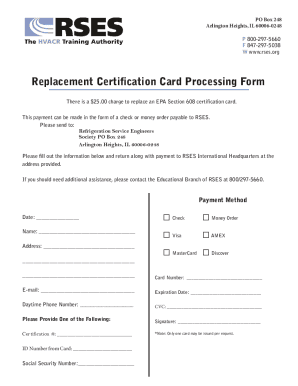

Get the free Reconveyance Letter Template

Show details

This document serves as a formal acknowledgment of the completion of obligations secured by a prior security instrument and is used to reconvey property rights and title back to the Grantor.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is reconveyance letter template

A reconveyance letter template is a legal document used to transfer the title of a property back to its original owner after a loan has been fully repaid.

pdfFiller scores top ratings on review platforms

LAKESHA PORTER

I LOVE THAT ALL THE APPS ARE COVENIENT

Very practical application that serves…

Very practical application that serves as a daily option when I don't have a printer readily available. Its become an essential part of my work flow, especially since it allows me to work from my computer without have to go out to send mail from the post office.

Easy to use application

Love it!

Very good service

Very flexible and easy to use

Who needs reconveyance letter template?

Explore how professionals across industries use pdfFiller.

How to fill out a reconveyance letter template form

Completing a reconveyance letter template form is essential for relinquishing a property deed once a debt has been repaid. This document legally transfers property rights back from the lender (the grantee) to the owner (the grantor). Accurate completion ensures compliance with local laws and provides a clear record of the transaction.

What is the reconveyance process?

The reconveyance process is a crucial aspect of real estate transactions, marking the return of a property title after the borrower has fulfilled their obligations on the mortgage.

-

Reconveyance is the act of transferring property back to the original owner, usually after a debt secured by that property has been fully satisfied.

-

Reconveyance carries significant legal implications as it officially concludes the borrower’s obligations and confirms the lender's release of any claims on the property.

-

Accurate completion of the reconveyance process is vital to avoid future disputes and to ensure the property title is clear for future transactions.

Who are the key parties involved?

Understanding the roles of each individual involved in the reconveyance letter is critical for effective communication and execution.

-

The grantor is the original property owner who receives the title back upon fulfilling their mortgage obligations.

-

The grantee is typically the lender or mortgage servicer who held the title during the mortgage period.

-

Sometimes, third parties such as notaries or legal representatives may be involved to validate and witness the execution of the reconveyance letter.

How should the property be described?

Providing a clear and accurate legal description of the property in the reconveyance letter is critical for legal validity.

-

An accurate description helps avoid future disputes regarding property boundaries and ownership.

-

Legal descriptions typically include details like the property's address, lot number, and parcel number, formatted according to local jurisdiction standards.

-

Using jurisdiction-specific legal descriptions can aid in compliance and clarity concerning property boundaries.

What should be included in the preamble?

The preamble of your reconveyance letter sets the stage for the document, summarizing the key elements and intentions.

-

Includes statements that summarize the obligations that have been satisfied to reinforce the intent of the reconveyance.

-

It’s essential to state the completion of all obligations to assure both parties that the terms of the agreement have been met.

-

Using legally recognized terms and phrases can further strengthen the document's validity and comprehension.

What terms should you understand?

Familiarizing yourself with the terms associated with reconveyance can help you better understand the process.

-

Understanding terms such as 'satisfaction of mortgage' and 'security instrument' is important.

-

'Reconveyance occurs when all financial obligations have been met, and proper documentation is submitted.'

-

Clearly stating that obligations have been satisfied is key for legal acknowledgment.

What compliance rules should you follow?

Each state has different laws regarding the reconveyance process; adhering to these is essential.

-

Familiarize yourself with local laws surrounding reconveyance to ensure compliance.

-

Always reference the correct governing law in your letter to lend validity to your document.

-

Consult with legal experts if you're unsure about requirements to mitigate any compliance-related issues.

How do you acknowledge and execute the document?

Proper acknowledgment and execution of the reconveyance letter is important in solidifying the transaction.

-

Both parties should review and fully understand the document before signing to ensure clarity.

-

Signatures should be placed in the designated areas, and any necessary witnesses should sign the document where required.

-

Consider notarizing the document to add an extra layer of verification, especially where state law requires it.

How can you utilize interactive tools on pdfFiller?

pdfFiller offers various interactive tools that streamline the process of filling out your reconveyance letter.

-

Use pdfFiller’s templates to easily input information into the reconveyance letter.

-

efully utilize pdfFiller’s eSigning feature, allowing multiple parties to sign and collaborate in real-time.

-

Keep track of your reconveyance templates for future needs, allowing for efficient document management.

What are best practices for effective document management?

Managing your reconveyance letters properly is critical for long-term accessibility and compliance.

-

Utilize cloud-based solutions such as pdfFiller to securely store your reconveyance letters for easy access.

-

Implement a system for tracking all real estate documents, ensuring you meet compliance standards.

-

pdfFiller offers document organization features that help you categorize and retrieve your property documents with ease.

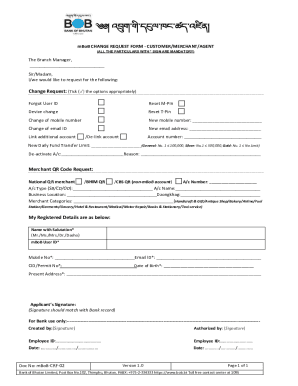

How to fill out the reconveyance letter template

-

1.Obtain the reconveyance letter template from a reliable source, such as pdfFiller.

-

2.Open the template in pdfFiller, ensuring you have the right permissions to edit.

-

3.Start by filling in the details of the lender, including their name and address in the designated fields.

-

4.Next, input the borrower's information, ensuring it matches the original mortgage documents.

-

5.Fill in the property details, including the legal description and address of the property being reconveyed.

-

6.Indicate the loan or mortgage number that corresponds to the property and ensure all information is correct.

-

7.Review all entries for accuracy to avoid any future legal disputes.

-

8.Once all fields are filled, save the document and generate a final copy.

-

9.Print the completed reconveyance letter and obtain necessary signatures from the lender and borrower.

-

10.Finally, record the document with the appropriate county office, if required, to formalize the reconveyance.

What is a Reconveyance Letter Template?

A Reconveyance Letter Template is a standardized document used to formally release a borrower from a loan obligation after the debt has been satisfied. This template is vital for individuals who want to ensure their property title is clear and unencumbered. By using a Reconveyance Letter Template, users can efficiently create a legally binding document that facilitates the proper transfer of property rights.

Why is it important to use a Reconveyance Letter Template?

Using a Reconveyance Letter Template ensures that all necessary legal language is included to protect both the borrower and lender. This document formalizes the end of a loan agreement and helps prevent future claims against the property. Ultimately, employing a Reconveyance Letter Template helps streamline the process of debt fulfillment and property ownership transfer, making it essential for anyone involved in real estate transactions.

Where can I find a reliable Reconveyance Letter Template?

You can find a reliable Reconveyance Letter Template on platforms like pdfFiller, which offers a variety of legal document templates tailored to your needs. The templates are designed to be user-friendly and customizable, allowing you to input specific details pertinent to your situation. With pdfFiller, you can ensure that you have access to up-to-date and compliant templates that meet legal standards.

How do I fill out a Reconveyance Letter Template?

Filling out a Reconveyance Letter Template typically involves entering information such as the property address, borrower details, and lender information. Once you have the required details, simply follow the template instructions to customize the document accordingly. Using pdfFiller's editing tools can make this process even more efficient, allowing you to complete your Reconveyance Letter Template accurately.

Can a Reconveyance Letter Template be used in any state?

While a Reconveyance Letter Template can generally be used across states, it’s essential to check for specific state laws regarding property and loan agreements. Each state may have its requirements for what must be included in a reconveyance document. By using a customizable template from pdfFiller, you can adjust the content to align with your state’s regulations, ensuring compliance and validity.

What happens after I submit my Reconveyance Letter Template?

After submitting your Reconveyance Letter Template, the document should be recorded with the appropriate county office or land registry to formally complete the process. This step is critical as it updates public records reflecting that the loan has been settled and the property is free of encumbrances. Once recorded, you will receive confirmation, and it’s recommended to keep a copy of the reconveyance for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.