Get the free Quitclaim Deed Mortgage Template

Show details

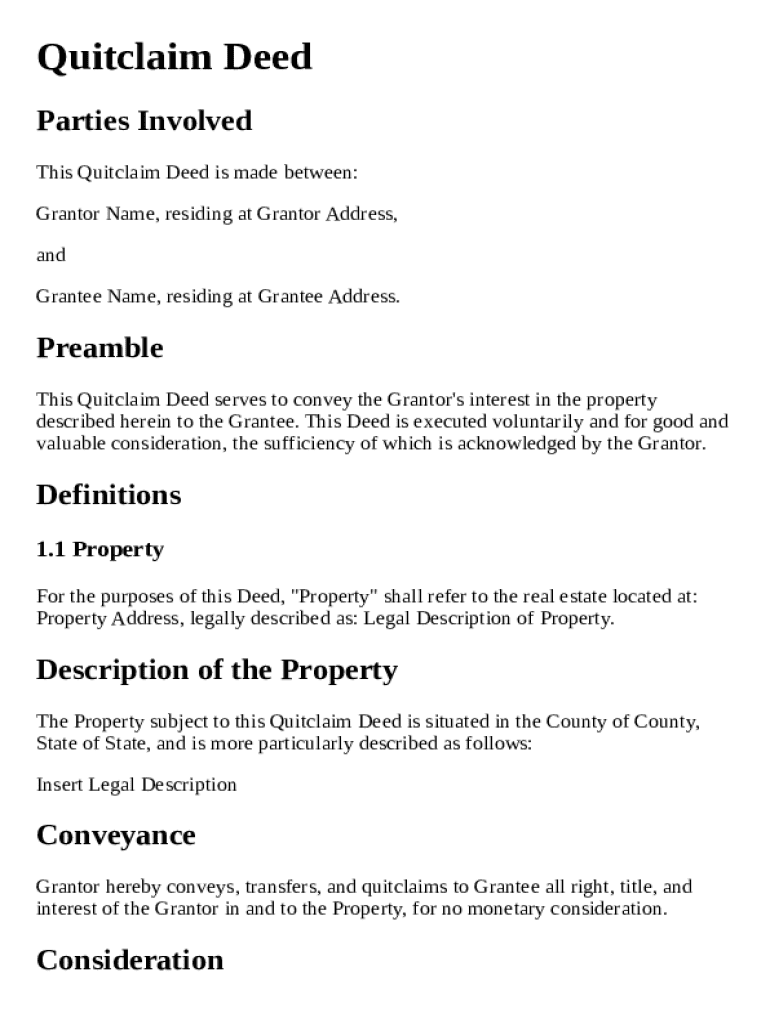

This document serves to convey the Grantor\'s interest in a specific property to the Grantee, ensuring legal transfer of ownership without any monetary exchange.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is quitclaim deed mortgage template

A quitclaim deed mortgage template is a legal document that allows one party to relinquish their interest in a property without making any guarantees about the title.

pdfFiller scores top ratings on review platforms

Form is user friendly. I enjoyed the fill-in, also the printing of the form.

I still need to get used to the forting of the forms

Great!!!! Sooooooo Convenient!!!!!!!!!!!!!!!!1

Best way to complete federal job application forms!

new user so will navigate more but for now impressed

I love this. However, I was overcharged and I want that resolved.

Who needs quitclaim deed mortgage template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Quitclaim Deed Submission on pdfFiller

A quitclaim deed is a crucial legal document used to transfer property rights without any warranties or claims about the property's title. If you're looking to fill out a quitclaim deed mortgage template form, this guide will provide you with all the necessary steps and information.

What is a quitclaim deed?

A quitclaim deed is a legal instrument that allows a granter to transfer their interests in a property to a grantee without any guarantees about the title. Unlike warranty deeds, quitclaim deeds do not assure the buyer that the grantor holds clear title to the property.

-

Quitclaim deeds serve to transfer property rights without guaranteeing the validity of the title, making them ideal for certain situations such as transferring property between family members.

-

One primary feature is that these deeds do not require a title search. This can expedite the transfer process but may involve risks regarding the property’s title clarity.

-

Unlike warranty deeds, which provide protections to the grantee against title defects, quitclaim deeds have no such warranties, making them less secure.

Who are the parties involved in a quitclaim deed?

In a typical quitclaim deed transaction, two parties are involved: the grantor, who is the person transferring the property interest, and the grantee, who receives the property rights.

-

The grantor is the current owner of the property, while the grantee is the individual or entity receiving the interest in the property.

-

It’s essential to include accurate addresses for both parties to ensure proper identification and to avoid legal complications later.

-

Incorrect information can lead to disputes or invalidation of the deed, emphasizing the need for attention to detail during this process.

What are the key components of a quitclaim deed?

A well-drafted quitclaim deed includes several key components essential for legal validity and clarity. Understanding these components can streamline the process of filling out the quitclaim deed mortgage template form.

-

This section contains the legal implications of the conveyance, outlining the intent behind the transfer.

-

A detailed description of the property, including its legal description, is critical to ensure there is no ambiguity about what is being transferred.

-

This clause specifies exactly what is being transferred, creating a clear understanding of the nature of the transaction.

How do fill out the quitclaim deed form?

Filling out the quitclaim deed is a straightforward process when broken down into manageable steps. Following these steps can ensure all necessary information is correctly recorded.

-

Begin with entering the names of the grantor and grantee as required. Ensure the correct spelling for each party's names.

-

Provide the full address and any additional legal descriptions of the property to avoid confusion.

-

Define any monetary (if applicable) or non-monetary considerations involved in the transfer, clarifying the reasons for the deed.

Why is notarization important for quitclaim deeds?

Notarization is a vital step in the quitclaim deed process, ensuring that the document is legally recognized. It adds an extra layer of authenticity to the document.

-

Notarized documents are less likely to face legal challenges, as notaries verify the identity of the signers and witness their signatures.

-

Visit a notary public, present valid identification, and sign the document in the presence of the notary for it to be officially acknowledged.

-

This form, filled by the notary, serves as proof that the document was executed correctly under the law.

What are the state-specific requirements?

It’s essential to understand that quitclaim deed requirements can vary significantly from state to state, so be sure to check local laws.

-

Each state has its own requirements for the form's format and the information needed, making personalized research important.

-

Legal databases and state government websites can provide useful guidelines and templates for your quitclaim deed.

-

Be attentive to any state-specific compliance notes, as non-compliance can result in legal complications or rejected submissions.

How can pdfFiller assist with quitclaim deeds?

pdfFiller offers an array of features that can significantly ease the process of drafting, filling, and submitting quitclaim deeds, making it an invaluable tool.

-

With pdfFiller, users can easily create and edit PDF documents, ensuring that quitclaim deed forms are professional and legally compliant.

-

The platform offers intuitive tools for adding signatures, making it easier to navigate the legal requirements and ensure accuracy.

-

Teams can collaborate within the platform to share and submit documents, enhancing efficiency and accuracy in managing important property transfer documents.

What are best practices for finalizing your quitclaim deed submission?

Finalizing your quitclaim deed is crucial for ensuring that it is correctly filed and legally binding. Following best practices can help avoid pitfalls.

-

Double-check all entries on the quitclaim deed template form before submission to avoid errors and possible delays in processing.

-

After submission, verify with the local recorder's office to ensure the deed has been officially recorded.

-

Store copies of your quitclaim deed in a safe place, ensuring that they are easily accessible for future reference or legal needs.

How to fill out the quitclaim deed mortgage template

-

1.Open the quitclaim deed mortgage template on pdfFiller.

-

2.Fill in the names of the grantor (the person transferring ownership) and the grantee (the person receiving ownership).

-

3.Enter the property address and legal description for clarity.

-

4.Include any pertinent details such as the date of transfer and any conditions of the transfer.

-

5.Review the document for any missing fields or errors.

-

6.Save your changes and download the completed document.

-

7.Consider printing multiple copies for your records and for the grantee's records.

What is a Quitclaim Deed Mortgage Template?

A Quitclaim Deed Mortgage Template is a legal document used to transfer ownership rights of real estate from one party to another without any warranties. This template simplifies the process by providing a ready-made structure that can be filled out to create a deed quickly. When seeking a Quitclaim Deed Mortgage Template, ensure it is compliant with your state laws to avoid potential legal issues.

How do I use a Quitclaim Deed Mortgage Template?

To use a Quitclaim Deed Mortgage Template, first download the template from a reliable source. Once you have the document, fill in the necessary information, such as the property details and the names of the parties involved. After completing the Quitclaim Deed Mortgage Template, it's essential to sign the document in the presence of a notary to finalize the transfer legally.

Is a Quitclaim Deed Mortgage Template necessary for property transfers?

While a Quitclaim Deed Mortgage Template isn't legally required for all property transfers, using one can provide clarity and prevent disputes later. This template ensures that all parties understand the terms of the transfer and provides a clear record of ownership. Opting for a Quitclaim Deed Mortgage Template is a wise choice for avoiding misunderstandings in property dealings.

What are the benefits of using a Quitclaim Deed Mortgage Template?

Using a Quitclaim Deed Mortgage Template offers several advantages. It streamlines the property transfer process and saves time by providing a standardized format that reduces the chance of errors. Additionally, with a Quitclaim Deed Mortgage Template, you can avoid legal complexities and confidently manage the transfer of ownership.

Can I modify a Quitclaim Deed Mortgage Template?

Yes, you can modify a Quitclaim Deed Mortgage Template to fit your specific needs, as long as you adhere to legal requirements. When making alterations, ensure that all critical information is accurate and that the document remains compliant with state regulations. This flexibility allows you to customize the Quitclaim Deed Mortgage Template while still protecting your interests.

Where can I find a reliable Quitclaim Deed Mortgage Template?

You can find a reliable Quitclaim Deed Mortgage Template on various legal document websites, including pdfFiller. These platforms often provide templates that are regularly updated and compliant with current laws. Accessing a quality Quitclaim Deed Mortgage Template from a reputable source ensures that your property transfer will be smooth and legally sound.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.