Get the free Power of Attorney for Tax Purposes Template

Show details

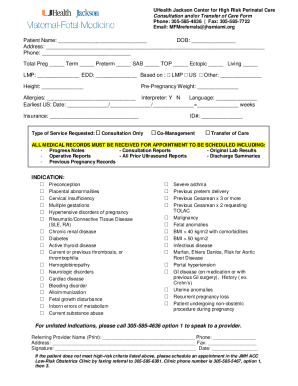

This document authorizes an individual (Agent) to act on behalf of another individual (Principal) in matters related to taxes, including filing tax returns and managing tax payments.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is power of attorney for

A power of attorney for allows one person to designate another to act on their behalf in legal or financial matters.

pdfFiller scores top ratings on review platforms

this web site is very easy to use…

this web site is very easy to use especially for first time users.

Thank you

Thank you, responded very quickly! Great! I am pleasantly surprised!

Very good resource!

Very good resource!Very easy to use and just what I need to edit an occasional document.

Must have

I don't have anything to do. The application is clear. I'm a french user, but's is okay for me. I hope i've explain my self well. I recommands this application.

Very user friendly

lots of docs

hi this site is great has lots of documents

Who needs power of attorney for?

Explore how professionals across industries use pdfFiller.

How to fill out a power of attorney for form form

What is the power of attorney for tax purposes?

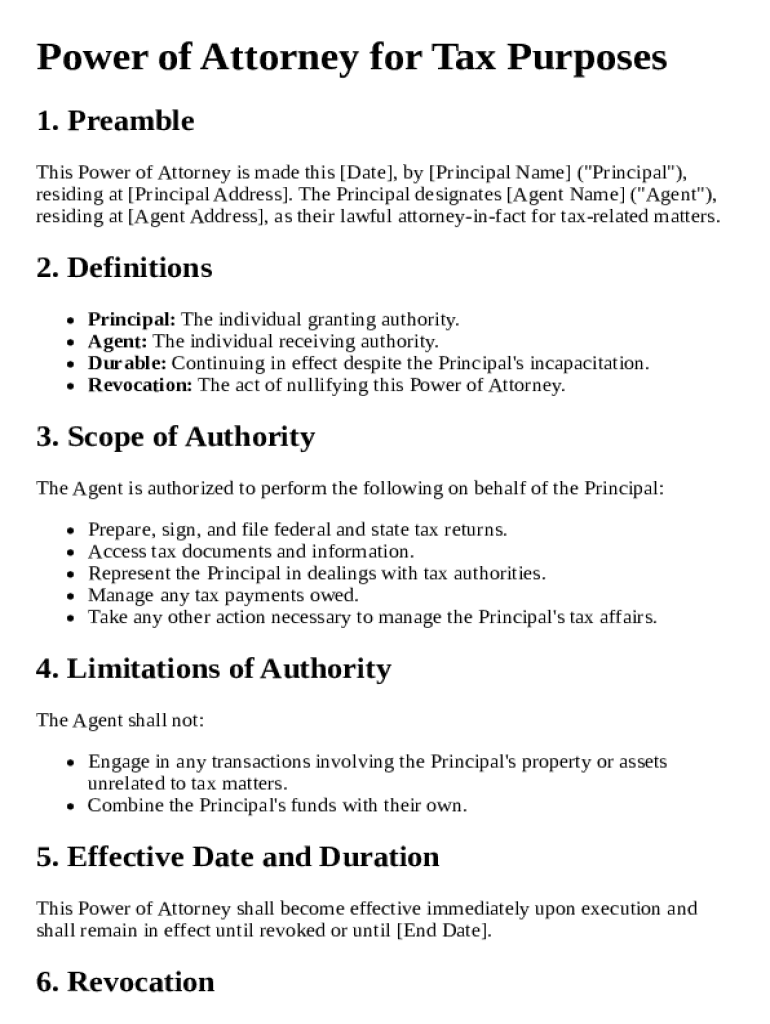

A power of attorney (POA) for tax purposes is a legal document that allows one person, known as the 'Agent,' to act on behalf of another person, termed the 'Principal,' during tax related matters. Having a POA in place is crucial for individuals who may find themselves unable to manage their own taxes due to a variety of reasons such as health issues or travel. This arrangement facilitates smoother dealings with tax authorities.

-

The POA permits the Agent to handle tax-related decisions and submissions.

-

It ensures tax affairs are managed in a timely and efficient manner.

-

A Principal can be any individual who requires assistance, while any trusted adult can serve as an Agent.

What key terms should understand in a power of attorney document?

Understanding the terminology surrounding a power of attorney is vital. Key terms include the roles played by the Principal and the Agent, as well as the distinctions between durable and non-durable powers. These distinctions affect the longevity and accessibility of the document, making it essential for anyone considering this option.

-

The Principal grants authority while the Agent executes powers on their behalf.

-

A durable POA remains effective even if the Principal becomes incapacitated, while a non-durable POA does not.

-

A POA can be revoked at any time by the Principal following the legal procedures.

How do craft a power of attorney document?

Creating a power of attorney document involves structuring several critical components. The preamble sets the initial declaration, while correctly identifying the Principal and Agent is crucial for clarity. Ensuring the scope of authority is well defined protects both parties by outlining what the Agent can and cannot do.

-

Clear statements to establish the intent and purpose of the POA.

-

Including full names, addresses, and relevant identification numbers of both the Principal and Agent.

-

Detailing powers granted to the Agent in the tax context.

-

Explicitly stating what the Agent cannot do, such as selling real estate.

When does the power of attorney become effective?

The effective date of a power of attorney can vary based on the decisions made by the Principal. It can be effective immediately, or it may be set to activate only in certain conditions, such as incapacitation. Understanding these options allows for better management of the POA’s duration.

-

Explicitly state if and when the POA activates.

-

The POA may remain active until revoked, or it may have a set expiration date.

-

Regular reviews to ensure it remains current with life changes and intentions.

How can revoke a power of attorney?

Revoking a power of attorney is a straightforward process but must follow legal guidelines. It's crucial to notify all relevant parties, including the Agent and any institutions that may have accepted the POA. Creating a formal revocation document ensures clarity and legal standing.

-

The Principal can revoke the POA at any time, regardless of circumstances.

-

Prepare a written document stating the revocation and sign it.

-

Notify all involved parties and relevant entities about the revocation to avoid misunderstandings.

What are the legal requirements for a power of attorney?

Every state has specific laws governing the creation and use of power of attorney documents. Familiarity with the legal framework helps ensure compliance and reduces the risk of disputes. Key elements include state-specific requirements for execution, including witness signatures and notarization.

-

Become familiar with state laws, as they vary significantly across jurisdictions.

-

Following local regulations is non-negotiable for valid POA execution.

-

For instance, some states may require multiple witnesses or notarization.

What are the signing requirements and notarization for a POA?

Proper signing and notarization are essential steps in the power of attorney process. This adds an extra layer of security and legitimacy to the document. Certain signatures or notarizations may be required to make the POA enforceable, depending on the jurisdiction.

-

Typically, the Principal must sign, possibly with witnesses present.

-

A Notary Public verifies identities and may require the presence of the Principal.

-

Witnesses may be necessary in some states to provide additional validation.

What are the responsibilities of an Agent?

An Agent holds significant responsibilities under a power of attorney, primarily acting in the best interests of the Principal. This role requires transparency, accountability, and adherence to the Principal’s wishes to maintain trust in this relationship.

-

Duties include managing taxes, filing returns, and communicating with tax authorities.

-

An Agent must prioritize the Principal's needs and desires in decision-making.

-

Negligence can lead to legal actions or loss of agency privileges.

How can pdfFiller assist with power of attorney management?

pdfFiller provides a user-friendly platform for managing the power of attorney process, allowing users to edit, sign, and store documents securely. With interactive tools designed for customization, individuals can create a POA tailored to their needs without hassle.

-

Step-by-step guidance simplifies the completion of the document.

-

Users can modify fields and sections to suit their unique requirements.

-

Users can eSign, store, and manage their documents conveniently from anywhere.

How to fill out the power of attorney for

-

1.Download the power of attorney form from pdfFiller.

-

2.Open the file in pdfFiller's editor.

-

3.Begin by filling in the principal's full name and address to identify who is granting the power.

-

4.Next, enter the agent's full name and address, indicating who will receive the authority.

-

5.Specify the extent of the powers granted, such as financial decisions, healthcare decisions, or both.

-

6.If applicable, indicate any limitations or special provisions regarding the authority granted.

-

7.Include the date the power of attorney becomes effective, if different from the signing date.

-

8.Sign the document to validate it; some states may require notarization or witnesses—check local laws before finalizing.

-

9.Review all entered details for accuracy.

-

10.Save the completed form, and consider distributing copies to all relevant parties.

What is a Power of Attorney for Tax Purposes Template?

A Power of Attorney for Tax Purposes Template is a legal document that allows an individual to authorize another person to handle their tax-related matters. This template is essential for ensuring that your tax filings, refunds, and communications with the IRS are managed efficiently. By using a Power of Attorney for Tax Purposes Template, you can provide someone you trust the ability to act on your behalf, making tax season much easier.

Who should consider using a Power of Attorney for Tax Purposes Template?

Individuals who find managing their taxes challenging or those who travel frequently may benefit significantly from a Power of Attorney for Tax Purposes Template. This includes business owners, expatriates, and elderly individuals seeking assistance with their tax obligations. By designating someone through this template, you ensure that your tax affairs are handled by a reliable representative, thus reducing stress and potential errors.

How do I create a Power of Attorney for Tax Purposes Template using pdfFiller?

Creating a Power of Attorney for Tax Purposes Template with pdfFiller is straightforward and user-friendly. You can start by selecting a template from pdfFiller's extensive library, then customize it to include your specific information. After filling out the necessary fields, you can easily save, download, or share your completed template, ensuring that you are prepared for any tax-related needs.

What information is needed to fill out a Power of Attorney for Tax Purposes Template?

To accurately complete a Power of Attorney for Tax Purposes Template, you will need to provide details about both the principal and the agent, such as names, addresses, and Social Security numbers. Additionally, outline the specific tax activities the agent is authorized to perform, which can include filing tax returns, accessing IRS records, and negotiating on your behalf. Having this information ready ensures a smooth completion process.

Is a Power of Attorney for Tax Purposes Template valid across all states?

Yes, a Power of Attorney for Tax Purposes Template generally holds validity across all states, but there may be slight variations in the requirements. It’s crucial to ensure that the template complies with both state-specific rules and IRS guidelines. Before using the template, consider consulting with a tax professional or attorney to confirm that your document meets all necessary legal standards.

Can I revoke a Power of Attorney for Tax Purposes Template once it's established?

Absolutely, you can revoke a Power of Attorney for Tax Purposes Template at any time as long as you are competent. To do this, you should notify the agent in writing and ideally provide a copy to the IRS. This revocation will ensure that your previous agent no longer has the authority to act on your behalf, thereby giving you full control over your tax matters again.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.