Get the free General Financial Power of Attorney Template

Show details

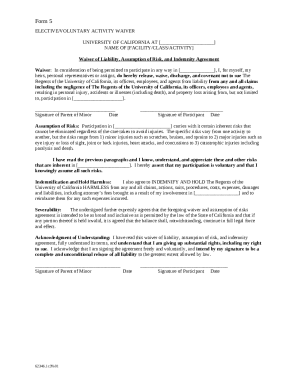

This document is a legal agreement that grants authority to an agent to manage the financial affairs of the principal, including handling bank accounts, real estate transactions, and tax matters.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is general financial power of

A general financial power of attorney is a legal document that grants an individual the authority to manage someone else's financial affairs.

pdfFiller scores top ratings on review platforms

Quite Nice

Convenient, reliable.

signatures given and collected is super easy

So far so good

What do you like best?

The support solved my problem really fast. Amazing.

What do you dislike?

It's quite expensive for an annual subscription. Is there any monthly option?

Recommendations to others considering the product:

It's really useful. Try it!

What problems are you solving with the product? What benefits have you realized?

They cancel my subscription even it has been charged. And the benefit was my CC transaction was voided. Amazing.

Very easy to use

Very easy to use, takes the place of my scanner and printer in most cases.

Who needs general financial power of?

Explore how professionals across industries use pdfFiller.

General Financial Power of Attorney Guide

How does a general financial power of attorney work?

A general financial power of attorney allows an individual, known as the principal, to appoint another person, referred to as the agent, to manage financial and legal affairs on their behalf. This arrangement is often used when the principal is unable to handle their own finances due to various reasons such as illness, travel, or other obligations. Understanding the purpose and intricacies of this legal document is crucial for effective financial management.

-

A general financial power of attorney is a legal document that grants authority to an agent to act on behalf of the principal in financial matters, ensuring decisions and transactions are handled appropriately.

-

It allows for the proper management of financial affairs, provides continuity in decision-making in case of incapacitation, and ensures that trusted individuals handle sensitive transactions.

-

A durable power of attorney remains effective even if the principal becomes incapacitated, whereas a non-durable power ceases to be valid under such circumstances.

Who are the parties involved in the general financial power of attorney?

The principal and the agent are the two primary parties in a general financial power of attorney agreement. The principal is the individual granting authority, while the agent is the person entrusted with financial responsibilities. Understanding the roles and responsibilities of each party is essential to ensure the agreement operates smoothly.

-

The principal is responsible for defining the scope of authority granted to the agent and must ensure they trust this individual with their financial matters.

-

The agent acts on behalf of the principal in fiscal matters, making crucial decisions that can affect the principal’s financial wellbeing.

-

Selecting a trustworthy agent is vital as they will have access to sensitive information and financial assets, making their integrity pivotal.

What are the key components of the general financial power of attorney agreement?

A well-structured general financial power of attorney should clearly outline the agreement's components to avoid misunderstandings. Key elements include the effective date, the scope of authority granted to the agent, and any limitations to protect the principal's interests.

-

This specifies when the agent's authority begins and ensures clarity regarding the timeline of their responsibilities.

-

It clearly delineates what actions the agent is authorized to take, from managing bank accounts to handling real estate transactions.

-

These are provisions that restrict the agent's powers to protect the principal's interests, ensuring that the agent does not overstep their bounds.

How do you fill out the general financial power of attorney form?

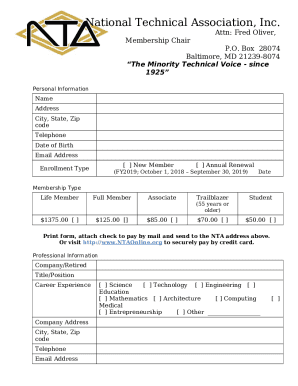

Filling out the general financial power of attorney form can feel overwhelming; however, following a structured approach simplifies the process. Key steps involve providing essential personal information about both the principal and the agent, ensuring accuracy to avoid complications.

-

Begin by downloading the appropriate form, then fill in the principal's details followed by the agent's information, ensuring all sections are complete.

-

The form will typically require full names, addresses, and contact information for both parties, along with any specific powers being granted.

-

Include thorough contact information and, if applicable, additional documentation to verify the agent's capability.

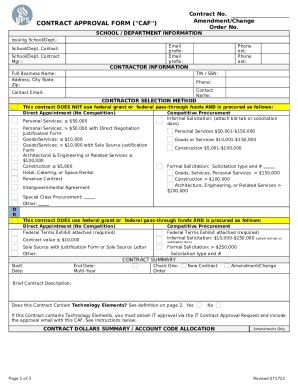

What are the notarization and witness requirements?

Notarization adds an extra layer of legitimacy to a general financial power of attorney, ensuring that the document is recognized as valid. Different states have varying requirements for witnesses and notarization, so it’s essential to check specific local guidelines.

-

The notarization process validates the principal's identity and confirms that they are signing willingly and without coercion.

-

Witnesses must be impartial individuals, often over the age of 18, who can attest to the principal's signing of the document.

-

Each state may have unique regulations regarding the number of witnesses required and specific notarization procedures.

What is the process for revoking the power of attorney?

Revoking a general financial power of attorney is occasionally necessary for various reasons, including changes in trust or preferences. The process generally requires clear documentation stating the intent to revoke, which must be communicated to the agent and possibly notarized.

-

To revoke the agreement, the principal must draft a formal revocation document stating their intent and provide it to all relevant parties.

-

If circumstances change, a power of attorney may sometimes be reinstated by detailing the new intent in a formal document.

-

Factors like potential impacts on financial management and the need for a new agent should be considered before proceeding.

What are the governing laws and compliance considerations?

Understanding the laws governing power of attorney documents in your particular state is essential for legal compliance. Failure to adhere to local regulations can lead to significant consequences, including the invalidation of the document.

-

Each state has specific laws that dictate how a general financial power of attorney must be structured and executed.

-

When utilizing forms, ensure that all state-specific requirements are met to maintain validity.

-

Failing to comply with legal requirements can render the power of attorney ineffective, causing potential legal challenges in managing affairs.

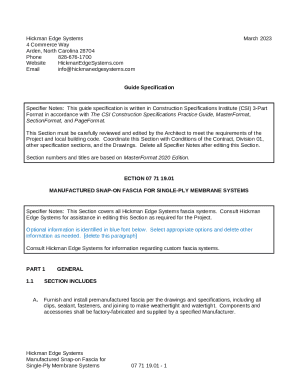

How can pdfFiller assist in document management?

pdfFiller offers a comprehensive suite of tools designed to streamline the management of your general financial power of attorney and other important documents. This includes editing capabilities, eSigning features, and collaborative tools to facilitate teamwork.

-

pdfFiller enables users to easily edit their power of attorney documents, ensuring they meet all necessary requirements before finalization.

-

The electronic signing function speeds up the document approval processes, making it easier to manage formal documents efficiently.

-

Utilize built-in collaboration tools to enhance communication among teams while managing financial power of attorney agreements.

How to fill out the general financial power of

-

1.Open pdfFiller and upload the 'general financial power of' form you need to fill out.

-

2.Begin by entering the principal's full name and address in the designated fields at the top of the document.

-

3.Next, provide the agent's full name and address; this is the person who will be given financial authority.

-

4.Specify the powers being granted to the agent; be clear and detailed about what financial matters they can handle.

-

5.Review any sections related to limitations or specific instructions regarding the agent's authority to ensure clarity.

-

6.Add the date on which this power of attorney becomes effective, if applicable.

-

7.Have the principal sign the document in the presence of a notary public or witnesses as required by your jurisdiction.

-

8.Once signed, save and download the completed document from pdfFiller for your records and to share with the agent.

What is a General Financial Power of Attorney Template and why do I need one?

A General Financial Power of Attorney Template facilitates the delegation of financial decision-making authority to a trusted individual. This can be crucial in situations where you may be unable to manage your finances, such as during illness or travel. Having a General Financial Power of Attorney Template ensures that your financial affairs are handled according to your wishes, providing peace of mind.

How do I create a General Financial Power of Attorney Template?

Creating a General Financial Power of Attorney Template can be achieved using tools like pdfFiller, which allows you to edit and customize templates easily. Begin by selecting a legally compliant template and fill in the necessary details, including the agent's name and specific powers granted. Once completed, ensure you sign the document appropriately, as per your state's requirements, to make it legally valid.

Who should I appoint as my agent in a General Financial Power of Attorney Template?

When choosing an agent for your General Financial Power of Attorney Template, consider someone you trust implicitly to manage your financial matters. This could be a family member, friend, or a professional such as an attorney or accountant. It's also important to communicate your expectations and review the powers you are granting to ensure they align with your needs.

Can I revoke my General Financial Power of Attorney Template?

Yes, you can revoke your General Financial Power of Attorney Template at any time as long as you are mentally competent. This process typically involves creating a revocation document and notifying your agent and any relevant financial institutions. It is advisable to also destroy the old template to prevent any confusion regarding your financial representation.

When does my General Financial Power of Attorney Template take effect?

A General Financial Power of Attorney Template can be designed to take effect immediately upon signing or it can be made effective only under certain conditions, such as incapacity. If you want it to be effective immediately, include that clause in your template. Clearly outlining this in your General Financial Power of Attorney Template avoids ambiguity regarding when your designated agent can act on your behalf.

What should I include in my General Financial Power of Attorney Template?

Your General Financial Power of Attorney Template should clearly specify the powers granted to your agent, including the ability to manage bank accounts, pay bills, and make investment decisions. It is also important to include any limitations or conditions on these powers. By carefully detailing these aspects, your General Financial Power of Attorney Template will ensure your financial affairs are managed as you intend.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.