Get the free Deed of Variation Intestacy Template

Show details

This document serves as a formal variation to the intestacy provisions regarding the distribution of the Grantor\'s estate, specifically concerning a property transfer to a Beneficiary.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is deed of variation intestacy

A deed of variation intestacy is a legal document that allows beneficiaries to alter the distribution of an estate following a person’s death when they have died without a valid will.

pdfFiller scores top ratings on review platforms

Just started using it

Just started using it, but everything seems to be functioning optimally. Thus far a very good PDF filler.

Works well so far lets see in about 1…

Works well so far lets see in about 1 month

very helpful

Great tool allows me to edit my pdf's…

Great tool allows me to edit my pdf's on the run !!

very good and 100% cool

THANK YOU

THANK YOU - IT IS WORKING WELL

Who needs deed of variation intestacy?

Explore how professionals across industries use pdfFiller.

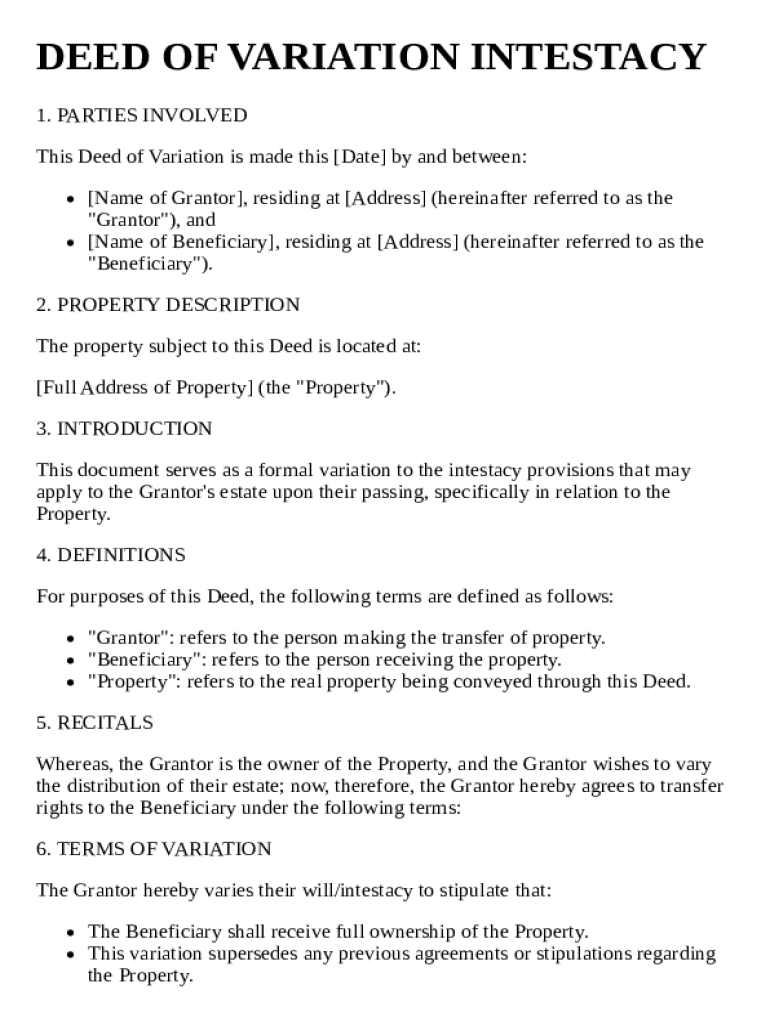

Comprehensive Guide to the Deed of Variation Intestacy Form

A deed of variation intestacy form is essential for modifying how an estate is distributed when someone passes away without a valid will. This guide will walk you through understanding the form, the involved parties, property requirements, and more, ensuring you navigate this process with confidence.

Understanding a deed of variation on intestacy

A deed of variation allows beneficiaries to alter the distribution of an estate under intestacy laws. This is significant as it can potentially align inheritance with the deceased's wishes or support family dynamics. Legally, these variations must comply with relevant statutes to be effective.

-

A deed of variation serves to reallocate assets among beneficiaries, offering flexibility in estate distribution where a will is absent.

-

When an estate goes through intestacy, this deed allows involved parties to ensure that the distribution reflects their collective agreement rather than strict legal mandates.

-

Any modification must adhere to legal standards; otherwise, it may lead to conflicts or nullification of the deed.

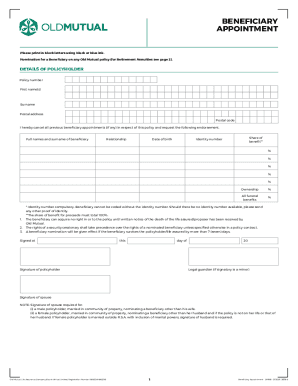

Who are the key parties involved in the deed?

In a deed of variation, the grantor, beneficiaries, and possibly other interested parties are central to the process. Understanding their roles ensures clarity during execution.

-

Typically the executor or the party with the authority to alter the estate distribution, the grantor facilitates the reallocation.

-

These are individuals entitled to a share of the estate, whose rights may be modified through the deed.

-

When several beneficiaries are involved, their consent becomes crucial to ensure a mutually agreed upon variation.

What detailed property description is required?

Accurate property descriptions in a deed of variation are vital for legal clarity. Misleading or vague details can lead to disputes or challenges in execution.

-

The full and correct address must be clearly stated to identify the property being modified in the deed.

-

Precise descriptions ensure compliance with legal standards and help prevent potential conflicts among beneficiaries.

-

Using titles, land registry details, or tax identification numbers can enhance the legitimacy of property descriptions.

How are the terms of variation explained?

Clearly stating the terms of variation is crucial for understanding how the estate's assets will be distributed post-modification. Clarity in language helps prevent misunderstandings.

-

Begin by directly stating what is being varied in the distribution of assets.

-

Using terms such as 'this variation hereby alters' or 'the following distributions are agreed' is effective.

-

Example clauses might include reallocating a percentage of a property or defining specific distributions to individual beneficiaries.

What is consideration in the deed of variation?

Consideration in legal terms refers to something of value exchanged between parties. Understanding its role in a deed of variation is critical for legality and enforceability.

-

Consideration ensures that variations are not merely gifts but involve some exchange or benefit to at least one of the parties.

-

This can range from cash payments to agreements regarding future support or services.

-

Failure to establish adequate consideration may render the variation invalid and affect existing beneficiary rights.

What legal and governing framework applies?

Each state has its laws governing deeds of variation. Familiarizing yourself with these regulations is vital during the drafting process.

-

The specific laws governing variations depend on the jurisdiction, necessitating careful research.

-

Ensuring compliance not only legitimizes the variation but also minimizes legal risks.

-

Variations may have different legal standings depending on the local statutes, impacting how the deed is drafted.

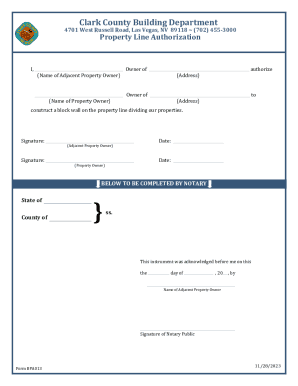

What is the notarization process for the deed?

Notarization is an essential step in validating the deed of variation. This process ensures that signatures are verified and documented properly.

-

The grantor and all signatories must present themselves in front of a Notary Public to authenticate the deed.

-

A Notary Public serves not only as a witness but also ensures the document meets legal standards.

-

Missing signatures or incorrect identification can lead to delays or invalidation of the notarized document.

How is the deed of variation executed?

The execution process of the deed of variation is critical for its validity. Following the guidelines ensures that the deed holds up legally.

-

All relevant parties must sign the document; a witness may also be necessary in certain jurisdictions.

-

Overlooking signatory requirements or failing to meet witness guidelines can lead to significant legal challenges.

-

Executing incorrectly can render the deed invalid, leading to continued complications in distributing the estate.

How to use pdfFiller for your deed of variation?

pdfFiller provides a user-friendly platform for creating, editing, and managing deeds of variation. By leveraging its tools, you can streamline this often-complex process.

-

Users can easily navigate to locate the deed of variation template within pdfFiller.

-

Access from anywhere, collaboration capabilities, and secure storage enhance the document management experience.

-

The platform allows for seamless editing, electronic signing, and efficient management, ensuring the deed is ready for execution quickly.

How to fill out the deed of variation intestacy

-

1.Obtain the blank deed of variation intestacy form from pdfFiller.

-

2.Open the form in your pdfFiller account.

-

3.Begin by entering the deceased's full name and date of death at the top of the document.

-

4.Identify and list the beneficiaries involved in the intestacy.

-

5.Clearly state the desired changes to the distribution of the estate, specifying how assets will now be divided.

-

6.Include signatures from all involved beneficiaries to confirm agreement to the changes.

-

7.Add the date of signing and ensure all parties receive a copy of the completed document.

-

8.Save the completed form in your pdfFiller account and download or print it as needed.

What is a Deed of Variation Intestacy Template?

A Deed of Variation Intestacy Template is a legal document used to alter the distribution of an estate when someone passes without a will. This template allows beneficiaries to agree on how the assets of the deceased should be shared differently than dictated by intestacy laws. Utilizing this template can help streamline the process and ensure that the final distribution aligns with the wishes of the parties involved.

Who should use a Deed of Variation Intestacy Template?

Individuals or groups of beneficiaries who inherit an estate under intestacy laws can benefit from a Deed of Variation Intestacy Template. It is particularly useful when beneficiaries wish to redistribute the estate in a manner that is different from the default legal distribution. This legal tool can foster better relationships among heirs by allowing them to openly agree on how the estate is to be divided.

How does a Deed of Variation Intestacy Template work?

The Deed of Variation Intestacy Template works by allowing beneficiaries to outline new terms of distribution that deviate from the legal requirements set by intestacy laws. Once the document is finalized and signed by all relevant parties, it is submitted to the probate court as part of the estate administration process. This ensures that the new arrangements will be legally recognized and honored in place of the original intestacy provisions.

Is a Deed of Variation Intestacy Template legally binding?

Yes, a Deed of Variation Intestacy Template becomes legally binding once it is executed by all parties involved. The parties must agree to the modifications, sign the document, and comply with the necessary legal requirements for it to hold validity. This legal binding nature underscores the importance of having an accurately completed template to avoid disputes down the line.

What are the benefits of using a Deed of Variation Intestacy Template?

Using a Deed of Variation Intestacy Template offers numerous benefits, including the ability to modify how the deceased's assets are shared among heirs. It can help to minimize family disputes, provide tax advantages, and allow for specific wishes of the beneficiaries to be honored. Additionally, this template can enhance communication and collaboration among family members, resulting in a smoother estate settlement.

Can I create a Deed of Variation Intestacy Template myself?

While it is possible to create your own Deed of Variation Intestacy Template, it is advisable to consult with a legal professional to ensure its accuracy and compliance with the law. A properly drafted template will prevent potential complications and disputes that may arise later. Using a reputable online service like pdfFiller can also simplify the process, providing accessible templates that can be easily customized.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.