Get the free Financial Advisor Proposal Template

Show details

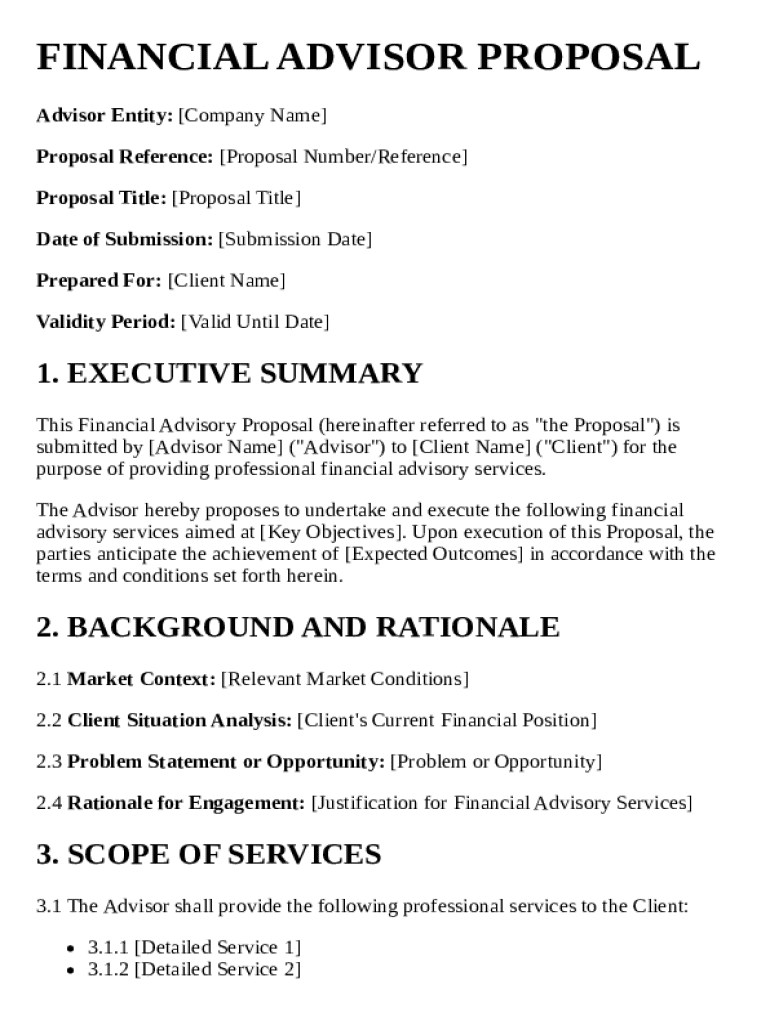

This document outlines the proposal for providing professional financial advisory services by the Advisor to the Client, including the scope of services, objectives, performance metrics, methodology,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is financial advisor proposal template

A financial advisor proposal template is a structured document used by financial advisors to outline their services, fees, and the value they offer to potential clients.

pdfFiller scores top ratings on review platforms

hi

So far, so good!

Works Great!

awsome

I LOVE IT

excellent

Who needs financial advisor proposal template?

Explore how professionals across industries use pdfFiller.

Comprehensive Financial Advisor Proposal Template

Filling out a financial advisor proposal template form requires attention to detail to ensure clarity and effectiveness. This document serves as a tool to convey the advisor's strategies, objectives, and potential outcomes to clients. With a comprehensive structure, advisors can enhance their chances of winning client engagement.

What is the purpose of a financial advisor proposal?

Understanding the purpose and significance of a financial advisor proposal is critical for building successful advisor-client relationships. These proposals act as blueprints, providing clients with a clear understanding of how the financial advisor intends to address their unique needs and circumstances.

-

Establishes the basis for professional services by outlining what the advisor can offer.

-

Strengthens client trust through detailed explanations of services, demonstrating expertise and professionalism.

What key components make a proposal effective?

An effective financial advisor proposal must include several key components. It should be structured logically, be tailored to the client's needs, and communicate the advisor’s value proposition clearly. This clarity not only enhances professionalism but also facilitates better understanding for clients.

Which essential fields are needed in a financial advisor proposal?

Specific fields in a financial advisor proposal template form are crucial for clarity and legal compliance. Properly identifying the advisory entity, creating a clear reference system, and ensuring accurate client details contribute to effective communication.

-

This should include the advisor's full company name, ensuring clients know precisely who they are engaging with.

-

A clear reference system aids in tracking proposals and establishing a timeline for follow-ups.

-

Accurate identification of the client fosters trust and minimizes misunderstandings during the advisory relationship.

How to develop a compelling executive summary?

The executive summary is arguably one of the most critical parts of a proposal. It serves as an overview and sets the tone for the entire document. Crafting a clear and engaging executive summary can make the following sections easier to digest.

-

Clearly outline the primary goals of your financial advisement to align expectations with the client.

-

Describe the anticipated results of your services, ensuring they resonate with the client’s needs.

-

Maintain focus to help the client quickly comprehend your proposal's essence, encouraging further reading.

Why is conducting background and rationale analysis important?

A thorough background and rationale analysis allows advisors to tailor proposals more effectively. Evaluating market context and understanding the client’s financial situation helps in defining the necessity for services and justifying recommendations.

-

Consider current market conditions that may impact financial decisions and service delivery.

-

Detailed analysis of the client's existing financial circumstances can unveil opportunities for engagement.

-

Identifying specific client issues helps frame solutions that your advisory services can provide.

What should be included in the scope of services?

Clearly defining the scope of services in a proposal is critical to avoid misunderstandings. Detailing specific services, outlining deliverables, and establishing timelines can contribute to a more organized engagement.

-

Detail each advisory service offered, ensuring they align with the client's needs.

-

Clarifying what the client will receive and when sets the expectation for project progress.

-

Establish key checkpoints to monitor progress and provide clients with updates.

How to establish objectives and performance metrics?

Establishing clear objectives is key in demonstrating the advisory commitment and expertise. By defining primary and secondary objectives alongside measurable performance metrics, advisors can show clients how progress will be tracked.

-

Defining what you hope to achieve helps focus efforts and clarify service expectations.

-

Utilizing key performance indicators (KPIs) aids in evaluating the success of your services effectively.

What is the methodology behind a financial advisor proposal?

A defined methodology lends professionalism and structure to the proposal. It showcases how the advisor will approach the client's needs and includes risk management considerations to ensure the client feels secure in the advisory process.

-

Structured methodologies ensure process consistency and reliability throughout client engagements.

-

Discuss risk mitigation strategies that protect both the advisor and the client.

How to build an effective compensation and budget structure?

Creating a transparent compensation system helps manage client expectations regarding fees. An effective budget structure can improve client trust, allowing for a smoother advisory relationship.

-

Clarification of fees minimizes future disputes and builds trust with clients.

-

Detail when payments are due to avoid confusion and ensure timely service delivery.

How can pdfFiller optimize proposal management?

Leveraging pdfFiller for a financial advisor proposal template form streamlines the creation, editing, and management of proposals. The platform allows for easy customization, collaboration, and signing, enabling teams to work more efficiently.

-

Easily edit templates to tailor proposals to specific client situations.

-

Facilitate teamwork through cloud-based access, enabling individuals and teams to work together effectively.

-

The eSigning feature ensures quick approvals and reduces turnaround time for document management.

How to fill out the financial advisor proposal template

-

1.Open the financial advisor proposal template in pdfFiller.

-

2.Read through the introductory section to understand the purpose of the proposal.

-

3.Fill in your personal information, including name, title, and company details, in the designated fields.

-

4.Describe your services by highlighting your expertise, including areas like retirement planning, investment management, or tax strategies, in the relevant section.

-

5.Outline your fees clearly—this could include hourly rates, flat fees, or commission structures based on your payment model.

-

6.Add a personal touch by including a brief values statement or mission to show your commitment to clients.

-

7.Review the sections on client engagement and reporting frequency; customize these to reflect how often you'll communicate with your clients and the type of reports they will receive.

-

8.Finalize by checking for typos and ensuring all fields are filled out accurately; make adjustments as needed for clarity.

-

9.Save your completed proposal and choose the option to share or print for delivery to potential clients.

What is a Financial Advisor Proposal Template?

A Financial Advisor Proposal Template is a structured document that allows financial advisors to present their services, fees, and strategies to potential clients. This template ensures that necessary information is clearly communicated, facilitating a professional image. Utilizing a standardized format can speed up the proposal process, making it easier for both advisors and clients to understand the services offered.

Why should I use a Financial Advisor Proposal Template?

Using a Financial Advisor Proposal Template saves time and ensures consistency in your proposals. With pre-defined sections, you can easily customize the content to fit your unique approach while maintaining a professional look. Additionally, this template enhances your ability to outline service offerings effectively, helping potential clients grasp the value of your expertise in financial planning.

How can I customize my Financial Advisor Proposal Template?

Customizing your Financial Advisor Proposal Template is straightforward; you can modify text, add your logo, and adjust color schemes to reflect your brand. It is important to include personal anecdotes or case studies that demonstrate your past successes. Tailoring the template to address the specific needs and concerns of each client will make your proposal stand out and connect better with potential clients.

What elements should be included in a Financial Advisor Proposal Template?

A comprehensive Financial Advisor Proposal Template should include sections such as an overview of services, fee structure, risk assessment, and a strategy outline. Including testimonials or case studies can also enhance its impact. Additionally, clarity and professionalism in the presentation foster trust, making potential clients more likely to choose your services over others.

Where can I find a Financial Advisor Proposal Template?

You can find a Financial Advisor Proposal Template on various document management platforms, including pdfFiller. Such platforms offer customizable templates that you can edit online. Accessing these templates can expedite your proposal creation process, allowing you to focus more on building relationships with clients rather than on administrative tasks.

How does using a Financial Advisor Proposal Template improve client relations?

Utilizing a Financial Advisor Proposal Template enhances clarity and professionalism, which can significantly improve client relations. When clients receive proposals that are easy to understand and well-organized, they are likely to feel more confident in your capabilities. This improved communication can lead to stronger relationships and higher client retention rates, as prospective clients appreciate the effort put into understanding their needs.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.