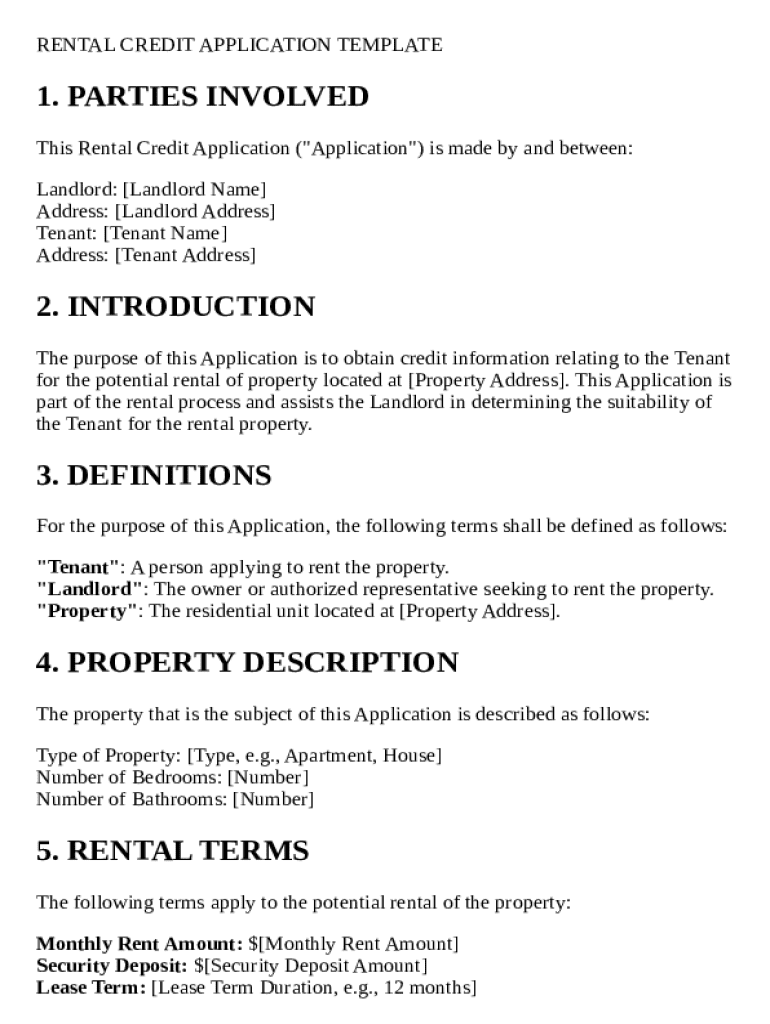

Get the free Rental Credit Application Template

Show details

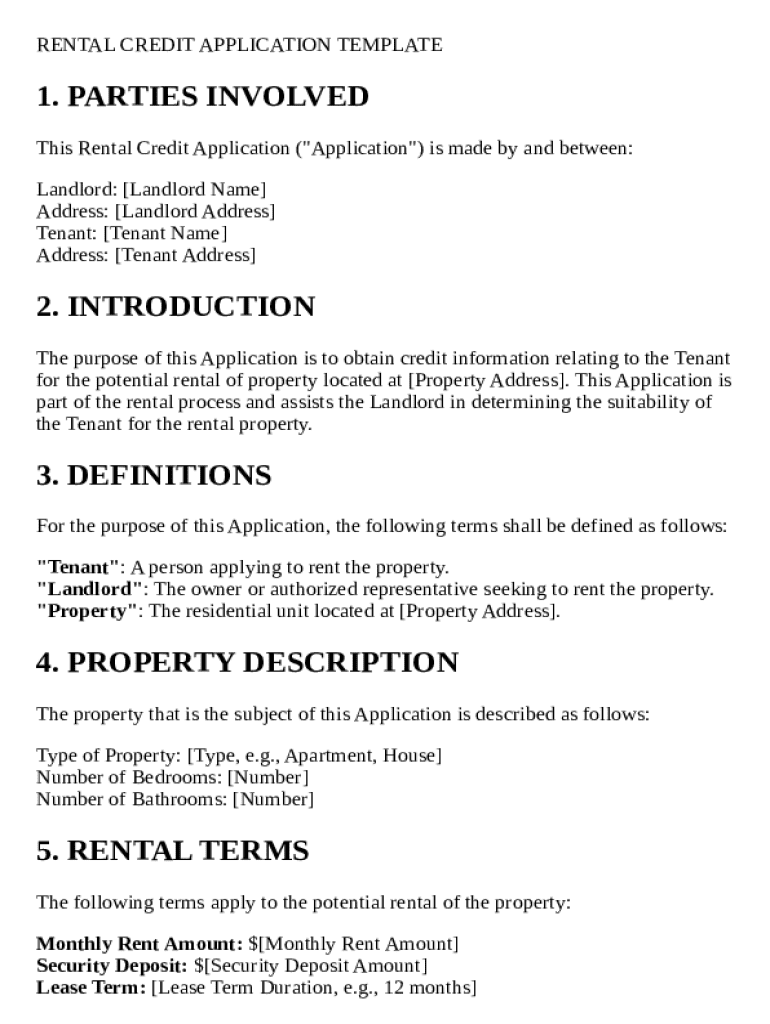

This document serves as a template for a rental credit application, detailing the necessary information required from the Tenant and outlining responsibilities and terms for both the Tenant and Landlord.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is rental credit application template

A rental credit application template is a standardized form used by landlords or property managers to assess a prospective tenant's creditworthiness and rental history.

pdfFiller scores top ratings on review platforms

Nice edit option compare to other pdf editors

Works excellent

nice

I'm new to the trial offer. Do not have much experience with it, at the moment.

i suppose too many variation son why the platform is used but inro walk throughout wit examples could help

The great app ever

Who needs rental credit application template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Filling Out the Rental Credit Application Template Form

TL;DR: To fill out a rental credit application template form, collect your personal information, ensure you understand the requirements, and follow each step carefully to provide accurate data. Utilize tools like pdfFiller for ease of editing and signing.

What parties are involved in a rental credit application?

Understanding the roles of both landlords and tenants is crucial. Landlords seek to ensure that they are renting to responsible individuals, while tenants need to provide assurance of their financial stability.

-

The landlord is the property owner who rents out the space to tenants.

-

The tenant is the individual or group applying to rent the property and typically seeks to occupy the unit.

Both parties must provide names and addresses to ensure proper identification and correspondence during the rental process.

Why is the rental credit application important?

The rental credit application is a pivotal document in the rental process. It serves to protect both landlord and tenant by ensuring all parties are aware of their rights and obligations.

-

Landlords use this application to assess the financial reliability of potential tenants, thereby reducing risk.

-

Tenants can clarify their rights and obligations, ensuring they highlight any potential issues upfront.

What key definitions are relevant to the application?

Understanding key terms is essential for successfully navigating the application process.

-

A tenant is a person who rents land or property under a rental agreement.

-

The landlord is responsible for maintaining the property and ensuring it is in a habitable condition.

-

In this context, property refers to the physical space being rented out, including all relevant structures and amenities.

How do you describe the property?

Providing detailed descriptions of the property is essential to avoid misunderstandings regarding what is being rented.

-

You should specify the type of property, such as an apartment, house, or commercial space.

-

Specifying the number of bedrooms and bathrooms helps clarify the space available to potential tenants.

What are the critical rental terms?

Clearly outlining rental terms ensures both parties understand financial obligations before signing.

-

Clearly state the rent due each month, which is typically market-driven.

-

Outline the security deposit amount that safeguards the landlord against potential damages.

-

Define the duration of the lease, which can range from months to years.

What are tenant responsibilities in the rental agreement?

Tenants must understand their responsibilities to maintain a good relationship with the landlord.

-

It is essential for tenants to ensure that rent is paid on time to avoid penalties or eviction.

-

Tenants are generally required to maintain the property’s condition, including cleanliness and proper usage.

-

Compliance with community guidelines ensures a harmonious living environment for all tenants.

What are landlord responsibilities in the rental agreement?

Landlords also bear specific responsibilities to ensure the rental property is habitable.

-

Landlords must ensure that the property complies with health and safety standards.

-

They must address maintenance requests in a timely manner to keep the property in good condition.

-

Proper management of security deposits is crucial for both legal compliance and tenant peace of mind.

What steps should tenants follow in the application process?

Navigating the application process can be daunting, but by following these steps, tenants can simplify their experience.

-

Gather details such as Social Security numbers, income documentation, and rental history.

-

Fill out the rental credit application form thoroughly and accurately.

-

Be aware that a credit check can influence your application approval based on your credit score.

What are the signature requirements and agreements?

Signatures from both parties validate the agreement and confirm the terms outlined in the application.

-

Both the tenant and the landlord must sign the application to enforce the terms contained within.

-

Through their signatures, both parties acknowledge their understanding and acceptance of the terms.

How can pdfFiller assist with your rental credit application needs?

Using pdfFiller simplifies the process of creating and managing rental credit applications.

-

pdfFiller allows users to customize templates quickly, ensuring all necessary details are correctly filled in.

-

Users can eSign documents directly within the platform, speeding up the approval process.

-

Tenants and landlords can collaborate on the application, making real-time changes to ensure clarity.

How to fill out the rental credit application template

-

1.Begin by downloading the rental credit application template from pdfFiller.

-

2.Open the template using the pdfFiller interface.

-

3.Start filling in your personal information, including your full name, address, phone number, and email address.

-

4.Provide details about your employment history, including your current employer, position, and income.

-

5.List previous rental addresses along with the duration of residency at each location.

-

6.Include references who can vouch for your rental behavior, such as previous landlords or employers.

-

7.Input your social security number to allow for credit check authorization.

-

8.Review all filled sections for accuracy and completeness.

-

9.Submit the completed application through pdfFiller's submission options or save it for later use.

What is a Rental Credit Application Template and why is it important?

A Rental Credit Application Template is a standardized document used by landlords and property management teams to gather essential information from potential tenants. This template typically includes sections for personal information, employment history, and financial details. Utilizing a Rental Credit Application Template helps ensure that the screening process is efficient and fair, allowing property managers to assess a renter's suitability for tenancy effectively.

How can I customize my Rental Credit Application Template?

You can easily customize your Rental Credit Application Template using platforms like pdfFiller, which allows you to modify text fields and add specific questions tailored to your rental criteria. Customization ensures that the application captures all relevant information specific to your rental property requirements. This tailored approach not only streamlines the application process but also enhances the data collected for better tenant evaluation.

What information should be included in a Rental Credit Application Template?

A comprehensive Rental Credit Application Template should include personal identification details, rental history, employment status, income verification, and references. Additionally, incorporating consent for a background check can be beneficial. By clearly outlining all necessary sections in your Rental Credit Application Template, you can gather sufficient information to make informed decisions about potential tenants.

Is there a standard format for a Rental Credit Application Template?

While there isn't a universally accepted standard format for a Rental Credit Application Template, most templates cover key sections like tenant information, rental history, and employment details. It's crucial to ensure that your template meets any legal requirements specific to your location. By using a well-structured Rental Credit Application Template, you facilitate an organized approach to tenant screening.

Can I access a Rental Credit Application Template on multiple devices?

Yes, with cloud-based solutions like pdfFiller, you can access your Rental Credit Application Template from any device with an internet connection. This accessibility allows both landlords and applicants to fill out and submit the application conveniently. Accessing your Rental Credit Application Template on multiple devices enhances the efficiency of the application process.

Are there benefits to using an online Rental Credit Application Template?

Using an online Rental Credit Application Template offers numerous benefits, including ease of use, quick editing capabilities, and secure data storage. Online templates often come with pre-built fields that streamline the application process for both landlords and renters. Moreover, an online Rental Credit Application Template facilitates efficient tracking and management of submitted applications through a cloud platform.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.