Get the free Power of Attorney for Loan Template

Show details

This document serves as a legal authorization for an agent to act on behalf of the principal regarding loanrelated matters, including applying for loans, managing financial accounts, and handling

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is power of attorney for

A power of attorney for is a legal document that allows one person to act on behalf of another in legal or financial matters.

pdfFiller scores top ratings on review platforms

great service

Great!!!

Works very well!

great

great

It is excellent.... Thank you!

Who needs power of attorney for?

Explore how professionals across industries use pdfFiller.

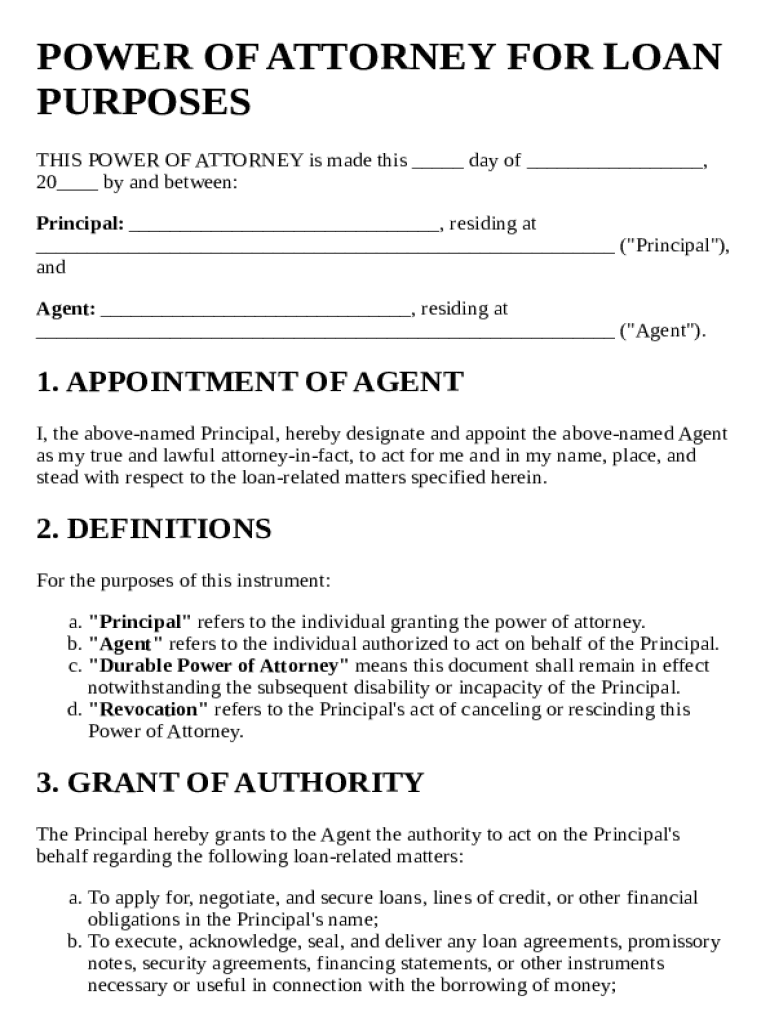

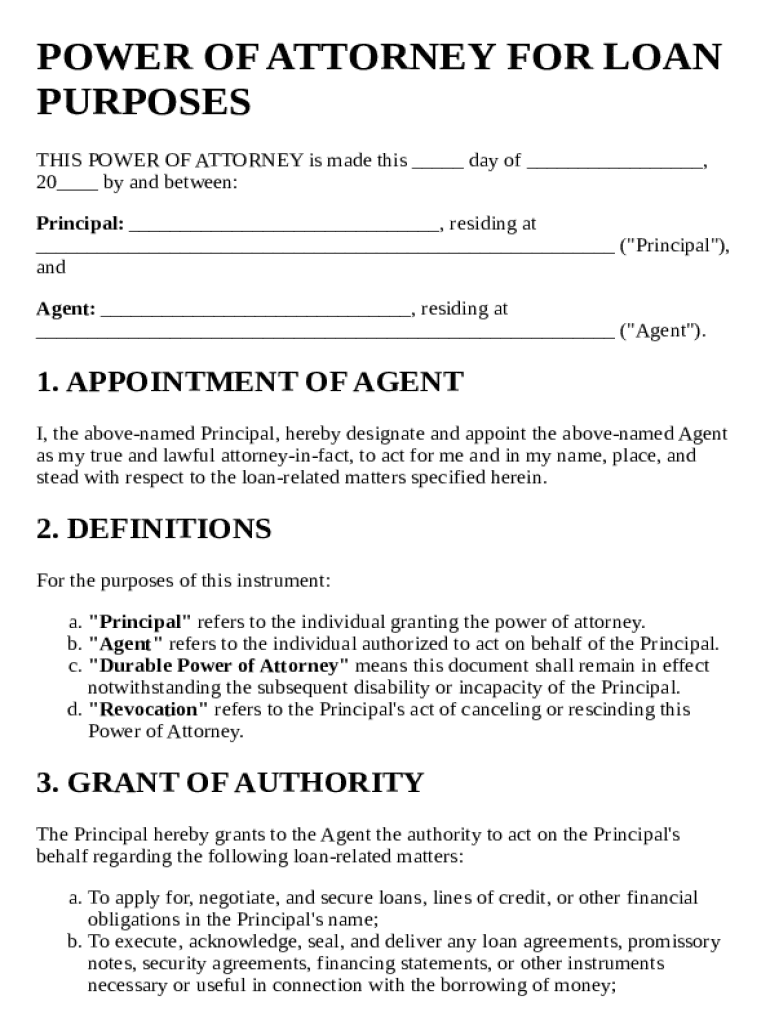

Power of Attorney for Loan Purposes

Understanding how to create a power of attorney for loan purposes is crucial for ensuring that your financial affairs are managed according to your wishes. This document grants someone the authority to act on your behalf, particularly in financial or legal transactions.

The power of attorney for loans can be a pivotal tool in managing your financial matters, especially when you require someone to act during your absence or inability to do so.

What is a power of attorney for loans?

A power of attorney (POA) for loans is a legal document that allows you, the Principal, to appoint an Agent to make decisions and sign documents related to loan transactions. This may include applying for loans, signing contracts, or managing debts.

-

The purpose of a POA in loan contexts is to ensure that your financial interests are represented, especially when you are unable to act.

-

A General POA is effective only while you are competent, whereas a Durable POA remains in effect even if you become incapacitated.

-

Understanding your rights as Principal and the responsibilities of your Agent is crucial for effective management.

Who are the key parties in a power of attorney?

-

The Principal is the individual who grants the authority through the POA. Factors like trust and competency should be evaluated when choosing someone.

-

The Agent is the individual or entity that acts on behalf of the Principal. Their role involves making financial decisions within the limits set by the POA.

-

Trustworthiness and capability are essential traits to consider when appointing your Agent.

What powers should be granted?

When drafting a power of attorney, it’s essential to list specific loan-related actions your Agent is permitted to undertake, ensuring clarity and legal protection.

-

The Agent can apply for loans on behalf of the Principal, expanding access to necessary funds.

-

Your Agent may need to sign financial documents, which can include loan agreements and credit contracts.

-

Understanding the implications of lending agreements ensures that the Agent acts in accordance with financial regulations.

How do you create a power of attorney for loan purposes?

-

Start by drafting your Power of Attorney document using templates available online or through legal services.

-

Include necessary details such as the names of the Principal and Agent, the scope of authority, and specific powers granted.

-

To make the document legally binding, it must be signed in front of a notary public.

What state-specific considerations exist?

State laws can significantly vary in terms of POA requirements and regulations, especially regarding loan-related powers.

-

Each state might have specific laws governing the powers exercised by an Agent, so it’s crucial to familiarize yourself with local regulations.

-

Adhering to state requirements is not just advisable but often necessary for enforcing the validity of your POA.

-

Factors such as the state’s acknowledgment of digital signatures or online submissions can influence how you proceed.

How do you manage your power of attorney?

Regular maintenance and review of your power of attorney document are vital to ensure it remains relevant and effective.

-

Set a schedule to review your POA periodically to ensure it still reflects your current situation and choice of Agent.

-

Life changes like marriage, relocation, or changes in financial status may necessitate an update.

-

Establish tools and practices to oversee the financial activities conducted by your Agent.

What if you need to revoke the power of attorney?

You have the right to revoke a power of attorney at any time, as long as you are competent.

-

Notify your Agent of the revocation and prepare a revocation letter to formalize the process.

-

Be sure to inform banks and other financial entities that your POA has been revoked to prevent unauthorized actions.

-

Clarify specific scenarios in which the Agent cannot act, especially in case of discovered malfeasance.

How can pdfFiller assist you?

pdfFiller provides an easy-to-use platform for accessing, filling out, and managing your power of attorney forms online.

-

Utilize user-friendly tools to create and edit your power of attorney documents with efficiency.

-

The platform offers eSigning capabilities that streamline the execution of your POA documents.

-

Use collaboration tools to work seamlessly with your Agent, ensuring transparent communication throughout the process.

How to fill out the power of attorney for

-

1.Open pdfFiller and upload your power of attorney document.

-

2.Begin by entering the name of the principal (the person granting authority) in the designated field.

-

3.Next, fill in the name of the agent (the person receiving authority) clearly and accurately.

-

4.Specify the powers being granted to the agent, including any limitations or specific tasks.

-

5.Include the date when the power of attorney will commence and, if applicable, when it will expire.

-

6.Review the document carefully to ensure all information is correct and complete.

-

7.Sign the document in the presence of a witness or notary, if required by state law.

-

8.Download or print the filled power of attorney document for your records and distribution.

What is a Power of Attorney for Loan Template?

A Power of Attorney for Loan Template is a legal document that grants someone the authority to act on your behalf regarding loan matters. This template can facilitate the loan application process, allowing an appointed agent to make decisions, sign documents, or manage financial transactions without needing your direct involvement. Utilizing a well-structured Power of Attorney for Loan Template ensures that both you and your agent are clear on responsibilities and limits.

Who should consider using a Power of Attorney for Loan Template?

Individuals who may have difficulty attending loan meetings or signing documents due to certain circumstances should consider a Power of Attorney for Loan Template. This includes those with health issues, travel plans, or busy schedules. Creating this template allows a trusted individual to handle your loan activities while you remain informed and engaged without physical presence.

How do I customize a Power of Attorney for Loan Template?

Customizing a Power of Attorney for Loan Template is straightforward with platforms like pdfFiller. You can easily edit the document to include specific instructions, name your designated agent, and define the scope of their authority concerning your loan. By ensuring your unique needs are met in the template, you guarantee that your representative understands and follows your intentions regarding financial matters.

What are the risks of using a Power of Attorney for Loan Template?

Using a Power of Attorney for Loan Template carries inherent risks if not crafted carefully. There’s potential for misuse if your agent is dishonest or does not act in your best interest. Therefore, it is crucial to choose a trustworthy individual and clearly define the powers granted to prevent misunderstandings when making financial decisions related to your loans.

Can I revoke a Power of Attorney for Loan Template once it's created?

Yes, a Power of Attorney for Loan Template can be revoked at any time as long as you are of sound mind. It’s advisable to notify your agent and any institutions involved, such as banks or lenders, about the revocation to ensure all parties are aware that the agent can no longer act on your behalf. Proper documentation of the revocation is essential to prevent any confusion in future transactions.

How can pdfFiller assist in managing my Power of Attorney for Loan Template?

pdfFiller offers a user-friendly platform that simplifies the management of your Power of Attorney for Loan Template. With features such as secure storage, easy editing, and e-sign capabilities, users can efficiently handle their documents from anywhere. This solution not only helps in creating and customizing templates but also ensures that your documents are accessible and organized when you need them.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.