Comprehensive Guide to Form 1099-PATR Rev April Form

Understanding Form 1099-PATR

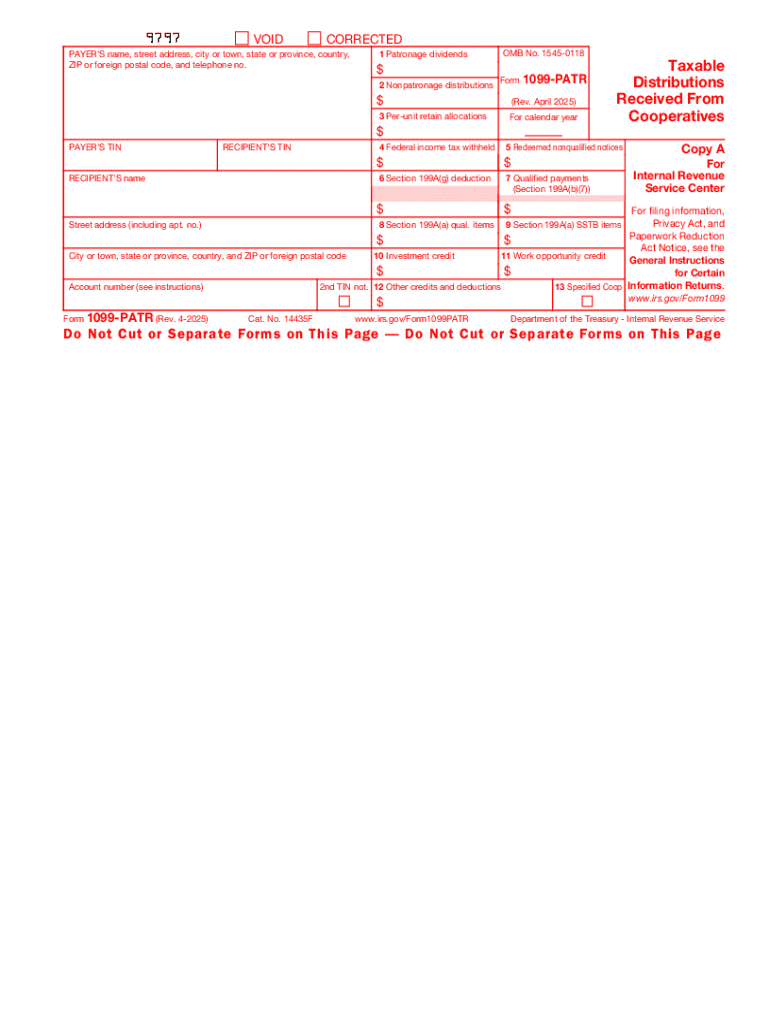

Form 1099-PATR is a crucial document used primarily by cooperatives to report patronage dividends paid to their members. This form serves the purpose of ensuring that members are aware of the taxable income they may need to report when filing their individual tax returns. Certified under the Internal Revenue Code, the form mandates specific reporting requirements aimed at maintaining transparency in financial dealings between cooperatives and their patrons.

Cooperatives are entities that jointly own and operate businesses, and they often distribute profits back to members in the form of patronage dividends. These distributions are not limited to cash; they may include stock dividends or other property. Understanding Form 1099-PATR's role in reporting these distributions is essential for tax compliance and ensuring that members correctly acknowledge their income.

Form 1099-PATR assists in reporting patronage dividends to ensure members understand their tax obligations.

It is mandatory for cooperatives that have paid out patronage dividends exceeding $10 to issue this form to their members.

The form is typically provided to members by January 31st of the following tax year.

Key dates and deadlines

Filing deadlines for Form 1099-PATR play a significant role in ensuring compliance with IRS regulations. The IRS specifies that cooperatives must submit the Form 1099-PATR to the IRS by the end of February for paper submissions and by the end of March if e-filing is utilized. Additionally, cooperatives must provide copies of the form to recipients by January 31st to ensure members have sufficient time to report their income.

It's also essential to be aware of state-specific deadlines, as some states may require different filing schedules or formats. Phillips State, for instance, mandates an additional filing of the 1099 forms by March 15th, thus requiring cooperatives operating in such jurisdictions to stay vigilant and adhere to local regulations to avoid potential penalties.

January 31: Deadline for providing the completed Form 1099-PATR to recipients.

February 28: Deadline for submitting paper forms to the IRS.

March 31: Deadline for electronically filing Form 1099-PATR with the IRS.

Failing to meet these deadlines can result in penalties ranging from $50 to $270 per form, escalating based on how late the form is filed. Additionally, members who fail to receive their form on time may face challenges when reporting their income, potentially leading to discrepancies in their tax filings.

Preparing to complete your form 1099-PATR

A successful completion of Form 1099-PATR requires gathering specific information both from the recipients and the cooperative itself. Cooperatives should collect the recipients' names, addresses, taxpayer identification numbers (TIN), and amounts of patronage dividends distributed. This information ensures accuracy and compliance, reducing the likelihood of any discrepancies or IRS penalties.

Additionally, cooperatives must input their details, including their EIN (Employer Identification Number) and other relevant financial information. It's beneficial to establish a systematic way of recording these details to streamline the filing process. Properly understanding what each box on the Form 1099-PATR requires can significantly ease the completion process and ensure accurate reporting.

Recipient information: Names, addresses, and TINs.

Amount of patronage dividends paid or distributed.

Cooperative's EIN and other identifying information.

Familiarity with the specific sections of the form can help facilitate accurate reporting. A comprehensive understanding of common terms and codes used in the form enhances clarity and compliance. Common boxes include Box 1 for patronage dividends, Box 2 for taxable distributions, and others related to specific types of dividends.

Step-by-step guide to filling out form 1099-PATR

To start the process of filling out Form 1099-PATR, cooperative representatives can access the form through various means. The IRS website offers a free downloadable version of the form, or users can utilize pdfFiller's online tools to access an interactive template. This flexibility allows users to choose the most convenient method for their specific needs.

Once the form is accessed, entering the required information follows a systematic order. Begin by filling in the payer's information, including the cooperative's name, address, and EIN. Next, input the recipient's details, ensuring names and taxpayer identification numbers are accurate to avoid later issues.

Fill out the cooperative's information accurately.

Enter recipient details, including names and TINs.

Indicate the amount of patronage dividends distributed.

After completing the form sections, review entries to ensure all data is correct. Common errors to avoid include misspelling names, incorrect TINs, and blank fields. Cooperative representatives should compare their records against the entries in the form. This meticulous review enhances the reliability of the filed information.

Signing the form is the final administrative step required before submission, which can be done electronically via pdfFiller. This option provides a convenient solution that maintains the integrity of the document while ensuring compliance with IRS eSignature regulations.

Submitting your form 1099-PATR

Once the Form 1099-PATR is filled out and reviewed, cooperatives need to decide on the method of filing. Options include paper filing, where the completed form is mailed to the IRS, or electronic filing through e-file systems. The choice between these methods can be influenced by several factors including volume of forms, ease, and processing speed.

E-filing generally offers advantages such as faster processing times and immediate confirmation of receipt from the IRS, while paper filing may involve longer processing periods. If opting for paper submission, be mindful of the correct mailing address based on the state of the cooperative or relevant IRS instructions.

Paper filing requires sending forms to the IRS with the appropriate address.

Electronic filing can be done through various online platforms, ensuring swift processing.

Be sure to check state filing requirements if applicable.

Record keeping and compliance

Maintaining accurate records is essential for cooperatives, particularly for compliance but for resolving any discrepancies that may arise during tax audits. The IRS recommends retaining copies of Form 1099-PATR and supporting documents for at least three years after the due date of the form. This ensures that cooperatives have access to the necessary information, should questions arise from either the IRS or recipients.

Cooperatives should develop an organized system to store these documents, both in physical and digital formats. This system increases efficiency when managing annual filings and can reduce stress when the tax season approaches. Adhering to IRS guidelines and remaining updated on regulatory changes regarding Form 1099-PATR is crucial for ensuring compliance and protecting cooperative interests.

Retain copies for at least three years, as recommended by the IRS.

Organize all records clearly, making retrieval easier when needed.

Stay up-to-date with any changes to IRS regulations regarding Form 1099-PATR.

Handling questions and issues

It is common for cooperatives to have questions concerning Form 1099-PATR, from eligibility and filing processes to penalties for non-compliance. A frequently asked questions section can address common concerns, including what to do if a form is submitted incorrectly or how to rectify errors once submitted. Being proactive in seeking answers can save time and complications in the future.

For direct assistance, contacting the IRS is advisable, especially for intricate questions. The IRS provides resources and contact information through its official website. Additionally, utilizing pdfFiller’s support resources can help cooperatives navigate the intricacies of Form 1099-PATR. Comprehensive tutorials and customer service access offer users the tools needed to manage the filing process effectively.

Refer to the IRS for official guidelines and assistance.

Utilize pdfFiller’s support features for additional help.

Keep a record of FAQs to streamline the resolution of common concerns.

Enhancing your document management with pdfFiller

Using pdfFiller provides numerous advantages in managing Form 1099-PATR and other important documents. With its cloud-based platform, pdfFiller allows users to edit PDFs, eSign, and collaborate in real-time. This streamlines workflows significantly, especially for cooperatives that may need to process multiple filings simultaneously or manage teams responsible for compliance.

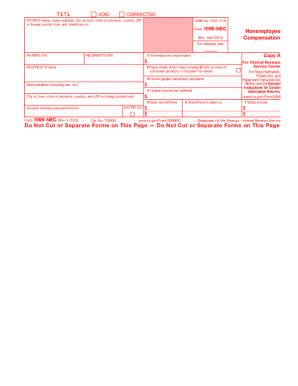

Moreover, pdfFiller's tools extend beyond Form 1099-PATR. The platform supports a range of related forms, such as W-2 or Form 1099-MISC, allowing users to consolidate their document management processes into one efficient system. With its versatile collaborative features, teams can maintain communication and ensure every member involved in the filing process has the most up-to-date information.

Edit, sign, and manage documents all from one platform.

Collaborate effectively with team members regarding multitudes of filings.

Access tailored tools for various tax-related documents.