Get the free Small Business Loan Proposal Template

Show details

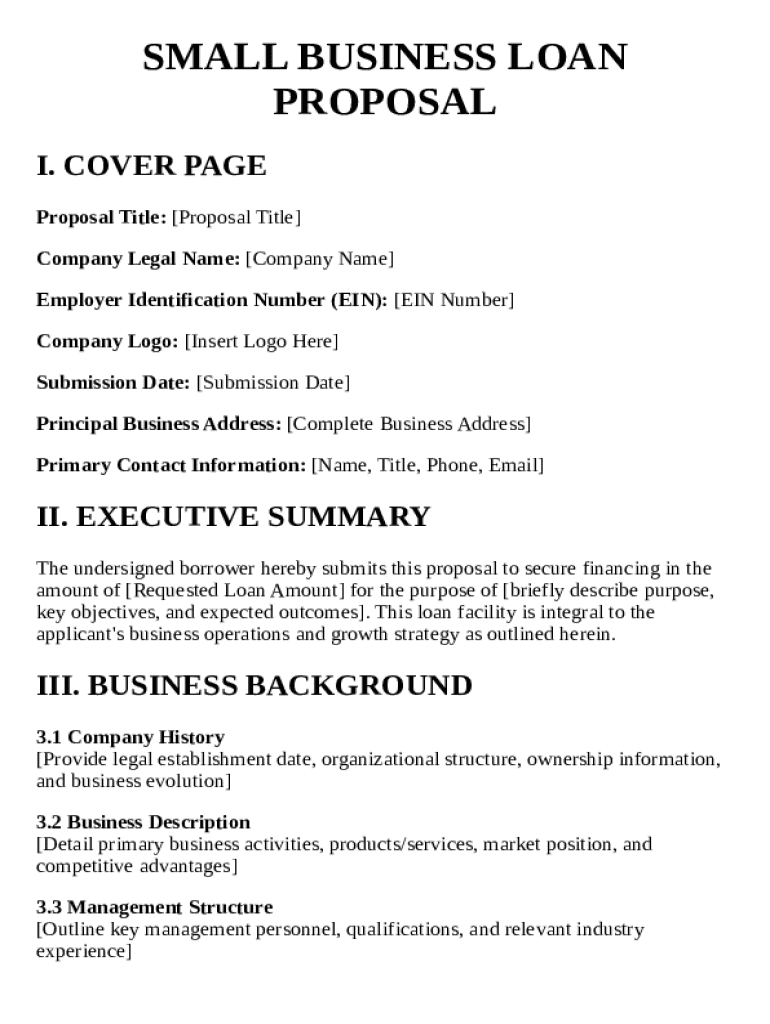

This document is a proposal for securing financing to support a small business. It includes sections for company information, executive summary, business background, loan request specifications, objectives,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is small business loan proposal

A small business loan proposal is a formal document that outlines a business's financial needs and plans to secure funding from lenders or investors.

pdfFiller scores top ratings on review platforms

I think their customer service is excellent and very responsive. I was intimidated by the website but that is a reflection on my limited tolerance to "figure it out".

** ****** Pittsburgh, PA

I thoroughly enjoyed using the platform which made editing and using the documents incredibly easy. Their customer service is also excellent and went above and beyond to accommodate my request immediately.

Awesome customer service. Great program, def keeper. **** ***** Richmond TX

It took me a few minutes but I finally caught on.Thank you

I've appreciated this site and what it offers. It is difficult for me to locate exact form to make corrections or additions.

Easy to edit and recreate a more professional invoice

Who needs small business loan proposal?

Explore how professionals across industries use pdfFiller.

Complete small business loan proposal form guide

How does a small business loan proposal work?

A small business loan proposal is a detailed document that outlines a business's financial needs and how it plans to use the funds. Effective proposals increase the chances of obtaining financing by clearly presenting the business's objectives and financial future.

This guide aims to help you create a comprehensive small business loan proposal form, ensuring that you will supply lenders with the essential information required to analyze your request. By following the outlined sections carefully, you'll be better positioned to secure funding for your small business.

-

Knowing how to structure your proposal ensures that you cover each essential component.

-

Lenders will require specific financial documents, which are crucial for credibility.

What are the essential components of your loan proposal?

A well-structured loan proposal significantly influences decision-makers at lending institutions. Thus, including essential information in your small business loan proposal form is vital for clarity and professionalism.

-

Include proposal title, company name, contact information, and submission date.

-

Provide a brief overview of your loan request, emphasizing its importance for business growth.

What detailed information should your business background include?

Provide the necessary context for your business to demonstrate credibility and establish a solid foundation for your proposal.

-

Outline when your business was founded, its structure, and key milestones.

-

Detail the nature of your products/services and the market position you hold.

-

Highlight your executive team and their qualifications to showcase your leadership.

What are the specifications of your loan request?

Lending institutions want specifics when it comes to financial requests, so make sure you provide clear details to avoid confusion.

-

Clearly define the amount you seek and your desired term structure.

-

Explain how the funds will be used, specifying primary and secondary purposes.

How do you define business objectives and expected outcomes?

Showcase your strategic planning by including both immediate and long-term business objectives.

-

Detail your short-term and long-term goals and the metrics used to assess them.

-

Indicate financial and operational metrics that will measure success.

What does your implementation methodology entail?

Illustrate how you plan to execute your proposal through structured strategies and risk management.

-

Outline your strategic approach for achieving your specified objectives.

-

Discuss potential challenges and outline plans to address them.

What financial projections and analyses should you provide?

Presenting solid financial data will prove your business’s financial health and support your funding request.

-

Summarize your current assets, liabilities, and overall financial stability.

-

Break down the specifics of your projected budget, justifying each figure.

How to fill out the small business loan proposal

-

1.Begin by gathering all necessary financial documents such as income statements, balance sheets, and cash flow statements.

-

2.Outline your business plan briefly, covering your business model, target market, and marketing strategies.

-

3.Clearly state the amount of funding you are requesting and how it will be utilized within your business.

-

4.Explain how you plan to repay the loan, including projected revenue growth and timelines.

-

5.Use pdfFiller to upload your completed small business loan proposal template, ensuring all sections are filled out accurately.

-

6.Review your document for clarity and completeness, making sure all financial projections and repayment plans are detailed.

-

7.Once satisfied, use pdfFiller's features to add any necessary digital signatures and annotations before submitting the proposal to lenders.

What is a Small Business Loan Proposal Template?

A Small Business Loan Proposal Template is a structured document that helps business owners present their funding requests to lenders. This template typically includes details such as the business overview, financial projections, and how the loan will be utilized. By providing a clear and organized proposal, businesses can significantly increase their chances of securing financial backing.

How can a Small Business Loan Proposal Template benefit my application?

Using a Small Business Loan Proposal Template ensures that all essential components of your loan application are covered comprehensively. This can help to streamline the review process for lenders, allowing them to assess your proposal efficiently. A professional template can also enhance your credibility as a borrower, making it easier to gain lender trust.

What key elements should be included in a Small Business Loan Proposal Template?

An effective Small Business Loan Proposal Template should include a detailed business description, market analysis, management background, financial history, and future projections. Additionally, it should clearly outline the purpose of the loan and how the funds will be used to grow the business. Having these elements laid out neatly can provide clarity and reassure lenders of your business's viability.

Can I customize a Small Business Loan Proposal Template for my specific business needs?

Absolutely! A Small Business Loan Proposal Template can be easily customized to fit your specific business industry and unique financial requirements. Personalizing the template allows you to highlight strengths that are particularly relevant to your business and improve the effectiveness of your proposal in capturing the lender's attention.

Where can I find a Small Business Loan Proposal Template?

You can find a variety of Small Business Loan Proposal Templates online, including on platforms like pdfFiller. These templates are designed to be user-friendly and accessible, allowing you to fill them out easily. Additionally, pdfFiller offers features for editing and formatting the template according to your preferences, making it an ideal choice for your proposal needs.

Is it necessary to have a Small Business Loan Proposal Template for every loan application?

While it may not be mandatory to use a Small Business Loan Proposal Template for every loan application, doing so can significantly enhance your chances of approval. A well-organized proposal can provide all the necessary information that lenders seek, making your application stand out. By presenting a clear rationale for your loan needs, you build a stronger case for receiving funding.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.