Get the free Property Trust Deed Template

Show details

This document establishes a trust agreement for managing a property for the benefit of specified beneficiaries.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is property trust deed template

A property trust deed template is a legal document used to establish a trust for holding property on behalf of beneficiaries.

pdfFiller scores top ratings on review platforms

excelent program, by the moment what ive been learning is good program

Excellent experience

only needed it for a one off use

Excellent

It is very easy to use.

great software

Who needs property trust deed template?

Explore how professionals across industries use pdfFiller.

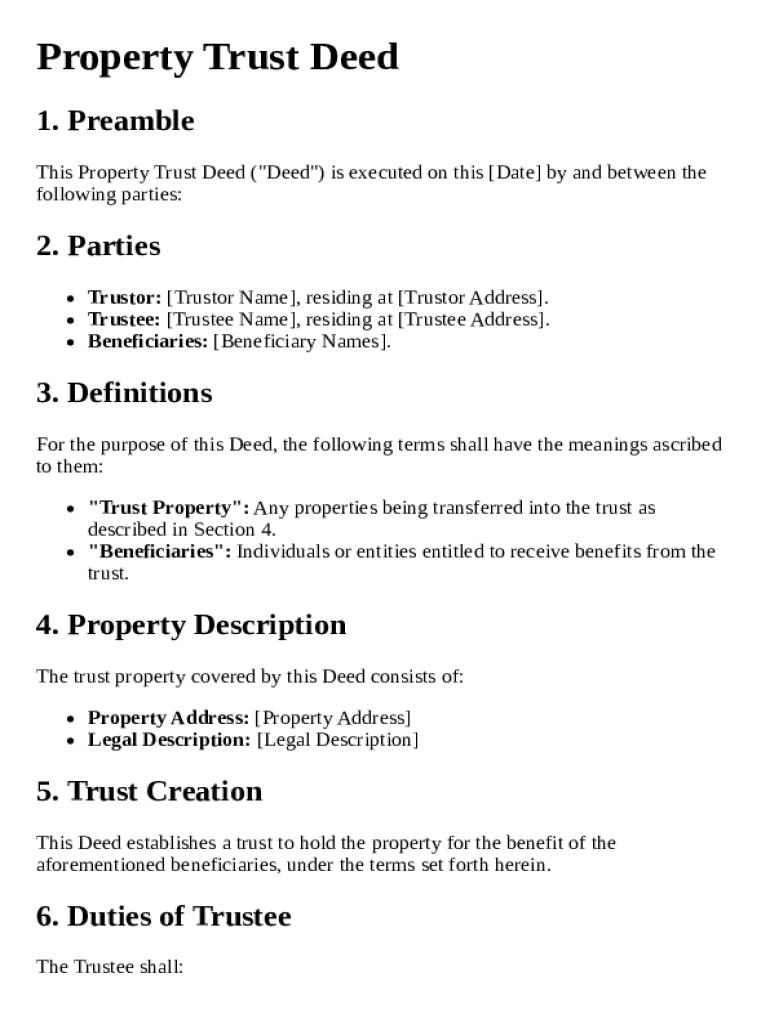

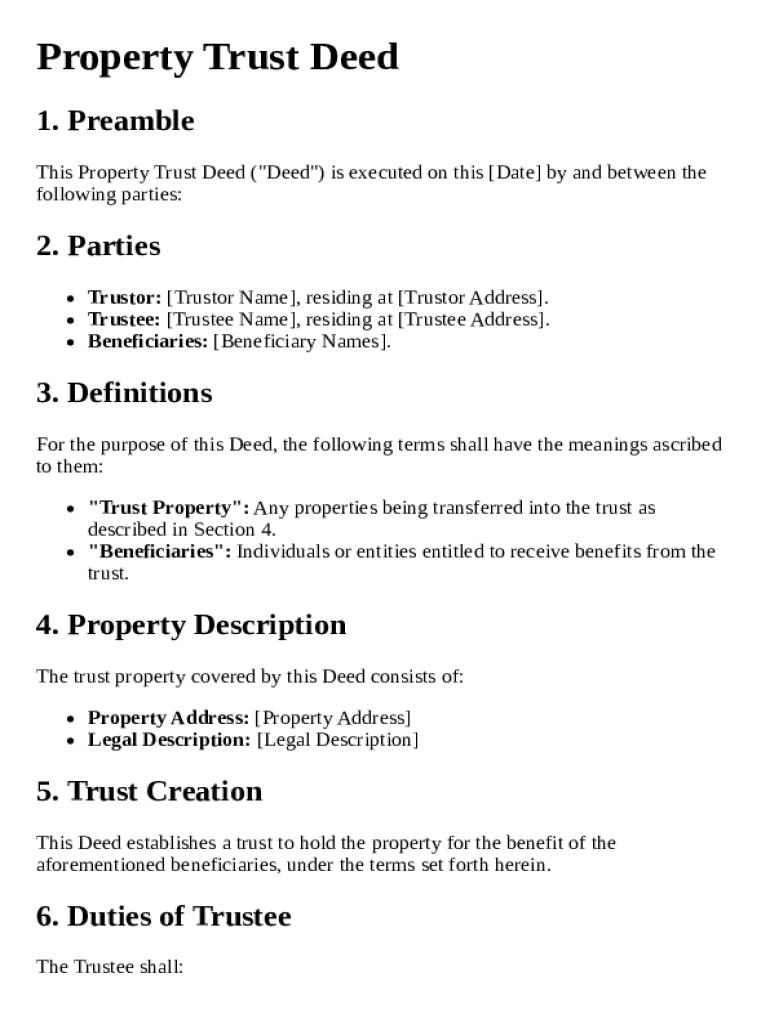

Comprehensive Guide to Property Trust Deed Template Form

To fill out a property trust deed template form, begin by carefully defining the property involved and the parties (trustor, trustee, and beneficiaries) associated with the trust. Next, ensure accurate descriptions, including legal elements, and sign the document in the presence of a notary. Lastly, keep the copy organized for future reference and execution.

What is a property trust deed?

A property trust deed is a legal document that outlines the terms under which property is held in trust. Its primary purpose is to protect the interests of beneficiaries while outlining the responsibilities of the trustee. Understanding the definitions and roles of a trustor (the property owner), trustee (the manager of the property), and beneficiaries (those who receive benefit) is crucial.

What are the key elements of a property trust deed?

Key elements include the preamble declaring the intent to create a trust, identification of involved parties, and essential definitions of terms like trust property and beneficiaries. Each element plays a significant role in ensuring clarity and legality.

-

Specifies the purpose and significance of executing the deed.

-

Identifies trustor, trustee, and beneficiaries and their relationships.

-

Clarifies critical terms to avoid ambiguity in the deed.

How can accurately describe the property in a trust?

Describing the property under trust accurately is vital for future legal transactions. You'll want to provide a legal description that includes specific geographic details along with the property's address and other legal identifiers. This detail not only clarifies which property is under trust but also prevents disputes.

What is the trust creation process?

Creating a trust involves a series of steps that start with drafting the trust deed and ensuring all legal requirements are met. A legal expert may assist in drafting an effective trust document, and services like pdfFiller can make the document creation process seamless and efficient.

What are the responsibilities of a trustee?

The trustee has several critical responsibilities, including managing the trust property in the beneficiaries' best interests, distributing trust income and maintaining accurate records of all transactions. The trustee acts as a fiduciary, meaning they must prioritize the needs of the beneficiaries above their own.

What powers are granted to the trustee?

Trustees are granted significant powers necessary to perform their duties, including buying, selling, and transferring property. They may also enter into contracts for property maintenance. However, these powers often come with limitations and should be clearly defined within the trust deed.

What does indemnification of the trustee mean?

Indemnification clauses serve to protect trustees from personal liability for actions taken in good faith during their management of the trust. Understanding these clauses is important, as they provide legal protection and ensure the trustee feels secure in executing their duties.

How does governing law affect property trust deeds?

State laws significantly influence the enforcement and execution of property trust deeds. Each state may have different statutes regulating trust creation and management, so it's crucial to consult legal standards applicable in your jurisdiction while drafting a trust.

What is the process for executing a property trust deed?

Execution involves signing the property trust deed in the presence of a notary public. Ensuring that all signatures are correct and acknowledged is essential, as is the inclusion of accurate dates and names to validate the trust legally.

What are the next steps after creating a trust?

Once the trust is created, the next steps include taking necessary actions as outlined in the deed and implementing effective trust management strategies. Services like pdfFiller can facilitate document management, ensuring that you remain compliant and organized.

What is a Property Trust Deed Template and why do I need one?

A Property Trust Deed Template is a legal document that outlines the terms and conditions under which property is held in trust. It is essential for individuals or groups who want to establish a legal framework for managing their real estate assets. By using a customizable Property Trust Deed Template, you ensure that your intentions are clearly stated, thus preventing disputes and ensuring compliance with relevant laws.

How can a Property Trust Deed Template help in estate planning?

Using a Property Trust Deed Template can be a pivotal tool in estate planning, as it allows you to designate how your property will be managed and distributed upon your passing. This template provides clear instructions on the management of the property and can help avoid potential conflicts among heirs. Moreover, establishing a trust using this template can sometimes provide tax benefits and protect assets from creditors.

Can I customize my Property Trust Deed Template for specific needs?

Absolutely! A Property Trust Deed Template is designed to be flexible, allowing you to tailor its provisions according to your specific circumstances. You can modify key sections, such as beneficiaries, trustee duties, and property management instructions, ensuring it aligns perfectly with your intended outcomes. Customization can make a significant difference in managing your property effectively and adhering to personal preferences.

What should I consider when choosing a Property Trust Deed Template?

When selecting a Property Trust Deed Template, it’s crucial to consider legality and compliance with local laws. You should ensure the template includes all necessary clauses, especially concerning trusteeship and beneficiary distributions. Furthermore, look for templates that provide guidance on how to fill in the details correctly, as this will save time and help you avoid complications in the implementation of the trust.

Is a Property Trust Deed Template suitable for both residential and commercial properties?

Yes, a Property Trust Deed Template can be used for both residential and commercial properties. It's important to choose or customize a template that reflects the specific needs associated with the type of property in question. Different property types may entail varying legal requirements and management considerations, so tailor your template accordingly to cover all necessary aspects.

Where can I find a reliable Property Trust Deed Template?

You can find a reliable Property Trust Deed Template on platforms like pdfFiller, which provides a variety of templates that are easy to access and customize. By using pdfFiller's extensive library, you can ensure that the template meets your legal needs and can be edited from anywhere. This access facilitates seamless collaboration if you need help from legal professionals in tailoring your Property Trust Deed Template.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.