Get the free Financial Lasting Power of Attorney Template

Show details

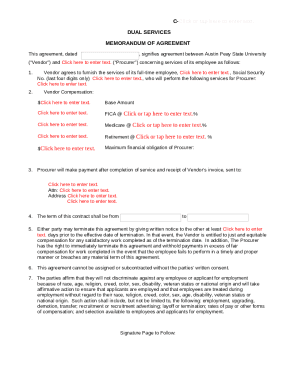

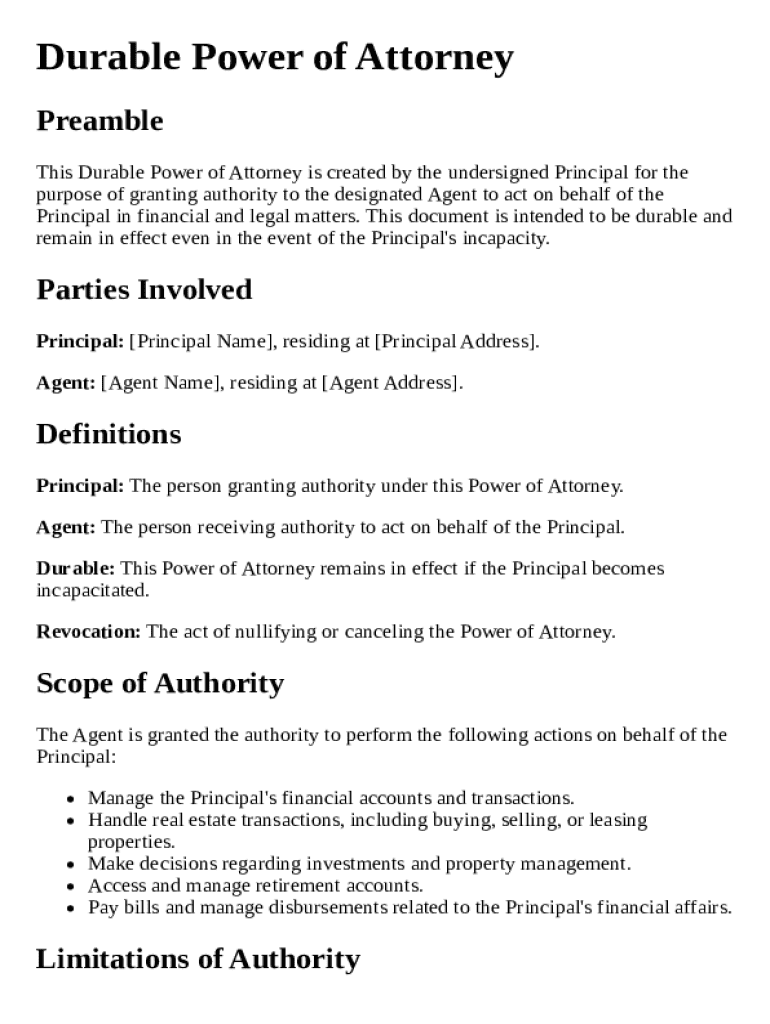

This document grants authority to an Agent to act on behalf of the Principal in financial and legal matters, remaining in effect even if the Principal becomes incapacitated.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is financial lasting power of

A financial lasting power of attorney is a legal document that allows an individual to delegate financial decision-making authority to another person in the event they become incapacitated.

pdfFiller scores top ratings on review platforms

i'm not a computer literate person and i get confused when i have to email something

I'M disabled, and confined to a wheelchair. I'm not able to get out, and look for a place that will agree to fax things. I have arthritis real bad, and it is painful to hold a pen, and fill things out. The ability to do all of this for my nurses, and care-provider's, with PDF filler online is a true blessing. Thank you, so much!

I am able to add text and change Doc,s with ease

SO FAR I HAVE FOUND PDF FILLER TO BE EXCELLENT

AT FIRST I WAS NERVOUS IN USING THIS PROGRAM AND I WAS NOT INTIMIDATED BY THIS PROGRAM

Realistically I would not have the financial capability nor want to pay for this reoccurring payment unless I had a business of my own.

Who needs financial lasting power of?

Explore how professionals across industries use pdfFiller.

Long-Read How-to Guide on Financial Lasting Power of Attorney

A financial lasting power of attorney (LPA) is a crucial legal document that enables you to appoint someone to make financial decisions on your behalf. This guide will help you understand the key aspects of creating and managing your LPA, ensuring that your financial interests are safeguarded even if you become incapacitated.

What is financial lasting power of attorney?

The Financial Lasting Power of Attorney is a legal instrument that gives one person the authority to act on another's behalf concerning financial matters. Its primary purpose is to ensure that your financial affairs continue to be managed properly if you become unable to do so.

-

It allows the appointed agent to manage your finances in case of your incapacity, covering everything from banking to real estate decisions.

-

The authority granted remains in effect even if you are incapacitated, making it a vital component of long-term financial planning.

Who are the key parties involved?

In an LPA, there are typically two primary roles: the principal and the agent. Understanding the responsibilities and rights of each can help prevent disputes and ensure smooth operation.

-

The principal is the individual who creates the LPA and grants authority to the agent.

-

The agent is the trusted individual or individuals who receive the authority to act on behalf of the principal.

-

It's crucial to choose an agent who you trust fully, as they will have significant control over your finances.

What are the key terms related to the durable power of attorney?

Understanding the vocabulary around a financial lasting power of attorney can aid in making informed decisions. Here are the essential terms you should know.

-

This term refers to the individual who is empowered to make decisions.

-

The agent is authorized to act and make decisions on behalf of the principal.

-

This indicates that the authority remains in effect even if the principal becomes incapacitated.

-

Revocation is the process through which the principal can cancel the LPA, provided they are still capable.

What powers are granted?

The LPA allows the agent to perform a variety of tasks to manage finances effectively. It is critical that both parties understand the extent of this authority.

-

The agent can handle all routine banking transactions, ensuring bills are paid timely.

-

This includes buying, selling, or leasing property as needed by the principal's financial strategy.

-

The agent may also make investment choices that can lead to financial growth.

-

Managing these accounts to provide for the principal during their retirement years.

-

The agent is responsible for handling ongoing expenses, avoiding late payments or penalties.

What limitations exist on the agent's authority?

While the agent has extensive powers, there are key limitations designed to protect the principal's best interests. It's important to understand these boundaries.

-

Agents generally cannot make medical choices, as this falls under a separate category of authority.

-

Alterations to designated beneficiaries typically require written consent from the principal.

-

The agent must always act in the principal's best interests, adhering to ethical standards.

When does the financial lasting power of attorney take effect?

Understanding when the powers granted by the LPA begin and when they end is crucial for both parties. Clarity on these timelines helps avoid potential disputes.

-

The LPA can be signed to take effect immediately upon signing, ensuring timely financial management.

-

The authority typically remains in effect until it is revoked by the principal.

-

A clear revocation clause must be included, detailing how the principal can cancel the LPA.

What legal compliance is required?

Ensuring that the LPA complies with legal standards is essential for its validity. Knowledge of relevant laws helps in safeguarding the interests of all parties involved.

-

Each state has specific laws regarding LPAs, making it vital to choose the appropriate jurisdiction.

-

Ensuring that the document adheres to legal standards protects its validity and enforceability.

-

Any modifications to the LPA must be made in accordance with legal requirements to ensure continued validity.

How can pdfFiller help you manage your durable power of attorney?

pdfFiller offers comprehensive tools for creating, editing, and managing your durable power of attorney documents. This user-friendly platform simplifies the often-complex process of documentation.

-

Easily customize your financial documents with a few clicks.

-

Utilize a secure and efficient process for signing documents digitally.

-

Share documents and work collaboratively to mitigate issues.

-

Access your documents anywhere, ensuring you are always prepared.

How to navigate the application process?

Navigating the application process can feel daunting. However, with the right steps and precautions, you can secure your financial future safely.

-

Ensure you have all necessary documentation ready, and follow the prescribed steps methodically.

-

Avoid common mistakes such as incomplete signatures and missing witness information.

-

Utilize interactive tools on pdfFiller to guide you through the process seamlessly.

Preparing for financial planning appointments

When preparing for your financial planning sessions, adequate preparation ensures you receive the most out of your meetings. Here’s how to gear up effectively.

-

Gather all relevant financial documents ahead of time to facilitate productive discussions.

-

Prepare insightful questions that will help you better understand your financial landscape.

-

Think about future scenarios, including potential incapacity, and how they relate to your financial planning.

How to fill out the financial lasting power of

-

1.Visit pdfFiller's website and log in or create an account to access their forms.

-

2.Search for 'financial lasting power of attorney' in the templates section.

-

3.Select the appropriate template and open it in the editor.

-

4.Fill in your personal information such as your name, address, and contact details at the designated fields.

-

5.Designate an attorney-in-fact by entering their personal information where prompted, ensuring they are trustworthy.

-

6.Specify the powers you wish to grant to your attorney-in-fact, referencing any necessary financial decisions, such as managing bank accounts or property.

-

7.Review the document for accuracy, ensuring all necessary fields are filled out completely.

-

8.Sign the document electronically and, if required, have your attorney-in-fact sign as well.

-

9.Download or print the completed document for your records and consider having it notarized for added legal validity.

-

10.Store the document in a safe place and inform your attorney-in-fact about its existence and contents.

What is a Financial Lasting Power of Attorney Template?

A Financial Lasting Power of Attorney Template is a legal document that allows you to appoint someone to manage your financial affairs if you become unable to do so yourself. This template ensures that your financial decisions are handled according to your wishes, providing clarity and preventing potential disputes. Using a Financial Lasting Power of Attorney Template simplifies the process, making it easier for individuals to create robust and legally compliant documents.

Why do I need a Financial Lasting Power of Attorney Template?

Having a Financial Lasting Power of Attorney Template is essential for anyone wanting to ensure their financial matters are taken care of according to their preferences. It provides you with peace of mind knowing that in case of incapacitation, someone you trust can step in and manage your finances without any legal complications. This template serves as a safeguard, making it easier for your chosen agent to act on your behalf without delays or additional legal hurdles.

How can I customize a Financial Lasting Power of Attorney Template?

Customizing a Financial Lasting Power of Attorney Template is straightforward and can be done by specifying the powers you wish to grant your agent. You can also include conditions or limitations regarding certain transactions to tailor the document to your needs. Utilizing pdfFiller's platform, you have access to tools that enable easy modifications, ensuring your Financial Lasting Power of Attorney Template reflects your unique requirements and intentions.

Is a Financial Lasting Power of Attorney Template legally binding?

Yes, a Financial Lasting Power of Attorney Template is legally binding as long as it meets the regulations of your jurisdiction. To ensure its validity, the document usually needs to be signed in the presence of witnesses or a notary. pdfFiller helps you navigate these legal requirements by providing templates that are compliant with local laws, making sure your Financial Lasting Power of Attorney Template is enforceable.

What must I include in a Financial Lasting Power of Attorney Template?

A Financial Lasting Power of Attorney Template should include essential details such as your personal information, the agent's information, and a clear statement of the powers being granted. It’s also important to outline any limitations or specific circumstances under which the authority becomes effective. By using pdfFiller, you can ensure that your Financial Lasting Power of Attorney Template is comprehensive and adheres to legal standards.

Can I revoke a Financial Lasting Power of Attorney Template?

Yes, you have the right to revoke a Financial Lasting Power of Attorney Template at any time as long as you are mentally competent. Revocation should be done in writing, and it’s best practice to notify your agent and update any relevant institutions or parties. With pdfFiller, you can easily manage and update your documents, ensuring that your financial preferences remain current.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.