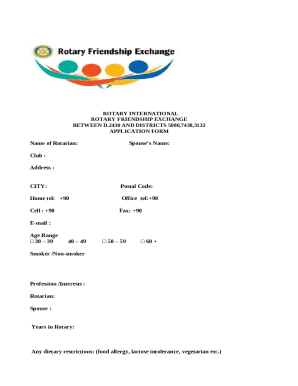

Get the free Home Insurance Power of Attorney Template

Show details

This document grants authority to an agent to manage home insurance matters on behalf of the principal.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is home insurance power of

A home insurance power of attorney is a legal document that allows an appointed individual to manage home insurance policies on behalf of the policyholder.

pdfFiller scores top ratings on review platforms

Cant believe how easy it is to use...very very happy with PDFfille

I have had a great experience with this app for the purpose of getting the proper paper work done

esta genial me sirvio mucho para la escuela

The savings in time, money and processing are enormous. I would highly recommend the app to anyone interested in time management.

Great forms to find, helped with several projects

Really great product. So many of the forms I am sent would mean hours of unnecessary handwriting. With PDF Filler I am able to complete them in 1/2 the time. (The only negative is the learning curve, but once I learned how to maneuver around its great!)

Who needs home insurance power of?

Explore how professionals across industries use pdfFiller.

Home Insurance Power of Attorney How-to Guide

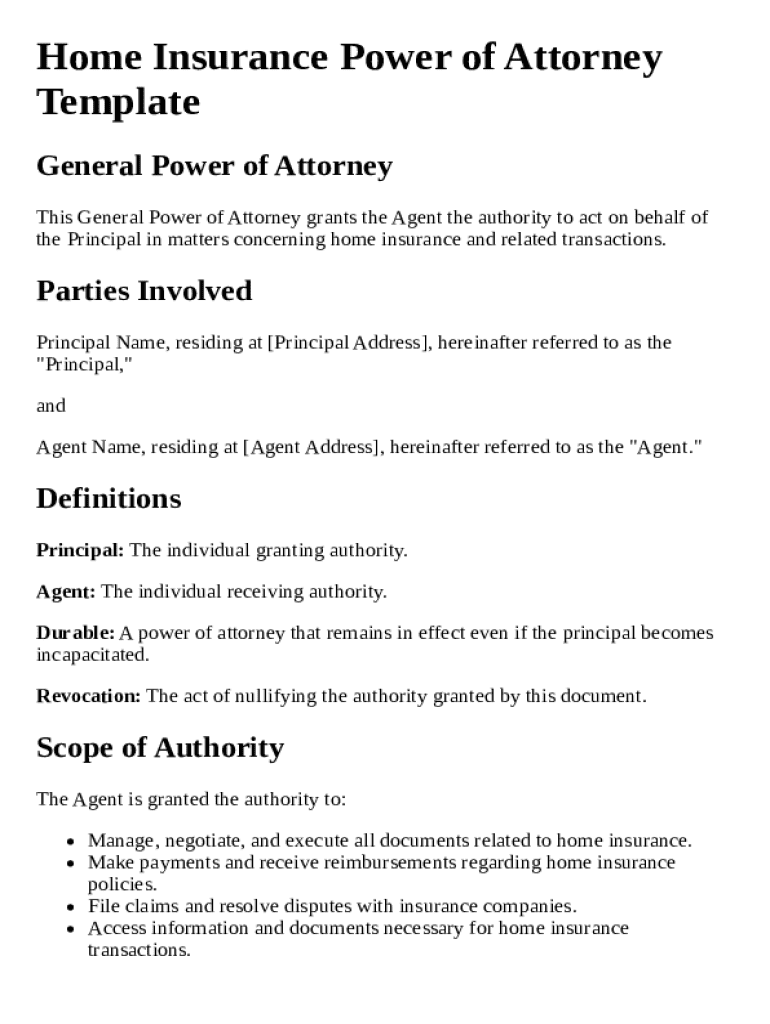

What is a home insurance power of attorney?

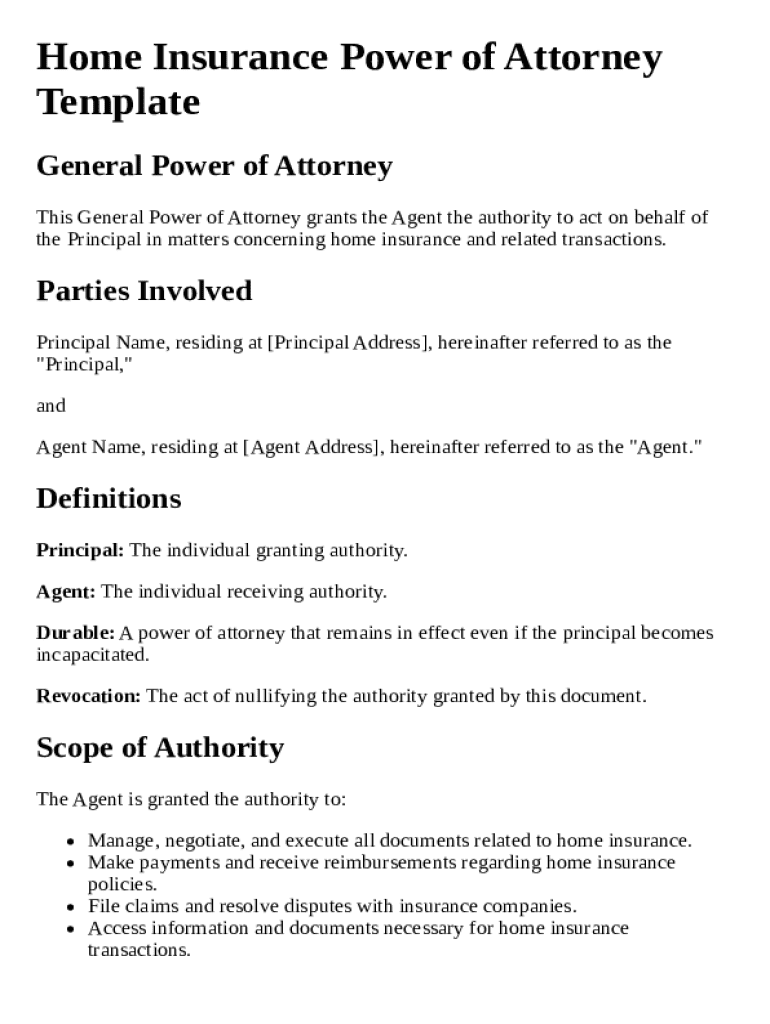

A Home Insurance Power of Attorney (POA) is a legal document that empowers a designated person, known as the Agent, to make decisions and manage home insurance matters on behalf of another individual, the Principal. The purpose of this document is to ensure seamless management of home insurance claims, policy changes, and communication with insurers, enhancing the efficiency of insurance-related decision-making.

Why might you need one?

Having a Power of Attorney for home insurance offers several benefits. It streamlines the process of handling insurance claims and communication, especially during times of incapacity or when the Principal is unavailable. This preemptive measure can alleviate stress for families and safeguard property interests.

Who are the key parties involved?

In the context of home insurance, the Principal is the individual granting authority, while the Agent is responsible for managing home insurance tasks on behalf of the Principal. It's crucial for both parties to meet state residency and identification requirements, reinforcing the importance of trust in selecting an Agent.

-

The individual who creates the POA and assigns authority.

-

The person assigned to manage home insurance decisions.

What are the legal terms to know?

Understanding legal terminology like Durable, Revocation, and Scope of Authority is critical when drafting a Home Insurance POA. For instance, a Durable POA remains effective even if the Principal becomes incapacitated. Revocation involves the Principal formally canceling the document, while Scope of Authority defines the extent of the Agent's powers.

-

A POA that remains in effect despite the Principal's incapacity.

-

The process of canceling the authority granted in the POA.

-

Specifies which decisions the Agent can make on behalf of the Principal.

How to establish the scope of authority?

Establishing the scope of authority is crucial for the effectiveness of the Power of Attorney. The Principal should clearly outline which tasks the Agent is authorized to perform, such as filing claims or making policy changes. Setting limitations is equally important to prevent the misuse of power.

-

Tasks like filing claims and communicating with insurers.

-

Clear boundaries to minimize the risk of misuse.

-

Rights and responsibilities associated with the granted authority.

How to create a home insurance power of attorney?

Creating a Home Insurance Power of Attorney involves a few critical steps. The Principal must gather necessary documents and information, then complete the Power of Attorney template, ensuring all details are accurate. Using tools like pdfFiller can simplify the process by facilitating easy editing and signing.

-

Identify required identification and supporting documents.

-

Fill out the Power of Attorney form with accurate information.

-

Edit and sign the document efficiently through the platform.

What is the signing and notarization process?

Signing the Power of Attorney is a critical step, requiring signatures from both the Principal and Agent. Notarization verifies the identities of both parties and lends legal force to the document ensuring its acceptance in various legal situations. pdfFiller offers resources to facilitate this notarization process smoothly.

-

The Principal's signature is essential for the validity of the POA.

-

The Agent's signature confirms their acceptance of the role.

-

A necessary step for enhancing legal enforceability.

When does the power of attorney become effective?

The effective date of a Home Insurance Power of Attorney is crucial for both the Principal and the Agent. It can be set to begin immediately upon signing or at a later date specified by the Principal. Understanding the duration and procedures for revocation is also vital as circumstances change.

-

Determine when the powers granted commence.

-

Decide how long the POA will remain valid.

-

Situations that may lead to changing or revoking the authority.

What are state-specific legal considerations?

Different states have specific regulations regarding Powers of Attorney for home insurance. It's essential to verify the legal requirements and enforceability of such documents based on regional laws. Consulting local legal resources can provide invaluable guidance and ensure compliance.

-

Understand your state’s laws governing POA for home insurance.

-

Discuss whether POA is recognized legally in various situations.

-

Locate contacts for receiving further assistance in your area.

How to manage and maintain the power of attorney?

Ongoing management of a Home Insurance Power of Attorney is vital for its effectiveness. Regular revisions and updates may be necessary as personal circumstances and laws change. Utilizing pdfFiller aids in keeping documents organized and compliant with legal standards, simplifying document management.

-

Regularly review and update the POA based on your situation.

-

Organize and ensure your documents remain legitimate.

-

Maintain adherence to local legal requirements and updates.

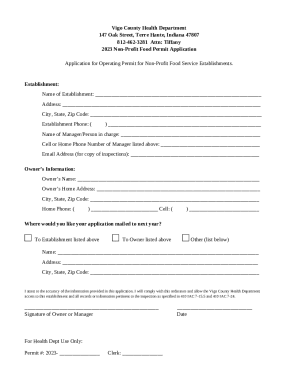

How to fill out the home insurance power of

-

1.Begin by downloading the home insurance power of attorney form from PDFfiller.

-

2.Open the form in PDFfiller and review the personal information sections at the top.

-

3.Fill in the names and addresses of both the principal (you) and the agent (the person you're appointing).

-

4.Specify the powers you want to grant your agent regarding home insurance decisions and claims.

-

5.Include any limitations or specific instructions if applicable.

-

6.Review all the information for accuracy, ensuring that no sections are left blank.

-

7.Add your signature and date in the designated areas at the bottom of the form.

-

8.If required, have your signature notarized to comply with local legal requirements.

-

9.Download or print the completed document for your records.

-

10.Send a signed copy to your insurance company and keep one for yourself.

What is a Home Insurance Power of Attorney Template?

A Home Insurance Power of Attorney Template is a legal document that allows one person to act on behalf of another in matters regarding home insurance policies. This template makes it easier for individuals to manage insurance claims, payments, and overall policy management without needing the direct involvement of the homeowner. By using a Home Insurance Power of Attorney Template, you can ensure that your home insurance affairs are handled efficiently when you are unable to do so yourself.

Why should I use a Home Insurance Power of Attorney Template?

Utilizing a Home Insurance Power of Attorney Template provides clarity and ensures that your insurance matters are addressed even when you are unavailable. By designating a trusted individual as your attorney-in-fact, they can make critical decisions regarding your home insurance in your absence. This proactive approach helps eliminate delays during emergencies, making it a valuable resource for any homeowner.

How do I fill out a Home Insurance Power of Attorney Template?

Filling out a Home Insurance Power of Attorney Template involves providing essential information, such as the names and addresses of both the principal and the attorney-in-fact. Be sure to specify the powers granted, which generally include managing insurance claims or negotiating terms. Once completed, ensure the document is signed and witnessed, if necessary, according to your state laws to make it legally binding.

Can I customize a Home Insurance Power of Attorney Template for my needs?

Absolutely, a Home Insurance Power of Attorney Template is designed to be flexible and customizable based on your specific requirements. You can modify the scope of powers granted to your attorney-in-fact to suit your home insurance situation. Customization ensures that the document reflects your personal preferences and the specific demands of your insurance policy.

What should I consider before choosing someone as my attorney-in-fact for home insurance?

Choosing your attorney-in-fact for home insurance decisions is a critical step. Consider their trustworthiness, understanding of insurance matters, and their willingness to take on this responsibility. It's also important to communicate openly with them about your wishes regarding your Home Insurance Power of Attorney Template to ensure they are equipped to act in your best interest.

Where can I find a reliable Home Insurance Power of Attorney Template?

You can find a reliable Home Insurance Power of Attorney Template on platforms like pdfFiller, which offers a wide range of customizable templates. These templates not only adhere to legal standards but also provide user-friendly editing features. By using pdfFiller, you'll have access to a comprehensive document management solution that allows you to create, edit, and sign your legal documents with ease.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.