Get the free Power of Attorney for Insurance Claims Template

Show details

Dieser Vollmachtstext ermchtigt den Bevollmchtigten, im Namen des Vollmachtgebers in Angelegenheiten im Zusammenhang mit Versicherungsansprchen zu handeln und definiert die Befugnisse sowie Einschrnkungen.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is power of attorney for

A power of attorney is a legal document that allows one person to act on behalf of another in legal or financial matters.

pdfFiller scores top ratings on review platforms

Easy to import edit- wished I had this a long time ago!

I was desperately trying to find a way to send my Doctor forms. Scanner/Printer was knocked out from the storm.

Very user friendly

IT WAS GREAT

You should make rearranging pages in the pdf easier

Awesome!

This is not intuitive, but I figured it out.

Who needs power of attorney for?

Explore how professionals across industries use pdfFiller.

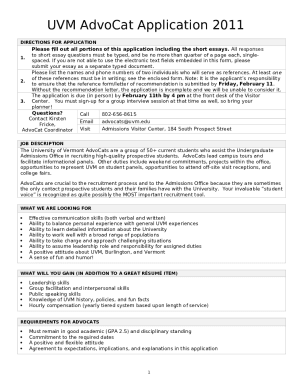

How to fill out the power of attorney for

-

1.Open the PDFfiller website and log into your account or create a new one.

-

2.Search for 'Power of Attorney' templates using the search bar.

-

3.Select a suitable template from the available options.

-

4.Fill in your name and the name of the person you are giving authority to in the designated fields.

-

5.Specify the powers you are granting, such as financial decisions, medical decisions, or property management.

-

6.Add any limitations or conditions you want to include in the document.

-

7.Include the effective date of the power of attorney and any duration if applicable.

-

8.Review the document for accuracy, ensuring all necessary information is filled out correctly.

-

9.Sign the document digitally or print it out to sign manually.

-

10.Save the completed document to your account or download it for your records.

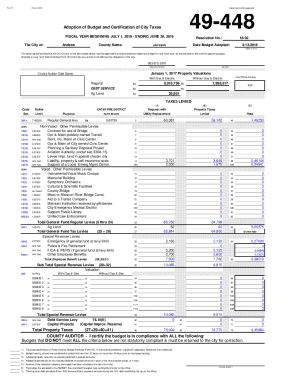

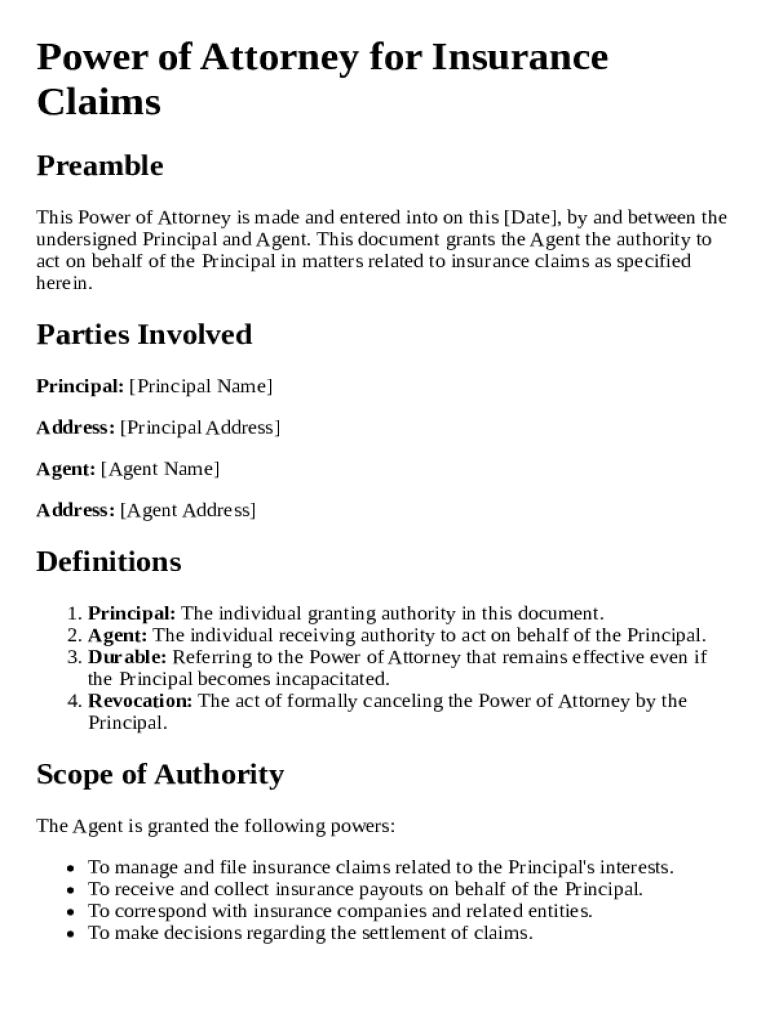

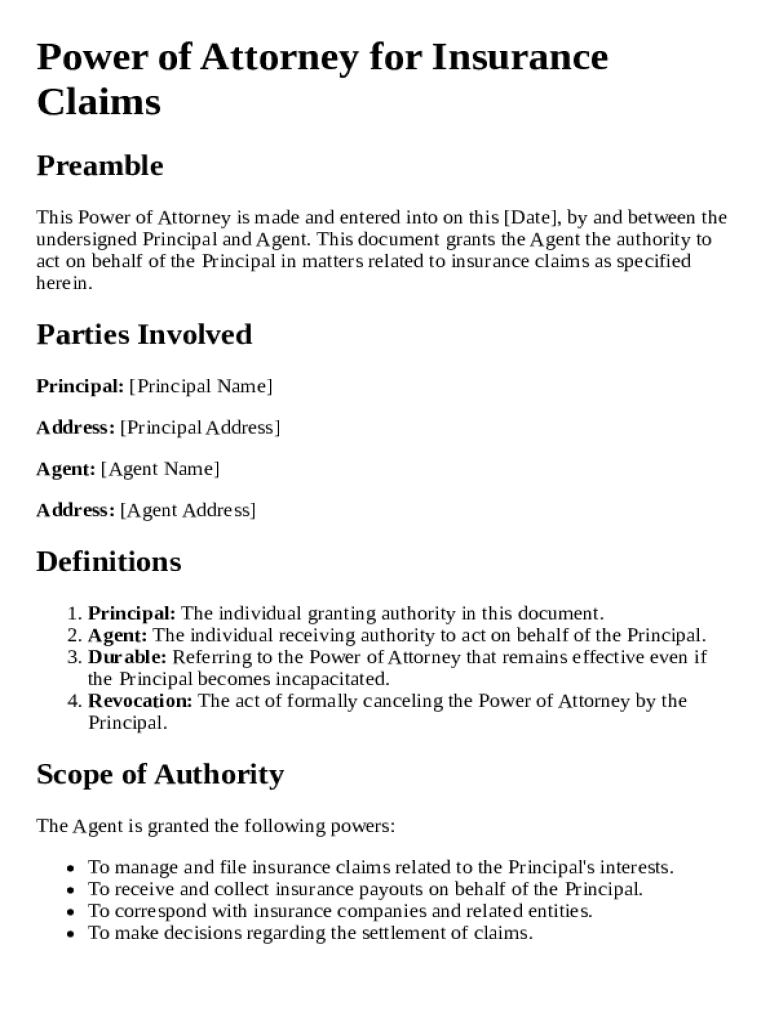

What is a Power of Attorney for Insurance Claims Template?

A Power of Attorney for Insurance Claims Template is a legal document that allows one person to authorize another to handle their insurance claims on their behalf. This template simplifies the process of granting someone the power to manage claims, ensuring smooth communication with insurance providers. Utilizing a structured Power of Attorney for Insurance Claims Template can save time and reduce potential errors in handling important insurance matters.

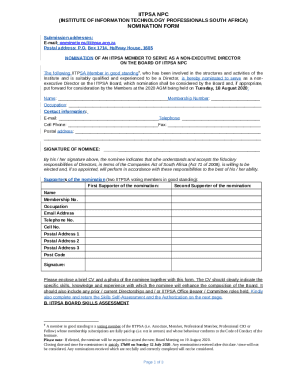

When should I use a Power of Attorney for Insurance Claims Template?

You should use a Power of Attorney for Insurance Claims Template when you are unable to manage your insurance claims directly due to factors like illness, absence, or personal incapacity. This document allows a trusted individual to navigate the claims process on your behalf, ensuring that your interests are represented appropriately. Implementing this template when necessary can help expedite the claims process and provide peace of mind.

What are the key components of a Power of Attorney for Insurance Claims Template?

A comprehensive Power of Attorney for Insurance Claims Template typically includes information about the principal, the attorney-in-fact, and the specific powers granted. It outlines the authority concerning insurance claims, defining what actions the attorney-in-fact can take, such as filing claims, negotiating settlements, and receiving payments. Ensuring that all necessary details are included in the Power of Attorney for Insurance Claims Template helps avoid misunderstandings and legal complications.

How can I customize a Power of Attorney for Insurance Claims Template?

Customizing a Power of Attorney for Insurance Claims Template can ensure it meets your specific needs. You can modify sections that define powers tailored to your situation, add the recipient's name, and include any special instructions. It is important to review the finalized version with legal counsel to make sure it complies with applicable laws and adequately represents your intentions regarding insurance claims.

Is it necessary to notarize a Power of Attorney for Insurance Claims Template?

Notarization for a Power of Attorney for Insurance Claims Template is often recommended to enhance the document's legitimacy and acceptance by insurance companies. Many institutions require a notarized copy to process claims effectively. While notarization may not be legally mandated in every jurisdiction, it helps safeguard against potential disputes and ensures smoother execution of your claims.

Can I revoke a Power of Attorney for Insurance Claims Template once it's established?

Yes, you can revoke a Power of Attorney for Insurance Claims Template at any time, provided you are of sound mind. To revoke, you should create a written document stating your intent to cancel the powers previously granted. Inform your attorney-in-fact and any relevant insurance companies promptly about the revocation to avoid any potential issues with your claims management.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.