Get the free Beneficiary Designation Form

Show details

A critical document used to officially name the person(s) who will receive the assets (e.g., life insurance payout, retirement funds) of an account holder upon their death.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is beneficiary designation form

A beneficiary designation form is a legal document that specifies who will receive the assets or benefits from an account or policy upon the owner's death.

pdfFiller scores top ratings on review platforms

I had a quick need to make some changes to a PDF. I found your application and it worked immediately. I want to learn more about these other features.

It was good but I don't need it any more

Very good experience so far. I've only used this for 1 day. But would like to learn more features.

NOT ALWAYS EASY TO N=KNOW WHAT TO DO NEXT

No issues once I contacted the support department who answered my questions. I understand that you are in business to make money on a service. I just felt it was costly for a piece of paper or two that would cost me 10. Cents at a FedEx or Office Max type business.

I love the ease of typing on the PDF, I'm still learning how to send it to others with fill in blanks. But I like it. Pricey for the redaction ability but I suppose better than Adobe

Who needs beneficiary designation form?

Explore how professionals across industries use pdfFiller.

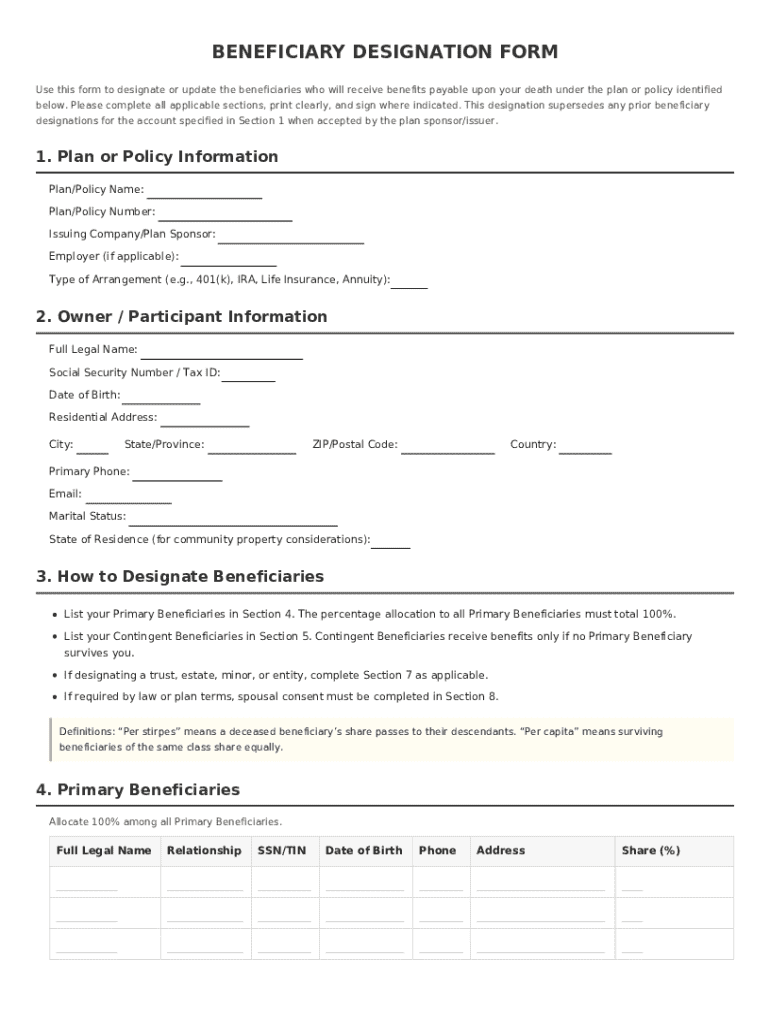

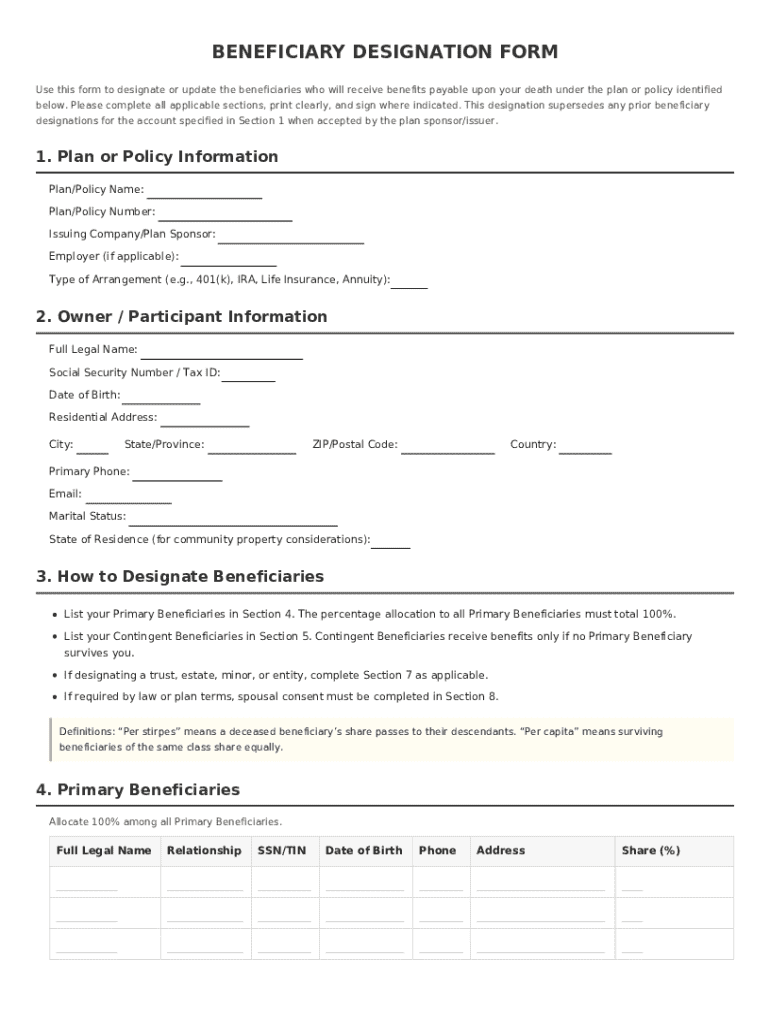

Comprehensive Guide to Completing Your Beneficiary Designation Form

How can you ensure your beneficiary designation form is correct?

To fill out a beneficiary designation form effectively, gather necessary information such as legal names, social security numbers, and contact details for your beneficiaries. Accurately fill in your own details, including the policy information related to your plan. With this guide, you will understand how to complete the process with ease and confidence.

Understanding the beneficiary designation form

A beneficiary designation form is a crucial document used to specify who will receive assets upon your passing. Understanding its importance helps you ensure the right people benefit from your assets. It is vital for financial and estate planning, especially when it involves significant assets or dependents.

-

This form allows individuals to designate who will inherit their financial assets, which may include life insurance, retirement accounts, and investments.

-

This form should be updated following significant life changes, such as marriage, divorce, or the birth of a child, to reflect current wishes.

-

Designations can have legal standing, which means they can override wills and trusts if not updated, emphasizing the importance of regular reviews.

What information is required about your plan and policy?

Accurate information about your plan or policy ensures that beneficiaries are correctly identified and assets are rightfully distributed. This entails specifying the type of arrangement and the insurance provider.

-

Clearly state the plan name, such as a retirement account or life insurance policy to eliminate confusion.

-

Include your policy number and the company name to ensure all parties are aware of the correct reference.

-

Indicate whether the plan is associated with an employer and describe the arrangement type, whether it's a 401(k), IRA, or another financial product.

How to correctly fill out owner/participant information?

Providing detailed owner or participant information is vital. The clarity of your identity ensures the designated beneficiaries are tied directly to your assets.

-

Your full legal name ensures there are no discrepancies, and providing contact information makes it easier for the issuing company to reach you.

-

These identifiers confirm your identity and are often required for legal reasons and administrative purposes.

-

Your marital status might affect beneficiary choices and state laws regarding inheritance, so it's essential to disclose this accurately.

What should you know about designating your beneficiaries?

Designating beneficiaries can seem straightforward, but nuances exist that are crucial for proper allocation and legal standing.

-

Primary beneficiaries are first in line to inherit, while contingent beneficiaries receive assets only if primary beneficiaries are unable to do so.

-

It's vital to state allocation percentages explicitly to avoid confusion over asset distribution.

-

Consider legal requirements for minors and how trusts may be designated to ensure compliance with laws.

How can you fill out the beneficiary section step-by-step?

Completing the beneficiary section requires attention to detail to minimize errors, which can have legal implications.

-

Provide the complete legal names of beneficiaries along with their relationship to you for clarity.

-

Accurate details help identify beneficiaries correctly and assist in any future dealings regarding the policy.

-

Ensure the total percentage allocated equals 100% to avoid conflicts over the distribution of assets.

What legal terms do you need to know?

Understanding legal terminology is essential to making informed decisions about your beneficiary designations.

-

These terms describe how assets are distributed among descendants—per stirpes ensures division among branches of a family.

-

Familiarize yourself with terms like revocable and irrevocable beneficiaries, as these affect how and when you can change designations.

-

Legal terms can affect the ease of transferring assets and the protection of beneficiaries, making their comprehension crucial.

What common mistakes should you avoid?

Many individuals make errors when filling out their forms, and avoiding these can save complications and heartache later.

-

Leaving someone out could cause unintended consequences, such as exclusion from inheriting assets.

-

Regular updates are necessary, as changes in relationships or personal circumstances can significantly alter your wishes.

-

Verifying all information prevents costly mistakes, such as typos in names or percentages allocated.

What are the important reminders for users?

Regular reviews and updates are essential after completing your beneficiary designation form. changes in your personal situation or laws may necessitate adjustments to ensure your wishes are honored.

-

Periodic reviews ensure that your designated beneficiaries align with your current life situation.

-

With pdfFiller, you can edit, eSign, and manage your documents effectively, making it simpler to keep your designations up-to-date.

-

Ensure all previous designations are superseded to avoid confusion or legal challenges down the line.

How to fill out the beneficiary designation form

-

1.Access your beneficiary designation form on pdfFiller.

-

2.Begin by entering your personal information, including full name, date of birth, and contact details in the designated fields.

-

3.Identify the account or policy for which you are designating a beneficiary, this is typically found at the top of the form.

-

4.Next, select the beneficiaries by entering their names, relationship to you, and their contact information. Ensure you specify the percentage of benefits each will receive, if applicable.

-

5.Review your entries for accuracy, confirming all information is correct and up to date.

-

6.If desired, you may include contingent beneficiaries who would receive benefits if the primary beneficiary is unable to do so.

-

7.After filling in the details, save your form. Utilize the pdfFiller tools to sign the document electronically or print it for hand signing.

-

8.Finally, submit the completed form to your account provider or keep it for your records, ensuring all parties involved are aware of the designations.

What is a Beneficiary Designation Form?

A Beneficiary Designation Form is a critical document that allows individuals to specify who will receive their assets upon their death. This form is often used for bank accounts, investment accounts, and life insurance policies. By filling out a Beneficiary Designation Form, you can ensure that your wishes are honored without going through probate.

Why is it important to keep my Beneficiary Designation Form updated?

Keeping your Beneficiary Designation Form updated is essential because life circumstances change. Marriages, divorces, and the births of children can all impact who you want to designate as your beneficiary. Regularly reviewing and updating your Beneficiary Designation Form helps to avoid disputes and ensures that your assets go to the right individuals.

How do I fill out a Beneficiary Designation Form correctly?

Filling out a Beneficiary Designation Form correctly involves providing accurate information about yourself and your beneficiaries. Typically, you'll need to state your name, contact information, and the name of the beneficiary, as well as their social security number or date of birth. It’s crucial to double-check all details to ensure there are no mistakes that could affect the distribution of your assets.

Can I change my beneficiaries after submitting a Beneficiary Designation Form?

Yes, you can change your beneficiaries even after submitting a Beneficiary Designation Form. However, it is paramount to complete a new form and follow any specific procedures set by the financial institution or insurance company holding your assets. Always retain copies of your previous forms for reference, and notify your beneficiaries of any changes made.

Where can I find a Beneficiary Designation Form for my accounts?

You can typically find a Beneficiary Designation Form on the official website of your bank, insurance company, or investment firm. Many institutions offer these forms as downloadable PDFs for convenience. If you’re unsure how to obtain a Beneficiary Designation Form, it's best to contact customer service directly for assistance.

What happens if I don't submit a Beneficiary Designation Form?

If you do not submit a Beneficiary Designation Form, your assets may be distributed according to state intestacy laws, which may not reflect your intentions. This can lead to complications and disputes among family members. To ensure your assets are distributed as you wish, it’s highly recommended to complete and submit a Beneficiary Designation Form.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.