Get the free Living Trust Power of Attorney Template

Show details

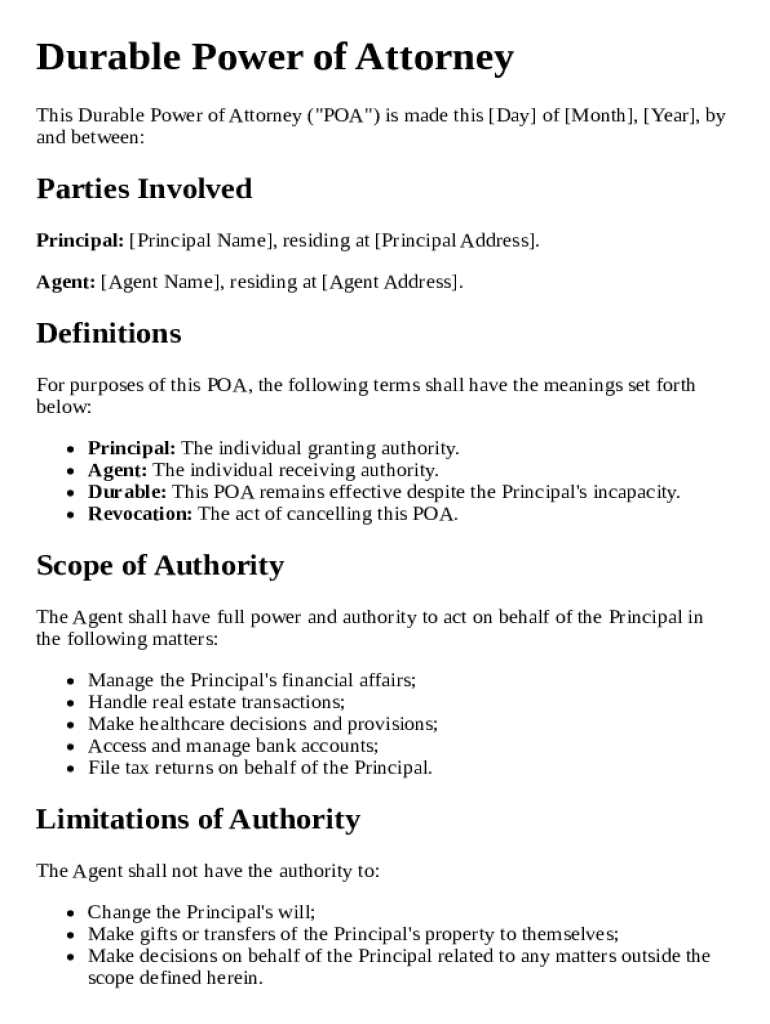

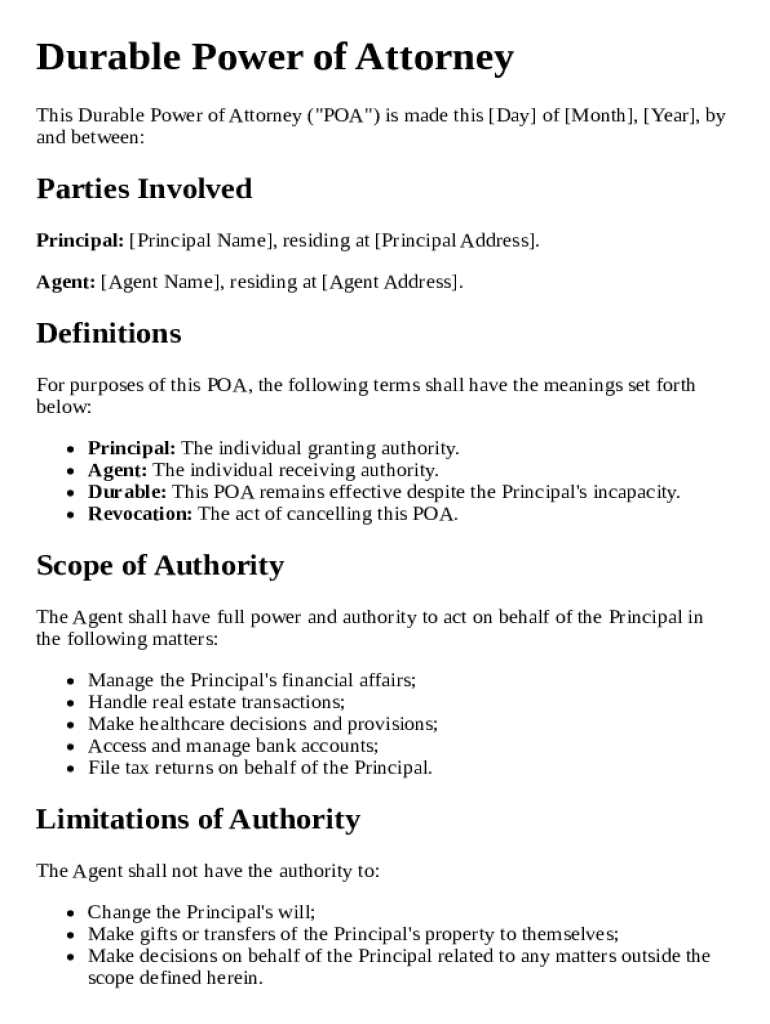

This document allows a Principal to grant authority to an Agent to manage financial, healthcare, and real estate decisions on their behalf, remaining effective despite the Principal\'s incapacity.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is living trust power of

A living trust power of attorney is a legal document that enables an individual to designate a trusted person to manage their financial affairs and property in the event they become unable to do so themselves.

pdfFiller scores top ratings on review platforms

very easy to manuver.

Nice

It was good and easily obtainable.

Easy to use

easy and convenient

This program makes me look more professional !

Who needs living trust power of?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Living Trust Power of Attorney Forms

What is the living trust concept?

A living trust is a legal entity that holds your assets during your lifetime and can dictate the distribution of those assets upon your death. It is significant in estate planning because it helps avoid probate, providing a smoother transition of assets. Unlike a Power of Attorney (POA), which grants authority to another person, a living trust is primarily about asset management and distribution. Various scenarios, such as blended families or individuals with significant assets, illustrate the advantages of establishing a living trust.

-

A legal arrangement to manage assets for you during your life and transfer them after death.

-

A POA enables someone to act on your behalf, while a trust manages your assets.

-

Useful for avoiding probate, protecting beneficiaries, and managing complex family situations.

What is a durable power of attorney?

A Durable Power of Attorney (POA) is a legal document that grants someone (the Agent) the authority to act on behalf of another person (the Principal) in a legally binding manner. The significance lies in its durability; it remains in effect even if the Principal becomes incapacitated. Key parties involved include the Principal, who creates the document, and the Agent, who is tasked with making decisions concerning the Principal’s finances and healthcare.

-

It allows the Agent to act without needing court approval, providing efficiency.

-

Principal is the person granting authority; Agent is the individual given power.

-

The document remains effective until revoked or the death of the Principal.

What are the roles and responsibilities of the agent?

The Agent in a Durable Power of Attorney holds significant duties and responsibilities. They are primarily tasked with acting in the best interests of the Principal in financial, healthcare, and legal matters. It is essential for the Agent to understand their scope of authority, which may include managing bank accounts, making healthcare decisions, and handling legal affairs. However, there are limitations to this authority to prevent misuse.

-

Agents can manage finances and make healthcare decisions as outlined in the POA.

-

Encompasses financial management, healthcare decisions, and legal actions on behalf.

-

Agents must operate within the confines of the authority granted; illegal actions are prohibited.

How do you fill out the durable power of attorney form?

Filling out a Durable Power of Attorney form requires careful attention to detail. Begin with the Principal's details, including name, address, and other identifying information. Next, clearly outline the Agent's responsibilities, ensuring you specify the scope of authority granted. Common pitfalls include leaving sections blank or failing to notarize the document, which can invalidate the POA.

-

Begin with personal information, followed by designating your Agent.

-

Focus on the Principal's details and the specific powers granted to the Agent.

-

Ensure not to leave sections blank and always get the document notarized.

What is the revocation process for a durable power of attorney?

Revoking a Durable Power of Attorney requires understanding the conditions under which a POA can be undone. The Principal has the legal right to revoke the POA anytime, provided they are of sound mind. A proper revocation invalidates the Agent's authority, which must be communicated to all parties involved to prevent confusion or misuse of authority.

-

POA can be revoked as long as the Principal is competent and meets certain criteria.

-

Complete a revocation document and notify involved parties, including the previous Agent.

-

Communicating revocation prevents unauthorized actions by the old Agent.

What criteria should you use to choose an effective agent?

Selecting an Agent for a Durable Power of Attorney is a critical decision that requires consideration of several factors. Look for qualities such as trustworthiness, financial acumen, and the ability to manage complex situations. Legal considerations must also be evaluated, as potential conflicts of interest could hinder effective decision-making. To ensure the selected Agent will act in your best interests, consider their past experiences and willingness to take on this responsibility.

-

Seek reliable individuals with experience in financial matters and legal understanding.

-

Evaluate any potential conflicts, such as personal relationships or financial interests.

-

Select someone who appreciates the gravity of their role and is committed to your welfare.

Why is notarization and compliance important?

Notarizing the Durable Power of Attorney is crucial for its validation. It serves to authenticate the signature of the Principal, ensuring that the document is legally binding. Additionally, state-specific compliance requirements must be acknowledged to ensure the execution of the POA adheres to local laws. Failing to comply can lead to challenges in enforcing the powers granted under the POA.

-

Validates the document, preventing disputes regarding authenticity.

-

Each state has unique laws that need to be followed for the POA to be enforceable.

-

It's essential to verify requirements in your area to ensure the POA functions properly.

How does pdfFiller enhance your durable POA experience?

pdfFiller serves as an excellent tool for the management of your Durable Power of Attorney documents. The platform allows users to efficiently edit, sign, and store their POA forms in a secure cloud-based environment. With interactive features that make document creation straightforward, pdfFiller simplifies the entire process from filling to signing, guiding users through each step for a seamless experience.

-

pdfFiller allows easy document editing, ensuring all necessary fields are completed.

-

Securely store and access your documents from anywhere, reducing the risk of loss.

-

User-friendly features facilitate easy navigation and completion of the document.

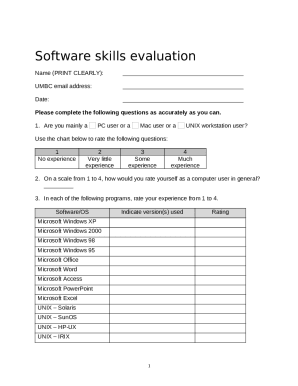

How to fill out the living trust power of

-

1.Access pdfFiller and log in to your account.

-

2.Search for or select the 'Living Trust Power of Attorney' template.

-

3.Begin by filling in your personal details in the specified fields, such as your name and address.

-

4.Identify and enter the agent's information—this is the person you are granting power to.

-

5.Review the terms of the trust and specify any limitations or guidelines for how the power can be exercised.

-

6.If applicable, provide instructions regarding your assets and how they should be managed.

-

7.Sign the document as required, typically in the presence of a notary or witnesses, depending on state laws.

-

8.Review the completed document thoroughly to ensure accuracy before saving or printing.

What is a Living Trust Power of Attorney Template and why do I need one?

A Living Trust Power of Attorney Template is a legal document that allows an individual to designate someone else to manage their financial affairs in the event that they become incapacitated. This template ensures that your financial decisions can be made without court intervention, which can save time and money. Having this document in place provides peace of mind knowing that your affairs are in capable hands.

How do I create a Living Trust Power of Attorney Template?

Creating a Living Trust Power of Attorney Template involves several straightforward steps. First, you'll want to choose a trusted individual to act on your behalf. Then, using a template from a reputable source like pdfFiller, fill in the necessary details specific to your situation. Finally, ensure that both you and your chosen agent sign the document in accordance with your state’s legal requirements.

Can I customize my Living Trust Power of Attorney Template?

Absolutely! A Living Trust Power of Attorney Template is designed to be customizable to suit your particular needs. Whether you want to include specific powers, limit authority, or designate multiple agents, most templates allow for modifications. Utilizing a flexible platform like pdfFiller enables you to easily make these changes, ensuring the document reflects your intentions accurately.

What are the benefits of using a template for my Living Trust Power of Attorney?

Using a template for your Living Trust Power of Attorney offers numerous benefits that simplify the document creation process. Templates provide a structured format ensuring that all essential elements are included, reducing the chances of errors. Additionally, templates save time and can often be adapted for various situations, making them a practical choice for individuals looking to manage their legal affairs efficiently.

Is a Living Trust Power of Attorney Template legally binding?

Yes, a Living Trust Power of Attorney Template can be legally binding if executed according to your state’s laws. For the document to be valid, it typically requires your signature and may also need witnesses or notarization, depending on local regulations. Always confirm the legal requirements in your jurisdiction to ensure that your template holds its intended power.

Who should I appoint in my Living Trust Power of Attorney Template?

When appointing an individual in your Living Trust Power of Attorney Template, choose someone you trust implicitly, as they will be making significant decisions on your behalf. It could be a family member, a close friend, or a professional such as an attorney or financial advisor. Consider their ability to manage your finances, their availability, and their willingness to accept the responsibilities associated with this role.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.