Get the free Property Title Report Template

Show details

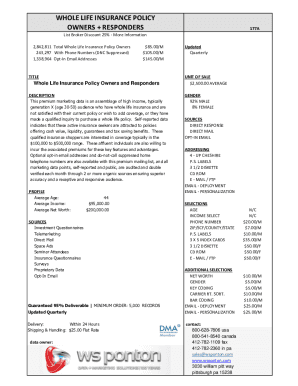

This document summarizes the legal status of a property, including title validity and existing liens, to inform parties involved in real estate transactions.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is property title report template

A property title report template is a standardized document used to summarize the legal ownership and interests in a property.

pdfFiller scores top ratings on review platforms

GOOD

GOOD APP VERY USEFUL

It's GREAT

It's GREAT. It's simple, easy to use, user friendly, and Handy.

wonderful

wonderful and easy to use

This has been very helpful

This has been very helpful, I'm able to edit and convert documents

great service

great service

PDfFiller

PDfFiller

is a great service with more to help people in alot of ways.

Who needs property title report template?

Explore how professionals across industries use pdfFiller.

How to fill out a property title report template form

Understanding the property title report

A property title report is a crucial document that outlines the legal ownership of a property. It not only defines the property in question but also underscores its title status, thereby protecting both buyers and sellers during real estate transactions. The report includes essential details that provide transparency and assurance, allowing all parties to understand rights and obligations.

-

The report ensures that buyers are fully informed about any potential issues affecting the property.

-

It protects sellers by documenting their ownership, safeguarding against claims from third parties.

-

The report includes legal descriptions, ownership history, and any encumbrances on the title.

Who are the key parties involved?

In a property transaction, the seller and purchaser are the main parties involved in the title report process. Each party has distinct roles and responsibilities that significantly influence the outcome of the real estate transaction. Understanding these roles is essential as it can affect the legal integrity of the title report.

-

The seller's primary responsibility is to provide accurate information about the property and ensure the title is clear.

-

The purchaser must review all documentation to safeguard against potential disputes or fraudulent claims.

What terminology should be defined for clarity?

Clear definitions of terms are vital to understanding the property title report. Terms like 'property' and 'liens' may seem straightforward but can carry significant legal implications. Grasping these definitions ensures that both buyers and sellers are fully aware of their rights.

-

Refers to the land and any structures on it; vital for defining ownership.

-

Legal claims against the property that can affect transfer of ownership.

How to describe the property accurately

Providing an accurate property description is crucial in a title report. This includes not only the physical address but also specific details like parcel numbers and boundaries. Precise descriptions are necessary from a legal perspective to prevent future disputes.

-

Include county, city, and state to clearly identify the property.

-

Outline exact property lines to avoid misunderstandings regarding ownership.

What does it mean to evaluate title status?

Understanding whether a title is 'clear' or has existing liens is crucial in the evaluation process. A clear title indicates that there are no claims against the property, making it safe for a purchaser. On the other hand, existing liens can complicate transactions and require specific actions to resolve.

-

A title free of any liens, claims, or disputes, ensuring smooth transactions.

-

Liens must be cleared before completing the sale or else could lead to complications.

How to identify existing liens?

Identifying existing liens is critical before finalizing any property transaction. Common types of liens include mortgages, tax liens, and mechanic's liens, each with their own implications. Ignoring these liens can result in significant legal and financial consequences.

-

Includes tax liens, which are often levied for unpaid property taxes, and mechanic's liens from unpaid construction work.

-

Utilize public records or title search companies to gather information on existing liens.

What governing laws impact title reports?

State laws heavily regulate the preparation and execution of property title reports. Compliance with these laws is essential for both buyers and sellers, as regional variations can alter the requirements for title documentation. A strong understanding of applicable laws can protect against legal issues.

-

Different states may have unique laws governing the use of title reports.

-

Knowing local laws helps buyers understand their rights to dispute inaccurate information.

What are the steps to finalize the property title report?

Finalizing the property title report requires careful execution of the document. Both parties must sign the report, affirming its accuracy and truthfulness. Additionally, involving a notary public can further validate the document's authenticity.

-

Ensure all required signatures are obtained for the report to be legally binding.

-

Notarization adds another layer of security, affirming the signers’ identities.

Why is acknowledgment crucial?

Acknowledgment of signatures by a notary public is essential for legitimizing the property title report. This process confirms that all parties have willingly signed the document. Inadequate acknowledgment can jeopardize the report's legality, leading to potential disputes.

-

Acknowledgment is the formal recognition by a notary that the signatories are who they claim to be.

-

Failure to acknowledge can invalidate the contract, leading to legal challenges.

How to fill out the property title report template?

Filling out a property title report template can be straightforward if approached step by step. Understanding each section is critical—this guide will help navigate through common mistakes and tips for successful completion. Utilize tools like pdfFiller for efficient document management.

-

Follow a detailed checklist for each template section, ensuring all necessary information is included.

-

Failing to double-check information can lead to discrepancies that complicate the sale.

What interactive tools can aid in document management?

Leveraging interactive tools available through pdfFiller can significantly enhance document management. Features such as collaborative tools make it easy for multiple users to contribute, thereby streamlining the process. This ensures an efficient way to sign and share the Property Title Report.

-

pdfFiller allows users to edit and customize their title report templates easily.

-

Real-time collaborative tools enable multiple parties to review and edit documents simultaneously.

How to fill out the property title report template

-

1.Open pdfFiller and upload your property title report template file.

-

2.Begin by entering the property address in the designated section at the top of the form.

-

3.Fill in the owner's name as it appears on the official property records.

-

4.Include the property's legal description from previous title documents, ensuring it is accurate and complete.

-

5.Next, identify any encumbrances or liens against the property, such as mortgages or easements, in the specified fields.

-

6.If applicable, provide information about previous owners and the transaction history of the property to offer additional context.

-

7.Double-check all entries for accuracy before proceeding to the next step in the form.

-

8.Once all required fields are filled, review the document for any missing information or errors.

-

9.Save the completed property title report and proceed to print or share it as needed.

What is a Property Title Report Template?

A Property Title Report Template is a standardized document that outlines the key details of a property’s ownership history, including liens and encumbrances. This template allows users to efficiently compile relevant information, making it easier to assess property rights and responsibilities. By utilizing a Property Title Report Template, individuals and teams can ensure consistency and accuracy in their property assessments.

How can I create a Property Title Report Template using pdfFiller?

Creating a Property Title Report Template with pdfFiller is simple and efficient. Users can start with a blank document or customize an existing template to include necessary details such as owner information, property description, and legal documents. The intuitive editing tools provided by pdfFiller allow for quick adjustments, ensuring the final Property Title Report Template meets specific requirements and is ready for sharing.

Why is it important to have a Property Title Report Template?

Having a Property Title Report Template is essential for anyone involved in property transactions. It helps streamline the process of proving ownership and can highlight any potential issues that could affect the property, such as liens or disputes. By using a Property Title Report Template, users can easily access and present essential property details, enhancing credibility and transparency in real estate dealings.

Can the Property Title Report Template be customized for different property types?

Absolutely! The Property Title Report Template can be tailored for various property types, including residential, commercial, and industrial properties. Users can modify sections to include specific details relevant to each property type, ensuring that all necessary information is captured accurately. This flexibility makes the Property Title Report Template an invaluable tool for real estate professionals and individuals navigating property transactions.

What features should I look for in a Property Title Report Template?

When selecting a Property Title Report Template, look for features that facilitate customization and clarity. Essential elements include sections for ownership details, legal descriptions, and any encumbrances present. Additionally, ensure that the template supports electronic signatures and collaborative features, as these additions enhance the usability and effectiveness of the Property Title Report Template in real estate transactions.

Is there a way to share my Property Title Report Template with others?

Yes, pdfFiller allows users to easily share their Property Title Report Template with others via secure links or email. After finalizing the template, you can invite collaborators to view or edit the document, ensuring all relevant parties are on the same page. This sharing capability streamlines communication and helps facilitate smoother transactions in property dealings, making the Property Title Report Template even more practical.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.