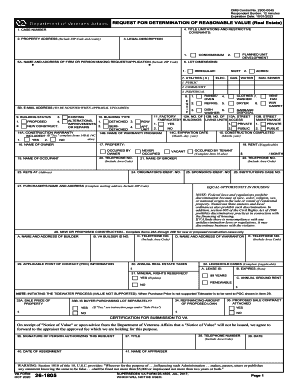

VA Form 26-1805, officially known as the 'Request for Determination of Reasonable Value', is a crucial document in the Veterans Affairs loan process. This form is essential for veterans looking to secure a VA-backed home loan, helping to establish the property's fair market value which is critical for lenders.

The primary purpose of VA Form 26-1805 is to facilitate the appraisal process that veterans must undergo when applying for a mortgage. It assures lenders that the property’s value aligns with the requested loan amount, ultimately safeguarding both the borrower and the lender. Understanding this form is imperative for any veteran embarking on homeownership.

Veterans, active-duty service members, and eligible surviving spouses must utilize this form if they wish to access VA home loans. It’s key for individuals wanting to leverage their military service for home financing benefits to familiarize themselves with this document.

Key sections of VA Form 26-1805

VA Form 26-1805 consists of four major sections, each critical for the thorough assessment of the loan application:

Each section plays a vital role in the overall evaluation of a veteran's loan application and must be completed meticulously.

Step-by-step instructions for completing VA Form 26-1805

Completing VA Form 26-1805 is straightforward when broken down into a series of steps. Let's explore each step in detail:

Follow these steps closely to ensure your form is completed correctly and increase the likelihood of a seamless loan processing experience.

Tips for submitting VA Form 26-1805

Submitting VA Form 26-1805 can be done either electronically or via traditional mail. Here are some best practices to consider:

Common pitfalls to avoid include neglecting to sign the form and submitting incomplete information, as these can significantly slow down your application process.

Editing and managing VA Form 26-1805 with pdfFiller

pdfFiller provides a user-friendly platform for editing and managing your VA Form 26-1805. Here's how you can make the most of this tool:

By using pdfFiller, you ensure that your submission of VA Form 26-1805 is both accurate and efficient.

Tracking your VA Form 26-1805 submission

Once you've submitted your VA Form 26-1805, tracking its progress is important. Here’s how to do it effectively:

Proactive communication can help prevent further delays in the processing of your loan application.

Frequently asked questions about VA Form 26-1805

Navigating VA Form 26-1805 may prompt various questions regarding its use. Here are some common inquiries:

These FAQs address critical concerns, ensuring a smoother experience with VA Form 26-1805.

Success stories: Users' experiences with VA Form 26-1805

Many veterans have shared positive experiences regarding their journey with VA Form 26-1805. Here are a couple of insights from users:

These testimonials highlight how pdfFiller can facilitate a more efficient process for veterans navigating the complexities of VA Form 26-1805.

People Also Ask about va appraisal form

What is a VA 1805 form?

What is the VA 26 1805 form?

What is the VA surviving spouse form?

Do I qualify for a VA loan if my father was in the military?

How long does a VA reconsideration of value take?

What are VA appraisals called?

Does VA require bedroom photos on appraisal?

What is the difference between a regular appraisal and a VA appraisal?

Can VA buyer pay more than appraised value?

What is VA form 1805?

What is a VA form 1805?

What is the VA 1805 form?

What is the VA certificate of reasonable value?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my va 26 1843 in Gmail?

How do I execute va form 26 1805 1 online?

Can I create an electronic signature for signing my 261805 in Gmail?

What is va form 26-1805?

Who is required to file va form 26-1805?

How to fill out va form 26-1805?

What is the purpose of va form 26-1805?

What information must be reported on va form 26-1805?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.