Get the free Insurance Proposal Template

Show details

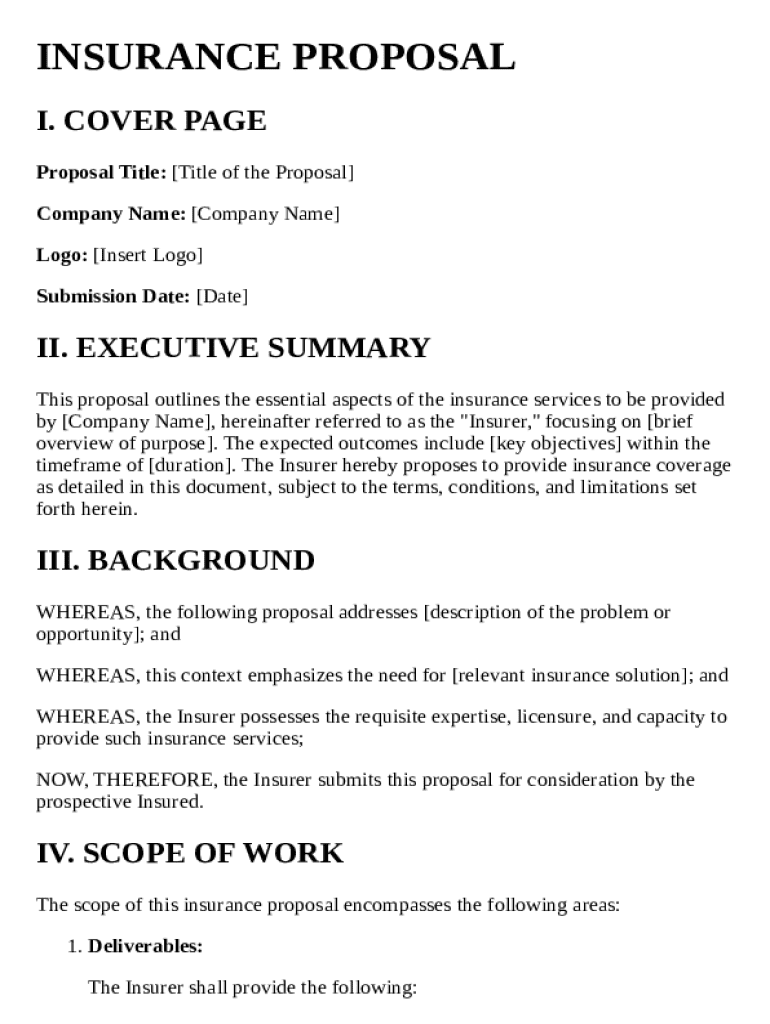

This document outlines the essential aspects of the insurance services to be provided by the Insurer, focusing on key objectives, deliverables, and insurance coverage details.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is insurance proposal template

An insurance proposal template is a standard document used by individuals or businesses to outline the details of an insurance policy they wish to obtain.

pdfFiller scores top ratings on review platforms

I very please with the format

Very straight forward and easy to implement!

Great service for my business! Intuitive format.

great

Okay

Awesome easy to use.

Who needs insurance proposal template?

Explore how professionals across industries use pdfFiller.

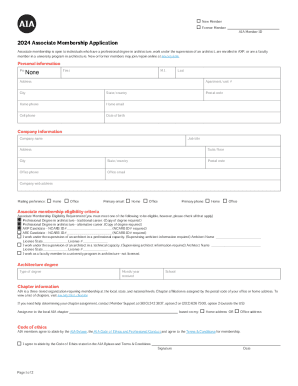

Insurance Proposal Template Form Guide

How to fill out an insurance proposal template form

Filling out an insurance proposal template form involves understanding the key components required, such as the cover page, executive summary, background analysis, and scope of work. Pay attention to the formatting and ensure you provide all necessary details. Using tools like pdfFiller can streamline this process, making it easier to create a professionally formatted document.

What are the components of an insurance proposal?

An insurance proposal typically consists of various key components that facilitate understanding and approval from the stakeholder. First, a definition of insurance proposals illustrates their significance to businesses. Second, legal requirements vary by region, affecting how proposals are formatted and what they must include. Finally, common components include cover pages, executive summaries, and detailed scopes of work.

-

Insurance proposals serve as formal requests that outline the terms of coverage and costs, which are essential for businesses to mitigate risks.

-

These often include necessary disclosures and compliance with insurance laws in the region where the policy will be enforced.

-

Key elements found in proposals typically include the title, company logos, executive summaries, and detailed descriptions of policy offerings.

How to craft your insurance proposal cover page?

Your cover page sets the tone for your insurance proposal. Essential details to include are the title, your company name, and your logo for brand recognition. Formatting your cover page professionally enhances first impressions, while also including the submission date is important for tracking.

-

Ensure the title is clear and descriptive, with your company name prominently displayed along with your logo.

-

Use legible fonts and maintain a clean layout, using sufficient white space to enhance readability.

-

Present it in a location that stands out, such as on the bottom right corner, for easy reference.

What should be included in the executive summary?

The executive summary is critical as it articulates the purpose of the proposal succinctly. Here, set clear expectations for outcomes and timelines to provide clarity. Highlighting terms, conditions, and limitations is crucial to ensure understanding between parties.

-

Begin with a concise overview of what the proposal intends to achieve.

-

Outline anticipated results, timelines, and key milestones that will guide the evaluation.

-

Include any conditions or limitations that might influence decision-making.

How to conduct background analysis for your proposal?

A thorough background analysis addresses the specific problems or opportunities your insurance proposal intends to cover. Emphasizing this need substantiates the purpose of your proposal. Moreover, demonstrating your expertise reinforces your capability to deliver the proposed solution.

-

Define the specific issue the insurance proposal will solve, providing context and relevance.

-

Articulate how your proposed insurance coverage meets this need effectively.

-

Include credentials or previously successful projects to showcase your capability.

What is the significance of defining the scope of work?

Defining the scope of work ensures clarity between parties on deliverables and timelines, reducing potential misunderstandings. This involves detailing actionable milestones for evaluation and setting clear lines of responsibility, which are pivotal in insurance agreements.

-

Clearly outline what services or coverages you will provide, with specific timelines.

-

Identify key check-in points or milestones that facilitate progress monitoring.

-

Ensure every term and deliverable is precisely defined to prevent ambiguity.

How to establish objectives and goals?

Identifying primary objectives for your insurance offering aligns with regulatory requirements and industry best practices. Articulating measurable outcomes also assists in evaluating the proposal's success and tracking compliance.

-

Define what you aim to achieve with your insurance proposal and outline primary goals.

-

Ensure your objectives are in accordance with local insurance laws and best practices.

-

Provide specific metrics that will indicate the success of your proposal.

What methodologies should be applied for successful execution?

Utilizing methodological frameworks helps in executing your proposals efficiently. Choosing strategies that align with your insurance objectives ensures that all activities are purpose-driven, while establishing monitoring protocols facilitates progress tracking.

-

Choose and explain frameworks that will guide implementation, ensuring alignment with the overall vision.

-

Choose strategies proven effective in insurance execution to simplify processes.

-

Set protocols for regular progress reviews and adjustments, enhancing adaptability.

How to calculate premiums and budget effectively?

Calculating insurance premiums involves understanding the specifics of coverage and risk assessments associated with policies. Budgeting for various types of insurance is critical, and adhering to best practices when presenting these details can enhance comprehension and trust.

-

Explore factors that affect premium calculations, such as risk assessments and policy specifics.

-

Account for different coverage types in your budgeting to assure adequate coverage.

-

Present budget and premiums clearly and concisely within your proposal.

How can pdfFiller tools enhance proposal management?

pdfFiller’s platform enables seamless editing, signing, and collaborating on proposals. With an intuitive interface, users can easily create and manage insurance proposal documents, ensuring efficiency and professionalism across the board.

-

pdfFiller allows for document creation, collaboration, and eSigning all in one secure platform.

-

Users can edit their proposals digitally with guided steps, making the process straightforward.

-

The platform enhances workflow by allowing team members to collaborate on documents in real-time.

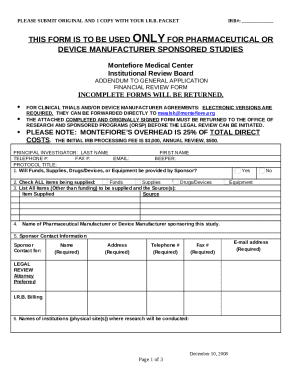

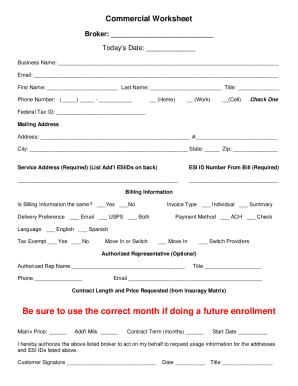

How to fill out the insurance proposal template

-

1.Visit pdfFiller and log in to your account.

-

2.Choose 'Create New' from the dashboard to start a new document.

-

3.Select 'Upload Document' to import the insurance proposal template file.

-

4.Once the template is loaded, use the text boxes to fill in client details such as name, contact information, and type of insurance required.

-

5.Specify the coverage limits and additional options as needed, ensuring accuracy.

-

6.Include any specific terms and conditions relevant to the proposal in the appropriate sections of the template.

-

7.Review all filled information for correctness and completeness before saving.

-

8.Save the document in your desired format or share it directly with the client through email or other options available in pdfFiller.

What is an Insurance Proposal Template and how can it benefit my business?

An Insurance Proposal Template is a pre-designed document that outlines the terms, coverage, and costs associated with an insurance policy. Using this template allows businesses to present clear and professional proposals to potential clients. This can significantly streamline the proposal process, enabling users to quickly fill in necessary details and focus on delivering quality service.

How can I customize the Insurance Proposal Template using pdfFiller?

Customizing the Insurance Proposal Template with pdfFiller is straightforward and user-friendly. You can easily edit text, add logos, adjust formatting, and incorporate specific policy details that reflect your services. This level of customization ensures that your proposal stands out and effectively communicates the uniqueness of your insurance offerings.

Is it possible to share the Insurance Proposal Template for collaboration?

Yes, pdfFiller allows users to share the Insurance Proposal Template for collaboration with team members or clients. You can send the template via email or share a direct link, facilitating input from others. This feature aids in gathering feedback and making necessary revisions to ensure that the proposal meets all parties' expectations.

What features does pdfFiller offer for managing Insurance Proposal Templates?

pdfFiller provides a range of features to help you manage your Insurance Proposal Templates efficiently. Users can store templates securely in the cloud, access them from anywhere, and track changes made by collaborators. Additionally, pdfFiller's eSigning functionality enables quick approval processes, saving time and ensuring a smooth workflow.

Can I use the Insurance Proposal Template for different types of insurance?

Absolutely! The Insurance Proposal Template is versatile and can be tailored for various types of insurance, including health, auto, home, and commercial insurance. By modifying the content to suit the specific type of coverage, you can create a specialized proposal that caters to different audiences and meets their unique insurance needs.

What should I include in my Insurance Proposal Template for it to be effective?

To craft an effective Insurance Proposal Template, include essential elements such as policy details, coverage limits, premium amounts, and any additional services offered. Additionally, provide clear terms and conditions, as well as contact information for follow-up questions. Ensuring that all relevant information is presented in an organized manner increases the likelihood of a successful proposal.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.