Get the free Quitclaim Deed to Llc With Mortgage Template

Show details

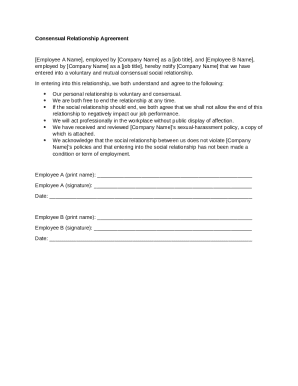

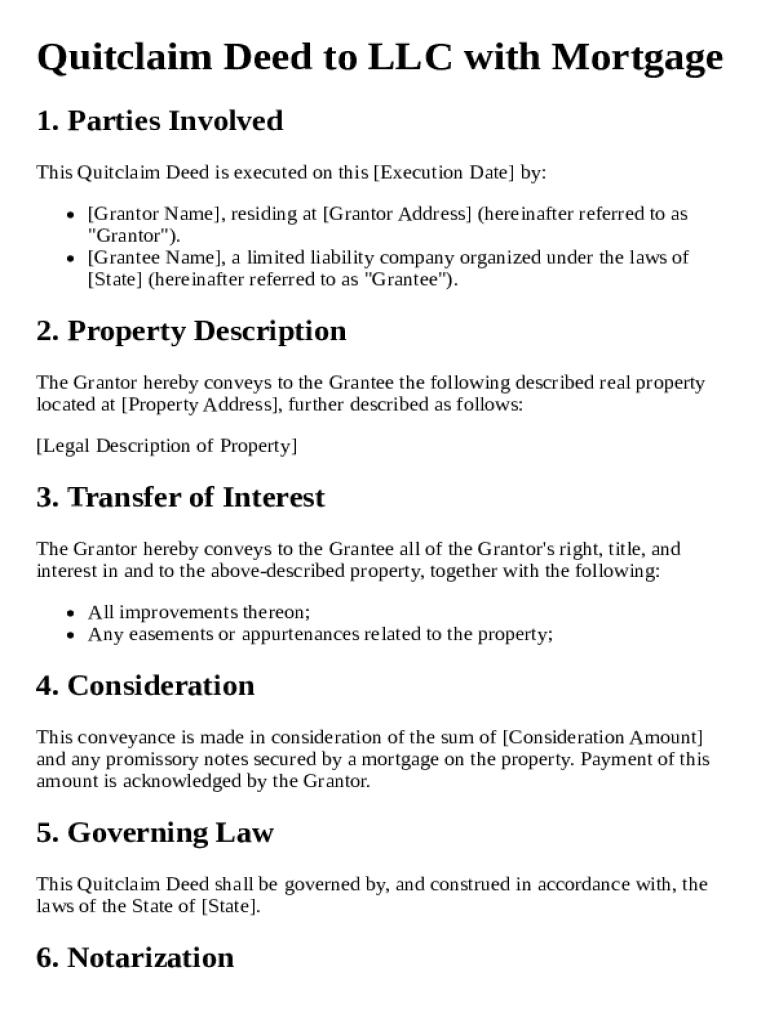

This document serves as a legal conveyance of property from a Grantor to a Grantee, specifically an LLC, including conditions, considerations, and required signatures.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is quitclaim deed to llc

A quitclaim deed to LLC is a legal document that transfers ownership interest in a property to a Limited Liability Company without any warranties.

pdfFiller scores top ratings on review platforms

very fast and effective

Very user friendly.

Great

I am quite satisfied thus far but I need to learn more about what it can help me with.

Never had a problem.

SATISFACTORY

Who needs quitclaim deed to llc?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Quitclaim Deed to Form

How to fill out a quitclaim deed to form

Filling out a quitclaim deed to LLC form involves accurately completing essential sections and ensuring compliance with state laws. Start by clearly identifying the involved parties, describe the property in detail, and ensure the completion of both grantor and grantee information. Once finalized, follow notarization and signature protocols to ensure the document's validity.

Understanding quitclaim deeds

A quitclaim deed is a legal instrument used to transfer any interest one party may have in a property to another party without making any guarantees about the title's validity or quality. This type of deed is often used in situations where property is being transferred between family members or to an LLC.

-

A quitclaim deed conveys property interest without warranties, making it ideal for informal transfers.

-

Unlike warranty deeds, which guarantee a clear title, quitclaim deeds offer no assurances, potentially exposing the grantee to risk.

-

Quitclaim deeds are frequently used in divorce settlements, to clear title defects, or when transferring property to LLCs.

What is included in a quitclaim deed to an ?

When preparing a quitclaim deed to transfer property to an LLC, it's vital to include specific components that define the transaction clearly. This includes correct identification of the parties involved, precise legal descriptions of the property, and the proper usage of language stipulated by state law for LLC-related deeds.

-

Include the names of the grantor (the person transferring the property) and the grantee (the LLC).

-

Use terminology that indicates the intention to convey property rights to the LLC, which may vary by state.

-

Ensure the property's legal description is accurate to avoid future disputes or issues with title.

How to fill out a quitclaim deed to

Completing the quitclaim deed involves several crucial steps to ensure clarity and legal validity. Each section requires specific details about both the grantor and the grantee, including names, addresses, and the precise nature of the property being transferred.

-

Begin with your personal details, followed by those of the LLC, and include the property description.

-

Be sure to fill in all necessary data, especially in the grantor and grantee sections, to avoid invalidation.

-

Watch out for incomplete information, misspellings, or inaccurate property descriptions that can void the deed.

Transfer of interest explained

Transferring property interest via a quitclaim deed involves conveying all rights and interests in the property from the grantor to the grantee. This transfer can include physical properties and may extend to improvements and appurtenances associated with the real estate.

-

The deed transfers the grantor's rights, ensuring that the LLC can make decisions related to the property.

-

Once the deed is executed, the LLC holds the title and is responsible for any encumbrances or liens against it.

-

Make sure any improvements made to the property, as well as associated rights, are accounted for in the transfer.

Considerations in a quitclaim deed to

When drafting a quitclaim deed, various considerations need to be addressed, particularly regarding the financial aspects of the property transfer. Determining the consideration amount and understanding the implications of any existing mortgages is crucial.

-

This refers to the payment exchanged for the property; it can be nominal or reflect market value.

-

Existing mortgages must be considered, as they could affect the transfer and future obligations of the LLC.

-

Understand any legal requirements in your state regarding consideration to ensure the deed's enforceability.

State compliance: governing laws

Different states have unique regulations governing quitclaim deeds. Understanding the specific legal requirements in your state is essential for ensuring the validity of the deed and avoiding future disputes.

-

Research your state's specific laws regarding quitclaim deeds to ensure all required elements are included.

-

Laws can affect the transfer process, such as the necessity for notarization or specific wording in the deed.

-

Check with local state offices or legal resources to understand the regulations that may impact your quitclaim deed.

Notarization requirements

Most states require a quitclaim deed to be notarized to ensure its authenticity and to prevent fraud. Notarization typically involves signing the deed in front of a notary public who can formally validate the parties’ identities.

-

Notarization provides legal validation to the deed, which may be necessary to record it at the local courthouse.

-

You'll typically need valid identification to verify your identity when presenting the deed to the notary.

-

Notaries can often be found at banks, legal offices, or through online notary services.

Signing and finalizing the quitclaim deed

Proper execution of the quitclaim deed requires signatures from both the grantor and the grantee. Ensuring that all parties sign the document in compliance with local laws is critical for validating the transfer of ownership.

-

Both parties must sign the document, and some states may require witnesses or additional acknowledgment.

-

A deed is considered valid once signed and notarized according to local requirements.

-

Store the completed deed in a secure location, and consider recording it with the county to protect your interests.

Digital solutions with pdfFiller

pdfFiller provides an intuitive platform for creating and managing your quitclaim deed to LLC. With comprehensive tools and templates, users can simplify the document preparation process while ensuring compliance with necessary regulations.

-

Utilize pdfFiller's templates to easily fill out your quitclaim deed to LLC with all required information.

-

Access and store your document securely in the cloud for easy retrieval and collaboration.

-

pdfFiller's eSignature allows for quick execution of your quitclaim deed, eliminating the need for physical signatures.

How to fill out the quitclaim deed to llc

-

1.Navigate to pdfFiller and log in to your account.

-

2.Search for the 'quitclaim deed to LLC' template in the document library.

-

3.Select the template and click 'Fill Now' to begin editing.

-

4.Enter the names of the grantor and the LLC as the grantee in the respective fields.

-

5.Provide the legal description of the property being transferred.

-

6.Input the date of transfer in the designated area.

-

7.Check to ensure all information is accurate and complete before signing.

-

8.If required, have the document notarized after signing.

-

9.Download or save the completed deed to your device, or share it directly from pdfFiller.

What is a Quitclaim Deed to LLC with Mortgage Template?

A Quitclaim Deed to LLC with Mortgage Template is a legal document that allows the owner of a property to transfer their interest to a Limited Liability Company (LLC), even if there is a mortgage involved. This template simplifies the process by providing a ready-made format that includes all necessary legal provisions. It's essential for property owners who want to protect their personal assets while maintaining clear ownership records.

Why should I use a Quitclaim Deed to LLC with Mortgage Template?

Using a Quitclaim Deed to LLC with Mortgage Template can save you time and ensure that you comply with legal requirements. This template is specifically designed to accommodate the complexities of transferring property ownership to an LLC while dealing with existing mortgages. Furthermore, it minimizes the risk of errors that could lead to disputes in the future, making it a smart choice for property owners.

Can I customize the Quitclaim Deed to LLC with Mortgage Template?

Absolutely! The Quitclaim Deed to LLC with Mortgage Template is fully customizable to meet your specific needs. Whether you need to add additional clauses or modify the structure to fit your situation, you can easily do so using pdfFiller's intuitive editing tools. This flexibility ensures the document serves your unique requirements effectively.

Do I need legal advice to use a Quitclaim Deed to LLC with Mortgage Template?

While the Quitclaim Deed to LLC with Mortgage Template is designed to be user-friendly, it is always advisable to consult with a legal expert. Real estate laws can vary by state, and having professional guidance can help ensure that the transfer adheres to local regulations and protects your interests. This additional layer of assurance can be invaluable in complex property transactions.

Is a Quitclaim Deed to LLC with Mortgage Template valid in my state?

The validity of a Quitclaim Deed to LLC with Mortgage Template may depend on your state's regulations. Generally, most states accept this format, but it’s crucial to verify your local laws. Using pdfFiller, you can easily access state-specific templates and guidelines to ensure your document is compliant and legally binding in your jurisdiction.

How does pdfFiller help with the Quitclaim Deed to LLC with Mortgage Template?

pdfFiller offers a comprehensive platform that allows users to create, edit, and manage the Quitclaim Deed to LLC with Mortgage Template seamlessly. With its cloud-based features, you can access your document from anywhere, ensuring convenience during property transactions. Additionally, the platform allows for easy e-signature options, making the entire process efficient and straightforward.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.