Get the free Personal Loan Proposal Template

Show details

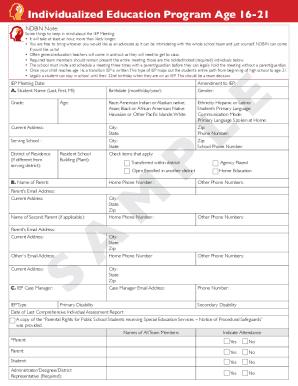

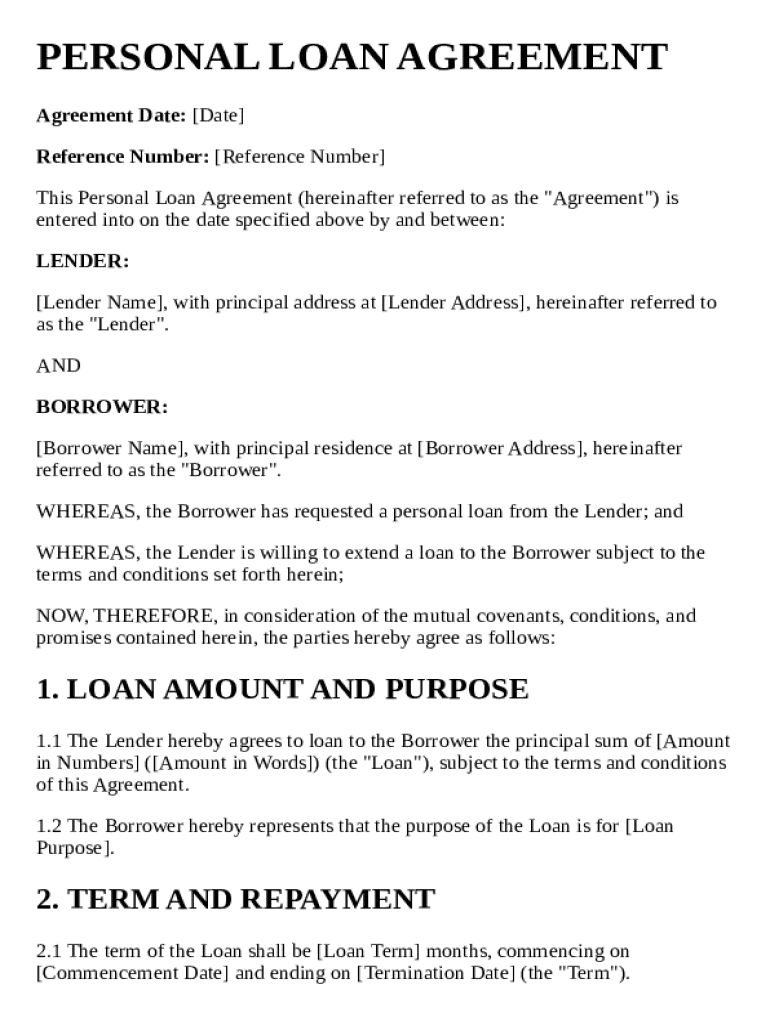

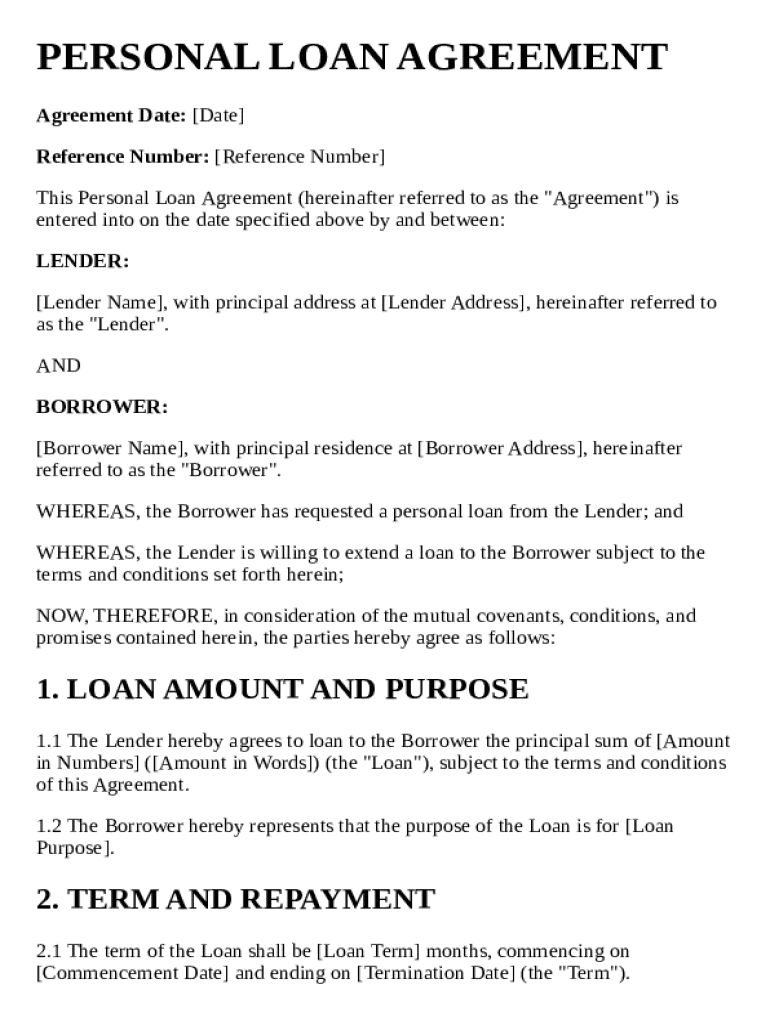

This document serves as a legal agreement between a lender and a borrower for the provision of a personal loan, outlining terms such as loan amount, repayment schedule, interest rate, and other conditions.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is personal loan proposal template

A personal loan proposal template is a structured document used to request a loan from financial institutions, detailing the borrower's financial situation and loan requirements.

pdfFiller scores top ratings on review platforms

This product is excelent. Este producto es excelent

Tolle Features. Könnte Preiswerter sein bzw. bestimmte Zielgruppen mit einem Preisnachlass unterstützen.

Great system would be a great tool to have if I had to sign more documents

PDFfiller helps me by saving me time and frustration in editing documents. I also appreciate the fax feature.

Amazing options for editing, signature, and sending the document multiple ways. So glad I found your service!!

I was able to upload and edit a document. I sent it to someone across the country who printed, signed it and sent it back. I then e-signed it and submitted it to a third party successfully.

Who needs personal loan proposal template?

Explore how professionals across industries use pdfFiller.

Personal Loan Proposal Template Form

Filling out a personal loan proposal template form is essential for effectively requesting a loan. This guide will navigate you through the critical components and steps to create a strong proposal that meets lender expectations.

What is a personal loan proposal?

A personal loan proposal is a formal document submitted to a lender to secure funding. It outlines your financial situation, the purpose of the loan, and how you plan to repay it. The proposal is crucial in convincing the lender that you are a reliable borrower.

Why are personal loan proposals important?

Personal loan proposals are important because they serve to enhance your chances of receiving the loan you seek. An effective proposal addresses lender concerns and presents a transparent financial picture, thereby increasing your credibility.

What are the common components of a loan proposal?

-

Clearly stating the reason for the loan, whether it’s for debt consolidation, medical expenses, or home improvement.

-

Presenting your income, expenses, and creditworthiness, which includes credit scores and past loan history.

-

Detailing how you intend to repay the loan, including timelines and amounts.

-

Including documents such as ID proof, income statements, and bank statements to support your proposal.

What are the essential components of a personal loan agreement?

-

These details ensure that there is a clear record of when the agreement was made and how to refer to it in the future.

-

Includes names, addresses, and contact information of both parties involved, ensuring proper communication.

-

Specifying the exact amount requested and its intended use is critical for lender assessment.

-

Outlining how long the loan will last and how repayments will be structured—monthly, quarterly, etc.

-

Describing the interest rate, how it is calculated, and whether it is fixed or variable.

-

Stating if there are any penalties for paying the loan off before the final date, which can affect your financial planning.

How do fill out a personal loan proposal form?

-

Collect all financial documents and details about the loan purpose to ensure you have everything you need to fill out the form.

-

Carefully provide information in each section of the form, following the prompts that guide you through the necessary details.

-

Take time to review your completed form to prevent any inaccuracies which could delay the approval process.

-

Submit the completed form along with supporting documents via your chosen method, whether online or in-person.

What are some tips for effective submissions?

Ensure that your submission is timely and follows the lender's specific guidelines for form filling and document attachment. Be prepared to provide additional information if requested, and maintain a professional tone throughout your proposal.

What are common mistakes to avoid?

-

Leaving sections blank can lead to automatic rejections, so ensure every area is filled out accurately.

-

Always double-check your numbers to reflect your current financial status; discrepancies can raise red flags.

-

Missing documents that support your application can lead to delays or denials.

How can edit and manage my loan proposal with pdfFiller?

-

pdfFiller offers a suite of tools that allow you to customize your proposal template easily, making adjustments as needed.

-

You can sign documents digitally through pdfFiller, ensuring that your proposal is submitted swiftly and securely.

-

Work with others on your proposal by sharing documents and receiving feedback directly within pdfFiller’s platform.

What are the best practices for submitting my loan proposal?

It's essential to ensure your proposal is submitted according to the lender's procedures. Follow up within a week of submission to check on your proposal's status, which demonstrates your enthusiasm and commitment.

What should understand about the lender's review process?

Lenders typically review proposals based on risk assessment criteria, including your credit score, income stability, and existing debts. They will evaluate your financial statements and make a decision based on whether they believe you can repay the loan.

What legal considerations are there in personal loan agreements?

-

Each loan agreement must comply with applicable laws, which vary by state and determine deductions, disclosures, and practices in lending.

-

Understanding your state regulations is critical, as they may impose additional requirements for lenders and borrowers.

-

Both parties must adhere to lending laws to avoid legal disputes or penalties, protecting both the lender and borrower.

How to fill out the personal loan proposal template

-

1.Start by downloading the personal loan proposal template from pdfFiller.

-

2.Open the template in pdfFiller and check the necessary fields.

-

3.Provide your personal information, including your full name, contact details, and social security number.

-

4.Detail the purpose of the loan and how much you are requesting.

-

5.Include your income sources and monthly expenses to showcase your financial background.

-

6.Add any co-borrowers if applicable, listing their details and credit information.

-

7.Summarize your loan repayment plan, including timeline and methods of payment.

-

8.Review the filled-out form for accuracy and completeness.

-

9.Save your changes and either print the document or send it directly to the lender through pdfFiller's submission options.

What is a Personal Loan Proposal Template and how can it benefit me?

A Personal Loan Proposal Template is a structured document designed to outline your borrowing needs and repayment plan to lenders. Using this template can streamline your proposal process by ensuring you include all necessary information, which can improve your chances of securing a loan. It is essential for individuals and teams looking to present a professional and comprehensive outline of their financial requests.

Who should use a Personal Loan Proposal Template?

Individuals looking to borrow money for personal expenses, such as debt consolidation, home improvement, or education, should consider using a Personal Loan Proposal Template. This template is useful for anyone seeking a clear and organized way to communicate their needs to lenders. By using it, potential borrowers can ensure they present their information logically, which can positively impact approval rates.

What key elements should a Personal Loan Proposal Template include?

A well-structured Personal Loan Proposal Template should include your personal details, the amount of the loan requested, the purpose of the loan, and your proposed repayment terms. It is also beneficial to include your credit history and any collateral you may offer. This comprehensive approach gives lenders a clear understanding of your request, increasing the likelihood of approval.

How can pdfFiller enhance my experience with the Personal Loan Proposal Template?

pdfFiller offers an efficient way to create, edit, and manage your Personal Loan Proposal Template. With its easy-to-use interface and cloud-based access, you can streamline document creation and ensure your proposal looks polished. Additionally, pdfFiller allows for seamless collaboration and eSigning, making it simpler to get necessary approvals without delays.

Can I customize the Personal Loan Proposal Template in pdfFiller?

Yes, pdfFiller allows you to customize your Personal Loan Proposal Template to fit your specific needs. You can easily add or remove sections, adjust formatting, and include any relevant information unique to your situation. This flexibility helps ensure that your proposal accurately reflects your requirements and personalizes your appeal to lenders.

Is using a Personal Loan Proposal Template necessary when applying for a loan?

While it's not mandatory to use a Personal Loan Proposal Template when applying for a loan, doing so can enhance your application. This template helps organize your information clearly and professionally, which is appealing to lenders. Ultimately, having a well-prepared proposal can increase your chances of loan approval, making it a valuable tool for applicants.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.