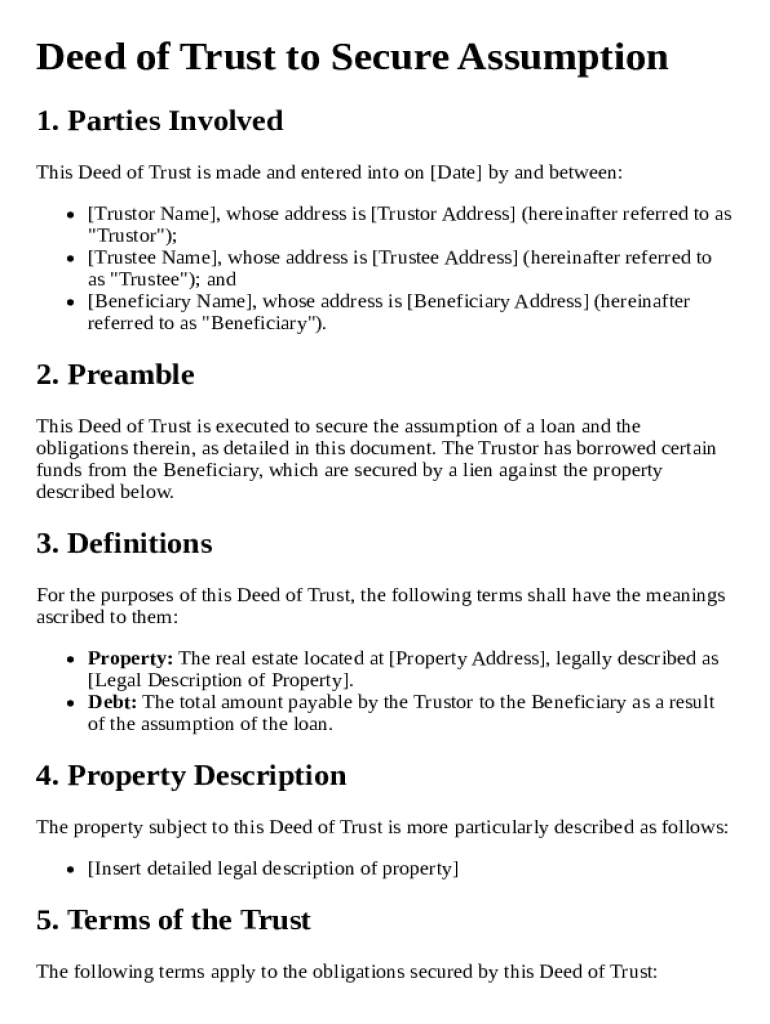

Get the free Deed of Trust to Secure Assumption Template

Show details

This document serves as a legal agreement to secure a loan assumption through a Deed of Trust, detailing the obligations of the Trustor, Trustee, and Beneficiary, as well as the property involved

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is deed of trust to

A deed of trust is a legal document that secures a loan by transferring the title of a property to a third party until the loan is paid off.

pdfFiller scores top ratings on review platforms

It was easy to complete the forms but hard to find them after they were completed.

Until now work very well. Im still knowing the program

pretty good so far but would like to learn more features

first time I completed the document it froze -

Support person was very professional and had a great deal of patience. Recommend some kind of tutorial or steps for getting started before filling a form. For example to edit steps 7, 8, 9. To save steps 3,4,5, etc.

It would be great if a hot line number was available in some cases. Thanks again for all of your assistance. I look forward to using your service again in the future and would recommend your product highly.

It is easy to use, but it would be great if I could merge multiple documents into one thru here instead of on my computer.

Who needs deed of trust to?

Explore how professionals across industries use pdfFiller.

How to Fill Out a Deed of Trust to Form Form

Understanding the Deed of Trust

A deed of trust is a legal document that establishes a lien on a property to secure a loan. This trust agreement involves three parties: the trustor (borrower), the trustee (an impartial third party), and the beneficiary (lender). Often confused with a promissory note, a deed of trust is the vehicle that allows the property to serve as collateral for the loan.

-

It is a security instrument that gives the lender a claim against the property if the borrower defaults.

-

Unlike a promissory note, which is a promise to repay a loan, a deed of trust secures the loan using the property.

-

It typically includes the loan amount, property description, and the duties of all involved parties.

Who Are the Parties Involved in the Deed of Trust?

Understanding the roles of each party in the deed of trust is essential for a smooth transaction. The trustor is the borrower who conveys the property title to the trustee. The trustee holds the title until the loan is paid off, while the beneficiary is the lender who receives the benefit of the trust.

-

The trustor takes on the loan, the trustee manages the process if the loan defaults, and the beneficiary receives payments.

-

Each party has obligations, such as the trustor making timely payments and the trustee ensuring compliance with the deed terms.

-

Proper identification of each party in the deed is critical for preventing disputes.

How to Prepare the Deed of Trust

Preparation of the deed of trust begins with gathering necessary data. Both the trustor and the beneficiary must provide details such as their names, addresses, and pertinent loan information.

-

Include full names, addresses, and identification numbers for the parties involved.

-

Clearly describe the property being secured, including the physical address and parcel number.

-

A distinct legal description is vital; it provides clarity in identifying the property in legal contexts.

How to Fill Out the Deed of Trust Form

Filling out the deed of trust form requires attention to detail. Each section must be completed accurately to avoid legal issues down the road.

-

Begin by entering the names and addresses of all parties involved, ensuring correct spelling and formatting.

-

Specify the terms of the trust, such as the interest rate and repayment schedule clearly.

-

Avoid leaving blanks, mislabeling parties, or overlooking legal descriptions.

How to Get the Signatures Notarized

Notarizing the deed of trust is a crucial step that adds legitimacy to the document. It involves signing the document in the presence of a notary public who officially certifies the identities of the signers.

-

Ensure all parties are present and have valid identification during the signing process.

-

Online notarization options, such as via pdfFiller, can be a convenient alternative to in-person meetings.

-

Utilizing e-signatures speeds up the notarization process and provides a secure means of signing documents.

What is the Process of Recording the Deed of Trust?

Once notarized, the next step is recording the deed of trust at the County Recorder's Office. This is essential for legal protection.

-

Submit the original signed deed of trust to the appropriate governmental office along with any required fees.

-

Recording establishes a public record of the lien, preventing future claims on the property.

-

The platform offers tools to manage recording paperwork efficiently.

What Happens After Recording?

After the deed of trust is recorded, the parties involved must understand their rights and obligations. This includes knowing the consequences of defaulting on the terms.

-

The trustor retains ownership while following the loan terms, and the trustee holds the power to act if default occurs.

-

Failure to meet payment obligations can lead to foreclosure and other legal actions.

-

The trustee may initiate foreclosure proceedings based on the terms of the deed of trust.

Best Practices for Managing a Deed of Trust

Effective management of a deed of trust is key to protecting both parties’ interests. Regular communication and documentation review help maintain clarity.

-

Schedule periodic reviews of the loan status to ensure all parties are aligned with payments.

-

Transparent communication can prevent misunderstandings and legal disputes.

-

Leverage pdfFiller's document management capabilities for securing updates and edits.

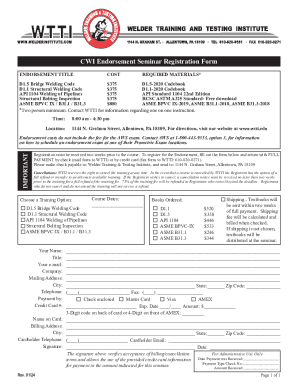

How to fill out the deed of trust to

-

1.Open pdfFiller and upload the deed of trust form you need to fill out.

-

2.Begin with the date of the document; enter the current date in the designated field.

-

3.Next, fill in the names and addresses of the borrower(s) and lender. Ensure all spelling is correct to avoid issues later.

-

4.Include a description of the property being secured by the deed of trust; this typically includes the address and possibly the parcel number.

-

5.State the loan amount clearly and indicate the interest rate if applicable.

-

6.Detail the terms of the loan, including maturity date and any special provisions that may apply.

-

7.Ensure to fill in the trustee's name and address; this is the third party holding the title until the loan is satisfied.

-

8.Review the document for any additional required signatures or initials, including those of the borrower(s) and lender.

-

9.Finally, save the completed document and choose whether to print, email, or store it as needed.

What is a Deed of Trust to Secure Assumption Template?

A Deed of Trust to Secure Assumption Template is a legal document that outlines the terms and conditions under which a property is assumed by another party. This template is essential for protecting the interests of both the original borrower and the new assuming party, ensuring all obligations related to the loan are clearly defined. Utilizing a well-crafted Deed of Trust to Secure Assumption Template can simplify a complicated transaction and provide clarity throughout the process.

Why do I need a Deed of Trust to Secure Assumption Template?

A Deed of Trust to Secure Assumption Template is crucial for anyone involved in property transfers where the existing mortgage is also being assumed. This document ensures that all parties are aware of their rights and obligations, minimizing the risk of future legal disputes. Whether you're a borrower or a new homeowner, having a solid Deed of Trust to Secure Assumption Template can make your transition smoother and legally sound.

How can pdfFiller help me create a Deed of Trust to Secure Assumption Template?

pdfFiller offers a user-friendly platform that allows you to easily create and customize your Deed of Trust to Secure Assumption Template. With numerous pre-made templates and editing tools, you can tailor the document to fit your specific needs and ensure compliance with local regulations. The cloud-based system allows you to access and manage your documents anytime, enhancing your overall document creation experience.

Can I eSign a Deed of Trust to Secure Assumption Template through pdfFiller?

Yes, pdfFiller provides an electronic signature feature that allows you to eSign your Deed of Trust to Secure Assumption Template securely. This functionality not only speeds up the signing process but also ensures that your document is legally binding. With pdfFiller, you can sign documents from anywhere, allowing for greater flexibility and efficiency in handling your legal paperwork.

What should I include in my Deed of Trust to Secure Assumption Template?

When drafting a Deed of Trust to Secure Assumption Template, it's crucial to include the names of all parties involved, the property's legal description, loan amounts, and payment terms. You should also outline the responsibilities of the parties and any necessary contingencies. By covering these essential elements, your Deed of Trust to Secure Assumption Template will provide clarity and protect your rights and obligations.

Are there any risks associated with not using a Deed of Trust to Secure Assumption Template?

Not using a Deed of Trust to Secure Assumption Template can lead to significant risks, such as misunderstandings about loan responsibilities and potential legal disputes. Without a formalized agreement, the new borrower may not be protected against unforeseen liabilities, risking their investment in the property. Ensuring the use of a comprehensive Deed of Trust to Secure Assumption Template can mitigate these risks and clarify expectations for all parties involved.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.