NY DTF FT-943 2025 free printable template

Get, Create, Make and Sign NY DTF FT-943

Editing NY DTF FT-943 online

Uncompromising security for your PDF editing and eSignature needs

NY DTF FT-943 Form Versions

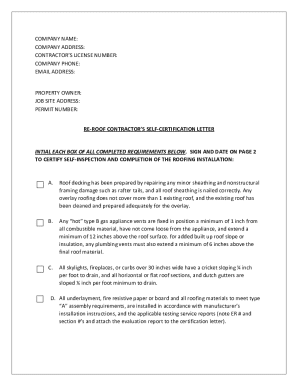

How to fill out NY DTF FT-943

How to fill out form ft-943 quarterly inventory

Who needs form ft-943 quarterly inventory?

A Comprehensive Guide to the FT-943 Quarterly Inventory Form

Understanding the FT-943 quarterly inventory form

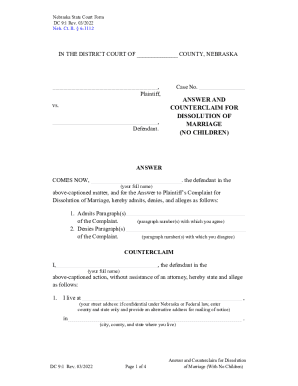

The FT-943 Quarterly Inventory Form is an essential document utilized by businesses to report their inventory quantitatively every quarter. Its significance cannot be overstated, as it allows companies to maintain accurate records of their inventory levels, which is crucial for both financial analysis and tax compliance.

Typically, businesses involved in the sale of goods, especially retail and wholesale entities, are required to file the FT-943 form. This regulation exists to ensure that the revenue generated from inventory sales is properly recorded and taxed, providing a transparent view of a company’s financial health.

The FT-943 includes various sections aimed at capturing comprehensive details about inventory levels, sales, and cost of goods sold (COGS). Accuracy in completing this form is paramount, as errors can lead to issues with tax filings and future audits.

Preparing to fill the FT-943 form

To effectively fill out the FT-943 form, gathering the necessary documentation is the first step. Essential records include previous inventory lists, sales receipts for the quarter, and any adjusting journal entries that may have impacted inventory value. These documents not only aid in accurate reporting but also serve as references if discrepancies arise during audits.

Familiarity with inventory terminology is equally important. Common terms include:

Understanding these terms and standard accounting practices related to inventory management can significantly ease the process of completing the FT-943 form.

Step-by-step guide to completing the FT-943 form

Completing the FT-943 form involves meticulous record-keeping and reporting, primarily divided into three major sections.

Section 1 focuses on the monthly inventory breakdown. In this section, businesses must report their inventory levels for each month within the quarterly period. It's vital to ensure that the reported figures accurately reflect physical counts to avoid common pitfalls. Two prevalent errors include balancing discrepancies, where the calculated COGS does not match inventory changes, and estimating issues that arise when not all inventory is accounted for.

Section 2 entails calculating cost of goods sold (COGS). The COGS formula generally is:

An example will illustrate how this works. If a company has a beginning inventory of $10,000, purchases an additional $5,000 worth of stock, and ends the quarter with an inventory of $7,000, the COGS would be calculated as follows: $10,000 + $5,000 - $7,000 = $8,000.

Section 3 is essential for adjustments and reconciliation. It is crucial to account for any damaged or unsold inventory in your records. When discrepancies in inventory counts arise, steps must be taken to reconcile these figures with physical counts and sales records to ensure all data captured accurately represents the business’s situation.

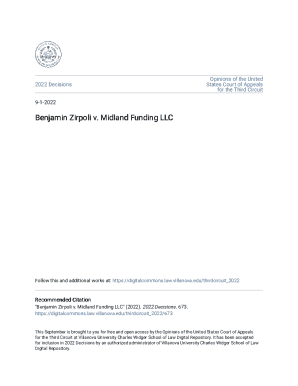

Editing and managing your FT-943 form

pdfFiller provides user-friendly tools for editing the FT-943 form. Utilizing pdfFiller allows individuals and teams to make real-time changes to form fields, ensuring that all information is up-to-date. The cloud-based platform also offers benefits like collaboration features, where multiple users can access and edit the document simultaneously without the hassle of emailing files back and forth.

Another great feature is the electronic signature capability. Users can easily add an eSignature to the FT-943 form. The legal implications of eSignatures are recognized across many jurisdictions, though it’s important to check local laws for compliance. In most cases, as long as consent is given, electronic signatures hold the same legal standing as traditional handwritten signatures.

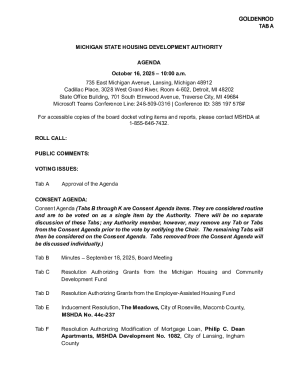

Tips for effective inventory management

Effective inventory management is critical for ensuring the accurate completion of the FT-943 quarterly inventory form. One of the best practices is to regularly update inventory records to reflect real-time data. This includes tracking sales and new purchases as they occur, rather than waiting until the end of the quarter. Such initiatives can help minimize discrepancies and errors.

Additionally, leveraging technology can streamline processes. Many cloud-based tools, like those offered by pdfFiller, integrate seamlessly with other management systems, improving overall efficiency. These tools can automate data collection from various sources, thus reducing manual entry errors and improving the accuracy of your FT-943 form.

Frequently asked questions (FAQs) about the FT-943 form

Businesses often face various issues while completing the FT-943 form. One common issue is when annual data doesn't align with quarterly reporting figures. To resolve this, ensure meticulous record-keeping throughout the year and regularly reconcile the quarterly data with annual totals.

Another frequent concern involves discrepancies in inventory counts. When this happens, it's crucial to perform a physical count and compare it to your recorded figures. If inconsistencies are found, adjustments should be made to ensure the FT-943 form reflects accurate data.

Additionally, understanding tax implications connected to inventory reporting is vital. How inventory is reported can directly affect tax obligations. Being aware of any exemptions or considerations that might apply can save businesses money and prevent complications during audits.

Case studies: real-world applications of the FT-943 form

Examining real-world applications can provide insights into the successful management of inventory through the FT-943 form. For instance, Business A integrated the FT-943 into their quarterly reporting process effectively, utilizing pdfFiller to maintain an organized and up-to-date approach. This visibility allowed them to stay ahead of discrepancies and make informed decisions about restocking and sales strategies.

Conversely, Business B encountered challenges with their quarterly reporting due to a lack of regular inventory updates. This resulted in significant discrepancies between their estimated inventory and the actual counts. By transitioning to pdfFiller's cloud-based solution and focusing on improving their processes, they were able to rectify these challenges, showcasing the transformative power of leveraging technology for inventory management.

Contacting support and resources

For assistance with the FT-943 form, businesses can contact their local Department of Taxation and Finance. They often provide resources and guides to help navigate the reporting process. Furthermore, inquiries regarding specific form-related questions can also be directed towards professional accounting services for personalized support.

Additionally, businesses can benefit from further learning opportunities, such as workshops or webinars on quarterly inventory management. Engaging with communities or forums centered around inventory management can offer users invaluable insights, best practices, and a chance to exchange experiences to continuously improve their inventory processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NY DTF FT-943 from Google Drive?

Where do I find NY DTF FT-943?

How do I fill out NY DTF FT-943 on an Android device?

What is form ft-943 quarterly inventory?

Who is required to file form ft-943 quarterly inventory?

How to fill out form ft-943 quarterly inventory?

What is the purpose of form ft-943 quarterly inventory?

What information must be reported on form ft-943 quarterly inventory?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.