Get the free Power of Attorney for Service Tax Representation Template

Show details

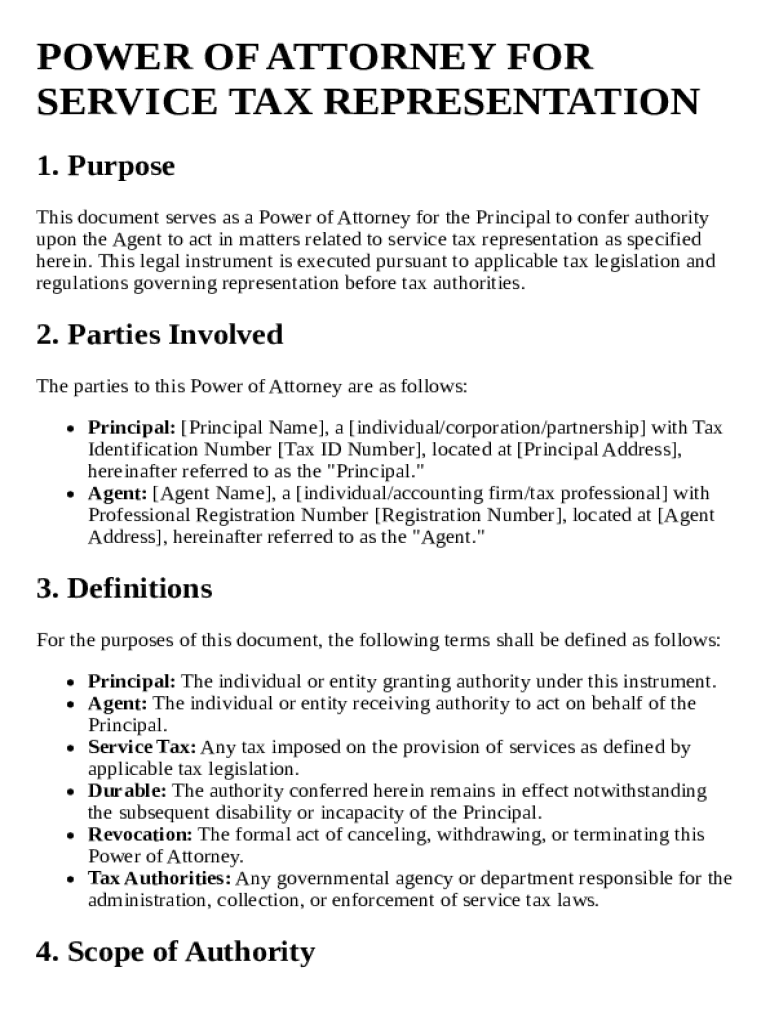

This document serves as a Power of Attorney for the Principal to confer authority upon the Agent to act in matters related to service tax representation as specified herein, executed pursuant to applicable

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is power of attorney for

A power of attorney is a legal document that allows one person to act on behalf of another in legal or financial matters.

pdfFiller scores top ratings on review platforms

A LITTLE DIFFUCULT FINDING WHAT YOU WANT

User friendly. Can't beat it when you have to handle multi documents for inputting information and forwarding under time crunch situations.

it worked great my computer is the problem

Very useful service. Trying to create a fillable pdf is made simple. Although when it's downloaded, one or two areas are not fillable anymore so have to do it again.

I did find it reasonably easy to use and looks good, thought it was a little difficult to start another document however.

Easy to use, a time saver, and very convenient.

Who needs power of attorney for?

Explore how professionals across industries use pdfFiller.

How to fill out a power of attorney for service tax representation

Understanding the power of attorney for service tax representation

A Power of Attorney (POA) is a legal document that grants one person (the Agent) the authority to act on behalf of another (the Principal), particularly in service tax matters. It's essential to have a POA in place for efficient representation with tax authorities, ensuring compliance and effective management of tax obligations.

-

In the context of service tax, a POA allows the Agent to represent the Principal in tax filings and disputes.

-

A POA facilitates seamless communication with tax authorities, helping to manage tax affairs without direct involvement from the Principal.

-

While a general POA covers various powers, a service tax POA specifically focuses on tax-related representation and actions.

Who are the parties involved in the power of attorney?

Understanding the roles of the Principal and Agent is crucial in the execution of a power of attorney for service tax matters. Both parties must meet specific profile requisites and understand their legal responsibilities.

-

The Principal is the individual or entity providing power; the Agent must be a qualified professional, such as a tax accountant.

-

The Principal can be an individual, corporation, or partnership with necessary tax liabilities.

-

The Agent should preferably be a licensed tax professional or accountant with expertise in service tax matters.

-

Both parties must understand their legal obligations, including confidentiality and duty of care to prevent any misuse of the authority granted.

What is the legal framework governing the power of attorney?

A clear understanding of the legal framework surrounding power of attorney is essential for ensuring compliance and the validity of the document.

-

Different jurisdictions may have specific regulations affecting how a POA is constructed and enforced.

-

Legislation governing service taxes may vary greatly depending on your location, requiring careful attention to detail.

-

Durable POA remains effective even if the Principal becomes incapacitated, ensuring ongoing authority in tax matters.

How is service tax defined and why is it relevant?

Service tax is a tax imposed on specific services rendered and can significantly impact your financial responsibilities. Understanding service tax is crucial for determining when and how to file taxes.

-

It includes various services provided by service providers that are taxable under established regulations.

-

Local, state, and federal regulations dictate the nature and rate of service tax applicable to different services.

-

Service tax differs from sales tax and value-added tax (VAT) as it applies specifically to the provision of services.

What is the scope of authority granted in the POA?

The scope of a Power of Attorney must be clearly defined to avoid misunderstandings and ensure both parties are aware of their capabilities.

-

The Agent may file returns, respond to inquiries from tax authorities, and represent the Principal in any tax-related matters.

-

This should be explicitly outlined in the POA to detail what actions the Agent can take.

-

The POA must contain specific clauses that fulfill legal requirements for filing service tax documents.

How do you fill out the power of attorney form for service tax representation?

Filling out a power of attorney form is straightforward if you follow a systematic approach. This guide will help you from start to finish.

-

Begin by downloading the form from a reliable source and ensure you have the correct version for your jurisdiction.

-

Complete all required sections carefully, including names, address, and the specific powers being granted.

-

Ensure the form is signed by both parties and that all information is accurate to avoid delays.

-

pdfFiller offers interactive tools to easily fill out, edit, and manage your POA documents, streamlining the process.

How to manage and revoke a power of attorney?

Managing a Power of Attorney involves understanding how to revoke it if necessary. This is critical for maintaining control over your affairs.

-

To revoke a POA, you must draft a revocation notice and notify the Agent and relevant tax authorities.

-

Follow a systematic approach to ensure the revocation is legally binding and appropriately processed.

-

Upon revocation, the Agent's power ceases immediately, and they must cease all actions on behalf of the Principal.

-

After revocation, inform the tax authorities to prevent the Agent from continuing to act on your behalf.

What costs and considerations should you know for service tax power of attorney?

Understanding the financial implications of establishing a Power of Attorney is as important as the legal components.

-

Costs may include professional fees for tax advisors, legal fees, and any associated governmental fees for filing.

-

Complexity of the tax issues and the professional fees of the Agent can significantly affect total costs.

-

You must monitor the Agent's actions and may incur costs related to maintaining compliance in your tax filings.

How to choose the right POA agent for service tax matters?

Selecting a competent Agent is vital for ensuring your interests are effectively represented. Here are some key considerations.

-

Look for qualifications, experience with service tax, and transparent communication skills.

-

Inquire about their experience with similar cases and understand their approach to handling service tax issues.

-

A successful Principal-Agent relationship is built on mutual trust and open lines of communication to ensure effective representation.

How to fill out the power of attorney for

-

1.Open the PDFfiller website and log into your account or create a new one.

-

2.Search for 'Power of Attorney' templates using the search bar.

-

3.Select a suitable template from the available options.

-

4.Fill in your name and the name of the person you are giving authority to in the designated fields.

-

5.Specify the powers you are granting, such as financial decisions, medical decisions, or property management.

-

6.Add any limitations or conditions you want to include in the document.

-

7.Include the effective date of the power of attorney and any duration if applicable.

-

8.Review the document for accuracy, ensuring all necessary information is filled out correctly.

-

9.Sign the document digitally or print it out to sign manually.

-

10.Save the completed document to your account or download it for your records.

What is a Power of Attorney for Service Tax Representation Template?

A Power of Attorney for Service Tax Representation Template is a legal document that allows one person to authorize another to handle tax-related matters on their behalf. This template streamlines the process of granting power for service tax representation, making it easier for individuals and businesses to ensure compliance with tax regulations. Utilizing this template can simplify interactions with the tax authorities, ensuring that all necessary documentation is properly managed.

Who needs a Power of Attorney for Service Tax Representation Template?

Any individual or business entity looking to delegate tax responsibilities to another person or professional should consider a Power of Attorney for Service Tax Representation Template. This could include tax consultants, accountants, or legal representatives who need the authority to act on behalf of the taxpayer. By using this template, users can assign specific power to manage service tax issues without compromising control over their financial affairs.

How can I obtain a Power of Attorney for Service Tax Representation Template?

You can easily obtain a Power of Attorney for Service Tax Representation Template through our platform at pdfFiller. Simply visit our website and search for the template in our extensive library of documents. Once located, you can customize it according to your needs, ensuring all required details are accurately filled in for your particular service tax representation situation.

What information should be included in my Power of Attorney for Service Tax Representation Template?

Your Power of Attorney for Service Tax Representation Template should include vital information such as the names and addresses of both the principal and the agent, the specific powers being granted, and the effective date of the document. It’s crucial to state the limitations of the authority to avoid any misuse. By detailing these factors, you ensure clarity in responsibilities and scope of representation.

Is a Power of Attorney for Service Tax Representation Template legally binding?

Yes, a Power of Attorney for Service Tax Representation Template is legally binding as long as it is executed according to the relevant laws in your jurisdiction. For it to be effective, both parties should sign the document, and in some cases, notarization may be required. When properly completed, this template serves as a powerful tool for managing tax obligations efficiently.

Can I revoke the Power of Attorney for Service Tax Representation Template?

Yes, you can revoke a Power of Attorney for Service Tax Representation Template at any time, provided you follow the correct process. To revoke it, you should create a formal revocation document and notify the agent of your decision. This ensures that all parties are aware that the previous authority has been rescinded, preventing any unauthorized actions regarding your service tax representation.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.