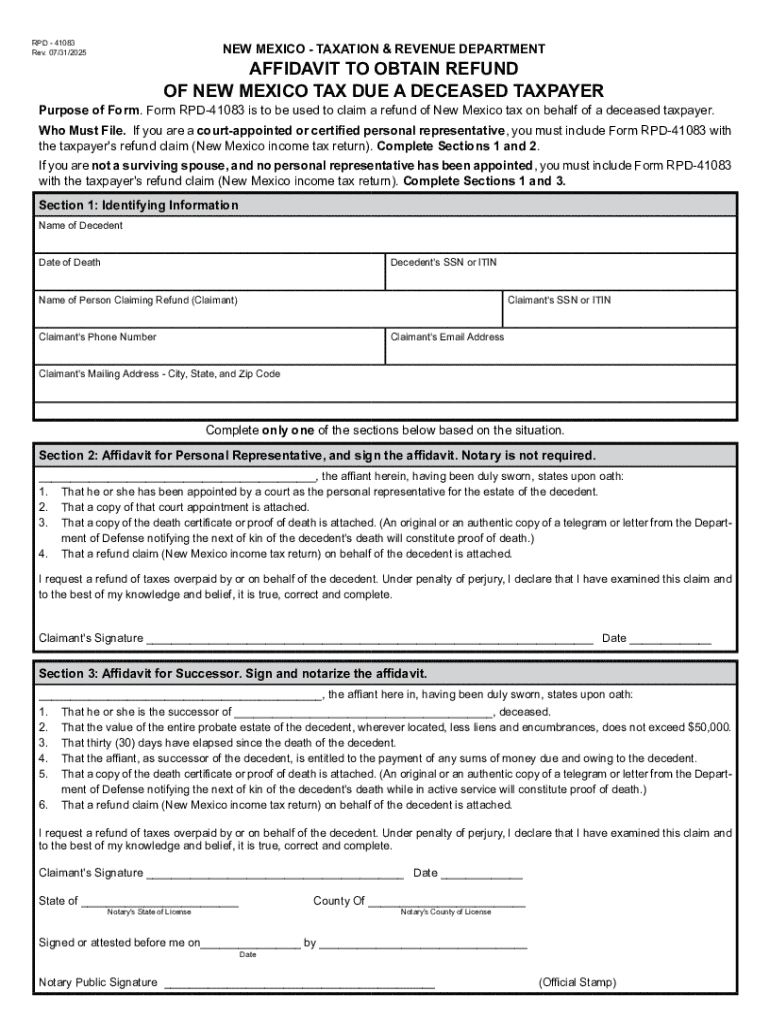

NM TRD RPD-41083 2025 free printable template

Get, Create, Make and Sign NM TRD RPD-41083

Editing NM TRD RPD-41083 online

Uncompromising security for your PDF editing and eSignature needs

NM TRD RPD-41083 Form Versions

Form: A Comprehensive How-to Guide

Understanding the concept of forms

Forms are structured documents designed to gather information or facilitate transactions across various fields—business, personal, and legal. They serve as essential tools for communication, ensuring that all necessary data is collected efficiently and accurately. Within a business context, forms streamline processes that impact everything from employee onboarding to customer feedback. In legal settings, they can establish agreements and protect rights, while in healthcare, forms help manage patient data and consent.

The types of forms you encounter can be categorized broadly into legal, medical, and financial forms. Each type serves a distinct purpose:

The importance of using online forms

Adopting digital forms over traditional paper formats has numerous advantages. Firstly, online forms improve accessibility and convenience, allowing users to fill them out from any device, anywhere. This is particularly beneficial for teams that work remotely or need to gather information from various locations. Additionally, digital forms are faster; they eliminate the time-consuming process of printing, distributing, and collecting paper forms.

Furthermore, turning to digital forms positively impacts the environment by reducing paper waste—a crucial consideration in today's eco-conscious society. With a significant percentage of business operations moving online, digital forms represent not just a trend but an essential adaptation to modern workflows.

Security is another critical aspect of online forms. They often feature encryption, secure access controls, and adhere to data protection regulations such as GDPR, ensuring that sensitive information remains confidential.

Creating forms with pdfFiller

Creating forms with pdfFiller is intuitive and straightforward. Begin by logging into your pdfFiller account, where a user-friendly interface awaits. The first step is choosing the right template from a vast library tailored to various uses, creating a strong foundation for your form.

Next, you can customize your form using interactive tools that allow you to add various fields such as text boxes, checkboxes, and signature lines. This customization is an opportunity to reflect your branding by adding logos and color schemes, helping to ensure consistency across your documents.

After customization, it's crucial to preview your form. Reviewing before finalizing ensures that all fields work as intended and that the layout meets your expectations.

Filling out and managing forms

Filling out forms can often be an arduous task, but pdfFiller offers features to streamline this process. Users can take advantage of bulk filling and auto-fill options, allowing for rapid completion of repetitive fields. Interactive elements like drop-down menus and pre-filled fields significantly enhance user experience.

Managing forms post-creation is equally vital. Sometimes you may need to edit a form after it has been filled out—be it for correcting errors or updating information. pdfFiller enables easy editing of forms, allowing users to make changes swiftly and maintain accuracy.

Signing forms securely

The electronic signature, or eSignature, process is a pivotal feature in today's digital document solutions. In pdfFiller, signing your forms is straightforward, with instruction provided to ensure that the eSignature holds legal validity in court.

You can easily collect signatures from others, sending forms directly from pdfFiller for their signatures, which simplifies the workflow. This collaborative approach not only saves time but also enhances accountability, ensuring everyone involved can track the status of document signatures.

Collaborating on forms

Collaboration features in pdfFiller allow teams to share forms effortlessly. You can invite team members to work on a document in real-time, fostering a collaborative environment that enhances productivity. With tools for real-time editing, commenting, and notifications, all users stay informed and involved throughout the document workflow.

Tracking changes and obtaining feedback is straightforward through version history features. Users can see who made specific changes and revert to previous versions if necessary, making collaboration not just seamless, but also secure.

Managing and storing your forms

Once forms are submitted, organizing them efficiently is paramount. pdfFiller offers a robust file management system, equipped with tagging and categorization features that streamline form retrieval. You can quickly locate specific documents, ensuring that vital information is always at your fingertips.

Furthermore, pdfFiller allows users to export forms into various formats such as PDF or Word, enhancing flexibility in document management. Cloud storage solutions enable secure backups, ensuring that you never lose critical forms while providing easy access from anywhere.

Frequently asked questions (FAQs)

Navigating any new technology can be challenging. Therefore, addressing common issues is essential. Users often encounter technical difficulties, such as issues with account access or submission errors. These challenges can typically be resolved through the comprehensive help section provided by pdfFiller, which guides users through troubleshooting processes.

Form sharing and collaboration can raise questions too. Users may be uncertain about permissions or the best practices in collaborative settings. pdfFiller’s support offers tips and best practices to maximize efficiency when working on shared forms, ensuring everyone involved understands their roles.

Success stories: How teams have benefited from form solutions

Numerous organizations have experienced significant transformations through the implementation of pdfFiller. For instance, a mid-sized retail company improved their workflow by 40% by switching from traditional paper forms to interactive digital formats. The integration enabled them to enhance their task management and oversight capabilities, leading to better compliance with market share expectations.

Another success story involves a healthcare provider who streamlined patient intake processes using pdfFiller. They reported increased patient satisfaction due to faster processing times and reduced paperwork hassle, which ultimately improved compliance with medical standards.

People Also Ask about

How do I get a New Mexico state tax ID number?

Who is required to file a NM tax return?

What is the New Mexico withholding form?

What is a RPD 41359 form?

Who needs a New Mexico CRS number?

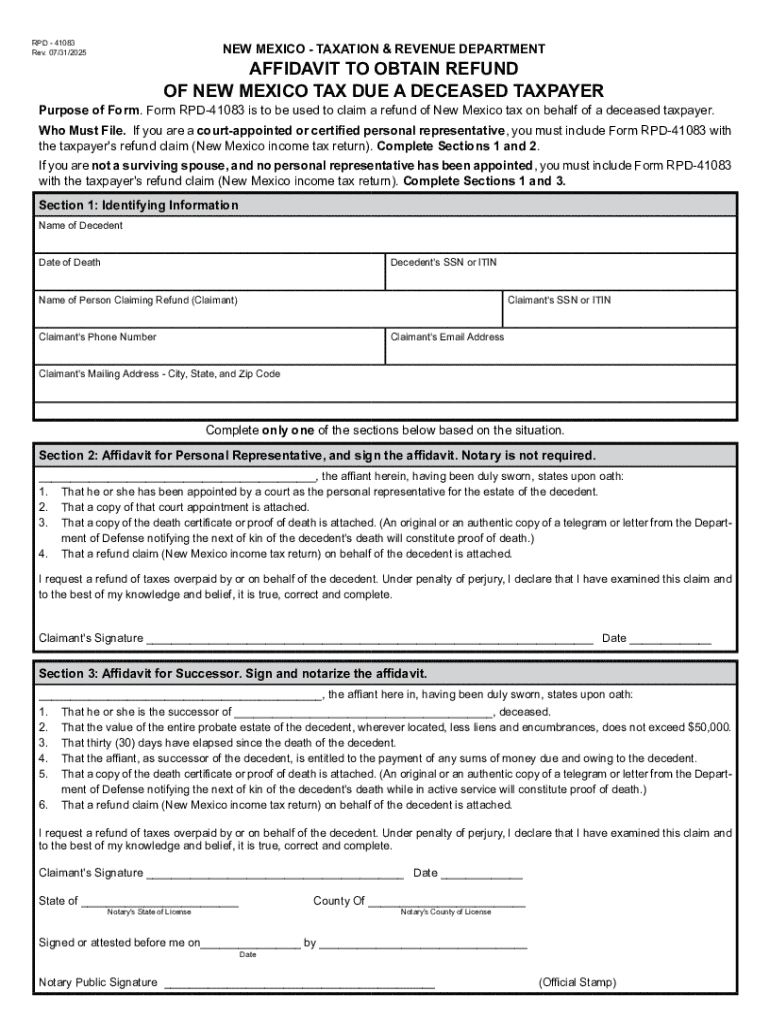

What is NM tax form RPD 41083?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get NM TRD RPD-41083?

Can I sign the NM TRD RPD-41083 electronically in Chrome?

How do I edit NM TRD RPD-41083 on an Android device?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.