Get the free Car Loan Between Friends - Private Loan Agreement

Show details

This document outlines the terms and conditions of a car loan between a lender and a borrower, including loan amount, interest rate, repayment terms, and default conditions.

We are not affiliated with any brand or entity on this form

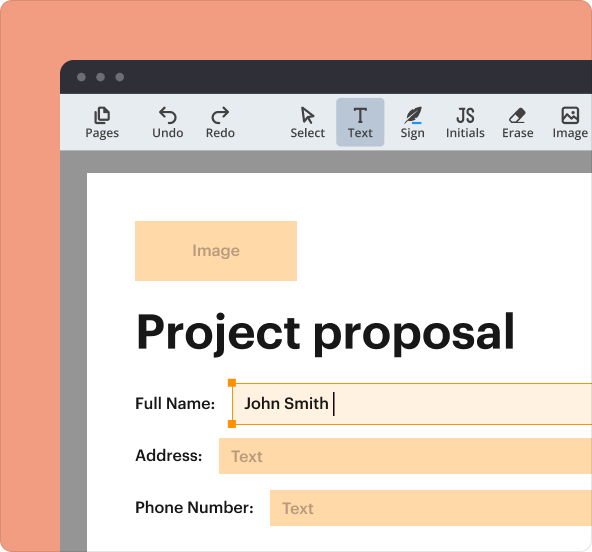

Why pdfFiller is the best tool for managing contracts

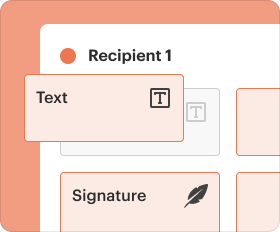

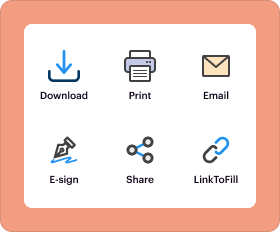

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is car loan between friends

A car loan between friends is a personal financing agreement where one friend lends money to another to purchase a vehicle, typically with flexible repayment terms.

pdfFiller scores top ratings on review platforms

very easy forms to use. very helpful

it makes editing pdfs easier

WWW.TATG-LLC.COM. FOR ALL OF YOUR ACCOUNTING NEEDS. TATG CREW LOVES PDFFILLER

great site loveed it very easty to use love it would refer anytime love it so much

So far, I'm just using the service to fill out miscellaneous forms for my Veterans Administration file and consolidating outlines for submittal as well. So far, so good with very little issues.

It is helpful

Who needs car loan between friends?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Creating a Car Loan Between Friends Form

Creating a car loan between friends form is a great way to formalize a loan agreement between individuals. This ensures both parties are protected and aware of their rights and obligations.

What is a car loan between friends?

A car loan between friends refers to an informal or formal arrangement where one party lends money to another for the purchase of a vehicle. These agreements can often lead to complexities, especially without a clear arrangement in writing.

-

Car loans between friends can be defined as personal financial agreements that facilitate borrowing or lending of funds for vehicle purchases.

-

Having a clearly defined loan agreement helps mitigate misunderstandings and provides legal backing in case of disputes.

-

Friends may enter such agreements to help out during financial difficulties, take advantage of favorable lending terms, or simply for convenience.

What are the key components of a car loan agreement?

A comprehensive car loan agreement includes several critical components that safeguard both lender and borrower interests.

-

Clearly state the total amount of money being borrowed for the vehicle.

-

Determine a fair interest rate, reflecting current market conditions to ensure the terms are just.

-

Set realistic deadlines for loan repayments to avoid unnecessary stress.

-

Indicate if any assets, like the purchased vehicle, will serve as collateral.

-

Outline the consequences should the borrower fail to meet the payment terms.

How to draft a car loan agreement step-by-step?

Drafting a car loan agreement can follow a structured process to ensure all necessary information is captured accurately.

-

Collect details from both the lender and borrower, as well as specifics about the vehicle.

-

Utilize resources from pdfFiller to find a suitable template for your car loan agreement.

-

Ensure all financial aspects like loan amount and interest rate are noted.

-

Use standard business agreement formats to enhance professionalism.

-

Allow time for both parties to review the document for accuracy before finalization.

How to fill out the loan agreement with a detailed breakdown?

Filling out a car loan agreement requires careful attention to each section to ensure clarity.

-

Each section must be addressed accurately; guidance can prevent errors.

-

Be aware of common mistakes like missing signatures or incorrect amounts.

-

Leverage tools offered by pdfFiller for a more seamless completion experience.

-

Ensure that both parties comprehend the terms before signing to prevent future misunderstandings.

How to manage and adjust the agreement?

Managing a car loan agreement over time can require periodic adjustments based on changing circumstances.

-

Continual communication between the borrower and lender can facilitate any changes necessary.

-

When financial situations change for either party, it is prudent to revisit the terms.

-

Utilize pdfFiller's features to make necessary changes in a user-friendly way.

-

Be aware of legal implications when altering loan agreements to ensure compliance.

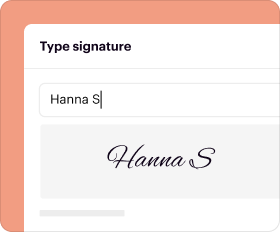

How to secure signatures and finalize the agreement?

Securing signatures is the final step in establishing a legally recognized car loan agreement.

-

E-signatures hold the same legal validity as handwritten signatures when executed properly.

-

Utilize pdfFiller for an efficient signing process to finalize the agreement.

-

Keep copies of the signed agreement for both parties to refer back to in the future.

-

Maintain clear communication and good practices throughout the loan period to sustain trust.

What are potential issues and resolutions in car loans between friends?

Issues may arise in personal loan agreements; being prepared for common disputes can save relationships.

-

Disagreements may arise over repayment terms or misunderstandings related to the agreement.

-

If discussions fail to resolve issues, it may be prudent to consult with a legal professional.

-

Keeping communication open and consistent can prevent potential misunderstandings.

How to fill out the car loan between friends

-

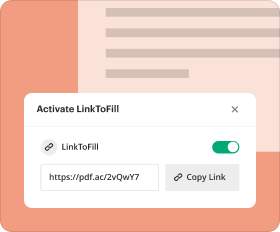

1.Begin by downloading the car loan between friends template from pdfFiller.

-

2.Open the PDF document in pdfFiller.

-

3.Fill in the date at the top of the document to indicate when the agreement is being made.

-

4.Input the full names and addresses of both the lender and the borrower in the designated fields.

-

5.Specify the total loan amount being borrowed for the car purchase next.

-

6.Outline the repayment terms, including the monthly payment amount, due dates, and interest rate if applicable.

-

7.Include any additional terms or conditions related to the loan, such as penalties for late payment.

-

8.Review all information for accuracy and completeness.

-

9.Save the filled document.

-

10.Optionally, share the document electronically or print it for both parties to sign.

What is a Car Loan Between Friends - Private Loan Agreement?

A Car Loan Between Friends - Private Loan Agreement is a document that outlines the terms and conditions for lending money between friends for purchasing a vehicle. This agreement ensures that both parties are clear on repayment schedules, interest rates, and other essential terms. Such agreements help to prevent misunderstandings and maintain the friendship intact.

How can I create a Car Loan Between Friends - Private Loan Agreement?

Creating a Car Loan Between Friends - Private Loan Agreement is quite simple using pdfFiller. You can start by navigating to our platform and choosing a customizable template for a loan agreement. After that, you can fill in the necessary details, such as the loan amount, repayment schedule, and any interest associated with the loan, ensuring that both parties have a clear understanding.

What details should be included in a Car Loan Between Friends - Private Loan Agreement?

A comprehensive Car Loan Between Friends - Private Loan Agreement should include the full names and addresses of both parties, the loan amount, the interest rate (if any), the repayment schedule, and any penalties for late payments. Additionally, it may be beneficial to include clauses regarding what happens if payment isn't made on time or if the borrower can't repay the loan, to eliminate ambiguity.

Is a Car Loan Between Friends - Private Loan Agreement legally binding?

Yes, a Car Loan Between Friends - Private Loan Agreement can be legally binding if it meets certain criteria. To ensure its enforceability, both parties should willingly sign the agreement and ideally have it notarized. This process validates the document and can help protect both the lender and borrower in case disputes arise in the future.

What are the benefits of having a Car Loan Between Friends - Private Loan Agreement?

Having a Car Loan Between Friends - Private Loan Agreement provides legal protection for both the lender and the borrower. It creates a documented record of the agreement, which helps prevent misunderstandings. Additionally, this agreement can strengthen the relationship by clarifying expectations and ensuring that both parties adhere to their commitments.

Can I modify a Car Loan Between Friends - Private Loan Agreement once it's signed?

Yes, you can modify a Car Loan Between Friends - Private Loan Agreement after it is signed if both parties agree to the changes. Modifications should be documented and signed by both individuals, ideally in a new written agreement or an addendum attached to the original. This adjustment will ensure both parties are on the same page regarding the new terms.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.