Get the free Private Equity Investment Proposal Template

Show details

This document outlines a proposal for private equity investment, detailing the investment opportunity, company overview, market analysis, financial projections, risk factors, and terms and conditions.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is private equity investment proposal

A private equity investment proposal is a formal document that outlines the terms and rationale for an investment in a private equity fund.

pdfFiller scores top ratings on review platforms

I would like to learn more about the features. But from the little I have used I'm quite satisfied.

It is everything I've been looking for!!

Makes it extremely easy to fill out PDF forms.

Works every time. What else does one need?

Its functions are cool and it works just fine, but it could be more visually pleasing.

Difficult to move around at first but then became easier with use and familiarity

Who needs private equity investment proposal?

Explore how professionals across industries use pdfFiller.

Comprehensive Private Equity Investment Proposal Guide

Filling out a private equity investment proposal form involves collecting and organizing critical information that showcases your investment opportunity. This guide provides the necessary steps and components to create a compelling proposal.

What is a private equity investment proposal form?

A private equity investment proposal form is a structured document that outlines an investment opportunity to potential investors. Understanding its importance is essential for attracting the right investors. A well-crafted proposal includes key components that enhance its effectiveness and appeal.

-

A structured proposal helps in presenting your investment case clearly, making it easier for investors to understand the opportunity.

-

Components like an executive summary, company overview, and financial projections add credibility to your proposal.

-

pdfFiller provides tools that simplify creating and organizing professional investment proposals.

How to create a compelling cover page?

The cover page sets the tone for your proposal. It should include essential information such as the title, company name, and who the proposal is presented by. A professional branding approach, including a logo, adds visual appeal.

-

Always include the title of your proposal, the name of your company, and the name of the person presenting the proposal.

-

Uploading a logo using pdfFiller enhances the professional look of your proposal.

-

Including a confidentiality notice is significant for protecting sensitive information.

What should be included in the executive summary?

The executive summary acts as the gatekeeper to your proposal, summarizing key elements like the investment amount and anticipated returns. It should highlight critical value propositions to grab investors' attention.

-

Focus on the target investment amount, expected returns, and the timeframe to provide clarity.

-

Emphasize what makes your investment unique, potentially leading to decisions.

-

pdfFiller's tools help draft clear and concise summaries effectively.

How to present the company overview?

The company overview sets the context for your investment proposal. It's important to detail your corporate structure, business model, and management team's credentials.

-

Include legal entity, incorporation date, and ownership details.

-

Explain core activities and revenue streams clearly to potential investors.

-

Highlight the experience and qualifications of key management personnel.

-

Utilize pdfFiller to collaborate on this section with team members for accuracy.

What makes market analysis crucial?

Understanding the market landscape is key for any investment proposal. An effective market analysis includes an overview of industry trends, competitive positioning, and growth opportunities.

-

Highlight growth trends and regulatory environments affecting your sector.

-

Analyze market share distribution to showcase your competitive advantage.

-

Look for potential new revenue streams that can enhance investment returns.

-

pdfFiller offers tools to analyze market data effectively.

How to articulate your investment thesis?

Clearly articulating an investment thesis provides strategic rationale for why investors would gain value from the deal. Emphasize operational improvements and market positioning.

-

Explain how the investment can create value for all stakeholders.

-

Outline the necessary changes to improve operational efficiency.

-

Utilize pdfFiller's templates to express your investment thesis effectively.

What should be included in transaction structure?

Clearly outlining investment terms is crucial for transparency. Detail the proposed investment, valuations, and allocation of proceeds.

-

Detail the investment amount, equity stake, and financing arrangements.

-

Discuss methods like comparable company analysis and discounted cash flow to support valuations.

-

Clearly outline how the investment capital will be utilized.

-

Formatting and ease of use through pdfFiller’s editing tools can enhance the document.

How to present financial projections?

Financial projections are vital to proving business viability. They should include revenue forecasts, profit-loss analyses, and cash flow studies.

-

Provide detailed revenue projections based on your key assumptions.

-

Conduct comprehensive analyses to predict profitability.

-

Ensure liquidity by evaluating operational cash flow needs.

-

Use pdfFiller for creating accurate and effective financial models.

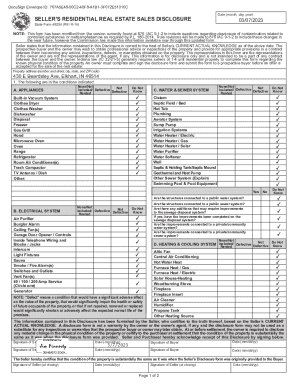

How to fill out the private equity investment proposal

-

1.Start by downloading the private equity investment proposal template from pdfFiller.

-

2.Open the document and review the sections outlined in the proposal, which typically include an executive summary, investment strategy, market analysis, team qualifications, and financial projections.

-

3.Begin filling in your company's basic information, including the name, location, and contact details.

-

4.Draft the executive summary, highlighting the investment opportunity and the unique value proposition your company offers.

-

5.Proceed to the investment strategy section, detailing how the funds will be used and the expected impact on growth.

-

6.In the market analysis section, present data on market trends, competition, and target demographics to support your proposal.

-

7.Next, provide information about your team, showcasing their expertise and past successes in relevant industries.

-

8.Include thorough financial projections, demonstrating expected returns and timeline for investors.

-

9.Review the completed proposal carefully for clarity and accuracy.

-

10.Save the finalized document and share it with potential investors through the pdfFiller platform.

What is a Private Equity Investment Proposal Template?

A Private Equity Investment Proposal Template is a structured document that helps individuals and companies present their investment opportunities to potential investors clearly and effectively. This template typically includes sections for executive summaries, financial projections, and market analysis. Using a well-designed Private Equity Investment Proposal Template can significantly enhance your chances of securing funding.

How can I customize a Private Equity Investment Proposal Template to fit my needs?

Customizing a Private Equity Investment Proposal Template is straightforward with the right tools. Start by outlining your unique investment strategy and adjust the template sections accordingly, such as adding data specific to your market or financial projections. By tailoring the Private Equity Investment Proposal Template to reflect your vision, you can present a compelling narrative that attracts investors.

Why is it important to have a clear structure in a Private Equity Investment Proposal Template?

A clear structure in a Private Equity Investment Proposal Template is essential as it allows investors to easily navigate through your proposal. An organized layout helps highlight key information such as the investment opportunity, expected returns, and risk factors. A well-structured Private Equity Investment Proposal Template ensures that your message is delivered effectively, making it easier for potential investors to understand and evaluate your proposition.

What key elements should I include in my Private Equity Investment Proposal Template?

When creating a Private Equity Investment Proposal Template, it's important to include essential elements such as an executive summary, business description, market analysis, financials, and exit strategy. Each section should provide clear and concise information, showcasing the viability and profitability of the investment. Incorporating these key components into your Private Equity Investment Proposal Template will help build investor confidence and interest.

Can I use a Private Equity Investment Proposal Template for multiple investment opportunities?

Yes, a Private Equity Investment Proposal Template can be adapted for use across various investment opportunities. By modifying certain sections to reflect specific details of each project, you can use the template as a versatile tool for pitching different ventures. This efficiency saves time and maintains a consistent quality presentation across your investment proposals using the Private Equity Investment Proposal Template.

Where can I find effective Private Equity Investment Proposal Templates?

Effective Private Equity Investment Proposal Templates can be found on platforms like pdfFiller, which offers customizable document solutions. Their templates provide a solid foundation while allowing for personalization to suit your specific needs. Utilizing a resource like pdfFiller for your Private Equity Investment Proposal Template ensures you have access to high-quality, professional formats that stand out to potential investors.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.