Get the free Power of Attorney for Loan Documents Template

Show details

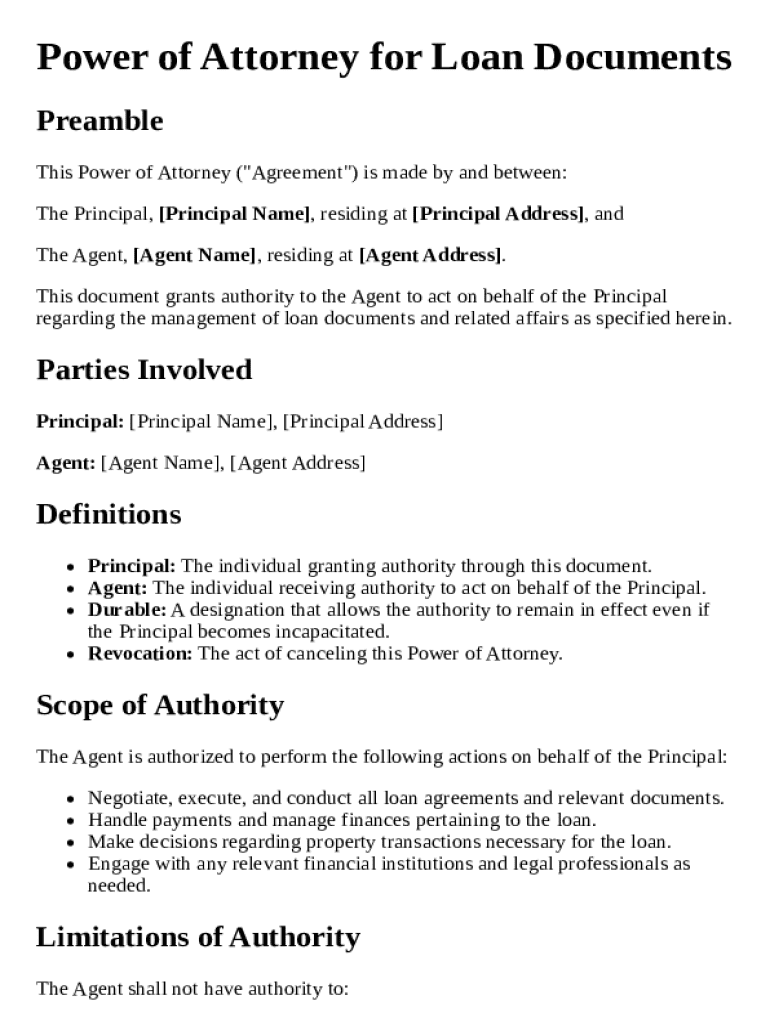

This document grants authority to an agent to manage loan documents and related affairs on behalf of the principal.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is power of attorney for

A power of attorney for allows one person to designate another to act on their behalf in legal or financial matters.

pdfFiller scores top ratings on review platforms

so far I think it great and the faxing will be very helpful because I don't use a landline anymore

You need some front end GUI. "What do you want to do?" "Create a brand new form from scratch?" "Make a PDF form fillable for your business?" etc.... I got the service and deleted my subscription only to play with it a little more and see the tiny, green side button that allows one to make the form fillable and then I realized this was a service I wanted. You are not demonstrating or advertising the best feature from the get-go.

Love that its so easy to use. I wish it was free/cheaper since I am only using it to apply for jobs. Would be cool if there was a discount code for people in the market looking for jobs if they took a survey for market research.

The form I filled in was for a Medal of Honor recommendation for a Vietnam vet. The format and help with the form was clear and efficient. I had to come back and modify it, and everything was smooth and easy.Thanks for a very professional tool.

I just needed it for a couple of docs at tax time. The app works great, but I wouldn't use it every month.

I am absolutely loving this program. I need to determine if I can embed a hyperlink in the PDF. I haven't been able to figure that out so far.

Who needs power of attorney for?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Power of Attorney for Loan Documents

How do you define power of attorney?

A Power of Attorney (POA) is a legal document that allows one person to act on behalf of another in legal, financial, or medical matters. It is crucial in financial transactions, particularly loans, as it provides the agent with the authority to make decisions or take actions for the principal. Understanding the different types of POAs, such as durable or non-durable, is essential for ensuring effective financial management.

-

A document granting legal authority to an agent to act on behalf of the principal.

-

Facilitates actions for loan applications, management, and repayment in the principal's absence.

-

Includes durable POA for ongoing matters and special POA for specific transactions.

Who are the key parties in a power of attorney for loans?

In a Power of Attorney, there are typically two key parties involved: the principal and the agent. The principal is the individual granting authority, while the agent is the one receiving it. Understanding the rights, responsibilities, and limitations of both parties is vital for smooth cooperation and decision-making.

-

The individual who grants the authority to the agent, retaining control over their affairs.

-

The designated person who has the power to make decisions and take actions on behalf of the principal.

-

The trust relationship between the principal and agent is key; proper understanding minimizes conflicts.

What steps are involved in creating a power of attorney document?

Creating a Power of Attorney document requires careful consideration and attention to detail. It is important to draft a form that captures all essential elements while adhering to legal requirements. Following a structured process will help avoid common mistakes that can invalidate the POA.

-

Inclusion of names, specific powers granted, and effective date are crucial for validity.

-

Outline your wishes clearly, involve legal advice where necessary, and ensure all parties sign.

-

Failing to specify authorities or leaving out necessary signatures can result in issues.

What is the scope of authority of the agent?

The scope of authority granted to the agent in a Power of Attorney can significantly affect loan transactions. It is vital to clearly define what actions the agent is authorized to take and what limitations are in place. This clarity helps maintain control while empowering the agent to make necessary decisions.

-

Agents can handle loan applications, sign documents, and manage payments according to defined authority.

-

Certain actions, such as making gifts or changing beneficiaries, may be restricted unless explicitly stated.

-

To avoid misunderstandings, clearly express actions that the agent cannot perform.

When does a power of attorney become effective?

The effective date of a Power of Attorney can vary and must be clearly stated within the document. Understanding the duration and revocation procedures is equally important for both the principal and agent. This knowledge ensures that everyone involved knows when the powers come into play and how they can be terminated.

-

POA can be effective immediately, or contingent on future events like the principal’s incapacitation.

-

Specify how long the POA lasts; this can be a set time or until revoked.

-

Outlining steps for terminating the POA prevents unauthorized actions; communicate this to involved parties.

What legal considerations should you be aware of?

Power of Attorney documents must adhere to specific state laws, which may vary significantly. Understanding the differences between durable and non-durable POAs is vital in a financial context, especially regarding how they function once a principal becomes incapacitated. Each state may also have particular regulations to follow in drafting a valid POA.

-

Each state has unique requirements that must be met for a POA to be legally binding.

-

A durable POA remains effective even if the principal becomes incapacitated, while a non-durable POA does not.

-

Some states may require notarized signatures or witnesses; be sure to confirm local requirements.

How can pdfFiller assist you in managing your power of attorney?

Using pdfFiller, users can create, edit, and manage their Power of Attorney documents with ease. The platform offers cloud-based features that enable efficient collaboration and editing, making document management straightforward. With tools that facilitate signing and sharing, managing POA documentation has never been easier.

-

Easily design your POA using customizable templates and straightforward editing tools.

-

Access your documents from anywhere to ensure continuous management of your affairs.

-

Invite agents and other stakeholders to review, edit, or sign the document as needed.

How to fill out the power of attorney for

-

1.Download the power of attorney form from pdfFiller.

-

2.Open the file in pdfFiller's editor.

-

3.Begin by filling in the principal's full name and address to identify who is granting the power.

-

4.Next, enter the agent's full name and address, indicating who will receive the authority.

-

5.Specify the extent of the powers granted, such as financial decisions, healthcare decisions, or both.

-

6.If applicable, indicate any limitations or special provisions regarding the authority granted.

-

7.Include the date the power of attorney becomes effective, if different from the signing date.

-

8.Sign the document to validate it; some states may require notarization or witnesses—check local laws before finalizing.

-

9.Review all entered details for accuracy.

-

10.Save the completed form, and consider distributing copies to all relevant parties.

What is a Power of Attorney for Loan Documents Template and why is it important?

A Power of Attorney for Loan Documents Template is a legal document that authorizes another person to handle financial transactions on behalf of the principal. This template is crucial when dealing with loan applications, allowing the designated agent to sign necessary documents without the principal's physical presence. Utilizing a template ensures that all required terms are included, providing a convenient and legally sound way to facilitate loan processes.

How can I create a Power of Attorney for Loan Documents Template using pdfFiller?

Creating a Power of Attorney for Loan Documents Template with pdfFiller is straightforward and user-friendly. You can start by selecting a suitable template from our library and customizing it with your specific details. Once you’ve filled in the necessary fields, pdfFiller allows you to save and share the document securely, facilitating easy access for both you and your designated agent.

Who should I appoint as my agent in a Power of Attorney for Loan Documents Template?

Choosing the right agent for a Power of Attorney for Loan Documents Template is essential for effective management of your loan documents. It’s advisable to appoint someone trustworthy and knowledgeable about financial matters, such as a family member or close friend. This ensures that your interests are adequately represented in all loan-related dealings, enhancing the process's efficiency.

Can I modify a completed Power of Attorney for Loan Documents Template?

Yes, you can modify a completed Power of Attorney for Loan Documents Template whenever necessary. pdfFiller provides easy editing capabilities, allowing you to update details, add new information, or change the agent if needed. Always ensure that any modifications comply with relevant legal requirements to maintain the document's validity.

What should I do if my Power of Attorney for Loan Documents Template needs to be revoked?

If you need to revoke your Power of Attorney for Loan Documents Template, it’s important to follow the proper legal procedures. You should notify your agent and any relevant institutions that you are revoking the authority granted. Additionally, consider completing a revocation form and ensuring that you keep a copy for your records, as this will serve as proof of your decision.

Are there any legal considerations for using a Power of Attorney for Loan Documents Template?

Yes, there are several legal considerations to keep in mind when using a Power of Attorney for Loan Documents Template. It is crucial to ensure that the document complies with your state’s laws, as requirements can vary. Additionally, be aware of the scope of authority granted to your agent to avoid potential misunderstandings or misuse of the Power of Attorney.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.