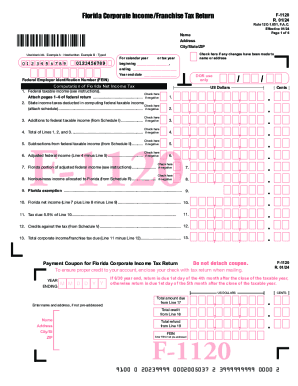

Get the free Certificate of Satisfaction Mortgage Template

Show details

This document certifies that a mortgage has been fully satisfied, paid, and discharged in accordance with applicable law, including details about the parties involved, mortgage information, property

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is certificate of satisfaction mortgage

A certificate of satisfaction mortgage is a legal document that confirms the satisfaction of a mortgage loan, indicating that the borrower has fulfilled their repayment obligations.

pdfFiller scores top ratings on review platforms

So far good. It has been challenging to learn how to use this. It has taken much application and chatting with your customer service reps, who have all been awesome. I won't say it's the easiest to learn but it's easy to use (if that makes any sense). We still can't explain why my msn email blocks pdf filler or pdf filler won't send it to my msn (not sure which). It never shows up in my spam/junk filter there and your website shows it sent. My gmail emails work fine using this.

I never got the code in my email to complete the emailing of the document to the tenant. Other than that I love the ease of using it. I hope to get help with emailed code soon.

Simple to use and super helpful! Thank you!

IT'S A GREAT HELP, EXCEPT I HAD TO TYPE THE FORM 3 TIMES BEFORE I FIGURED OUT HOW TO PRINT IT.

Its a useful product but very expensive for an online product.

I have to get used to it before I can comment.

Who needs certificate of satisfaction mortgage?

Explore how professionals across industries use pdfFiller.

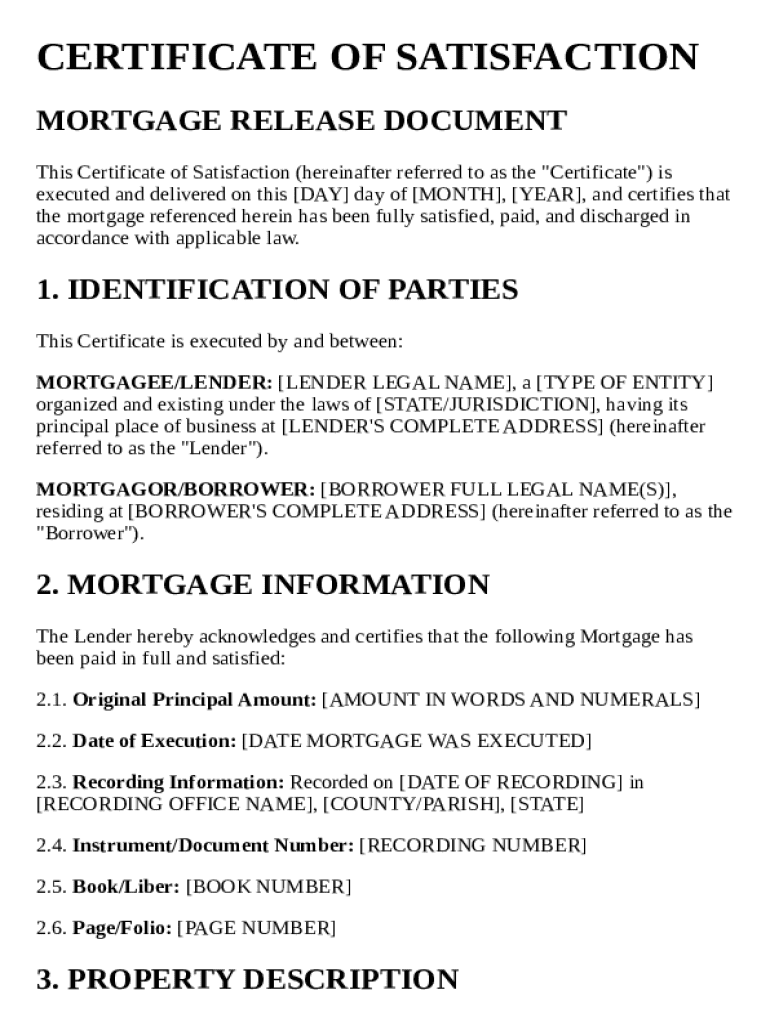

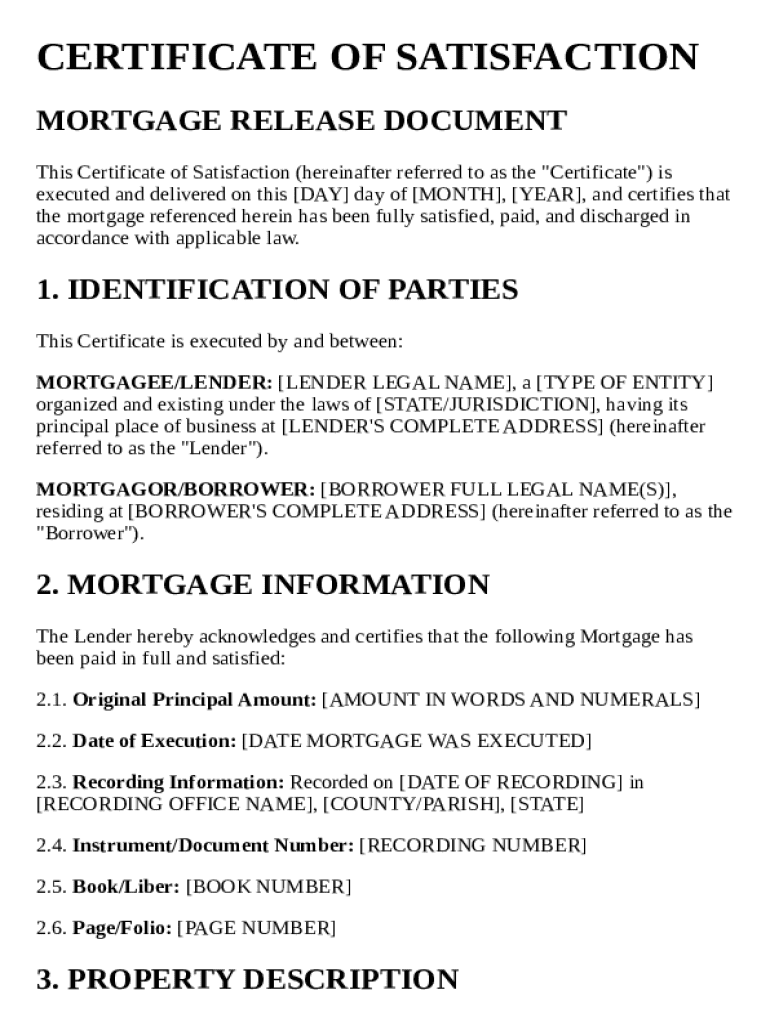

How to fill out a certificate of satisfaction mortgage form

A certificate of satisfaction mortgage form is essential when a borrower has paid off their mortgage. This document serves as proof that the lender has released their claim on the property, affirming that the mortgage obligation has been fulfilled. Understanding how to fill out this form is crucial for maintaining clear property ownership rights.

What is a certificate of satisfaction?

A certificate of satisfaction is a legal document that officially indicates that a borrower has satisfied their mortgage obligations. This document is crucial during the mortgage release process, as it signals the end of the lender's interest in the property. Moreover, it helps to clear the title of any encumbrance, thus ensuring that the owner's property rights are protected.

-

It signifies the mortgage has been fully satisfied, freeing the property from any claims.

-

Necessary for formal fulfillment of the loan contract, preventing future legal complications.

-

Releases the lien, allowing the property owner complete rights to the property.

What are the key components of the certificate?

The certificate of satisfaction must include several key components to be valid. These components ensure all parties involved are correctly identified and that the details of the mortgage are accurate.

-

Includes names and contact information for both the lender and the borrower.

-

Details such as the principal amount of the mortgage, important dates, and any relevant recording information.

-

A complete address along with a legal description that uniquely identifies the property.

How to fill out the certificate step-by-step?

Filling out the certificate involves a systematic approach, ensuring that all necessary information is gathered and accurately recorded. Each step is critical to avoid issues during the filing process.

-

Collect identifying details of the lender and borrower for accuracy.

-

Ensure all details, such as amount and dates, are recorded correctly to prevent future legal disputes.

-

Use precise legal terms to describe the property, avoiding vague language that could cause confusion.

What are common mistakes to avoid?

When completing the mortgage release form, several common mistakes can occur, jeopardizing the certification's validity. Being aware of these pitfalls can save time and resources in correcting errors.

-

Failure to include essential details can lead to the certificate being rejected by the recorder's office.

-

Describing the property incorrectly can lead to legal complications and delay ownership confirmation.

-

This can result in improper filing, making it harder to prove mortgage satisfaction.

What are the fees and requirements for filing?

Filing a certificate of satisfaction often involves specific fees and documentation requirements that can vary by region. Understanding these aspects can help avoid unexpected costs during the process.

-

Fees can include recording fees, preparation fees, and possible documentary stamp taxes.

-

Ensure you have the original mortgage documents and any identification necessary for filing.

-

Be aware that processes and fees differ significantly across states and counties.

When is legal advice necessary?

Legal guidance can be crucial in certain situations during the mortgage release process, especially to navigate state-specific laws. Knowing when to seek help is beneficial in ensuring compliance.

-

If disputes arise, or if the property has unique legal conditions, consultation is advised.

-

Each state has distinct laws regarding certificates of satisfaction, which can impact how documents are prepared and filed.

-

Use local bar associations or recommendations to find qualified attorneys familiar with mortgage law.

How to use pdfFiller for certificate editing?

Utilizing pdfFiller can streamline the process of editing and finalizing your certificate of satisfaction mortgage form. The platform provides various tools to ensure accessibility and collaboration.

-

Adobe-like tools allow for easy editing of PDF documents to ensure accuracy.

-

Teams can work together on a single document, making it easy to manage responsibilities.

-

Facilitate remote signing and submission, removing barriers to timely processing.

What happens after filing the certificate?

Once you file the certificate of satisfaction, several key transitions occur that can affect your property title and obligations. Understanding the post-filing process can help prepare for the next steps.

-

Expect a processing period that can vary from a few days to several weeks, depending on local county practices.

-

The release solidifies the owner's claim to the property, eliminating the lender's lien.

-

After approval, keep a copy of the certificate with your important documents as proof of satisfaction.

How to fill out the certificate of satisfaction mortgage

-

1.Obtain the certificate of satisfaction form from the lender or through a legal document provider.

-

2.Ensure you have the necessary details such as loan number, borrower information, and property address.

-

3.Clearly print or type your full name and the name of the lender in the designated fields on the form.

-

4.Include the date the loan was paid off or the last payment made in the appropriate section.

-

5.Sign and date the document in the provided signature area, ensuring it matches the name listed.

-

6.If required by your lender, attach proof of payment such as bank statements or transaction records.

-

7.Review the completed form for accuracy and completeness before submission.

-

8.Submit the signed certificate to the lender for their records and request them to file it with the county recorder's office.

What is a Certificate of Satisfaction Mortgage Template?

A Certificate of Satisfaction Mortgage Template is a legal document that verifies a mortgage has been fully paid off. This template allows homeowners to formally acknowledge that their mortgage obligations have been fulfilled. By using the Certificate of Satisfaction Mortgage Template, borrowers can ensure that they receive clear documentation for their records, which is essential for future property transactions.

How do I use the Certificate of Satisfaction Mortgage Template?

Using the Certificate of Satisfaction Mortgage Template is a straightforward process. First, fill in the necessary details such as the names of the parties involved, property information, and the mortgage details. Once completed, the document should be signed by the lender or mortgage holder to validate the satisfaction of the loan, providing you with a legally binding acknowledgment of your mortgage payoff.

Who needs a Certificate of Satisfaction Mortgage Template?

Homeowners who have fully paid off their mortgage should obtain a Certificate of Satisfaction Mortgage Template. This document is crucial for individuals planning to sell their property, as it provides proof that there are no outstanding mortgage obligations. Additionally, real estate agents and financial institutions may require this certificate to confirm the property title is clear for prospective buyers.

Can I create my own Certificate of Satisfaction Mortgage Template?

Yes, you can create your own Certificate of Satisfaction Mortgage Template, but it is essential to ensure that it meets the legal requirements of your state. Using an established template can simplify this process, as these are designed to include all necessary information. Be sure to customize the template according to your specific situation to avoid any legal issues.

Where can I find a reliable Certificate of Satisfaction Mortgage Template?

You can find a reliable Certificate of Satisfaction Mortgage Template on document management platforms like pdfFiller. These services offer professionally designed templates that are user-friendly and easy to customize. By using pdfFiller, you can access various templates and ensure that your Certificate of Satisfaction is legally compliant and properly formatted.

What happens if I don't get a Certificate of Satisfaction Mortgage Template after paying off my mortgage?

If you do not obtain a Certificate of Satisfaction Mortgage Template after paying off your mortgage, you may encounter challenges when selling your property. Without this document, potential buyers or lenders may question whether the mortgage exists or if it's fully satisfied. It's best to secure this certificate promptly to avoid any complications in the future and to keep clear records of your financial transactions.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.