Get the free Life Insurance Power of Attorney Template

Show details

This document grants authority to an Agent to act on behalf of the Principal in matters related to life insurance, including policy administration, premium payments, and claims processing.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is life insurance power of

Life insurance power of attorney enables an individual to make decisions regarding life insurance policies on behalf of another person.

pdfFiller scores top ratings on review platforms

It helped me sign my documents in an efficient way

GREAT SOFTWARE, ITS VERY EASY TO USE AND HAS COME IN VERY HANDY.

wonderful, fillable pdfs made easy. would love 4$ u 5$ a documents instead of monthly

Easy to use, will be using again when needed. Very easy directions to walk you through it.

Best customer service ! Always there...24 hrs a day!!

works well - would be nice if it fully integrated with PDF so you didnt have to log into the site and upload

Who needs life insurance power of?

Explore how professionals across industries use pdfFiller.

Navigating Life Insurance Power of Attorney Forms on pdfFiller

What is a life insurance power of attorney?

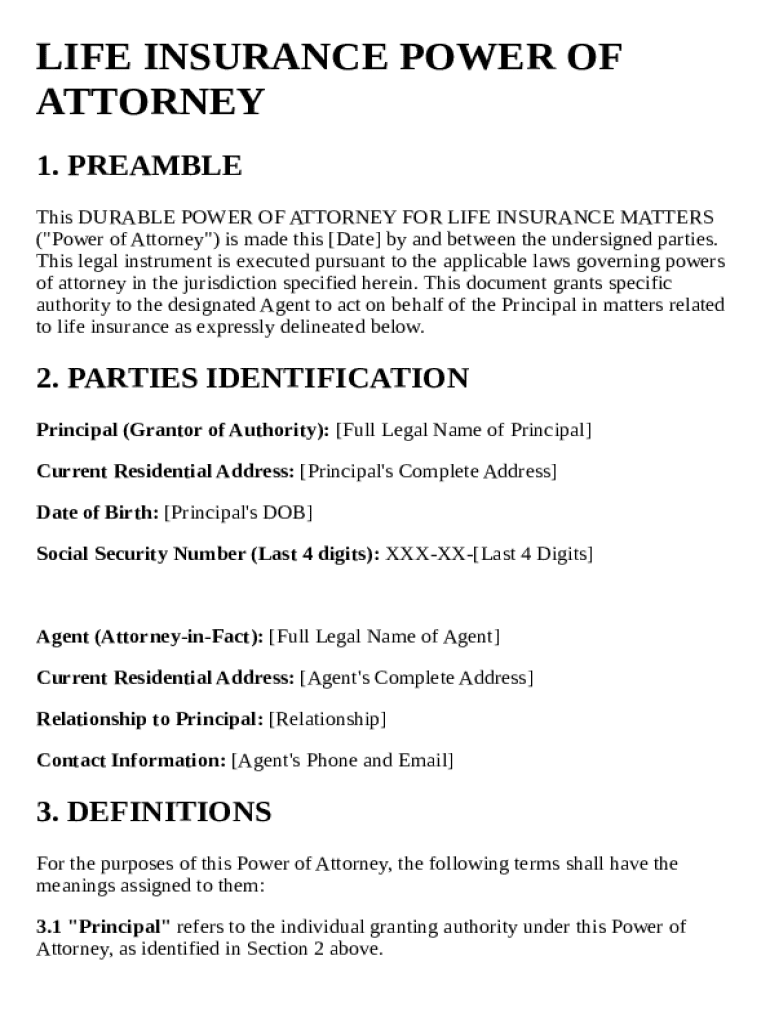

A Life Insurance Power of Attorney (POA) is a legal document that authorizes someone, known as an Agent, to make decisions regarding your life insurance policies on your behalf. This can include managing policies, making beneficiary changes, or handling claims, especially if you are unable to do so due to health issues. Properly executing this form ensures that your wishes about your life insurance policy are honored even if you cannot communicate them directly.

What are the components of the life insurance power of attorney document?

Key components of a Life Insurance Power of Attorney document include several critical elements. It begins with a preamble, which states the intent and execution date, followed by the identification of both the Principal (the person granting power) and the Agent (the person receiving power).

-

This section outlines the intent behind the document and the date it was executed.

-

Clearly states the names and contact details of both parties to avoid confusion.

-

Definitions clarify any complex terminology, ensuring both parties understand the document's contents.

-

Details the specific powers granted to the Agent, making it essential to outline permissions clearly.

How can you fill out the life insurance power of attorney form?

Filling out this form correctly is crucial. On pdfFiller, you can find a user-friendly interface that guides you through each step.

-

Follow the prompts on pdfFiller to ensure all fields are filled correctly.

-

This usually includes your name, address, and details about the life insurance policy.

-

The Agent will need to provide similar identifying information.

-

Double-check each section to avoid missing signatures or dates, which could invalidate your form.

What tools does pdfFiller provide for managing life insurance power of attorney documents?

pdfFiller offers robust editing tools that can enhance your experience with your Life Insurance Power of Attorney forms. With these features, users can make necessary revisions easily, which is advantageous as your situation changes.

-

Utilize pdfFiller's tools to revise your document effectively as needed.

-

Enjoy secure cloud storage for easy management and access from anywhere.

-

Work with others by sharing the document securely for feedback and necessary adjustments.

-

pdfFiller ensures compliance with document security standards to protect sensitive information.

What are best practices for managing a life insurance power of attorney?

Managing your Life Insurance Power of Attorney effectively requires regular attention and updates. It is advisable to review the document periodically, especially if there or significant life changes.

-

Ensure that your Power of Attorney is current by reviewing it regularly after any major life changes, such as marriage or divorce.

-

Engage with legal and financial advisors to verify that the document remains aligned with your goals.

-

Keep open lines of communication with your Agent, so they are aware of their responsibilities and your wishes.

What legal compliance factors should you consider?

Awareness of the laws governing Power of Attorney in your region is crucial to ensure legal compliance. Each locality might have different regulations, so it’s wise to check these before finalizing your document.

-

Research the specific laws that apply to Power of Attorney to avoid any legal pitfalls.

-

Create a checklist based on local regulations to ensure that all legal specifications are met.

-

It is always beneficial to consult with a legal professional to validate that your POA adheres to current laws.

How to fill out the life insurance power of

-

1.Download the life insurance power of attorney form from pdfFiller.

-

2.Open the PDF file in the pdfFiller editor.

-

3.Begin filling in the principal's information, including full name, address, and contact details in the designated fields.

-

4.Next, enter the agent's information, who will be given power of attorney, including their name, address, and contact details.

-

5.Specify the powers granted to the agent concerning the life insurance policies in the appropriate section; this often includes decision-making authority and the ability to access information.

-

6.Include any limitations on the agent's authority if desired or applicable.

-

7.Review all completed fields for accuracy to prevent issues later.

-

8.Once complete, save your draft to avoid losing any progress.

-

9.Finally, print the document for signatures; ensure the principal and agent sign and date where indicated, potentially in the presence of a witness or notary according to state laws.

What is a Life Insurance Power of Attorney Template?

A Life Insurance Power of Attorney Template is a legal document that allows an individual to designate another person to make decisions regarding their life insurance policies on their behalf. This template simplifies the process by providing a structured format for naming an agent and outlining their powers. Using a Life Insurance Power of Attorney Template ensures all necessary details are covered, giving peace of mind that your wishes are followed.

Who should consider using a Life Insurance Power of Attorney Template?

Individuals with life insurance policies who want to ensure that their financial decisions are handled in their absence should consider using a Life Insurance Power of Attorney Template. This includes those nearing the end of their life, individuals with health issues, or anyone traveling for extended periods. It provides clarity for family members and enhances the management of life insurance assets during critical times.

How do I fill out a Life Insurance Power of Attorney Template?

Filling out a Life Insurance Power of Attorney Template involves providing specific information about yourself, the appointed agent, and your life insurance policies. Ensure that both your name and the agent's name are clearly stated, along with any limitations on their authority if needed. Using the template makes this process straightforward, ensuring you capture all essential details without confusion.

What are the benefits of using a Life Insurance Power of Attorney Template?

Utilizing a Life Insurance Power of Attorney Template offers several benefits, including clarity in decision-making and reduced stress for your loved ones. It allows you to specify who can manage your life insurance affairs, which can ease potential conflicts during important times. Additionally, this template can help prevent disputes and misunderstandings, ensuring your intentions regarding your life insurance are honored.

Can I revoke a Life Insurance Power of Attorney Template, and how?

Yes, you can revoke a Life Insurance Power of Attorney Template at any time as long as you are mentally competent to do so. To revoke the document, you should notify your agent in writing and, if possible, provide a copy of the revocation to your insurance provider. This process ensures that your previous decisions do not affect current or future management of your life insurance policies.

Where can I find a Life Insurance Power of Attorney Template?

You can find a Life Insurance Power of Attorney Template on reputable legal document websites, including pdfFiller. These templates are designed to be user-friendly, allowing you to customize them easily according to your needs. Utilizing a platform like pdfFiller ensures you have access to a comprehensive solution for creating and managing all your essential documents, including life insurance power of attorney.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.