Last updated on Feb 17, 2026

Get the free payslip template form

Show details

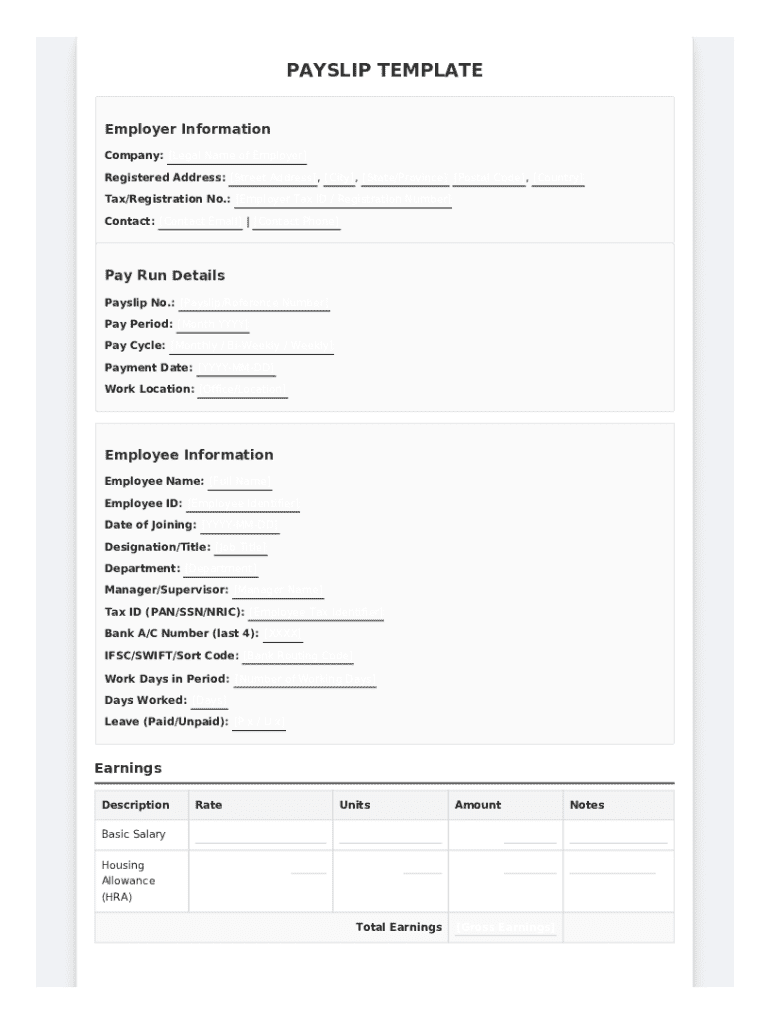

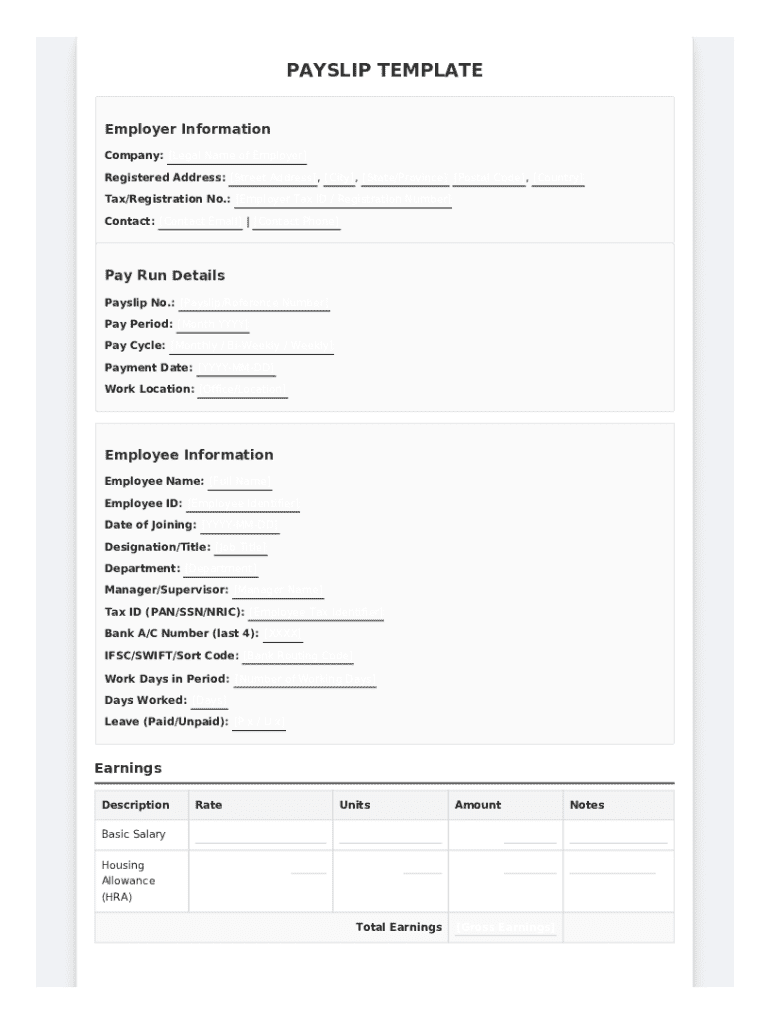

A standardized document provided to an employee detailing their earnings and deductions for a specific pay period. It itemizes gross pay, taxes, insurance premiums, and net pay.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is payslip template

A payslip template is a pre-structured document that outlines an employee's earnings, deductions, and net pay for a specific pay period.

pdfFiller scores top ratings on review platforms

Satisfied with established commonly used forms. Helped me without having to invent a similar form

Awesome way to edit a document!

IT WAS A BIT CONFUSING AT FIRST BUT IT WAS EASY ONCE YOU GET THE HANG OF IT

Very good website

Great

very easy to use. great for business people, a little expensive for an average user.

Who needs payslip template form?

Explore how professionals across industries use pdfFiller.

How to create and manage an effective payslip template form

TL;DR: How to fill out a payslip template form

To effectively fill out a payslip template form, gather all necessary employer and employee information, including pay run details, earnings, and deductions. Utilize standardized components to ensure compliance and accuracy, and make adjustments where necessary for customization. Use tools like pdfFiller to streamline the process and keep everything organized.

Understanding the payslip template

A payslip template is a standardized document that summarizes an employee's earnings along with deductions for a specific pay period. Its primary purpose is to provide employees with clear insights into their wages, taxes, and other deductions, thereby enhancing transparency between employers and employees. Utilizing a standardized payslip template greatly benefits both parties by ensuring consistency and compliance with labor regulations.

pdfFiller offers powerful tools for creating and managing customized payslip templates, allowing easy access and modification whenever necessary.

What are the components of a payslip template?

-

This includes the company name, address, contact information, and tax identification number.

-

Details such as pay period, date of payment, and total hours worked are vital for clarity.

-

Information regarding the employee such as name, employee ID, and position must be included.

-

A detailed list of earnings, consisting of hourly wages, bonuses, and overtime pay.

-

This section comprises deductions for taxes, social security, health insurance, and retirement contributions.

-

This final item lists the total amount the employee takes home after all deductions.

How do you fill out the payslip template?

Filling out a payslip template accurately is crucial for both compliance and employee satisfaction. Start by gathering all necessary data accurately, ensuring you fill in each section as required, from employer information through to net pay. Miscalculations can lead to dissatisfaction and potential legal issues.

When entering earnings and deductions, take your time to ensure precision and consider using automated tools or calculators to help with calculations. Additionally, it’s recommended to double-check all entries before finalizing the payslip.

How to use pdfFiller for payslip management?

-

Simply upload your existing payslip template and use pdfFiller’s editing tools to personalize it to your needs.

-

pdfFiller allows multiple users to sign and collaborate on documents, ensuring streamlined communication.

-

With pdfFiller’s cloud platform, review changes over time, maintaining a clear record of all document versions.

What are the compliance and best practices?

Employers must be aware of regional compliance requirements for issuing payslips, as variances in laws exist, such as requirements for itemized deductions or specific formats for payslips. Following best practices helps create accurate and timely payslips.

-

Always check the latest compliance information relevant to your region; ensure payslips are distributed on time; and consider utilizing professional payroll software.

-

Non-compliance can lead to legal actions, fines, or loss of employee trust; hence, proactively addressing compliance is essential.

Why customize your payslip template?

Customizing payslip templates can enhance brand identity and ensure they meet specific company needs. By adding or removing fields, businesses can focus on what’s important to them. Personalization through branding elements such as logos and company colors can also create a professional touch.

-

Improved clarity for employees and professionalism overall can make a strong impact on employee relations.

-

Use pdfFiller’s intuitive drag-and-drop design tools to easily add or remove fields and incorporate branding elements.

How to troubleshoot common issues?

Common mistakes when filling out a payslip template include missing information or inaccuracies in calculations. It's important to have a checklist for verification after filling out the document.

If you find errors post-filling, you can utilize pdfFiller to edit the filled payslip easily. The streamlined process allows for quick adjustments to rectify mistakes, keeping your payroll operations smooth and compliant with best practices.

What other templates can you explore?

-

pdfFiller offers a variety of templates, including salary statements and expense reports, which can be extremely useful for comprehensive financial management.

-

Understanding the differences between various financial documents can help ensure the right templates are used in conjunction with payslips.

-

Find and use these documents directly on the pdfFiller platform, simplifying the process.

How to fill out the payslip template form

-

1.Open the payslip template on pdfFiller.

-

2.Begin by entering the company name and logo at the top of the template.

-

3.Fill in the employee's details, including full name, address, and employee ID.

-

4.Input the pay period dates for which the payslip is being issued.

-

5.Enter the total hours worked and the applicable pay rate.

-

6.List out any bonuses, overtime, or additional earnings for that period.

-

7.Detail the deductions such as taxes, insurance, and retirement contributions.

-

8.Calculate the net pay by subtracting total deductions from total earnings.

-

9.Review all information for accuracy and make any necessary adjustments.

-

10.Finally, save the completed payslip and print or distribute it to the employee.

What is a Payslip Template and why is it important?

A Payslip Template is a formatted document that outlines an employee's earnings, deductions, and net pay for a specific pay period. Utilizing a Payslip Template is crucial for maintaining transparency within the employer-employee relationship, ensuring that all financial transactions are documented clearly. This template helps avoid misunderstandings regarding compensation while making it easy to keep accurate payroll records.

How can I create a customized Payslip Template?

Creating a customized Payslip Template is straightforward, especially with tools like pdfFiller. You can start with a pre-designed template, making necessary adjustments to align with your company’s branding and specific payroll requirements. By utilizing the versatile features offered by pdfFiller, you can easily add your logo, change colors, and modify sections to include unique deductions or bonuses tailored to your workforce.

Is it easy to edit a Payslip Template once it’s created?

Yes, editing a Payslip Template is incredibly easy with pdfFiller’s user-friendly interface. You can make changes on the fly, whether it’s updating employee information, adjusting pay rates, or adding new line items. This flexibility ensures your payslips remain up-to-date and accurate, which is essential for payroll compliance and employee satisfaction.

Can I use a Payslip Template for different types of employees?

Absolutely! A well-designed Payslip Template can accommodate various employee types, including full-time, part-time, and contract workers. You can customize the template to reflect different pay structures, such as hourly versus salaried, and include specific deductions relevant to each employee type. This versatility makes the Payslip Template a valuable tool for any business managing a diverse workforce.

What features should I look for in a Payslip Template?

When selecting a Payslip Template, look for features like automatic calculations, customizable fields, and the ability to save and reuse templates. The ideal Payslip Template should also be compatible with various file formats, ensuring you can download and share it easily. Additionally, consider templates that allow for secure e-signatures to facilitate quick approvals if needed.

How can a Payslip Template benefit remote teams?

A Payslip Template is especially beneficial for remote teams as it allows for quick access and distribution of payroll information regardless of location. By using a cloud-based solution like pdfFiller, team leaders can securely generate and share payslips electronically, ensuring everyone receives their compensation details on time. This not only enhances efficiency but also supports transparency within virtual working environments.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.