Get the free Financial Power of Attorney Template

Show details

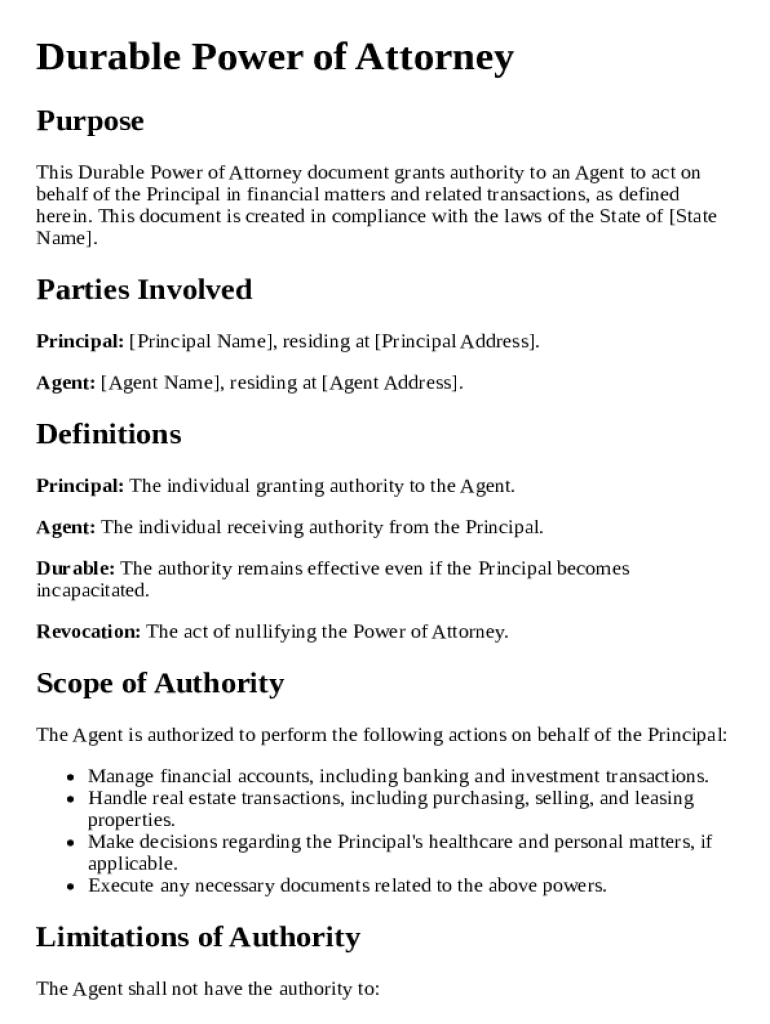

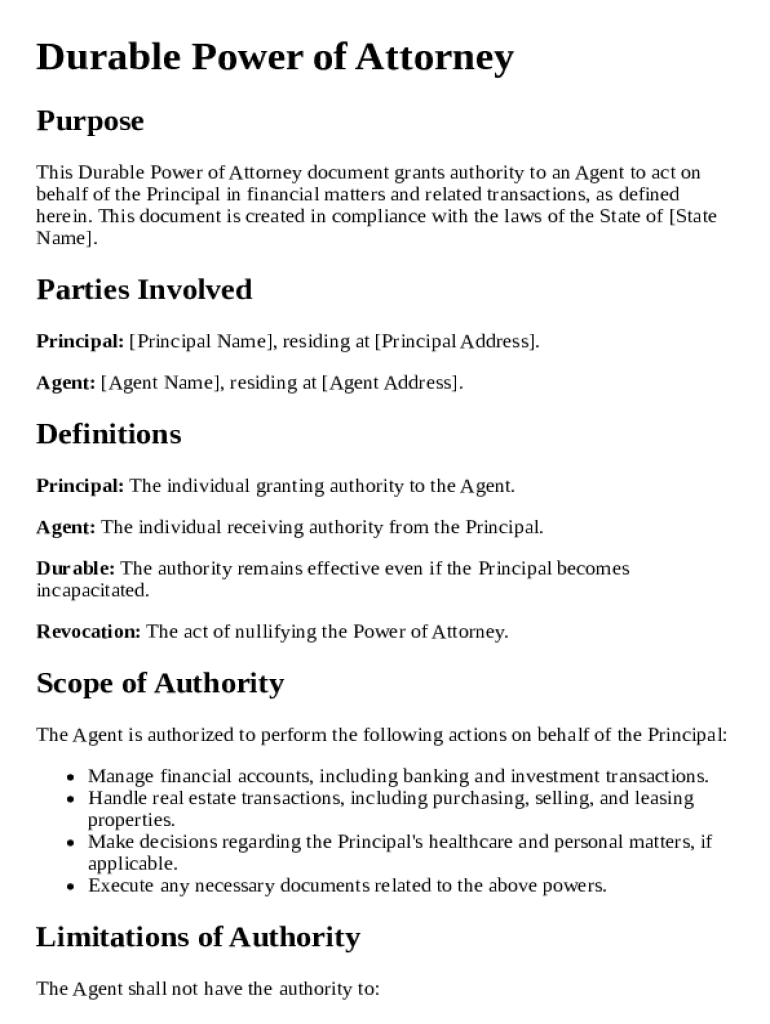

This document grants authority to an Agent to act on behalf of the Principal in financial matters, healthcare decisions, and related transactions, with definitions and limitations on authority.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is financial power of attorney

A financial power of attorney is a legal document that grants someone the authority to manage financial matters on behalf of another individual.

pdfFiller scores top ratings on review platforms

Best online PDF Workflow suite I have seen -it just works

beauiful

It is easy and does what I need.

Enabled me to complete an important document quickly and efficiently

Mam rada jednoduché a přehledné aplikace nad kterými nemusím zbytečně přemýšlet, neboť to většinou vede k tomu, ze úplně ztratím hlavu a prvotní myšlenku, ktera mě tam zavedla. . Takže v jednoduchosti je krása.

it was fine, but I did not want to sign up for a free trial. I just need the form

Who needs financial power of attorney?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Financial Power of Attorney Form on pdfFiller

Filling out a financial power of attorney form is essential for ensuring your financial affairs are managed according to your wishes, especially when you're unable to do so yourself. This guide will take you through the functions, requirements, and steps for completing this crucial document using pdfFiller.

What is a financial power of attorney?

A financial power of attorney (POA) is a legal document that enables one person, known as the Principal, to designate another person, called the Agent, to manage their financial affairs. This document can be pivotal in emergencies when the Principal is incapacitated or otherwise unable to make decisions regarding their finances.

-

It legally authorizes the Agent to handle financial matters on behalf of the Principal.

-

It ensures that your financial interests are protected in case of incapacitation or inability to act.

-

Durable POA remains effective even when the Principal becomes incapacitated, while Non-Durable POA ceases to be effective under such circumstances.

Who are the key parties involved in a financial power of attorney?

Understanding the roles of each party in a financial power of attorney is crucial for effective execution. The Principal appoints the Agent, who is entrusted with financial responsibilities.

-

The Principal is the individual who creates the POA and grants authority to the Agent, effectively stating their preferences for financial management.

-

The Agent is responsible for carrying out the Principal's financial decisions and must act in the Principal's best interests.

-

Both parties often need to provide identification and their addresses to validate the document and prevent fraud.

What is the scope of authority granted in a financial power of attorney?

The POA can grant a wide range of financial powers to the Agent, making it essential to clearly define the scope of authority. This precision helps in avoiding disputes and mismanagement.

-

This may include managing bank accounts, paying bills, and filing tax returns.

-

The Agent may have the authority to buy, sell, or manage real estate properties owned by the Principal.

-

While primarily focused on financial decisions, a durable POA can sometimes extend to healthcare choices.

-

It's crucial that the document is executed in accordance with state laws to ensure its validity.

What are the limitations of authority in a financial power of attorney?

While a financial power of attorney grants significant authority, it is essential to recognize the limitations to prevent misuse of power.

-

Agents cannot take actions that are explicitly forbidden by the POA or state laws.

-

The Agent usually needs the Principal's explicit consent to transfer significant assets.

-

The POA does not override any existing will; the Principal's inheritance plans remain unaffected.

When does a financial power of attorney become effective?

Understanding when the POA becomes effective is critical for both the Principal and the Agent. This can vary based on state laws and circumstances.

-

The POA can be effective immediately or can be specified to activate upon a certain event, such as incapacitation.

-

Authority granted under a POA can be set to expire on a specific date, or it can last until it's revoked.

-

The Principal must formally notify the Agent and possibly any relevant institutions to revoke the POA.

What are the legal framework and compliance requirements?

Adhering to legal frameworks is essential in validating the POA. This includes understanding the state-specific regulations that govern POAs.

-

Each state has unique rules regarding POAs, including signing and witnessing requirements.

-

Notarization is often required to ensure the POA is legally binding, providing an added layer of protection.

-

Understanding the jurisdiction is crucial, especially if the Principal and Agent reside in different states.

What are the step-by-step instructions for completing the form?

Completing the financial power of attorney form requires careful attention to detail to ensure every section is filled out correctly.

-

Accurately enter names, addresses, and contact information for both parties to establish clear identity verification.

-

Be specific about the powers being granted to prevent misinterpretation or overreach by the Agent.

-

Review for any missed signatures or incomplete fields before finalizing the document to avoid legal discrepancies.

-

Utilize features like auto-fill and digital signatures to simplify the process and ensure compliance.

How to manage your financial power of attorney document?

Once the POA is in place, it's equally important to manage and maintain the document effectively. Tools like pdfFiller can assist in this process.

-

Make necessary changes directly in the platform, maintaining an updated version of your document.

-

Utilize eSigning features to ensure that the document is signed securely and legally recognized.

-

Share the document with trusted individuals to streamline the approval and review process.

Conclusion and final steps

In conclusion, understanding the financial power of attorney form is vital for ensuring your financial matters are well-managed. Proper documentation not only protects your interests but also provides peace of mind. Regularly reviewing and securely storing your document will serve you well in times of need. Remember, pdfFiller empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform.

How to fill out the financial power of attorney

-

1.Open the PDF file of the financial power of attorney template from pdfFiller.

-

2.Begin by entering your full name and address in the designated fields.

-

3.Next, add the name and address of the person you are appointing as your agent or attorney-in-fact.

-

4.Clearly specify the powers you are granting to the agent, referencing financial decisions like managing bank accounts, investments, and property.

-

5.If applicable, include any limitations to the authority you want to impose on the agent's powers.

-

6.Review the document for completeness and accuracy; ensure all necessary sections are filled.

-

7.Once satisfied, print the document and sign it in the presence of a notary public if required by your state laws.

-

8.Finally, provide copies of the signed document to your agent and any relevant financial institutions.

What is a Financial Power of Attorney Template?

A Financial Power of Attorney Template is a legal document that allows you to designate someone to manage your financial affairs on your behalf. This template simplifies the creation process, ensuring that it meets legal requirements while being easy to understand. Using a Financial Power of Attorney Template means you can effectively plan for situations where you may not be able to handle your finances personally.

Why do I need a Financial Power of Attorney Template?

A Financial Power of Attorney Template is essential for anyone who wants to ensure their financial matters are handled according to their wishes, especially in cases of incapacity or absence. By utilizing this template, you can grant specific powers to a trusted individual, providing peace of mind that your finances will be managed effectively. It helps avoid potential disputes and confusion among family members regarding financial decisions.

How do I fill out a Financial Power of Attorney Template?

Filling out a Financial Power of Attorney Template is straightforward. Begin by identifying the person you trust to act on your behalf and provide their full name and contact details. Next, specify the powers you wish to grant them, such as accessing bank accounts or making investment decisions, ensuring that all details are clearly articulated to avoid any misunderstandings.

Can I customize my Financial Power of Attorney Template?

Absolutely! One of the benefits of using a Financial Power of Attorney Template is that it can be easily customized. You can modify it to fit your specific needs and preferences, adding or removing powers as necessary. It's important to ensure that the final document accurately reflects your wishes and complies with your state’s legal requirements.

Is a Financial Power of Attorney Template valid in all states?

A Financial Power of Attorney Template may not be universally valid due to varying state laws regarding powers of attorney. Each state has its own regulations that dictate what terms must be included for the document to be legally binding. It is advisable to consult with a legal professional or review your state's guidelines to ensure your Financial Power of Attorney Template is compliant.

What happens if I don’t use a Financial Power of Attorney Template?

Failing to utilize a Financial Power of Attorney Template means you risk having no one appointed to manage your finances if you become incapacitated. This can lead to legal complications and may require a court-appointed guardian, which can be time-consuming and expensive. By proactively using a Financial Power of Attorney Template, you ensure your financial matters are taken care of in alignment with your wishes.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.