Get the free Donation Agreement

Show details

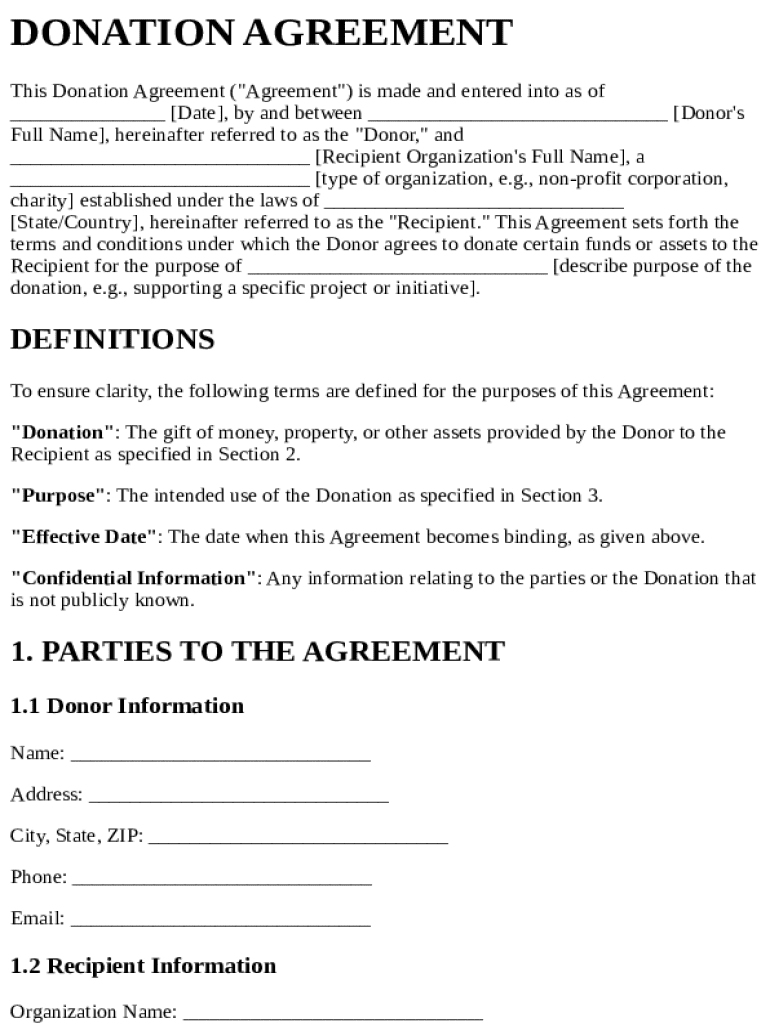

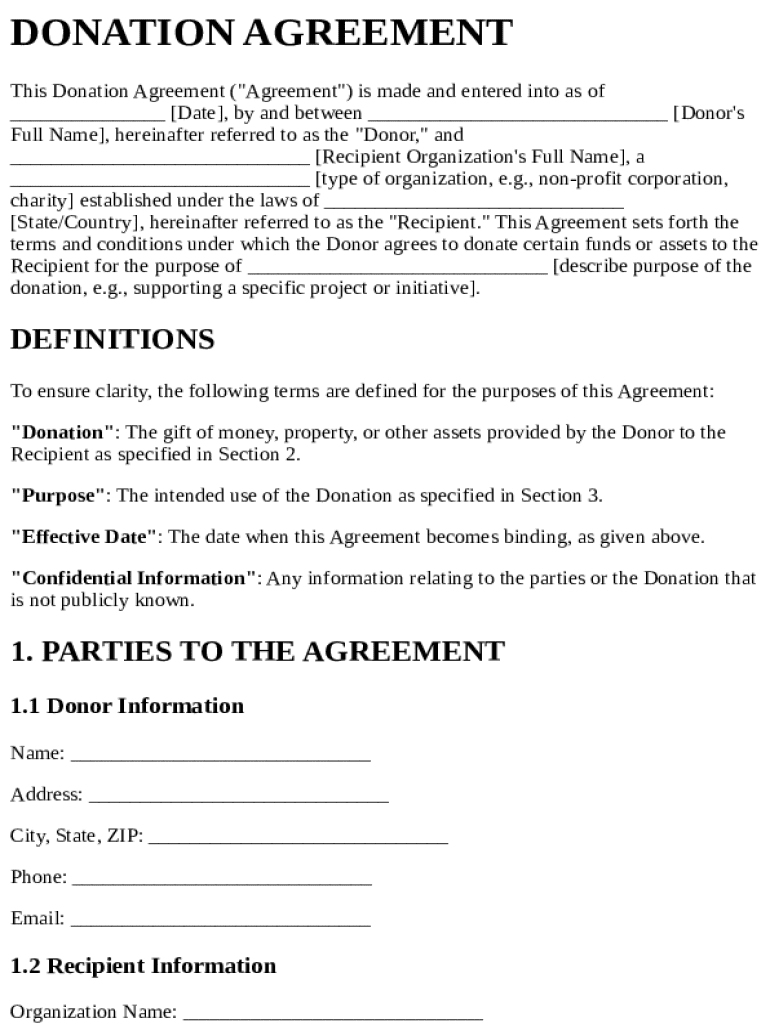

This document outlines the terms and conditions of a donation being made by a donor to a recipient organization, including definitions, responsibilities, and conditions of the donation.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

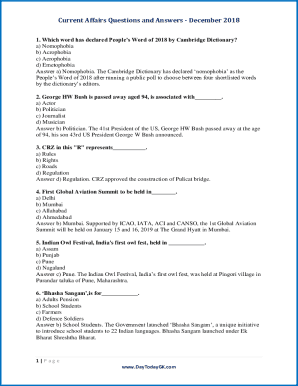

What is donation agreement

A donation agreement is a legal document that outlines the terms and conditions of a donation from a donor to a recipient organization.

pdfFiller scores top ratings on review platforms

It is easy to use especially when I need it often. I'm glad this service is available.

It has been easy to find to documents and fill and save. Quick and easy.

Love how easy and user friendly this app is! Sign up every year.

Easy to use, and straight forward. I would recommend it!

Es muy fácil de usar, además, que facilita el trabajo al que me dedico.

Easy to use on the pc. Would be nice if there was a mobile app!

Who needs donation agreement?

Explore how professionals across industries use pdfFiller.

Complete Guide to the Donation Agreement Form on pdfFiller

What is a donation agreement?

A donation agreement is a formal document outlining the terms under which a donor provides a gift or contribution to a recipient. This agreement is crucial to ensure that both parties clearly understand their rights, responsibilities, and the intended use of the donation. Without a formal donation agreement, misunderstandings can arise, potentially leading to disputes.

-

A donation agreement serves as a legally binding contract, specifying the details of the gift, including donor and recipient information.

-

A formal agreement protects both parties and ensures transparency and accountability regarding the donation.

-

Essential elements include donor and recipient identification, terms of the donation, and any restrictions on use.

What are the essential elements of the donation agreement form?

When drafting a donation agreement form, incorporating key elements is vital to avoid issues and clarify intentions. Clear identification and information about both the donor and recipient are crucial, along with specific terms of the donation. This level of specificity safeguards against future disputes and misunderstandings.

-

Full legal names and contact information for both the donor and recipient must be included.

-

Including addresses and any organizational affiliations adds clarity and formalizes the agreement.

-

Clearly stating the value of the donation along with any conditions of the gift enhances the agreement's effectiveness.

Why is the purpose of the donation significant?

Clarifying the intended use of donated funds or assets is critical. This not only ensures that the donation is utilized effectively, but it may also involve stipulations that dictate how the assets can be used. Such clarity helps both parties remain aligned on the purpose and aims of the contribution.

-

Clearly outlining how donations will be used sets expectations and can improve donor trust.

-

Some donations may come with restrictions, stating that funds should only be used for specific purposes.

-

Documenting the intended purposes ensures that all parties are clear about the donation's application.

How are payment and transfer terms defined in the donation agreement?

Establishing payment and transfer terms is an essential step in a donation agreement. Precise timelines for when donations are to be transferred and any detailing of payment methods ensure that both the donor and recipient are accountable for their respective responsibilities in the agreement.

-

Specify the due date for the donation transfer to avoid confusion.

-

Outline accepted payment methods and any required documentation for compliance.

-

Ensuring compliance with local laws regarding donations is vital to avoid legal complications.

What legal considerations should be included?

Legal considerations play a critical role in ensuring that donation agreements are enforceable. Understanding confidentiality clauses and the legal implications of the terms laid out in the agreement can save parties involved from potential legal disputes in the future. Individuals are encouraged to seek legal advice to navigate these complexities effectively.

-

Such clauses can protect sensitive information exchanged during the donation process.

-

It is essential to understand how laws regarding charitable donations apply.

-

Getting legal counsel is prudent when drafting or entering into a contractual agreement.

How do you fill out the donation agreement form using pdfFiller?

Using pdfFiller, filling out and managing a donation agreement form is a seamless process. The platform provides interactive tools that streamline the editing, signing, and collaboration phases, helping users tailor the document to their needs with ease. A step-by-step guide on this platform can enhance the efficiency of your document handling.

-

Detailed prompts available on pdfFiller simplify each phase of form completion.

-

Utilizing pdfFiller’s tools can enhance your document management effectiveness.

-

Customization features allow users to create personalized donation agreements effortlessly.

How to fill out the donation agreement

-

1.Open the donation agreement template on pdfFiller.

-

2.Begin by entering the donor's full name and contact information in the designated fields.

-

3.Input the recipient organization's name, address, and contact details next.

-

4.Specify the donation amount or description of items donated in the appropriate section.

-

5.Include any specific terms or conditions related to the donation, such as restrictions or use of funds.

-

6.Review the document for accuracy and completeness, ensuring all fields are filled out correctly.

-

7.If necessary, add any additional clauses or notes in the provided space.

-

8.Once satisfied with the information provided, save the document.

-

9.Finally, sign the agreement using the electronic signature feature or print it for a handwritten signature.

What is a Donation Agreement?

A Donation Agreement is a legal document that outlines the terms and conditions of a donation made by one party to another. This agreement serves to protect both the donor and the recipient by clearly defining what is being donated, any conditions attached to the donation, and the rights and obligations of both parties involved. Using a Donation Agreement can help ensure a smooth transfer of assets and minimize potential disputes in the future.

Why is it important to have a Donation Agreement?

Having a Donation Agreement is crucial for several reasons. First, it provides a clear and formal record of the donation, which can be beneficial for tax purposes and legal clarity. Additionally, a well-drafted Donation Agreement can help prevent misunderstandings or disputes between the donor and recipient by clearly outlining their respective rights and responsibilities.

Who should use a Donation Agreement?

A Donation Agreement is suitable for anyone planning to donate significant assets or sums of money, whether individuals or organizations. This includes charities, nonprofits, and private donors who wish to formalize their charitable contributions. By utilizing a Donation Agreement, donors can safeguard their intentions and ensure that the donation is used in the manner they intended.

What elements should be included in a Donation Agreement?

A comprehensive Donation Agreement should include several key elements. It should clearly identify the donor and recipient, outline the specific item or amount being donated, and specify any conditions that apply. Additionally, it is beneficial to include clauses regarding the handling of taxes and any legal implications related to the donation to further protect both parties.

Can I create a Donation Agreement using pdfFiller?

Yes, pdfFiller provides easy-to-use tools for creating a Donation Agreement online. Users can access customizable templates, ensure all necessary components are included, and edit documents seamlessly from any device. With pdfFiller, you can streamline the document creation process and securely manage your Donation Agreement with the necessary legal protections.

What are the tax implications of a Donation Agreement?

Understanding the tax implications of a Donation Agreement is vital for both donors and recipients. Depending on the amount and type of donation, different tax rules may apply, and including a Donation Agreement can help clarify these obligations. It's advisable to consult with a tax professional to understand how a Donation Agreement might affect your taxes and to ensure compliance with local regulations.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.