Get the free Payment Plan Proposal Template

Show details

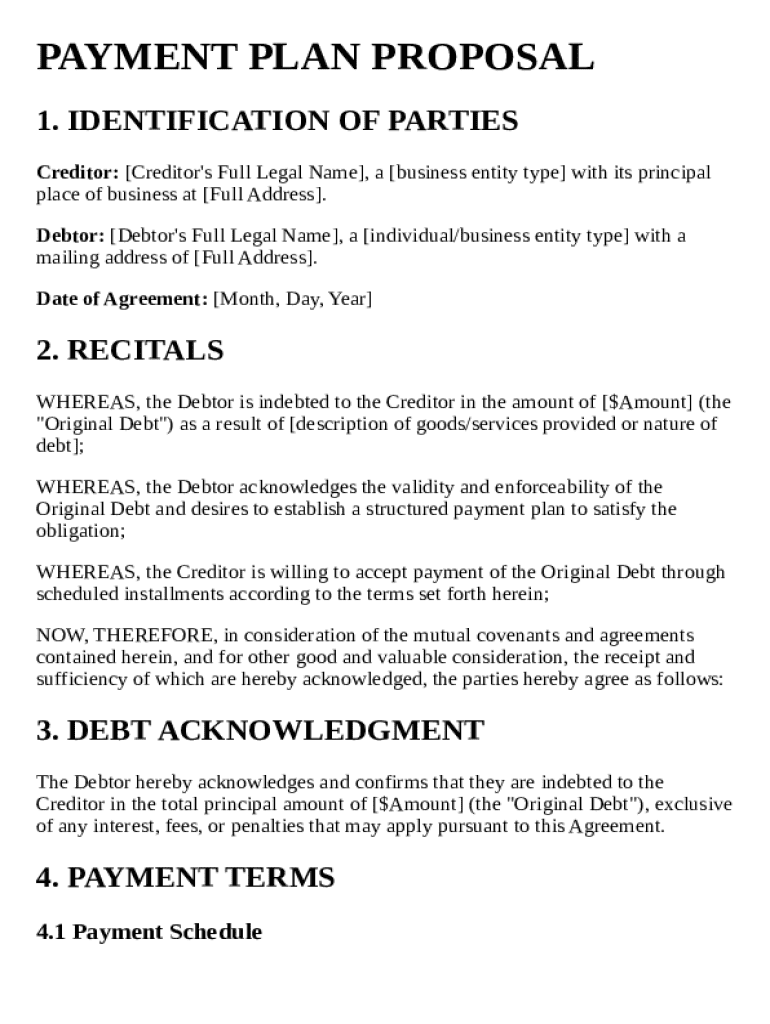

This document outlines the terms and conditions of a payment plan agreement between a creditor and debtor to repay a specified debt through structured installments.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is payment plan proposal template

A payment plan proposal template is a structured document used to outline the terms of a proposed payment plan between a debtor and a creditor.

pdfFiller scores top ratings on review platforms

Simple and smooth. Very happy about it

The filling of the spaces in blank when there are squares are a bit tedious. One has to center the square and it is not always neat and aligned with the other characters one enters. It is slow.

wow, for the abilities. its so customer friendly

good when I finally read all that must be done to sign a document.

a bit pricey but undoubtedly has every feature you could need on one service. The USPS Mail feature is 100% what encouragd my subscription. 10/10 recommend

it was really useful

Who needs payment plan proposal template?

Explore how professionals across industries use pdfFiller.

Complete Payment Plan Proposal Template Guide

What is a payment plan proposal?

A payment plan proposal is a formal document that outlines an agreement between a debtor and creditor regarding the repayment of a debt over time. Understanding its significance is crucial: for debtors, it provides a structured way to manage financial obligations, while for creditors, it safeguards their interests and clarifies the repayment process. Common scenarios requiring payment plan proposals include settling medical bills, managing loans, and acquiring services when immediate payment isn’t feasible.

Who are the parties involved in a payment plan proposal?

The two primary parties involved in a payment plan proposal are the creditor and the debtor. The creditor is the individual or entity to whom money is owed, while the debtor is the person or group who owes the debt. Accurate identification of these parties is essential, requiring information such as their names, addresses, and any relevant business entities.

Why is the recitals section important?

The recitals section of a payment plan proposal serves as the foundation for the agreement. It establishes the background context and reasons for the contract, enabling both parties to understand the origins of the debt. Articulating the original debt clearly and providing a narrative that contextualizes the parties' relationship ensures transparency and fosters trust in the agreement.

How crucial is acknowledgment of debt?

The debtor’s acknowledgment of the debt amount is one of the most vital aspects of a payment plan proposal. By acknowledging the original debt, the debtor commits to repaying the specified amount, reducing potential misunderstandings in the future. It is essential to state this amount clearly without ambiguity to avoid disputes during the repayment period.

What are the key components of payment terms?

The payment terms section outlines how the debtor will repay the debt, breaking down the total amount into manageable installments. Key components include the total debt, the number of installments, and the amount per installment. Variations in payment frequency—be it weekly, bi-weekly, or monthly—should be clearly specified, along with important dates for the first and final payments to ensure both parties are aligned.

How to handle interest and fees?

Understanding how interest and fees are calculated on the original debt is crucial for both parties. This section should detail the interest rate applied to the debt and any potential fees that may incur during engagement with the payment plan. Including these details in the documentation prevents misunderstandings and ensures all parties are aware of the true cost of the agreement.

What payment methods can be proposed?

A variety of payment methods can be included in a payment plan proposal. Common options are checks, electronic transfers, and credit cards. Each method has its implications for transaction speed and security, so both parties should discuss and agree on the most suitable option for their needs.

What happens if a debtor defaults?

Defaulting on a payment plan can have significant repercussions for debtors. This section should clearly define what constitutes default and outline the consequences that follow, which often include late fees or immediate payment demands. Including an acceleration clause in the proposal protects the creditor by allowing them to accelerate the debt repayment if the debtor fails to comply with the terms.

How can pdfFiller help in creating payment plan proposals?

pdfFiller is a versatile tool that enhances the ease of creating and managing payment plan proposals. Key features include editing capabilities, electronic signatures, and collaboration tools that streamline the drafting and signing process. Utilizing pdfFiller allows both parties to engage in payment agreements remotely, ensuring a smooth and efficient workflow.

How to finalize and manage the payment plan proposal?

Finalizing a payment plan proposal requires both parties to review and agree on the terms outlined in the document. Once all terms meet satisfaction, it is essential to sign the agreement to make it legally binding. After signing, using tools to monitor and manage the payment schedule is critical to ensure compliance and keep track of all payments.

What next steps should be taken after signing the proposal?

Post-signing, both creditor and debtor should establish a method for tracking payments and maintaining thorough records. Continuous communication is vital to address any issues that may arise, ensuring a healthy relationship during the payment process. Regular updates to each other can foster a successful fulfillment of the agreement.

How to fill out the payment plan proposal template

-

1.Open the payment plan proposal template in pdfFiller.

-

2.Start by entering your name and contact information in the designated fields.

-

3.Next, fill in the debtor's details, including their name and address.

-

4.Specify the total amount owed by the debtor, ensuring accuracy.

-

5.Outline the proposed payment terms, including the payment amount, frequency, and due dates.

-

6.Include any interest rates or fees applicable to the payment plan, if necessary.

-

7.Clearly state the consequences of missed payments to ensure understanding.

-

8.Review all entered information for accuracy and completeness.

-

9.Once satisfied, save the document within pdfFiller, and consider exporting it as a PDF for sharing.

-

10.Lastly, either email the proposal directly from pdfFiller or download it for personal distribution.

What is a Payment Plan Proposal Template?

A Payment Plan Proposal Template is a structured document that outlines the terms of a payment plan between parties. It typically includes payment amounts, due dates, and any applicable interest rates or fees. Utilizing a Payment Plan Proposal Template can help ensure that all parties have a clear understanding of their obligations and can improve the chances of meeting financial agreements.

How can I create an effective Payment Plan Proposal Template?

Creating an effective Payment Plan Proposal Template involves clearly defining the payment terms and ensuring all necessary details are included. Start by specifying the total amount owed and divide it into manageable payment installments with clearly stated due dates. Including both parties' signatures and any relevant information can help formalize the agreement, making your Payment Plan Proposal Template legally binding.

What should I include in my Payment Plan Proposal Template?

Your Payment Plan Proposal Template should include essential components such as the total amount owed, payment schedule, due dates for each installment, and any interest if applicable. Additionally, including contact information and any relevant legal references can enhance clarity. The more detailed your Payment Plan Proposal Template is, the less room there is for misunderstandings in the future.

Can I customize my Payment Plan Proposal Template?

Yes, customizing your Payment Plan Proposal Template is essential to meet the specific needs of your agreement. You can adjust payment amounts, add specific terms, or modify the layout to suit your branding. Customization ensures that your Payment Plan Proposal Template accurately reflects the nuances of your arrangement while providing clarity for both parties.

Is it necessary to have a payment plan proposal in writing?

Having a payment plan proposal in writing is highly advisable to avoid potential disputes. A written Payment Plan Proposal Template serves as a formal record of the agreed terms, making it easier to refer back to if needed. A written record increases accountability for both parties and provides legal protection in case any issues arise regarding payments.

Where can I find a reliable Payment Plan Proposal Template?

You can find a reliable Payment Plan Proposal Template on platforms like pdfFiller, which offers a variety of customizable templates. These templates are designed to be easy to use and can be modified to suit your specific needs. By using pdfFiller’s platform, you can create, edit, and manage your Payment Plan Proposal Template quickly and efficiently.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.