Get the free Homeowners Insurance Power of Attorney Template

Show details

A legal document that grants an agent the authority to manage the homeowner\'s insurance on behalf of the principal, including making payments and filing claims.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is homeowners insurance power of

Homeowners insurance power of attorney is a legal document that empowers a designated individual to manage insurance-related matters on behalf of a homeowner.

pdfFiller scores top ratings on review platforms

Easy to use, allows to make your own form. You can always find what you looking fo

I enjoy neatness of the forms i fill out.

I like being able to fill in forms from online. $72 is too much for this as I only pay $30 for several other internet programs. There should be a refund.

so far so good looking into having a single form fill out multiple forms. if possible

In my business I have to complete many PDF forms regularly and PDFfiller has been a life saver.

I would like to learn more about the features. But from the little I have used I'm quite satisfied.

Who needs homeowners insurance power of?

Explore how professionals across industries use pdfFiller.

Power of Attorney Homeowners Insurance Guide

How do you understand power of attorney in homeowners insurance?

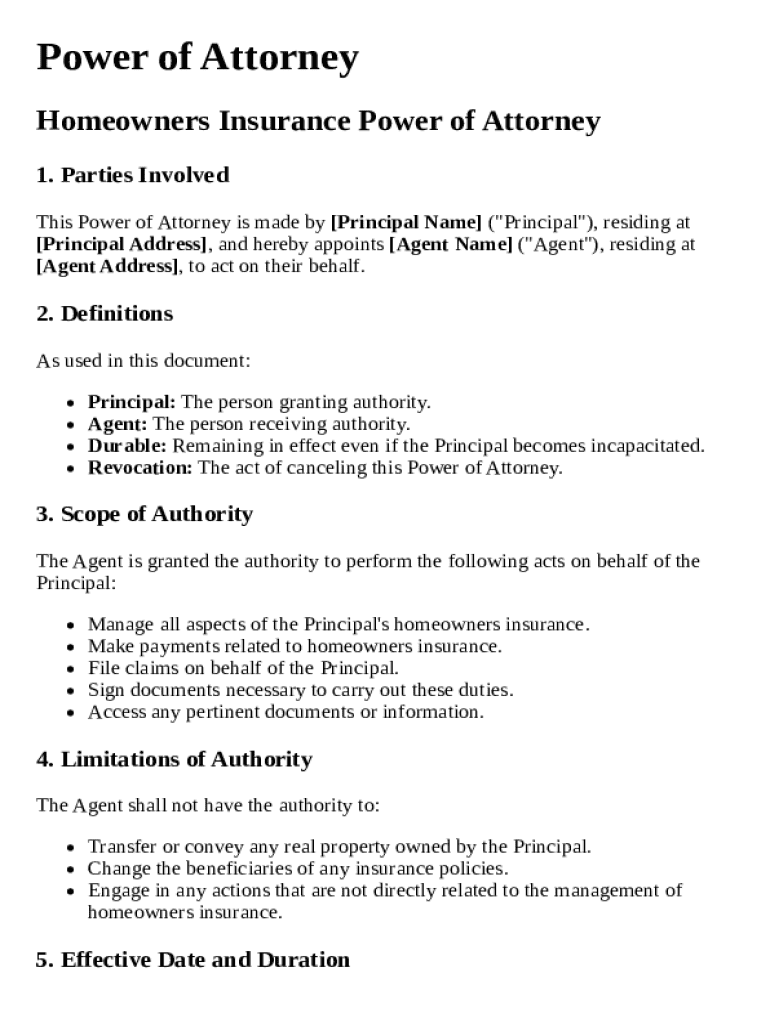

Power of Attorney (POA) is a legal document that allows one person, known as the Principal, to grant another person, called the Agent, the authority to act on their behalf in specified matters. In the context of homeowners insurance, a POA can be crucial for managing insurance policies when the Principal is unable to manage them themselves due to various reasons, such as being out of town or incapacitated.

-

Many homeowners find themselves needing assistance with insurance claims, payments, or other urgent decisions that require immediate action.

Who are the key parties involved in a power of attorney?

The two primary roles in a Power of Attorney arrangement are the Principal and the Agent. The Principal is the individual who grants the authority, while the Agent is entrusted with that power to carry out specific tasks related to homeowners insurance.

-

The Principal must ensure that the POA reflects their intentions and is legally sound.

-

The Agent is responsible for acting in the best interests of the Principal and should manage all insurance-related matters competently.

What are the important terms you should know?

Understanding specific terms associated with Power of Attorney can clarify the document’s implications. Key definitions include:

-

This refers to the person who grants the authority through the POA.

-

The individual receiving authority to act on behalf of the Principal.

-

Indicates that the POA remains effective even if the Principal becomes incapacitated.

-

The process through which the Principal can cancel the POA.

What is the scope of authority granted to the agent?

The scope of authority granted to the Agent in a homeowners insurance context is extensive. The Agent can manage all activities related to the Principal's insurance policy.

-

The Agent can oversee every feature including payments, claims, and communications with the insurance company.

-

An Agent can also file claims on behalf of the Principal, making it easier to navigate through potential disasters.

-

Agents need to access any relevant documentation to ensure claims and management are handled efficiently.

What limitations exist for the agent's authority?

While an Agent has significant power, there are limitations intended to protect the Principal’s interests. These restrictions ensure that the Agent acts within the boundaries of their authority.

-

Agents cannot transfer or convey real property without explicit permission from the Principal.

-

Agents are typically prohibited from altering beneficiaries of insurance policies, preserving the Principal's wishes.

-

Agents cannot engage in actions that do not pertain to homeowners insurance management.

How to establish effective date and duration of POA?

Establishing the effective date and duration of the Power of Attorney is crucial. This ensures clarity on when the Agent's authority begins and ends.

-

The POA can be designed to take effect immediately or upon a specified event, like incapacity.

-

The duration can be set for a specific timeframe or until formally revoked.

How can you revoke a power of attorney?

Revoking a Power of Attorney gives the Principal the authority to cease the Agent's power. Understanding this process is vital for homeowners.

-

The Principal must notify the Agent in writing to revoke the POA effectively.

-

Additionally, the Principal should communicate the revocation to any relevant third parties to avoid misunderstandings.

What are the governing laws and compliance considerations?

State laws governing Power of Attorney can differ significantly, impacting how insurance matters are handled. Awareness of these is critical.

-

Each state has specific regulations outlined in their respective statutes that could influence the validity of a POA.

-

Understanding compliance matters ensures that everything is conducted legally and reduces the potential for disputes.

What are the document execution and notarization requirements?

Proper execution and notarization of the Power of Attorney is necessary for it to be legally binding. Each step of this process needs to be given attention.

-

Typically, the Principal's signature is mandatory, but some states may require the Agent’s signature as well.

-

Notarization serves to validate the authenticity of the document, making it more robust against legal challenges.

How do you finalize the document for use?

Once the Power of Attorney is drafted, it’s essential to finalize it correctly before use. A checklist can simplify this crucial step.

-

Ensure it includes verifying details, signatures, and notarization.

-

For seamless document management, pdfFiller allows you to edit, sign, and collaborate efficiently, ensuring your documents are always ready for action.

How to fill out the homeowners insurance power of

-

1.Access the PDF form for homeowners insurance power of through pdfFiller.

-

2.Begin by entering your name and contact information in the designated fields.

-

3.Provide the name and contact information of the person you are granting power of attorney to.

-

4.Clearly state the specific powers you are granting regarding your homeowners insurance, such as filing claims or making policy changes.

-

5.Include any expiration date for the power of attorney if applicable.

-

6.Review the document for any omissions or errors.

-

7.Sign and date the document in the spaces provided.

-

8.Finally, save the completed document and share it with the designated person and your insurance company.

What is a Homeowners Insurance Power of Attorney Template?

A Homeowners Insurance Power of Attorney Template is a legal document that authorizes someone to act on your behalf regarding homeowners insurance matters. This template outlines the specific powers granted, making it easier for your designated agent to handle claims, manage policies, and make decisions related to your homeowners insurance. Utilizing a well-structured template ensures that your intentions are clearly communicated and legally binding.

Why would I need a Homeowners Insurance Power of Attorney Template?

You might need a Homeowners Insurance Power of Attorney Template if you are unable to manage your insurance affairs due to circumstances like illness, travel, or other commitments. This template allows you to designate someone you trust to make critical decisions about your policy, ensuring your interests are protected even when you are unavailable. Without this document, your options for managing insurance could be limited during critical times.

Can I customize the Homeowners Insurance Power of Attorney Template?

Yes, you can and should customize the Homeowners Insurance Power of Attorney Template to suit your specific needs. Each situation is unique, and personalizing your template ensures that it accurately reflects your intentions and the powers granted to your agent. By making necessary adjustments, you can include specific actions your attorney-in-fact can take, making the document more effective.

How do I use the Homeowners Insurance Power of Attorney Template once it's completed?

Once you've completed the Homeowners Insurance Power of Attorney Template, you should have it notarized to enhance its validity. After notarization, provide copies to your designated agent and any necessary parties, such as your insurance provider. This ensures that everyone involved is aware of the authority granted, facilitating smoother communications and actions regarding your homeowners insurance.

Is there a difference between a Homeowners Insurance Power of Attorney Template and a general power of attorney?

Yes, a Homeowners Insurance Power of Attorney Template is specifically tailored for matters related to homeowners insurance, while a general power of attorney covers a broader range of decisions pertaining to finances and legal matters. Using a specialized template ensures that the agent's powers are limited to homeowners insurance, preventing the possibility of misuse of authority. This specificity enhances the clarity and effectiveness of the document.

Where can I find a reliable Homeowners Insurance Power of Attorney Template?

You can find a reliable Homeowners Insurance Power of Attorney Template through document management platforms like pdfFiller. These platforms offer customizable templates that comply with legal standards, making the creation process straightforward. By accessing a reputable service, you ensure your template is not only user-friendly but also legally sound to meet your homeowners insurance needs.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.