Get the free Deed of Mortgage Template

Show details

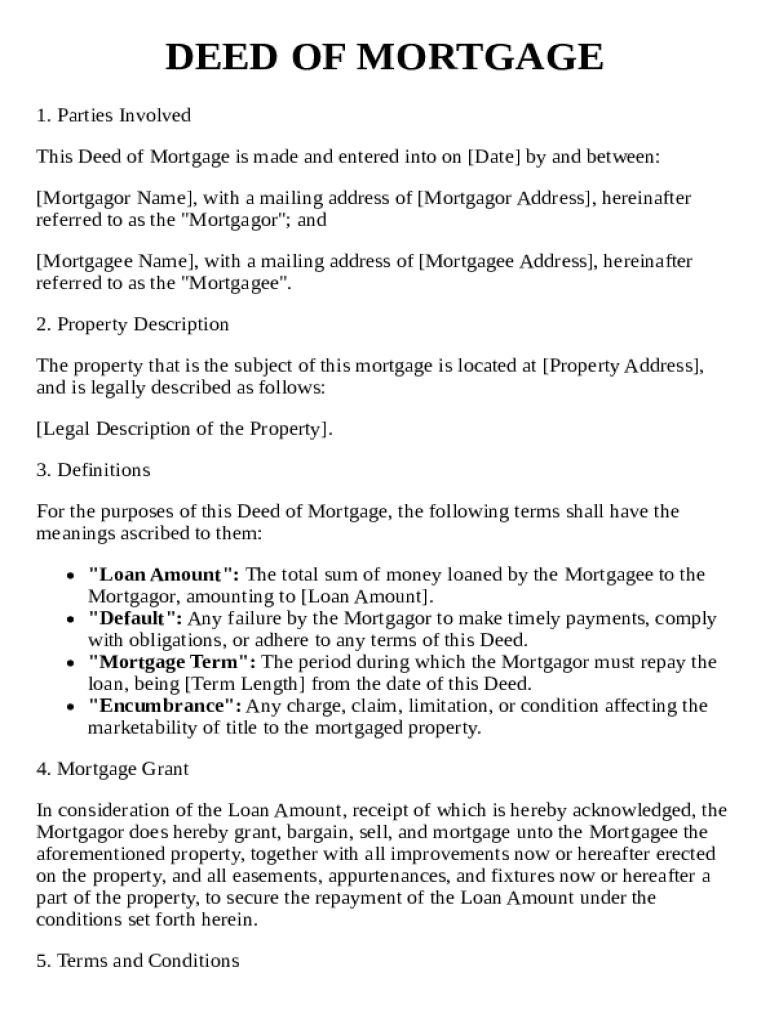

This document serves as a legal agreement between the Mortgagor and Mortgagee regarding the mortgage of a property, including terms, conditions, rights, and obligations.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is deed of mortgage template

A deed of mortgage template is a legal document that outlines the terms of a mortgage agreement between a borrower and a lender.

pdfFiller scores top ratings on review platforms

Works well so far

PDFfiller has been of great help in the editing of my documents.

Its great. really helped with my case

Easy to use features, great for non-professionals. I would give it 5 stars but it's subscription-based and a little pricey.

Great

every function is good, but for small enterprise to subscribe it is a bit expensive, because no often use this to edit pdf.

Who needs deed of mortgage template?

Explore how professionals across industries use pdfFiller.

Comprehensive guide to the deed of mortgage template form

How to fill out a deed of mortgage template form

Filling out a deed of mortgage template form is straightforward when you follow a structured process. Begin by gathering all necessary details, such as the names of the parties involved, property information, and financial terms. Use tools like pdfFiller to simplify this task, ensuring that you pay attention to each section for accuracy.

Understanding the mortgage deed

A mortgage deed is a crucial legal instrument that outlines the agreement between a borrower (mortgagor) and a lender (mortgagee). It serves to secure the lender's interest in a property and protects both parties during the real estate transaction. Key components of a mortgage deed typically include the property details, loan amount, interest rates, and terms of repayment.

-

A mortgage deed is a document that transfers interest in property as security for a loan.

-

The mortgagor is the borrower who provides property as security, while the mortgagee is the lender.

-

Components usually include the property description, loan amount, interest rate, and repayment schedule.

Who are the parties involved in a mortgage deed?

Understanding the identity of the parties involved in a mortgage deed is essential for its validity. The mortgagor (borrower) provides their name, address, and contact information, while the mortgagee (lender) must also provide similar details. Ensuring accuracy in these entries is fundamental, as any discrepancies can lead to legal complications.

-

Must include the full legal name, address of residence, and contact information.

-

Should consist of the lender's legal name, business address, and contact numbers.

-

Inaccurate details can render the deed unenforceable, leading to potential legal issues.

What details are needed in a property description?

A thorough property description is vital for a mortgage deed. This includes not just the property's physical address, but also its legal description, which is essential for clarity and legal standing. Obtaining a legal description can involve local land records or real estate agents, and it is crucial to understand local regulations that could influence this process.

-

Accurate addresses ensure clarity in the transaction and help prevent disputes.

-

Consult local property records or hire a real estate professional for assistance.

-

Incomplete or inaccurate property descriptions can lead to Title issues and legal challenges.

What definitions matter in a mortgage deed?

Understanding key financial terms related to a mortgage deed is essential for both parties. Core terms like loan amount, default, and mortgage term need to be defined clearly within the document. These terms play a significant role in the overall agreement and understanding the encumbrances that may affect the property.

-

Loan Amount specifies the money borrowed, while Default refers to failure in repayment.

-

Understanding these terms helps both parties adhere to the terms and conditions.

-

Encumbrances such as additional liens can affect ownership and terms associated with the mortgage.

What is the mortgage grant?

The mortgage grant clause is a pivotal section within the mortgage deed, indicating what is being lent to the mortgagee in exchange for the loan. This section clarifies the rights and interests transferred from the mortgagor to the mortgagee, including any improvements made on the property. Each mortgage deed may vary, so attention to detail is crucial in understanding what is included.

-

The grant transferring interest includes the right to reclaim property if terms are not met.

-

A well-defined grant clause protects both parties and maintains smooth transactions.

-

This may encompass physical structures, landscaping, and fixtures; ensure these are clearly listed.

What are the key terms and conditions of a mortgage?

The mortgage terms and conditions dictate the obligations of both the mortgagor and mortgagee. Key aspects include payment terms, due dates, and interest rates, which outline how and when the mortgagor must make payments. Clear understanding of default conditions and resolution steps is crucial for both parties to avoid legal penalties.

-

Specify loan payment amounts, timeline, and applicable interest percentages.

-

Default may occur as a result of late payments, which can have serious repercussions for the mortgagor.

-

Failure to adhere to payment terms can lead to foreclosure or additional legal actions.

How to fill out the deed of mortgage template form?

Filling out a deed of mortgage template form involves a systematic approach. Tools available on pdfFiller can assist in making the process seamless, offering interactive features that guide users through each step. It is essential to avoid common mistakes such as incorrect names or missing signatures, which can invalidate the document.

-

Follow the guide provided by pdfFiller, ensuring each field is accurately completed.

-

Use pdfFiller’s tools for tips and checks as you fill out the mortgage deed.

-

Ensure all necessary signatures are included and verify naming conventions for accuracy.

What does a sample mortgage deed look like?

Having a sample mortgage deed can be immensely beneficial for illustrative purposes. An annotated example demonstrates how to properly fill out each section, providing insights into potential variations due to regional requirements. Users can adapt these examples to suit their specific situations while being mindful of local regulations.

-

A completed sample mortgage deed can provide a reference point for users as they create their documents.

-

Noting differences in requirements based on state or region can help avoid confusion.

-

Users can adjust sample documents per their unique circumstances, ensuring compliance with local law.

How do mortgage deeds impact property ownership?

Mortgage deeds fundamentally influence property ownership and rights. The deed outlines ownership constraints during the loan term, culminating in the rights it affords post-repayment. Understanding lien release procedures, which can vary by region, is essential for borrowers to reclaim full ownership after fulfilling their mortgage obligations.

-

A mortgage relates specifically to the lender's right to the property until the debt is repaid.

-

Upon full payment, borrowers must complete lien release procedures to regain full ownership.

-

Defaulting can lead to foreclosure, impacting the borrower’s credit and property rights.

How do mortgage deeds compare with other types of deeds?

Different types of deeds serve unique purposes; a comparison with mortgage deeds helps clarify their specific roles. For instance, quitclaim deeds transfer ownership without guarantees, while warranty deeds offer assurances about ownership status. Understanding these differences is vital when deciding which deed to utilize in specific scenarios.

-

Mortgage deeds are specifically for loans secured by property, while quitclaim deeds may not include loan provisions.

-

Choose warranty deeds for full ownership guarantees or quitclaim for transferring interest without guarantees.

-

Legal implications differ significantly; consult a professional to ensure the right deed is selected.

How to fill out the deed of mortgage template

-

1.Open the deed of mortgage template on pdfFiller.

-

2.Read through the document to understand the sections required.

-

3.Fill in the borrower's personal information such as name, address, and contact details.

-

4.Enter the lender's information similarly, including name and address.

-

5.Specify the property details being mortgaged, including the address and legal description.

-

6.Fill in the loan amount that the borrower is requesting.

-

7.Detail the interest rate, payment schedule, and any special conditions relevant to the mortgage.

-

8.Review all sections for accuracy to ensure all information is correct and complete.

-

9.Sign the document where indicated; some templates might require notarization.

-

10.Save or download the filled-out mortgage deed in your preferred format.

What is a Deed of Mortgage Template, and why is it important?

A Deed of Mortgage Template is a crucial legal document that outlines the terms of a mortgage agreement between a lender and a borrower. It serves as a formal record of the secured loan, detailing the property being mortgaged and the obligations of both parties. Using a Deed of Mortgage Template ensures that all necessary legal elements are included, helping to prevent future disputes.

How can I customize a Deed of Mortgage Template for my needs?

Customizing a Deed of Mortgage Template is straightforward when using an online platform like pdfFiller. Users can easily input relevant information such as names, property details, and loan amounts directly into the template. Furthermore, the platform allows for the addition of specific conditions or clauses that align with your unique financial agreement, ensuring that the document meets your requirements.

Where can I find a reliable Deed of Mortgage Template online?

You can find a reliable Deed of Mortgage Template on platforms like pdfFiller, which offers a variety of templates designed to meet different legal standards. These templates are generated by legal experts and can be easily modified to fit your specific situation. Moreover, pdfFiller's comprehensive library ensures that you have access to the latest templates, making your document preparation process efficient.

What are the key components that should be included in a Deed of Mortgage Template?

A well-structured Deed of Mortgage Template should include essential components such as the names of the borrower and lender, a detailed description of the property, the loan amount, interest rate, and repayment terms. Additionally, it should outline the consequences of defaulting on the mortgage and any rights pertaining to foreclosure. Including this information ensures clarity and protects both parties involved.

Can a Deed of Mortgage Template be legally binding?

Yes, once properly filled out and signed by both parties, a Deed of Mortgage Template is a legally binding document. It is essential that the terms are clear and agreed upon by all involved parties to uphold its validity. Using a professionally designed template minimizes the risk of errors and strengthens the enforceability of the mortgage agreement.

Is it necessary to get legal advice when using a Deed of Mortgage Template?

While a Deed of Mortgage Template provides a solid foundation for your mortgage agreement, seeking legal advice is often recommended to ensure that all legal requirements are met. A legal professional can provide insights specific to your situation, potentially identifying clauses that need modification or additional elements to include. Engaging with a legal expert not only enhances the document's validity but also provides peace of mind.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.