Get the free Credit Check Authorization Form

Show details

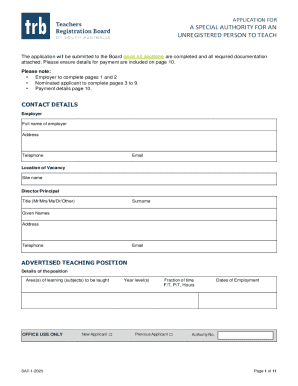

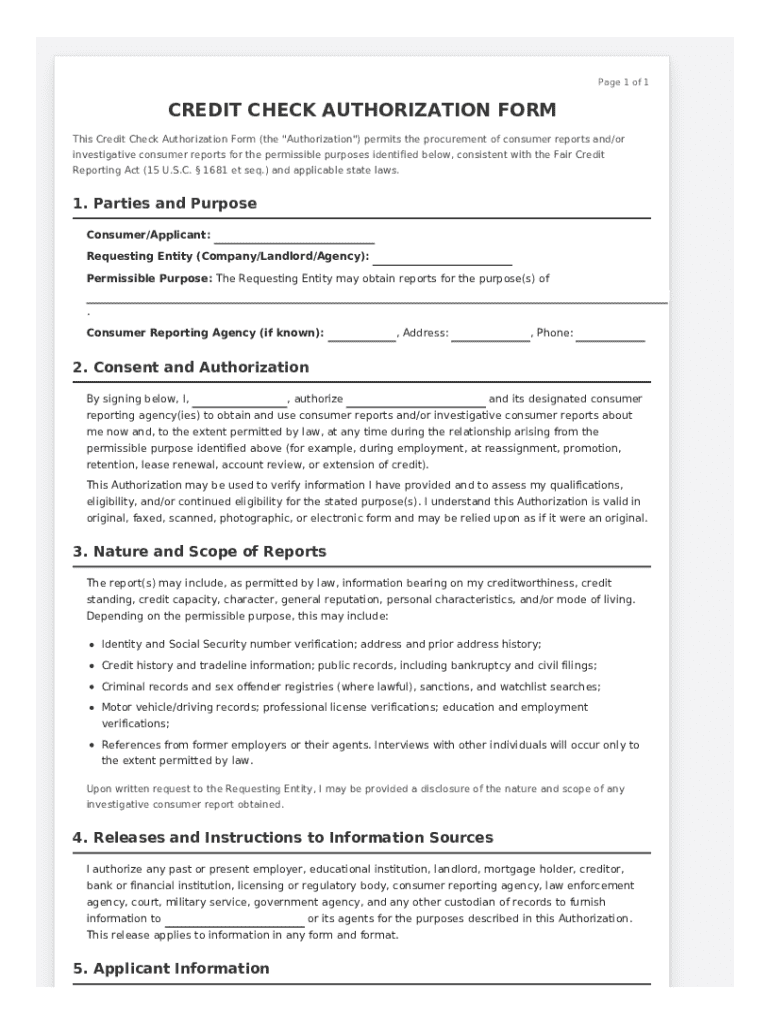

A required document signed by an applicant (e.g., for a lease, loan, or employment) granting explicit permission for the requesting party to access and review their personal credit report and financial

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is credit check authorization form

A credit check authorization form is a document that allows a lender or organization to access a person's credit report to evaluate their creditworthiness.

pdfFiller scores top ratings on review platforms

Really liking it smooth system

Pdf

Good

Easy to use, quick and efficient processes

Don't need it on regular basis so paying monthly for the service is not beneficial to me

Competitiveness in the market with PDF Filler

Editor of great autonomy, has added values of great importance to my daily tasks, robust and practical, I am quite satisfied with PDF Filler.

It is a great online Pdf editor, objective and competitive, compared to other Editors found in the market, its autonomy is of excellent quality in the conversion of PDF documents and electronic signatures.

It has a positive history with PDF files, it helps me with everyday tasks, how to convert documents to Pdf and send documents to a specific program for my work, I use SEI, it is also excellent in the electronic signature operation.

I feel that all new comers should be sent a video how to begin.

I can already tell this is going to make my life so much easier.

So far so good, make my life easier

AWESOME NO HEADACHES

Who needs credit check authorization form?

Explore how professionals across industries use pdfFiller.

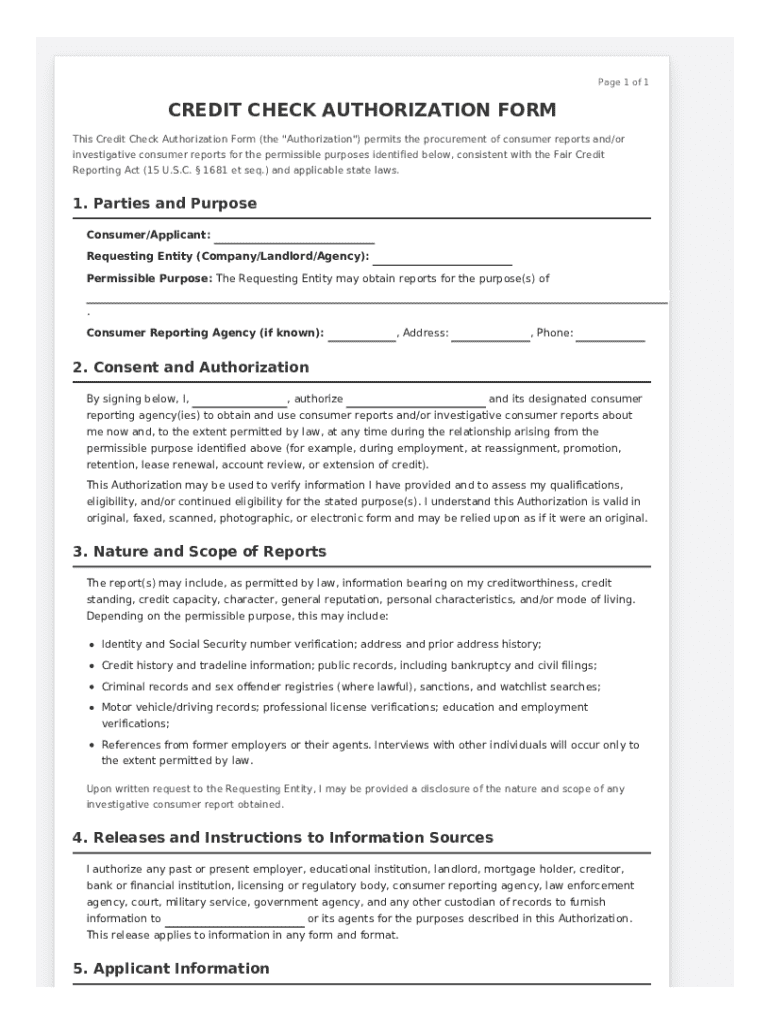

How to fill out the credit check authorization form

-

1.Open the credit check authorization form on pdfFiller.

-

2.Begin by entering the applicant's full name in the designated field.

-

3.Next, fill in the applicant's date of birth to help identify the correct credit report.

-

4.Input the applicant's social security number (if required) for verification purposes.

-

5.Enter the applicant's current address, including any previous addresses if requested.

-

6.Review the section that states the permissions granted for the credit check; ensure it is accurate and complete.

-

7.Sign the form electronically, ensuring the signature matches the name provided.

-

8.Date the form to indicate when the authorization was given.

-

9.Finally, double-check all entered information for accuracy before submitting or printing the form.

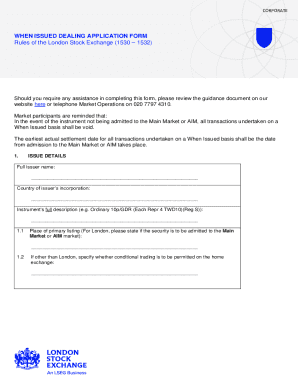

What is a Credit Check Authorization Form and why is it important?

A Credit Check Authorization Form is a crucial document that allows lenders or service providers to obtain a credit report on an individual or entity. This form ensures that the request for credit information complies with legal and regulatory standards, protecting both the requester and the individual involved. Using a Credit Check Authorization Form enables a streamlined process for making informed lending decisions.

Who typically needs to complete a Credit Check Authorization Form?

Individuals applying for loans, rentals, or any financial service that requires a review of credit history are generally required to complete a Credit Check Authorization Form. This often includes prospective tenants who want to rent an apartment or individuals seeking a personal loan. Completing this form is a standard practice aimed at promoting transparency and trust between parties.

How do I fill out a Credit Check Authorization Form?

Filling out a Credit Check Authorization Form involves providing personal information such as your full name, Social Security number, and current address. You must also include your consent for the lender or service provider to access your credit report. It’s important to ensure that all information is accurate and up-to-date to facilitate a smooth credit check process.

Can I revoke my authorization after submitting a Credit Check Authorization Form?

Yes, you can revoke your authorization after submitting a Credit Check Authorization Form, but it is important to do so formally and in writing. If you decide to withdraw consent, notify the entity that requested the credit check as soon as possible. Keep in mind that revocation may affect your application or agreement status, so it’s advisable to understand the implications beforehand.

How long is a Credit Check Authorization Form valid?

The validity of a Credit Check Authorization Form typically depends on the policies of the lender or service provider. Generally, it remains effective until the purpose of the credit check has been fulfilled or until you revoke your consent. Always check with the requesting organization for their specific timeframe and policies related to the use of the form.

Where can I get a Credit Check Authorization Form?

Credit Check Authorization Forms can often be obtained directly from lenders, leasing agents, or various online document platforms such as pdfFiller. These platforms provide customizable templates that ensure compliance with legal requirements. Utilizing a reputable service like pdfFiller can simplify the process and enhance your document management experience.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

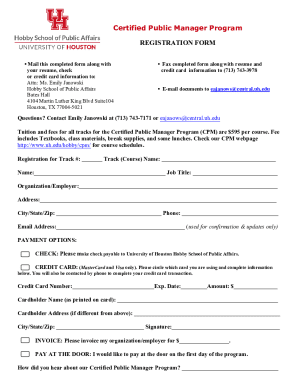

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.