Get the free Power of Attorney for Car Insurance Purposes Template

Show details

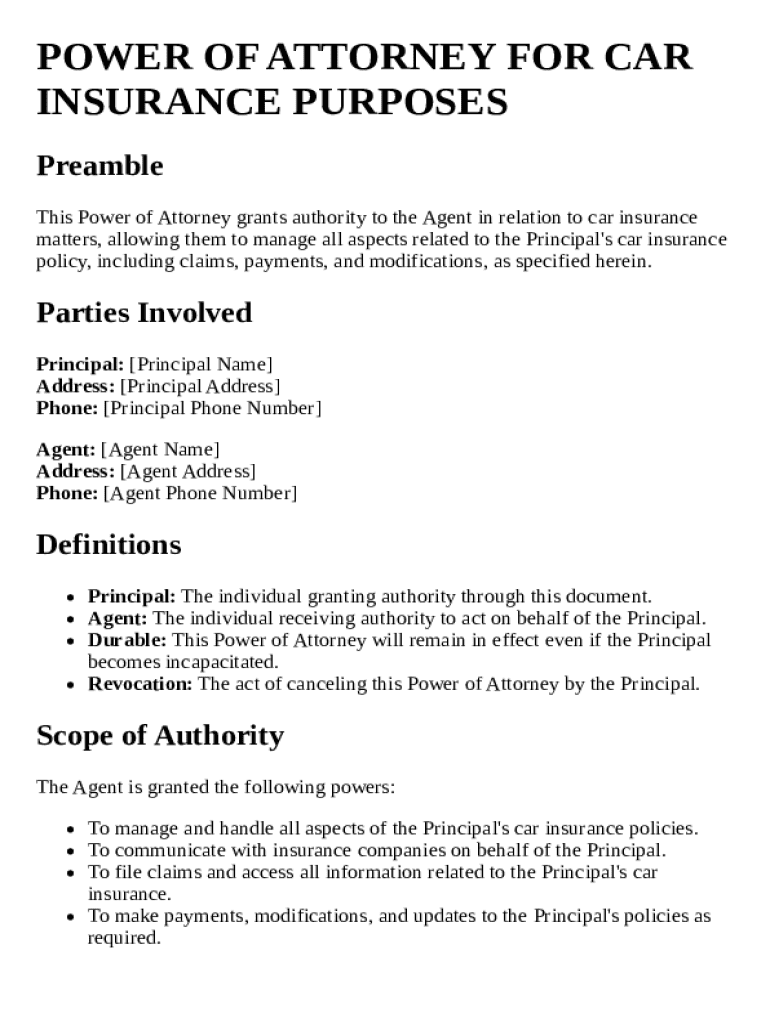

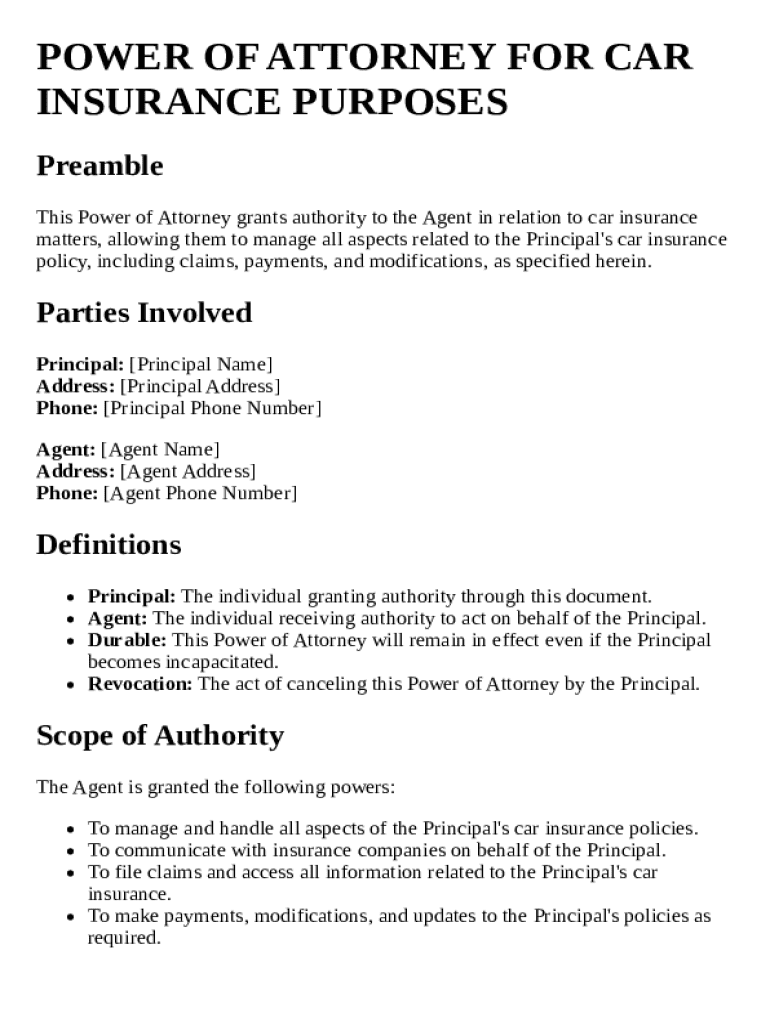

This document grants authority to an Agent to manage all aspects related to a Principal\'s car insurance, including claims, payments, and modifications.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is power of attorney for

A power of attorney for is a legal document that allows one person to act on behalf of another in legal or financial matters.

pdfFiller scores top ratings on review platforms

good

Very good application

Great program

Great program! I highly recommend it. It has made my job so much easier.

App is to use for my duty!

App is to use for my duty!

Thanks a lot!

Very fast and excellent support

Very fast and excellent support

Easy to fill up and very convenient.

Easy to fill up and very convenient.

very easy to use

very easy to use

Who needs power of attorney for?

Explore how professionals across industries use pdfFiller.

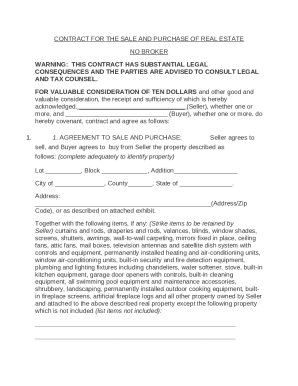

Power of Attorney for Car Insurance: A Comprehensive Guide

How do you define a power of attorney?

A Power of Attorney (POA) is a legal document that allows one person (the principal) to authorize another (the agent) to act on their behalf in specified matters. For car insurance, a POA can empower the agent to handle various tasks, such as filing claims or modifying policy details. This arrangement is crucial for individuals who may be unable to manage their insurance affairs due to various reasons.

-

A POA grants legal authority to the agent to act on behalf of the principal.

-

It facilitates easier management of insurance policies and claims.

-

There are different forms available, including general and specific POA tailored to car insurance.

What are the key components of a car insurance POA?

Understanding the vital components of a car insurance POA is essential for effective use. The POA usually begins with a preamble outlining its purpose, followed by defining key terms and the parties involved. The principal is the individual granting authority, while the agent is the one receiving it.

-

The opening statement clarifies the intent and scope of the POA.

-

Identifies the principal who grants authority and the agent who receives it.

-

Clarifies terminologies to ensure mutual understanding.

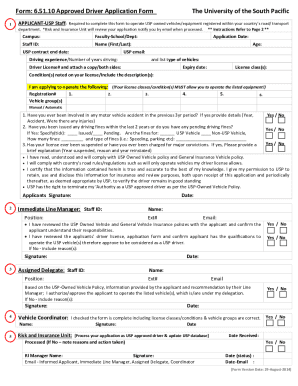

How do you fill out your power of attorney for car insurance?

Filling out a POA form requires careful attention to detail to prevent errors. Start by clearly identifying both the principal and agent's information, followed by accurately noting the powers granted. Clear instructions help in eliminating ambiguity and ensuring completeness.

-

Follow a clear format, starting with the principal's details and proceeding through the required fields of the form.

-

Make sure to accurately state names, addresses, and any additional information as needed for both parties.

-

Double-check all information provided to avoid mistakes, which can lead to disputes or legal issues.

What powers are granted under the scope of authority?

The scope of authority details what the agent is permitted to do on behalf of the principal. This can include managing car insurance policies, filing claims, and making changes as the principal may request. It's crucial that this section is comprehensively filled to avoid any limited authority that could hinder necessary actions.

-

Clarifies the extent of authority given to the agent to act in various capacities.

-

Allows the agent to renew policies or make changes necessary for the principal's coverage.

-

Empowers the agent to act swiftly on behalf of the principal in claims processing.

What are the limitations of authority in your POA?

When drafting a POA for car insurance, it’s crucial to be aware of specific limitations that can affect how authority is exercised. Many POAs do not grant the ability to transfer ownership of the vehicle, nor do they allow for healthcare decisions. Identifying these limitations ensures that the agent operates within legal bounds and responsibilities.

-

These may include restrictions on the ownership transfer of property or healthcare-related decisions.

-

Transparency regarding these limitations can prevent misuse or misunderstandings.

-

Understanding limits helps the agent to act efficiently without overstepping legal boundaries.

When does your POA take effect and how can it be revoked?

The effective date of a POA and its duration are significant factors to consider. The POA typically takes effect upon signing, unless it specifies otherwise. Knowing the process for revocation is equally essential as it allows the principal to regain control whenever necessary.

-

Most POAs become active once signed unless stated as otherwise.

-

POAs remain valid until revoked or until a specified end date occurs.

-

The principal can revoke the POA through a written notice, ensuring once again full control.

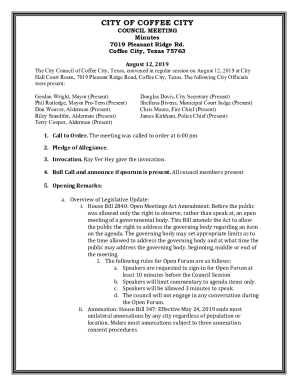

What legal considerations must you keep in mind?

Understanding the legal aspects surrounding a POA is crucial to ensure compliance with local laws. The POA must be crafted in accordance with state regulations, which may outline notarization requirements or other specific rules. This adherence not only provides legal backing but also adds credibility to the document.

-

Legal requirements vary by state; thus, it's vital to understand local laws that govern POAs.

-

Some states mandate notarization of the document to enhance its legality.

-

Check for particular regulations that apply to your state to ensure full compliance.

How do you sign and notarize your POA?

The signing and notarization process is vital for the validity of your POA. Both the principal and agent must sign the document, and notarization can further fortify its legal standing. Implementing best practices throughout this process can prevent complications in the future.

-

The principal should sign the document in the presence of a notary while the agent’s signature is also required.

-

Notarization confirms the identities of the signers and legitimizes the document.

-

Ensure all parties sign willingly and are aware of the powers being delegated.

How does pdfFiller make managing your POA easier?

Utilizing pdfFiller for managing your POA offers several advantages. The platform allows for easy editing, signing, and sharing of documents, providing a seamless experience for users. Benefits of this cloud-based platform include accessibility from anywhere and robust document management features.

-

Easily make changes to the document and secure signatures digitally.

-

Facilitate teamwork on documents, allowing multiple users to work on the POA simultaneously.

-

Access your documents anytime and anywhere, providing flexibility in managing your POA.

How to fill out the power of attorney for

-

1.Open pdfFiller and upload your power of attorney document.

-

2.Begin by entering the name of the principal (the person granting authority) in the designated field.

-

3.Next, fill in the name of the agent (the person receiving authority) clearly and accurately.

-

4.Specify the powers being granted to the agent, including any limitations or specific tasks.

-

5.Include the date when the power of attorney will commence and, if applicable, when it will expire.

-

6.Review the document carefully to ensure all information is correct and complete.

-

7.Sign the document in the presence of a witness or notary, if required by state law.

-

8.Download or print the filled power of attorney document for your records and distribution.

What is a Power of Attorney for Car Insurance Purposes Template?

A Power of Attorney for Car Insurance Purposes Template is a legal document that allows an individual to authorize another person to act on their behalf regarding car insurance matters. This template simplifies the process of managing insurance claims, policy changes, or negotiations with insurance companies. With this document, users can ensure that their insurance decisions are handled effectively and in line with their wishes.

Why would I need a Power of Attorney for Car Insurance Purposes Template?

If you are unable to manage your car insurance needs due to time constraints or other commitments, a Power of Attorney for Car Insurance Purposes Template is essential. This document allows someone you trust to make important decisions regarding your car insurance on your behalf. It ensures that your interests are represented, especially during emergencies or when you're unavailable to handle these matters.

How can I customize the Power of Attorney for Car Insurance Purposes Template?

Customizing the Power of Attorney for Car Insurance Purposes Template is straightforward. You can input specific details such as the name of the person you are appointing, the extent of their powers, and any limitations you’d like to impose. Using a platform like pdfFiller, you can easily edit the template to reflect your unique requirements, ensuring it meets your legal needs.

What are the key sections included in the Power of Attorney for Car Insurance Purposes Template?

The key sections of a Power of Attorney for Car Insurance Purposes Template typically include the principal's name, the agent's name, powers granted, and any specific limitations. Additionally, it may outline the duration of the power and signature lines for both parties. Ensuring these sections are properly filled out is crucial for the document's validity in legal situations relating to car insurance.

Is the Power of Attorney for Car Insurance Purposes Template legally binding?

Yes, the Power of Attorney for Car Insurance Purposes Template is legally binding when executed correctly. To ensure its legality, both the principal and the agent should sign the document, and it may require notarization depending on your jurisdiction's laws. It's important to follow local regulations to ensure the document holds up in any insurance dealings.

Where can I find a reliable Power of Attorney for Car Insurance Purposes Template?

You can find a reliable Power of Attorney for Car Insurance Purposes Template on platforms like pdfFiller, which offers a variety of legal document templates. These templates are user-friendly and designed to meet different legal requirements. Utilizing such resources ensures you have a comprehensive and suitable template tailored to manage your car insurance needs effectively.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.