Get the free Power of Attorney for Finance Template

Show details

This document grants the designated Agent the authority to manage financial matters on behalf of the Principal, including handling accounts, transactions, and taxrelated issues, while specifying the

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is power of attorney for

A power of attorney is a legal document that allows one person to act on behalf of another in legal or financial matters.

pdfFiller scores top ratings on review platforms

I have used the program in the past but need some training to get the full benefit of the program.

good working

I am not the most creative person but so far, this has been a fairly easy program to use with great success!

very nice of you, very nice, can't believe of the unlimited Features

good

Easy to use and has a wide range of services

Who needs power of attorney for?

Explore how professionals across industries use pdfFiller.

How to fill out a power of attorney for form form

What are the essentials of a power of attorney for finance?

A power of attorney (POA) is a legal document that grants one person the authority to act on behalf of another in specific financial matters. Understanding the relationship between the principal, the individual granting authority, and the agent, the person designated to make decisions, is crucial. This arrangement not only facilitates smooth financial management but protects the principal’s interests when they are unable to handle their own affairs.

-

Definition and Importance: A power of attorney for finance allows a designated person to make financial decisions, ensuring that someone you trust can oversee your financial matters in your absence.

-

Role of Agent and Principal: The principal retains control by choosing who represents them through the agent, creating a system for effective management of financial affairs.

-

Benefits: Utilizing a POA ensures that your financial needs are met during incapacitation, while also providing clarity on responsibilities.

Who are the parties involved in a power of attorney?

A power of attorney involves two primary parties: the principal and the agent. The principal is the person who grants authority, and the agent is the individual authorized to act on their behalf. Understanding these roles is essential for effective management of financial affairs.

-

Principal: This is the person granting the power, responsible for defining the extent of authority.

-

Agent: This individual must act in the principal’s best interest, adhering strictly to the outlined powers.

-

Accurate Information: Ensuring that names, addresses, and dates of birth are correctly recorded is vital to prevent future disputes.

What are the key terms in power of attorney documents?

Understanding the key terms within a power of attorney document helps clarify the responsibilities associated with each role. Definitions of principal, agent, and types of powers of attorney are integral to determining how the document operates.

-

Principal: The individual granting the authority who has specific duties to ensure the agent acts appropriately.

-

Agent: This person has specific responsibilities, such as making financial decisions, with limitations clearly defined.

-

Durable vs. Non-Durable: A durable power of attorney remains effective even when the principal becomes incapacitated, while a non-durable power ends under those circumstances.

-

Revocation: The process enables the principal to withdraw the agent's authority, which requires proper documentation and notification.

What is the scope of authority granted to your agent?

The scope of authority outlines the specific financial matters that the agent can manage. It is essential for the principal to define these powers clearly to avoid misuse of authority.

-

Typical Financial Matters: These may include managing bank accounts, paying bills, and handling investments on behalf of the principal.

-

Real Estate Transactions: Agents can conduct transactions related to property sales or purchases, impacting both parties significantly.

-

Tax Handling: The agent may be empowered to file tax returns or handle payment of taxes, ensuring compliance with state guidelines.

-

Making Financial Decisions: The agent's authority must respect the principal’s preferences and legal limitations.

What are the limitations of the agent's authority?

Limitations protect the interests of the principal and ensure that the agent acts within legal and ethical boundaries. It is helpful for both parties to understand what is off-limits to the agent.

-

Off-Limits Decisions: The agent cannot make healthcare decisions unless explicitly granted this power, emphasizing the necessity of clear definitions.

-

Legal and Ethical Responsibilities: Agents must comply with laws, adhering to the best practices that govern financial transactions on behalf of the principal.

-

Healthcare Decisions: Distinguishing between financial and healthcare authority ensures that the agent operates within defined limits.

What is the timeline of power of attorney effectiveness?

Defining the timeline is crucial when drafting a power of attorney as it dictates when the document becomes effective and when it will end. Clear specifications are essential to avoid confusion.

-

Effective Dates: Clearly stating the start and end conditions can prevent unintended authority from being given.

-

State Laws: Understanding how your state's regulations affect the timeline of the power of attorney is crucial to compliance.

-

Common Termination Conditions: Various factors, such as death or revocation, can lead to the termination of the power of attorney.

How can you revoke or manage changes to a power of attorney?

Revoking a power of attorney is a straightforward process but requires careful execution to ensure that all parties are informed and legal documents are correctly processed.

-

Steps to Revoke: Clear documentation and notifying the agent are crucial steps to nullify previous authority.

-

Conditions Leading to Revocation: Changes in personal circumstances or trust issues with the agent are common reasons for revocation.

-

Notifying Your Agent: Communication is critical to protect the principal’s interests and uphold clarity in financial management.

What legal jurisdictions affect power of attorney validity?

Legal jurisdictions play a significant role in the validity and enforceability of a power of attorney. Awareness of state-specific requirements is essential.

-

Governing Laws: Understanding how local laws influence the validity of a power of attorney ensures compliance.

-

State-Specific Requirements: Each state may have unique criteria that must be satisfied for a power of attorney to be considered valid.

-

Confirming Compliance: Resources and tools can help ensure that your power of attorney meets all necessary standards.

What are the signing and witnessing procedures?

Signing and witnessing procedures add a layer of security to the power of attorney process, ensuring authenticity and compliance with legal standards.

-

Signature Requirements: Both the principal and agent must provide signatures for the document to be valid.

-

Witnessing Necessities: Legal witnesses can include disinterested parties who meet state requirements.

-

Notarization: Certain situations necessitate notarization to enhance the document's legal standing.

How can you leverage pdfFiller for your power of attorney?

pdfFiller provides a seamless platform for creating, editing, and managing your power of attorney documents. Its tools make the process convenient and secure.

-

Interactive Tools: Users benefit from intuitive features that simplify filling out the power of attorney form.

-

Editing and Customization: Tailor your power of attorney to fit your specific needs with user-friendly editing options.

-

Secure eSigning: pdfFiller offers eSigning options that ensure your document's integrity and legality.

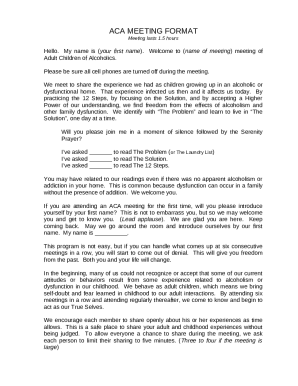

How to fill out the power of attorney for

-

1.Open the PDFfiller website and log into your account or create a new one.

-

2.Search for 'Power of Attorney' templates using the search bar.

-

3.Select a suitable template from the available options.

-

4.Fill in your name and the name of the person you are giving authority to in the designated fields.

-

5.Specify the powers you are granting, such as financial decisions, medical decisions, or property management.

-

6.Add any limitations or conditions you want to include in the document.

-

7.Include the effective date of the power of attorney and any duration if applicable.

-

8.Review the document for accuracy, ensuring all necessary information is filled out correctly.

-

9.Sign the document digitally or print it out to sign manually.

-

10.Save the completed document to your account or download it for your records.

What is a Power of Attorney for Finance Template?

A Power of Attorney for Finance Template is a legal document that allows an individual to appoint someone else to manage their financial matters on their behalf. This template simplifies the process of creating a formal agreement, ensuring that all necessary information is included. Using a Power of Attorney for Finance Template can save time and ensure legal compliance in financial transactions.

Why should I use a Power of Attorney for Finance Template?

Using a Power of Attorney for Finance Template ensures that the document contains all essential elements required by law. It provides a clear and structured format that can help prevent any misunderstandings between the parties involved. This template is useful for individuals who want to ensure their financial affairs are managed according to their wishes when they are unable to do so themselves.

Can I customize a Power of Attorney for Finance Template?

Yes, you can customize a Power of Attorney for Finance Template to fit your specific needs and circumstances. This flexibility allows you to define the scope of authority granted to your agent, making it a tailored solution for your financial management. Customizing the template ensures that the document accurately reflects your intentions and addresses your unique financial situation.

What should be included in a Power of Attorney for Finance Template?

A comprehensive Power of Attorney for Finance Template should include details such as the name and address of the principal, the agent, and the specific powers granted to the agent. Other important elements include any limitations on authority and when the document becomes effective. Including these details ensures clarity and compliance with legal standards, making the template a reliable resource.

Is a Power of Attorney for Finance Template legally binding?

Yes, a properly executed Power of Attorney for Finance Template is legally binding as long as it meets specific statutory requirements. This typically involves signing the document in the presence of witnesses or a notary public, depending on state laws. By following these guidelines, you can ensure that your Power of Attorney for Finance Template is recognized by financial institutions and legal authorities.

Where can I find a reliable Power of Attorney for Finance Template?

You can find a reliable Power of Attorney for Finance Template on pdfFiller, which offers a variety of customizable templates designed to meet legal standards. These templates are easy to fill out and modify, making it convenient for users to manage their financial affairs. pdfFiller ensures that all templates are updated with current legal requirements, providing peace of mind when creating important documents.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.