Get the free Balance Sheet Template

Show details

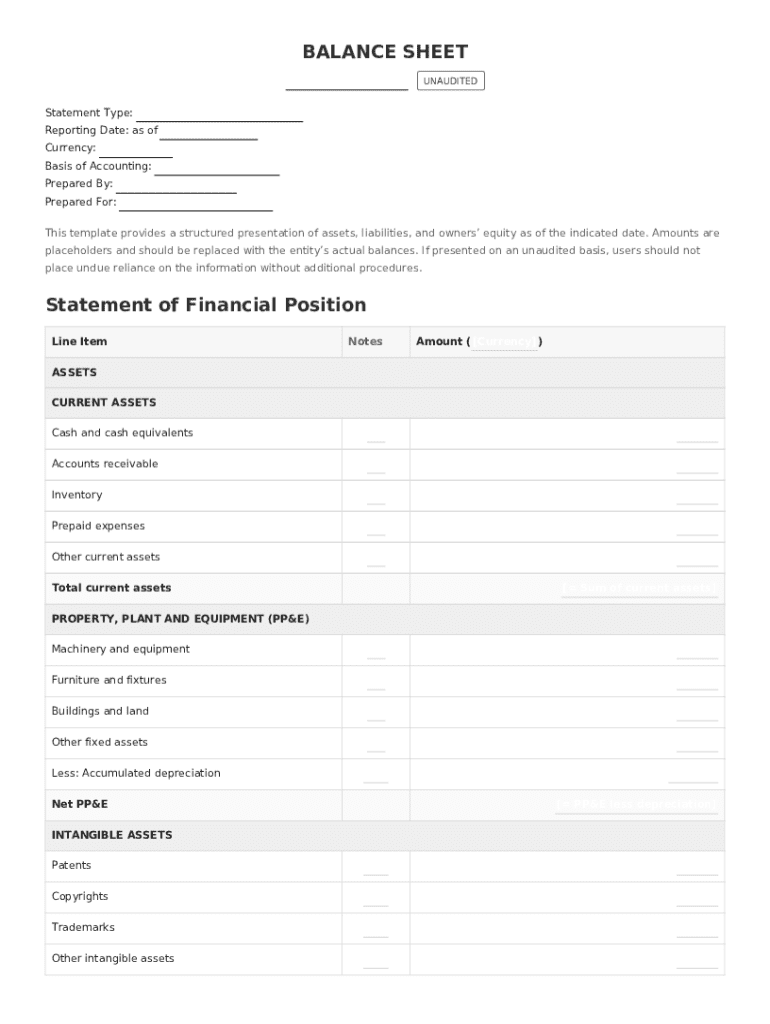

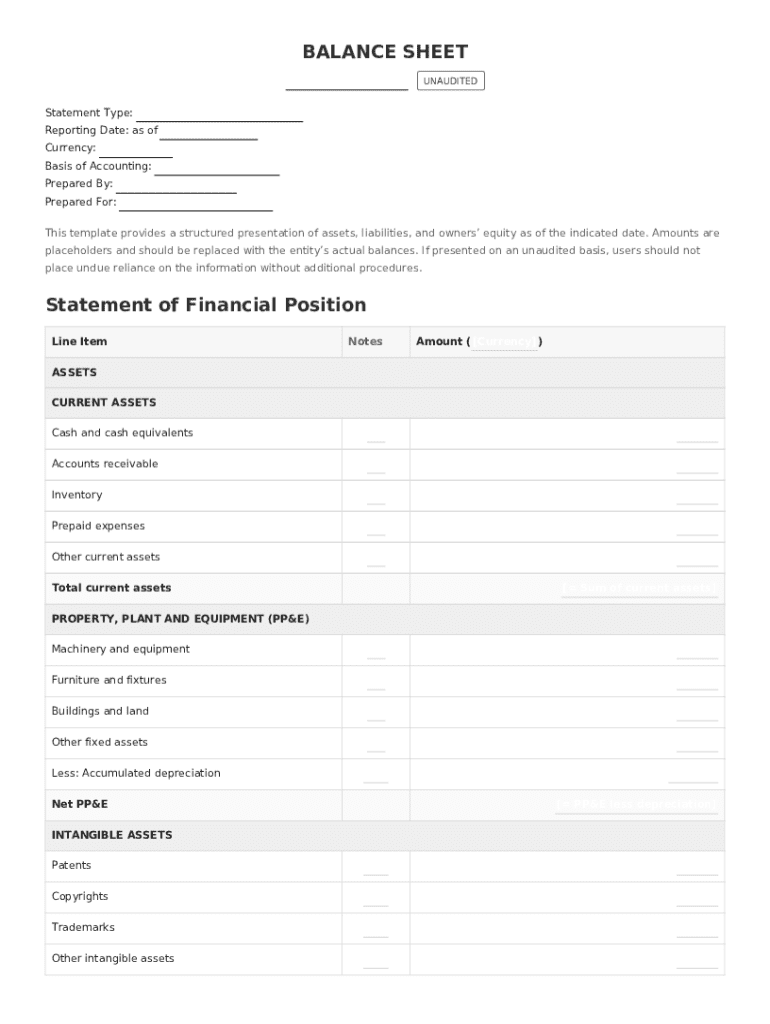

A fundamental financial statement that provides a snapshot of a company\'s financial health at a specific point in time, summarizing its assets (what it owns), liabilities (what it owes), and owner\'s

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is balance sheet template

A balance sheet template is a structured document that provides a snapshot of a company's financial position at a specific point in time, detailing assets, liabilities, and equity.

pdfFiller scores top ratings on review platforms

Thank You for an Amazing Program

I was having a difficult time creating a new document to file in my folders. I use this program now for all my note taking as I'm a Social Worker at a High School. The fill in bulk feature and the create from template has been life saving to me. I can easily generate notes on my caseload of students without having to go document by document. It has helped with my organization and the customer support has been Tier 1, there hasn't been an issue that I haven't had solved same day.

It was very easy and I am thankful for that

the bestttttttttttttt

GREAT! JUST HOPE WHEN EDITING THE FONT DOES NOT CHANGE.

the best appnever

It was very easy to use.. User friendly indeed!

Who needs balance sheet template?

Explore how professionals across industries use pdfFiller.

Comprehensive Balance Sheet Template Guide

In this comprehensive guide, we will delve into the crucial elements of a balance sheet template form form, ensuring that you can effectively manage financial reporting. This document serves as a summary of a company's financial position at a specific point in time.

What is a balance sheet?

A balance sheet is a financial statement that captures a company’s assets, liabilities, and equity. It plays a vital role in financial reporting by providing a snapshot of a company's financial health, showcasing how resources are financed, whether through debt or equity.

-

A balance sheet presents information about a company's financial position, allowing stakeholders to gauge its stability and liquidity.

-

Representing assets, liabilities, and equity accurately is crucial for maintaining stakeholder trust and legal compliance.

-

Understanding accounting principles, such as the accounting equation (Assets = Liabilities + Equity), is essential for constructing a sound balance sheet.

What are the components of a balance sheet?

The balance sheet consists of three primary components: assets, liabilities, and owner’s equity. Each component plays a crucial role in demonstrating the financial health of the organization.

What are assets?

-

These include cash, accounts receivable, and inventory, and are expected to be converted into cash within one year.

-

These long-term assets are critical for operations, and their value is impacted by depreciation, which reflects wear and tear over time.

-

Non-physical assets like patents and trademarks, which must be accounted for correctly to reflect true company value.

What are liabilities?

-

Obligations due within one year, such as accounts payable and taxes payable, which can affect liquidity.

-

Long-term obligations, such as loans and bonds payable, must be explicitly reported for accuracy.

What is owner's equity?

-

This includes retained earnings, common stock, and treasury stock, which together indicate ownership in the company.

-

Owner's equity is crucial for assessing the net worth and solvency of a business, serving as a buffer against liabilities.

How do you fill out a balance sheet template?

Accurate reporting of amounts is critical. The first step involves gathering the financial data necessary to populate the sheet.

-

Ensure all financial figures are derived from verified sources for authenticity.

-

Use actual entity balances rather than placeholders to achieve integrity in reporting.

-

Differentiate processes for audited and unaudited balance sheets to comply with accounting standards.

What are best practices for balancing the sheet?

Maintaining an accurate balance sheet requires vigilance and methodical practices to confirm all entries balance correctly.

-

Mistakes often arise from miscategorizing assets or failing to include all liability entries.

-

Total assets must always equal the combined total of liabilities and owner's equity.

-

Regular audits of balance sheets can prevent inaccuracies and ensure regulatory compliance.

How can pdfFiller tools help with your balance sheet?

pdfFiller's platform offers an array of features to enhance the balance sheet management process through editing, signing, and collaboration.

-

Utilize pdfFiller to modify your balance sheet template directly, save time and maintain accuracy.

-

Enhance document management with real-time collaboration tools that improve team efficiency.

-

With pdfFiller, easily retrieve balance sheet templates from any location, expediting data management.

What compliance considerations should you keep in mind?

When preparing your balance sheet, it’s essential to remain mindful of legal and regulatory compliance.

-

Adhering to standards such as GAAP or IFRS ensures that your financial reporting meets legal expectations.

-

For complex compliance needs, it’s recommended to engage with accountants who specialize in financial regulations.

Where can you find additional resources?

Utilize various links and resources to enhance your understanding and implementation of balance sheets.

-

Explore additional accounting resources and guidelines to deepen your understanding of best practices.

-

pdfFiller offers a range of financial templates that cater to various business needs, making document creation seamless.

How to fill out the balance sheet template

-

1.Open the balance sheet template in pdfFiller.

-

2.Begin by entering your company name and the date at the top of the document.

-

3.In the 'Assets' section, list all current assets, such as cash, accounts receivable, and inventory, along with their respective values.

-

4.Next, in the 'Liabilities' section, enter all current liabilities, including accounts payable and loans, along with their amounts.

-

5.Calculate total assets and total liabilities, ensuring they are appropriately categorized as current or long-term.

-

6.In the 'Equity' section, input owner’s equity or stockholder's equity and any retained earnings.

-

7.Double-check all entries for accuracy, ensuring that total assets equal the sum of total liabilities and equity.

-

8.Save the completed balance sheet template and consider printing or sharing it as needed.

What is a Balance Sheet Template and why do I need one?

A Balance Sheet Template is a structured format that helps you organize and present your company’s financial position at a specific point in time. It's essential for tracking assets, liabilities, and equity, enabling easy assessment of financial health. By using a Balance Sheet Template, businesses can streamline their financial reporting process, ensuring clarity and accuracy in financial statements.

How can pdfFiller's Balance Sheet Template enhance my financial reporting?

pdfFiller's Balance Sheet Template offers user-friendly features that allow you to edit and customize your financial reports easily. With cloud-based access, you can update and share your balance sheets in real-time with your team. This ensures that everyone is aligned on financial data, making it simpler to make informed business decisions.

Can I customize the Balance Sheet Template for my specific business needs?

Absolutely! pdfFiller's Balance Sheet Template is fully customizable, allowing you to tailor fields, add specific categories, and include relevant financial metrics. This flexibility ensures that the template meets your organizational requirements, giving you the control needed to accurately reflect your financial situation. By customizing the Balance Sheet Template, you can better communicate your business's financial status to stakeholders.

Is it easy to use pdfFiller’s Balance Sheet Template for newcomers?

Yes, pdfFiller’s Balance Sheet Template is designed with simplicity in mind, making it accessible even for newcomers to financial reporting. The intuitive interface walks you through each step, ensuring that users of all skill levels can create professional balance sheets. With clear instructions and helpful tools, the Balance Sheet Template helps demystify the financial reporting process.

What are the benefits of using a digital Balance Sheet Template versus a traditional one?

Using a digital Balance Sheet Template, like the one from pdfFiller, offers significant advantages over traditional paper methods. Digital templates allow for easier collaboration, instant updates, and automatic calculations, enhancing overall efficiency. This also means your financial data is securely stored in the cloud, making it easier to access, share, and retrieve when needed.

Can I save my Balance Sheet Template for future use?

Yes, pdfFiller allows you to save your customized Balance Sheet Template for future use, providing great flexibility for ongoing financial assessments. You can easily store multiple versions and make updates as your business evolves, ensuring you always have the most relevant data at your fingertips. This feature significantly optimizes your financial management process and saves time on repetitive tasks.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.