Get the free Change of Beneficiary Request Form

Show details

A formal document submitted to an account administrator (e.g., insurance company, 401k provider) to officially update or replace the person(s) previously designated to receive assets upon the account

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

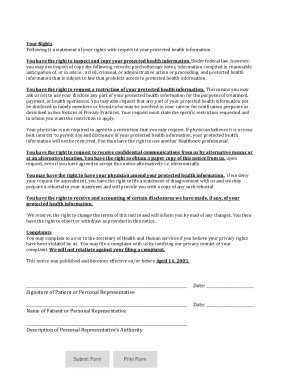

What is change of beneficiary request

A change of beneficiary request is a formal document used to designate or modify the individual or entity that will receive benefits from a policy or account upon the policyholder's death.

pdfFiller scores top ratings on review platforms

CHARACTERS ON LANDSCAPED FORMS PRINT IN ORIENTATION MODE AT TIMES

In my job, I have to work with some forms that have not been formatted correctly for being filled. It's great to have something that just fixes that whole problem.

very user friendly, I haven't sent anything yet but using the search forms on the internet was very useful.

It has been great. I need to use it more

It's a good program, convenient, relatively easy UI. Needing to subscribe to a function that was free for a time on the Adobe software, is an irritating feature of life in the 21st century.

I only used one form so I dont really know what else I can use it fo

Who needs change of beneficiary request?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Change of Beneficiary Request Form

How to fill out a change of beneficiary request form

Filling out a change of beneficiary request form is crucial to ensure that your assets are distributed according to your wishes. Begin by gathering necessary documents, understanding your current beneficiary designations, and following the step-by-step instructions provided in this guide.

Understanding the change of beneficiary request form

A change of beneficiary request form is essential for individuals looking to update their named beneficiaries on financial accounts or insurance policies. This form allows you to specify who will receive your assets upon your passing, which can significantly impact financial planning and inheritance.

-

A beneficiary change formally updates the individuals or entities designated to receive assets upon death, reflecting any life changes such as marriage or divorce.

-

Utilize this form in situations such as marriage, divorce, birth of a child, or when a beneficiary passes away.

-

Changes may occur due to personal events or shifts in relationships, necessitating a reevaluation of current beneficiaries.

Key definitions to know

Understanding key terms is vital when dealing with beneficiary changes. Terms like Owner, Insured, and Annuitant are foundational in the context of insurance and financial planning.

-

The Owner is the individual who holds the policy, the Insured is the person whose life is covered, and the Annuitant receives benefits from the policy.

-

Primary beneficiaries receive the benefits first; contingent beneficiaries only receive benefits if the primary beneficiary is deceased.

-

Specifying percentages in beneficiary designations ensures that assets are divided according to your wishes, reducing potential disputes.

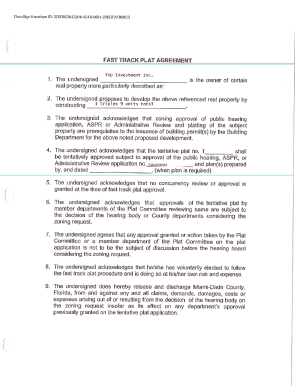

Preparing to fill out the request form

Preparation is key to successfully completing a change of beneficiary request form. Accurately gathering information can prevent delays in processing your update.

-

Collect all relevant documents such as your current policy, identity verification, and any legal documents related to your changes.

-

Review your existing beneficiary designations to confirm what needs to change.

-

In community property states, ensuring spousal consent is essential for changes that may impact shared assets.

Step-by-step instructions for completing the form

Following a systematic approach can simplify the complexities involved in completing the form. Below are detailed steps to guide you.

-

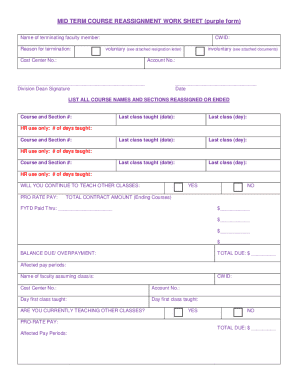

Input your company name and policy number accurately, along with complete owner information to ensure correct identification.

-

Clearly state your changes regarding current beneficiaries, and determine whether you will maintain or wholly replace designations.

-

Ensure you provide required signatures, including any irrevocable beneficiary agreements, to validate your form.

Ensuring compliance and smooth processing

To avoid complications, it’s important to understand the implications of past beneficiary designations and comply with submission guidelines.

-

Previously established designations may complicate changes, so understanding their impact is crucial.

-

Be aware of how your change request will be submitted and the expected processing times to avoid delays.

-

Engaging with professionals for complicated situations can help clarify legal and tax implications tied to your wishes.

Utilizing pdfFiller for your document needs

pdfFiller offers an efficient solution for managing your change of beneficiary request form and supports streamlined processes.

-

With pdfFiller, you can easily upload your completed forms and make adjustments as needed without losing document integrity.

-

Take advantage of eSignature capabilities to expedite processing and ensure that your document is legally binding.

-

pdfFiller allows teams to collaborate seamlessly, ensuring everyone involved can access, review, and finalize designations in real-time.

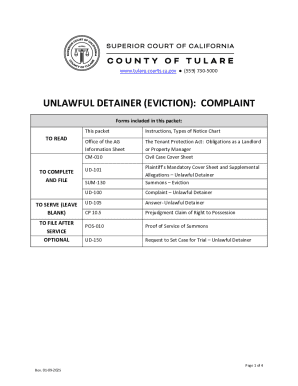

How to fill out the change of beneficiary request

-

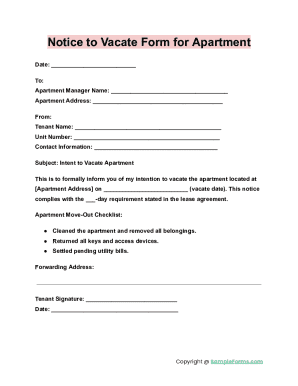

1.Obtain the Change of Beneficiary Request form from your insurance provider or financial institution.

-

2.Begin by writing your full name and insurance policy or account number at the top of the form.

-

3.Clearly identify the current beneficiaries by listing their names and relationship to you.

-

4.Next, specify the new beneficiary or beneficiaries, including their full names and contact information.

-

5.Indicate the percentage of benefits each new beneficiary will receive, ensuring the total equals 100%.

-

6.If applicable, include any specific conditions for the new beneficiaries, such as age requirements or time limits.

-

7.Review the completed form for accuracy, ensuring all information is correct and legible.

-

8.Sign and date the form to validate the request, confirming your intention to change the beneficiary.

-

9.Submit the form to your insurance provider or financial institution according to their instructions, either by mail or electronically, if available.

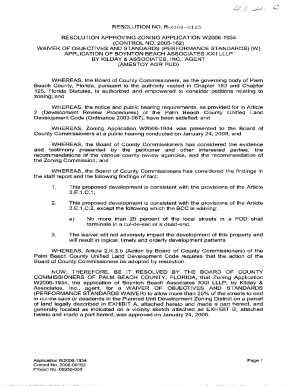

What is a Change of Beneficiary Request Form and why is it important?

A Change of Beneficiary Request Form is a legal document used to update the beneficiaries listed on insurance policies, retirement accounts, or other financial instruments. This form is important because it ensures that your assets are directed to the intended recipients upon your passing. Utilizing this form accurately helps avoid potential conflicts and ensures that your wishes are respected.

How do I complete a Change of Beneficiary Request Form correctly?

Completing a Change of Beneficiary Request Form requires you to provide specific information about the current and new beneficiaries, including names, relationships, and contact details. It's essential to reaffirm that the form is signed and dated to validate your request. Failing to follow the correct procedure may lead to delays or rejections of your request, impacting your beneficiaries.

Where can I access a Change of Beneficiary Request Form?

You can access a Change of Beneficiary Request Form on various financial institution websites, insurance companies, or legal services platforms such as pdfFiller. Our platform allows you to create, edit, and manage your forms securely from anywhere. Simply navigate to the relevant section to download or fill out the form as needed.

How often should I update my Change of Beneficiary Request Form?

It's advisable to review and update your Change of Beneficiary Request Form whenever there are significant life changes, such as marriage, divorce, or the birth of a child. Keeping this form current ensures that your beneficiaries reflect your current wishes and circumstances. Regular reviews can help prevent complications or disputes regarding asset distribution in the future.

What happens if I don’t file a Change of Beneficiary Request Form?

If you do not file a Change of Beneficiary Request Form, the beneficiaries listed in your original documents will remain in effect. This may not align with your current intentions, especially after major life events. It is essential to keep this information current to avoid potential legal complications and ensure the right individuals receive your assets.

Can I submit the Change of Beneficiary Request Form electronically?

Many institutions now accept electronic submissions for a Change of Beneficiary Request Form, particularly through platforms like pdfFiller. This option can save time and streamline the process. However, ensure that the institution's policy permits electronic forms and that you receive confirmation after submission to validate your request.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.