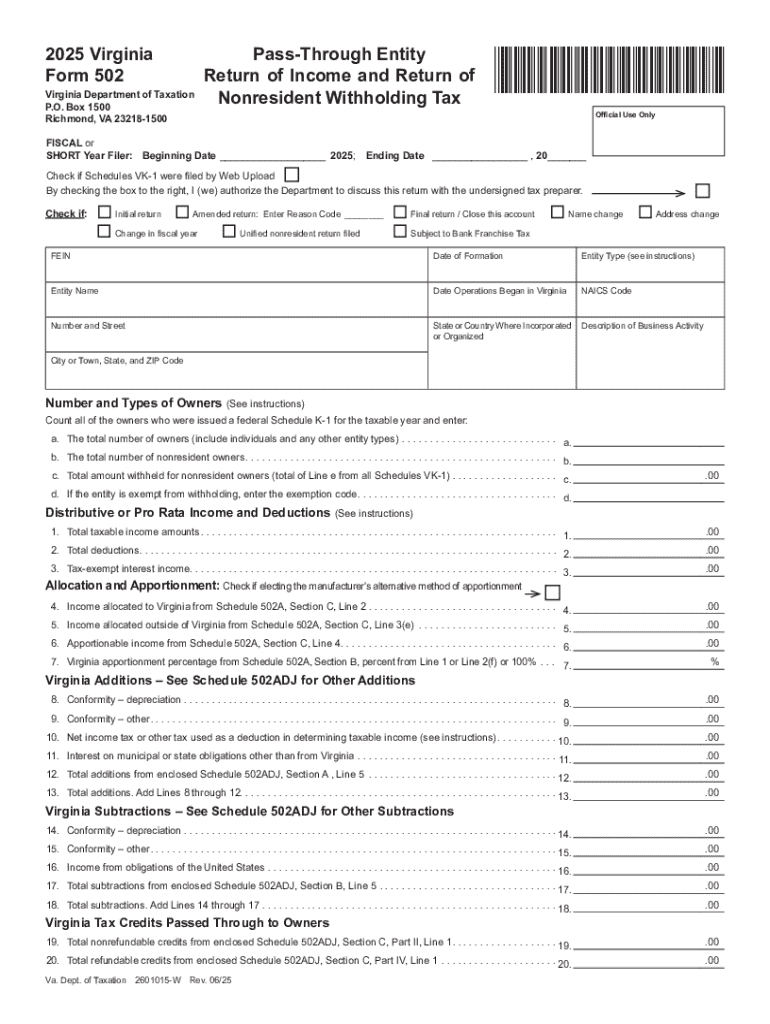

Get the free 2025 Form 502 - Pass-Through Entity Return of Income and Return ...

Get, Create, Make and Sign 2025 form 502

Editing 2025 form 502 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 form 502

How to fill out 2025 form 502

Who needs 2025 form 502?

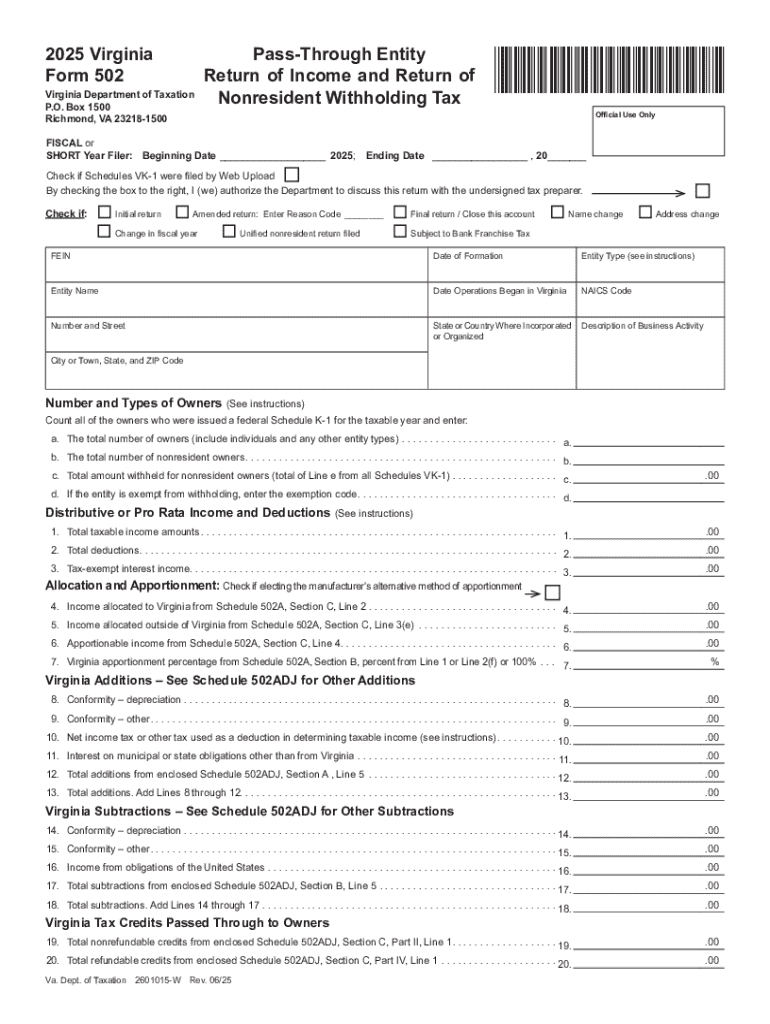

Your Comprehensive Guide to the 2025 Form 502 Form

Understanding the 2025 Form 502 Form

The 2025 Form 502 is an essential document for taxpayers looking to report their income, deductions, and tax credits accurately. As part of the evolving tax landscape, understanding this form is critical for compliance with tax laws in 2025.

In 2025, the Form 502 will include significant changes that address previous loopholes and enhance overall clarity. Whether you're an individual taxpayer or part of a larger team, familiarity with these updates will facilitate smoother filing.

Taxpayers who need to use the 2025 Form 502 include individuals receiving taxable income, small business owners, and anyone claiming applicable deductions or credits. Awareness of eligibility requirements ensures you file correctly.

Accessing the 2025 Form 502

Finding the 2025 Form 502 is now easier than ever. The form is available on the official IRS website and can also be accessed through reliable tax preparation services and document management platforms like pdfFiller.

You have the option to download the form as a PDF or fill it out online. Utilizing online forms can significantly reduce the risk of making errors and help track your progress efficiently.

pdfFiller provides robust features for Form 502, such as templates, import capabilities for prior forms, and built-in calculators that help ensure your entries are precise.

Step-by-step guide to filling out the 2025 Form 502

Filling out the 2025 Form 502 can seem daunting, but breaking it into manageable sections simplifies the process.

Section 1: Personal Information

This section requires details such as your name, address, and Social Security number. Ensure accuracy by double-checking against legal documents.

Use features on pdfFiller to input your information quickly and correctly, minimizing the chances of common errors.

Section 2: Income Reporting

Here, you’ll categorize your income, from wages to investment returns. Understanding the different brackets is pivotal for accurate reporting.

pdfFiller offers income calculation tools, allowing you to track various income types and avoid mathematical mistakes.

Section 3: Deductions and Credits

2025 introduces several new deductions, including those related to educational expenses and healthcare. Make sure to familiarize yourself with these.

Utilize pdfFiller's deduction helper to navigate the various categories, ensuring that you do not overlook potential savings.

Section 4: Final Review

After completing each section, a thorough review is imperative. Not only does this help catch errors, but it also ensures that every possible deduction has been claimed.

Editing your 2025 Form 502 with pdfFiller

Once your form is filled out, you may notice areas that require adjustments. pdfFiller provides an intuitive interface that allows users to edit PDFs efficiently.

Using interactive tools can enhance the clarity of your entries and streamline complex sections of the form. Whether it’s changing figures or adding comments, pdfFiller ensures you never lose track.

The collaboration features allow you to share the form with colleagues or accountants for feedback, streamlining the review process before submission.

Signing the 2025 Form 502

Electronic signing (eSigning) has become a necessary step in modern document management. The eSigning process on pdfFiller is straightforward, allowing you to sign your 2025 Form 502 quickly and securely.

To eSign on pdfFiller, simply select the ‘eSign’ option, and follow the prompts. Ensure that you meet legal compliance requirements, as this step confirms the authenticity of your submission.

Submitting your 2025 Form 502

Submitting your Form 502 can be done through various methods, including online submission via tax software or mailing a physical copy. Understanding each method's pros and cons will help you make an informed choice.

To ensure a successful submission, consider these tips:

After submission, tracking your status online can relieve anxiety about whether your form was received and processed.

Managing your 2025 Form 502 after submission

After you submit your 2025 Form 502, organizing your documents is crucial. pdfFiller offers excellent tools for document management, allowing you to store and access your forms easily.

If you need to make changes post-submission, you should know the procedures for amendments. It's a good practice to stay informed about the adjustments applicable to tax documents for your peace of mind.

Frequently asked questions (FAQs)

Navigating the complexities of the 2025 Form 502 may lead to common questions among users.

These questions often arise, and having resources on hand can ensure that you address them efficiently.

User stories and testimonials

The experiences of those who have used the 2025 Form 502 with pdfFiller can be enlightening. Many users report substantial time savings while ensuring accuracy in their filings.

Testimonials highlight how pdfFiller's features lead to a more organized and stress-free filing experience. Individuals and teams alike have benefitted from collaborative tools that facilitate easier feedback and amendments.

Additional tools and resources

For those needing further assistance with the 2025 Form 502, various web resources offer valuable insights. Engaging in webinars and interactive Q&A sessions can provide clarity and expert guidance.

Pagination and related forms

Navigating related forms is simplified with intuitive features on pdfFiller. These links lead to other relevant documents, helping you to stay organized.

Connect with pdfFiller

For personalized support with the 2025 Form 502, connect through pdfFiller's community hub. Here, users can ask questions and share their experiences, fostering a collaborative environment.

pdfFiller provides various services beyond form management, including data privacy features, collaboration tools, and innovative solutions for document workflows.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my 2025 form 502 in Gmail?

How do I edit 2025 form 502 straight from my smartphone?

How do I fill out 2025 form 502 using my mobile device?

What is 2025 form 502?

Who is required to file 2025 form 502?

How to fill out 2025 form 502?

What is the purpose of 2025 form 502?

What information must be reported on 2025 form 502?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.