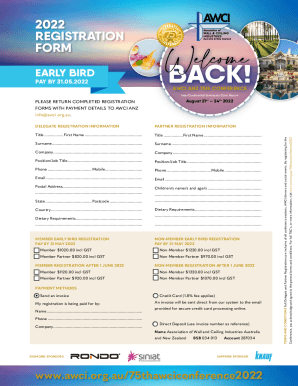

Get the free Commercial Real Estate Loan Application Template

Show details

This document serves as a template for applicants seeking loans for commercial property transactions, ensuring compliance with applicable regulations.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is commercial real estate loan

A commercial real estate loan is a mortgage specifically designed for the purchase or refinance of commercial properties such as office buildings, retail spaces, or multifamily housing units.

pdfFiller scores top ratings on review platforms

no big problems, was able to figure it out.

awesome software to edit and modify the PDF files

This program is easy to use makes my workday go so much faster! Thank you!

No complaints. With some determination, I was able to navigate the site successfully.

a little difficult to navigate for a first time use

Easy to use, very happy with this tool. Well worth the $$$

Who needs commercial real estate loan?

Explore how professionals across industries use pdfFiller.

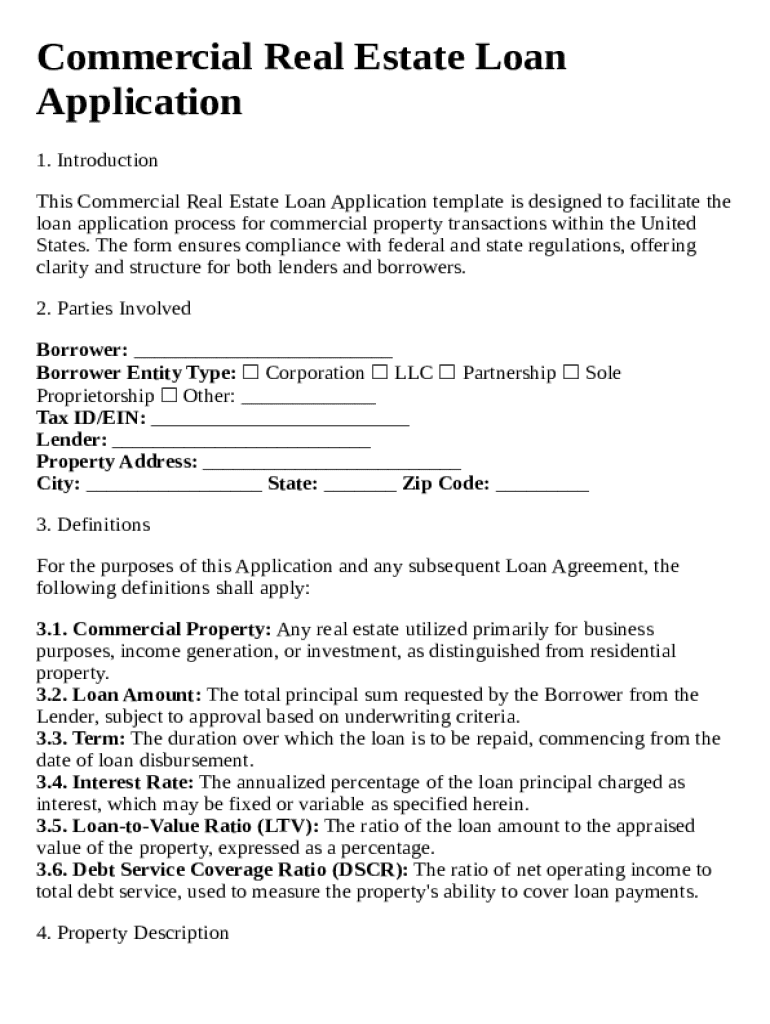

Comprehensive Guide to the Commercial Real Estate Loan Form

How to fill out a commercial real estate loan form

Filling out a commercial real estate loan form requires attention to detail, as it serves as a crucial document for securing financing. It is essential to gather all necessary information, including property details, financial statements, and borrower documents. Take your time to ensure accuracy to improve your chances of loan approval.

Understanding the commercial real estate loan application

The commercial real estate loan application is pivotal in securing financing, as it outlines the borrower’s financial health to lenders. It includes various sections that emphasize the importance of the application in commercial transactions. A well-structured application not only helps in compliance with regulations but also positively impacts loan approval chances.

-

The application is designed to collect essential information about the loan request and the borrower’s financial situation.

-

Various regulations govern the loan process, ensuring that both lenders and borrowers maintain fairness and transparency.

-

A clear and concise application can significantly increase the likelihood of loan approval, as it aids lenders in assessing risk.

Identifying the parties involved in the loan process

Recognizing the roles of each party is essential in the commercial loan process. The borrower is typically the entity seeking financing, while the lender is the financial institution providing the funds. Each party has specific documentation requirements that must be fulfilled for a smooth application process.

-

The borrower is the entity requesting the loan, while the lender provides the necessary funding based on the application review.

-

Borrowers may be corporations, LLCs, or individual investors, each facing different requirements.

-

Common documents include Tax Identification Numbers (TINs) and Employer Identification Numbers (EINs) to verify eligibility.

Navigating the key terms of the loan application

Understanding key terms in a commercial real estate loan application is vital for a successful outcome. Familiarity with definitions such as Loan Amount, Term, and Interest Rate helps applicants communicate clearly with lenders. Furthermore, grasping financial ratios like Loan-to-Value (LTV) and Debt Service Coverage Ratio (DSCR) can enhance an applicant's financial presentation.

-

Loan Amount is the total dollar value requested, while Term refers to the length of time for loan repayment.

-

LTV assesses the ratio of the loan amount to the property's appraised value, while DSCR measures the cash flow available to meet debt obligations.

-

A clear comprehension of these terms can significantly impact the success of the application process.

Describing the commercial property

Accurate property descriptions in the loan application are crucial for effective evaluation by lenders. Key aspects to cover include property size, lot size, and the year built. Additionally, distinguishing between property types—like Office, Retail, or Industrial—provides lenders with insights into the investment potential.

-

Details such as size, lot size, and age of the property greatly influence the loan approval process.

-

Understanding the nuances of various types of properties helps in tailoring the application to lender preferences.

-

Clarifying the intended use of the property can further secure financing by aligning with lender goals.

Detailing the loan request

The loan request is a pivotal aspect of the application that communicates the borrower's needs to the lender. Components include the loan amount, its purpose, and specific terms related to the financing. Clear articulation of whether the funds are for acquisition, refinance, or construction is essential.

-

The request should specify the loan amount, its intended purpose, and any specific term conditions.

-

Clearly define whether the request is for acquisition, refinancing, or construction as this affects terms.

-

Choosing between a Fixed, Variable, or Hybrid rate can impact monthly payments and overall costs.

Understanding financial information requirements

Lenders require detailed financial information to assess the viability of the loan request. Key details include annual property income and current occupancy rates, which reflect the property's financial health. Presenting this data effectively can enhance the chances of approval.

-

Include Annual Property Income and Occupancy Rates to provide a snapshot of financial health.

-

Both LTV and DSCR serve as indicators of risk for lenders and financial stability for the borrower.

-

Use clear charts and summaries to highlight key financial metrics, improving lender confidence.

Leveraging pdfFiller for document management

Using pdfFiller for commercial loan applications enhances efficiency in managing your documents. The platform allows users to fill out applications, edit content, and eSign documents seamlessly. This cloud-based solution ensures that all stakeholders can collaborate effectively, which is crucial for successful real estate transactions.

-

Users can follow a simple process to fill out and submit commercial loan applications through the platform.

-

pdfFiller provides tools that simplify the editing process and allow multiple users to collaborate in real-time.

-

Access your documents from anywhere, improving response times and efficiency in the transaction process.

Common mistakes to avoid in commercial loan applications

Many applicants make frequent mistakes that could jeopardize their loan approval chances. Ensuring accuracy and completeness while providing financial information is crucial. Simple errors can lead to significant delays or outright denials, so understanding common pitfalls is essential.

-

Common mistakes include insufficient documentation, inaccurate figures, and incomplete applications.

-

Carefully reviewing all submitted information can reduce errors and improve processing speed.

-

Double-checking applications or seeking professional assistance can help avert common mistakes.

How to fill out the commercial real estate loan

-

1.Visit pdfFiller's website and log in to your account or create a new one.

-

2.Search for the 'commercial real estate loan' form in the template library.

-

3.Once located, click on the form to open it in the editor.

-

4.Fill in the property details including address, type of property, and purchase price.

-

5.Provide your personal information such as name, address, and contact details.

-

6.Include the financial information including income, expenses, and any existing mortgage.

-

7.Specify the loan amount you are requesting and the loan term you prefer.

-

8.Review the filled form for accuracy and completeness before submission.

-

9.Finally, save the document or submit it directly through pdfFiller for processing.

What is a Commercial Real Estate Loan Application Template and why is it important?

A Commercial Real Estate Loan Application Template is a structured document specifically designed to gather essential information when applying for a loan to finance commercial properties. This template streamlines the application process, ensuring all necessary details are included, which helps expedite approval. Using a well-crafted Commercial Real Estate Loan Application Template can significantly enhance your chances of securing favorable loan terms.

How can I access a Commercial Real Estate Loan Application Template on pdfFiller?

You can easily access a Commercial Real Estate Loan Application Template on pdfFiller by navigating to our templates section and searching for commercial real estate. The template is fully customizable, allowing you to fill in your specific details effortlessly. This access-from-anywhere feature ensures that you can prepare your loan application efficiently, no matter where you are.

What information should I include in a Commercial Real Estate Loan Application Template?

When filling out a Commercial Real Estate Loan Application Template, you should include key details such as your business information, the type of property, proposed loan amount, and income projections. Additionally, lenders typically require information about your credit history and existing debts. Collecting this data ahead of time will streamline the application process and can help you make a stronger case for your loan.

Can I edit the Commercial Real Estate Loan Application Template after filling it out?

Yes, with pdfFiller, you can easily edit the Commercial Real Estate Loan Application Template even after initially filling it out. This allows you to make necessary adjustments as your financial situation or property details change. The flexibility in editing ensures that your application reflects the most accurate information before submission, which is crucial for loan approval.

How does using a Commercial Real Estate Loan Application Template benefit teams?

Using a Commercial Real Estate Loan Application Template benefits teams by ensuring that all members are on the same page with consistent data entry. This collaborative approach reduces errors and enhances clarity in the application process. Whether working remotely or in person, teams can streamline their application efforts and improve efficiency by using a shared Commercial Real Estate Loan Application Template through pdfFiller’s cloud-based platform.

Is a Commercial Real Estate Loan Application Template customizable on pdfFiller?

Absolutely! The Commercial Real Estate Loan Application Template on pdfFiller is highly customizable to fit your needs. You can modify sections, add your company logo, and tailor the text to meet specific requirements from lenders. This customization feature allows you to create a professional application that stands out while providing all the necessary information required for your commercial loan.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.