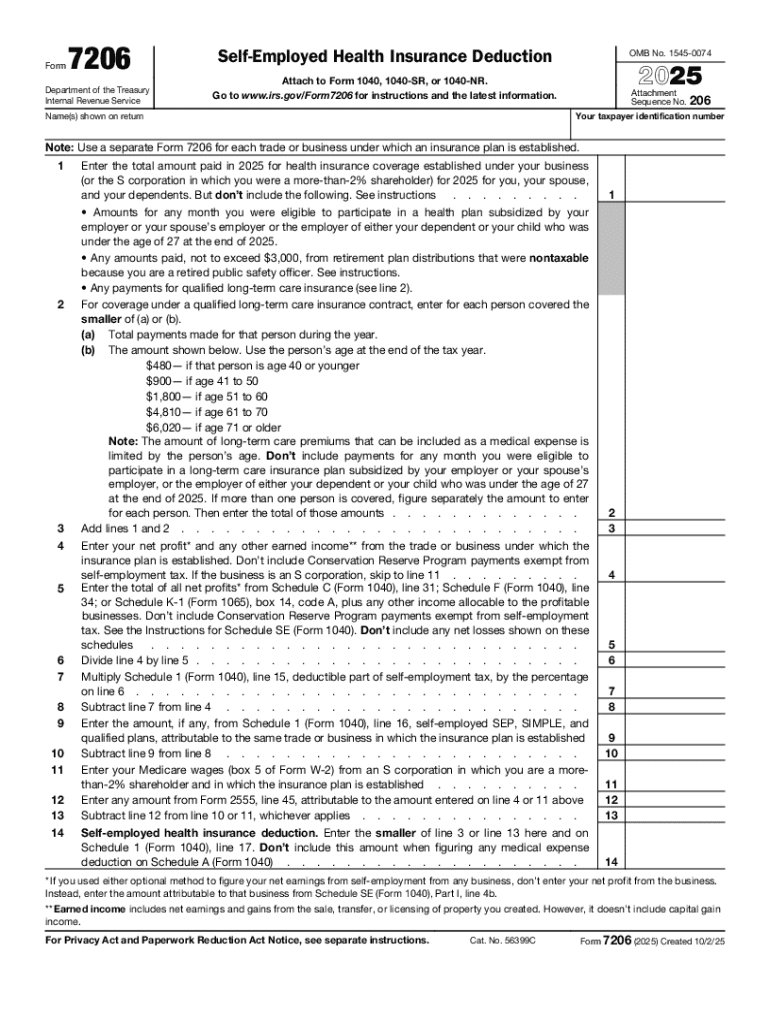

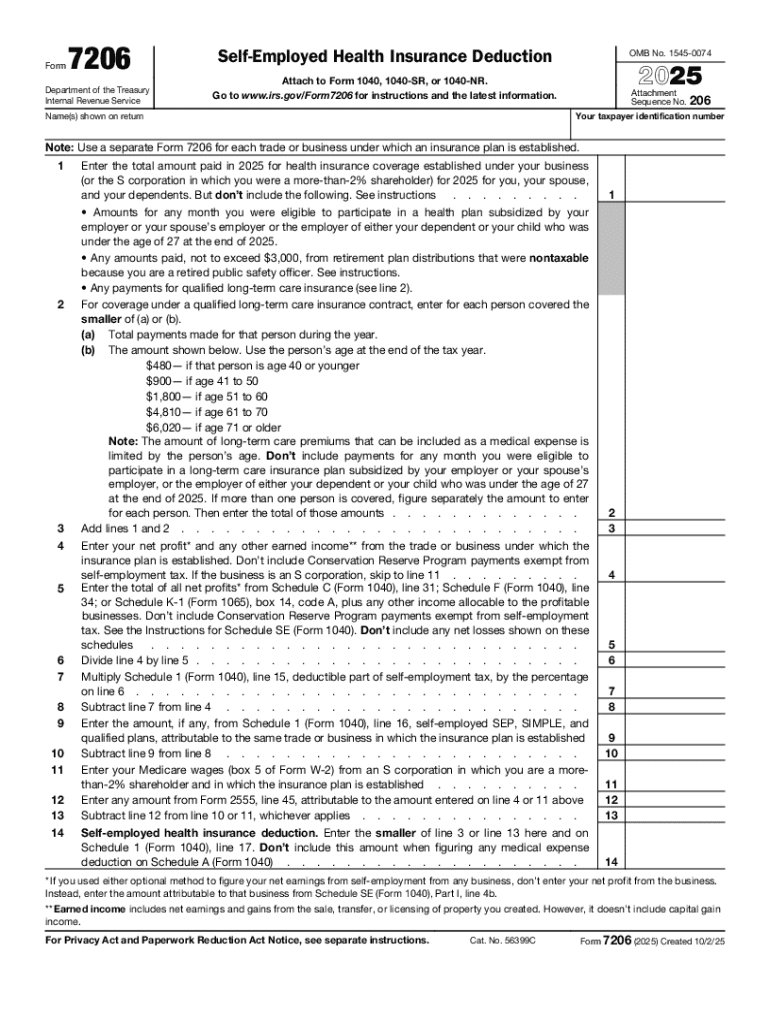

IRS 7206 2025-2026 free printable template

Get, Create, Make and Sign IRS 7206

Editing IRS 7206 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out IRS 7206

How to fill out 2025 form 7206

Who needs 2025 form 7206?

Comprehensive Guide to 2025 Form 7206 Form for S-Corporation Shareholders

Understanding IRS Form 7206

IRS Form 7206 is a critical document for S-Corporation shareholders, specifically designed for reporting self-employed health insurance premiums. This form enables eligible shareholders to claim deductions for health insurance costs, thereby impacting their overall tax obligation. Understanding the intricacies of Form 7206 is essential for proper compliance and optimization of tax benefits.

The form is pivotal not only for individual tax returns but also for ensuring that the S-Corporation meets its obligations under IRS regulations. As S-Corporations can have unique structures, the accurate completion of Form 7206 can reflect advantages in tax planning strategies.

Key features of Form 7206

Form 7206 boasts several unique attributes that distinguish it from other IRS forms. It contains sections specifically tailored for reporting self-employed health insurance premiums, which is integral for S-Corporation shareholders who have direct involvement in their healthcare coverage. These attributes make filling out Form 7206 a necessity in ensuring that health insurance costs are appropriately deducted.

Unlike standard W-2 forms, Form 7206 allows shareholders to formalize deductions that might not be readily apparent on their payroll records, making it a unique tool for tax management.

Filing requirements for Form 7206

Eligibility criteria for filing Form 7206 primarily revolve around whether the taxpayer is a shareholder in an S-Corporation with health insurance premiums to report. Filers must ensure they meet the IRS guidelines, which mandate that only those shareholders actively covered under a health insurance plan qualify.

Necessary documentation includes proof of premium payments and any correspondence with insurance providers. Collecting this information promptly can ease the reporting process come tax season.

Step-by-step guide to completing Form 7206

Completing Form 7206 requires careful attention to detail and organization. Here’s a breakdown of its essential sections:

To avoid common pitfalls, ensure the accuracy of your health insurance amounts. Double-check any math calculations, as errors can lead to penalties or missed deductions.

Important considerations for S-Corporation shareholders

Filing Form 7206 carries significant tax implications for S-Corporation shareholders. Successful filings can reduce personal tax burdens, but it must correlate with W-2 reporting. Thus, understanding how health insurance premiums appear on W-2s is crucial to prevent discrepancies. Shareholders should note that premiums paid on behalf of employees are treated differently than those claimed by shareholders.

Complying with IRS regulations is essential for avoiding penalties. Staying organized throughout the year can simplify the tax preparation process and establish peace of mind.

Common issues faced by filers and how to navigate them

Many filers encounter challenges when detailing health insurance premiums on Form 7206. Misreporting can arise from miscalculating premiums or confusion about which payments qualify. Such inaccuracies could invite penalties, making it imperative to double-check entries throughout the process.

Implementing best practices for tax preparation ensures that your filings remain compliant while maximizing the benefits afforded under IRS guidelines.

Utilizing pdfFiller for Form 7206 management

pdfFiller offers robust tools for managing Form 7206, providing users with features to edit, eSign, and collaborate on documents seamlessly. This online platform is tailored to facilitate efficient workflows, particularly for individuals and teams handling multiple tax forms.

Accessing a cloud-based solution allows users to manage their documents from anywhere, making pdfFiller an ideal choice for remote teams needing flexibility.

Real-world scenarios for filing Form 7206

Successful case studies demonstrate the value of effectively completing Form 7206. Users have reported significant savings in their tax liabilities thanks to meticulous entries, validating the necessity of accurate documentation.

Testimonials affirm that leveraging pdfFiller not only reduces the stress of paperwork but enhances overall compliance efficiency.

Final notes on Form 7206 and your tax obligations

Timely filing of Form 7206 is crucial in maintaining compliance with IRS requirements. Delays can lead to unwanted penalties and interest, heightening the importance of staying organized throughout the year. By implementing strategies to track health insurance premiums, S-Corporation shareholders can minimize their tax burdens effectively.

Successful tax planning involves a proactive approach to document management. Utilizing tools like pdfFiller can ensure that you remain compliant while maximizing the benefits of your S-Corporation structure.

Additional learning resources about Form 7206

The IRS provides a wealth of information regarding Form 7206 on its official website, including guidelines, forms, and instructional videos. These resources can aid shareholders in understanding their obligations and maximizing their benefits effectively. Furthermore, considering additional forms that may be needed can enhance the overall filing process, particularly when it involves employee benefits and health insurance deductions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IRS 7206 directly from Gmail?

Where do I find IRS 7206?

Can I sign the IRS 7206 electronically in Chrome?

What is 2025 form 7206?

Who is required to file 2025 form 7206?

How to fill out 2025 form 7206?

What is the purpose of 2025 form 7206?

What information must be reported on 2025 form 7206?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.