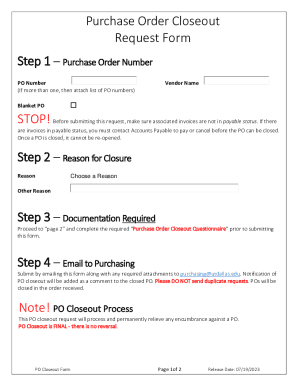

Get the free Form 433-A (OIC) (sp) (Rev. 4-2025)

Get, Create, Make and Sign form 433-a oic sp

How to edit form 433-a oic sp online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 433-a oic sp

How to fill out form 433-a oic sp

Who needs form 433-a oic sp?

A Comprehensive Guide to Form 433-A OIC SP Form

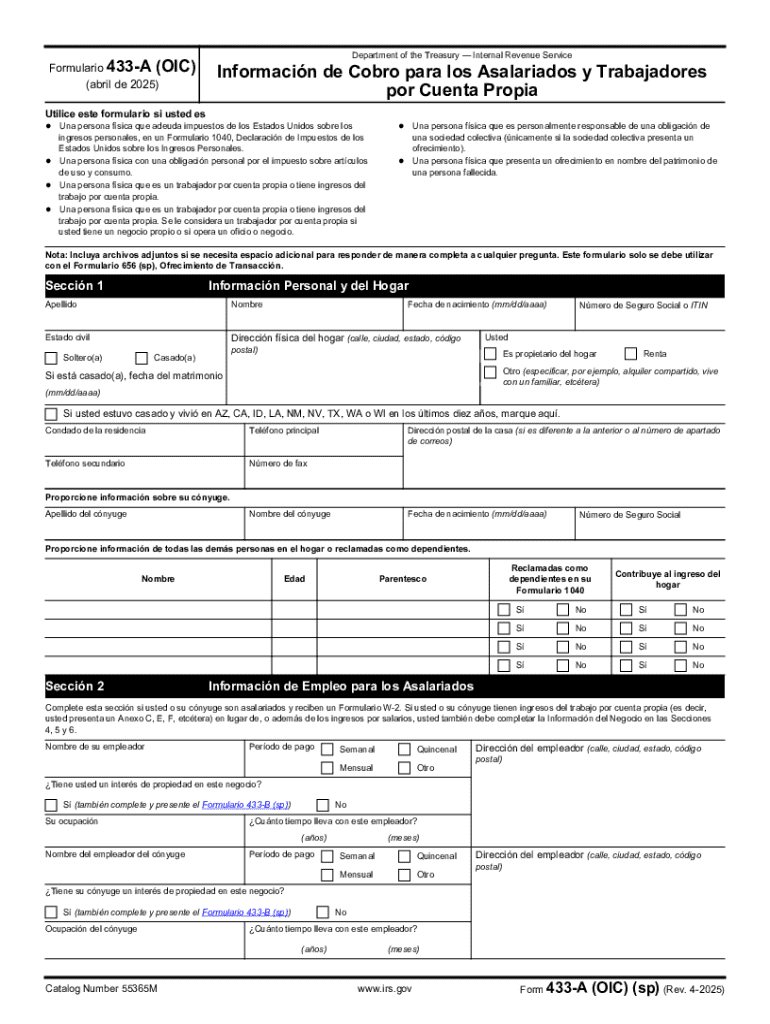

Understanding Form 433-A OIC SP

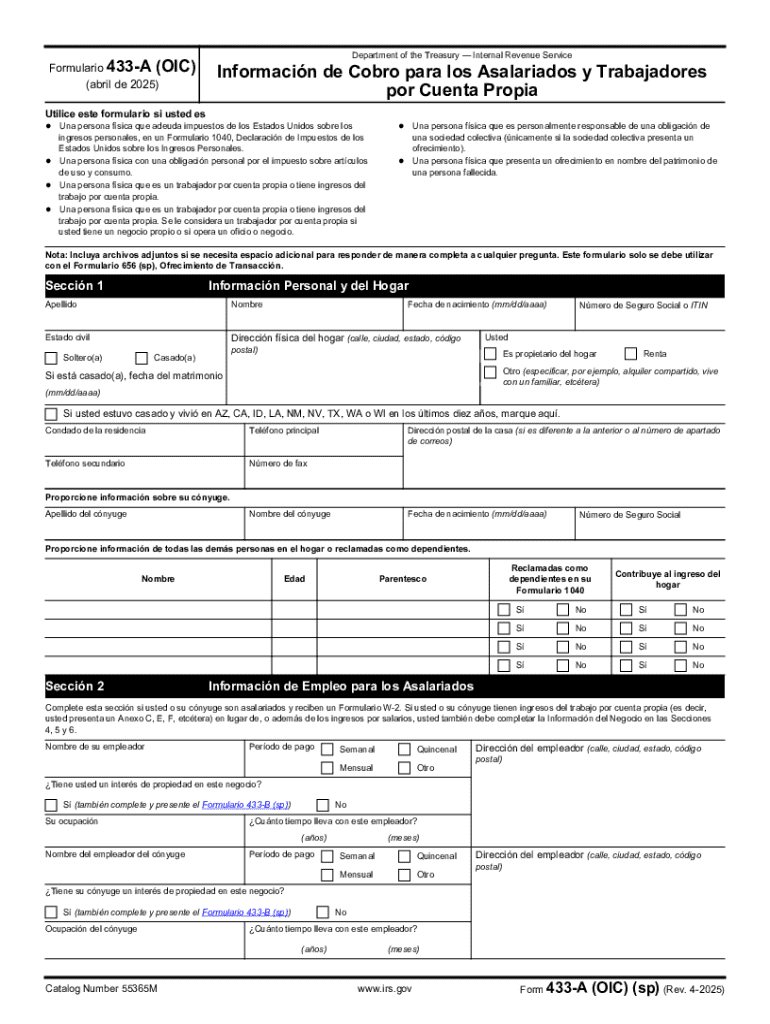

Form 433-A OIC SP is a crucial document used during the Offer in Compromise (OIC) process. This IRS form provides a comprehensive view of a taxpayer's financial situation, which the IRS evaluates to determine if they qualify for an OIC—a lifeline for individuals struggling under the weight of tax debt. By submitting this form, taxpayers disclose their financial information to demonstrate their inability to pay the total tax owed, making it a pivotal component in negotiating a settlement with the IRS.

The importance of Form 433-A OIC SP cannot be overstated. It serves not only as a detailed financial snapshot but also as a method for taxpayers to negotiate a lower tax obligation based on their current circumstances. Individuals facing significant hardship, or complex financial cases, will find that filling out this form accurately is essential to their offer’s success. If you have tax debt you can't reasonably pay, this form may be your first step towards relief.

Who needs to file Form 433-A OIC SP? Generally, any taxpayer looking to submit an Offer in Compromise will need to complete this form. It applies to individuals who find themselves in a financial situation that impedes their ability to pay tax liabilities in full. Understanding your financial standing is a prerequisite for filling out this form effectively.

Key components of Form 433-A OIC SP

The structure of Form 433-A OIC SP is designed to capture a comprehensive overview of your financial situation. Each section of the form plays a critical role in how the IRS assesses your application. The main components include personal information, financial details, and a breakdown of assets and liabilities.

How to fill out Form 433-A OIC SP correctly

Completing Form 433-A OIC SP may seem daunting, but it can be broken down into manageable steps. Start by gathering all required documents, which include recent tax returns, proof of income, and bank statements. These documents will support the information you provide and help ensure accuracy.

Next, fill in your personal information accurately. Include your name, Social Security Number, and contact details to initiate the process. After that, disclose your financial information thoroughly, ensuring all income sources and monthly expenses are detailed accurately to reflect your true financial situation.

When reporting your assets and liabilities, be comprehensive. List all properties and investments alongside any debts and obligations you have. This honest disclosure is critical; inaccurate or incomplete information may jeopardize your offer. Lastly, be aware of common pitfalls including guessing figures, omitting assets, or neglecting to update any changes in your financial situation before submission.

Types of Offers in Compromise (OIC)

The IRS recognizes various types of Offers in Compromise, each tailored to meet different taxpayer circumstances. Understanding these options is crucial for selecting the proper type of OIC applicable to your tax situation.

Choosing the right type of OIC can significantly influence the outcome of your tax resolution. Reflect on your unique circumstances and consider consulting a tax attorney or other tax professional to assist in making the best choice.

Strategies for increased OIC approval chances

Crafting a strong offer is key to increasing your chances of OIC approval. One of the most important factors is to provide a well-substantiated financial history that aligns with your current hardship. Accurate reporting of financial documentation is paramount; make sure your income listings, expense records, and asset declarations are precise.

In situations involving a complex tax case, it may be wise to collaborate with tax professionals who specialize in OIC submissions. Their experience can provide invaluable insight into your obligations, strengths in negotiations, and common IRS expectations. Timeliness is also crucial in the OIC process; missing IRS deadlines may lead to automatic rejection.

What happens after you submit Form 433-A OIC SP?

After submitting Form 433-A OIC SP, you enter a review period where the IRS evaluates your application. This initial period can vary in length, but it's essential to remain patient. Once your application is reviewed, there are several potential outcomes.

Understanding the importance of continued compliance is critical even after submission. Ensure all tax obligations are met while your OIC is under consideration to support your case effectively.

Frequently asked questions (FAQs) on Form 433-A OIC SP

Taxpayers often have questions once they delve into the complexities of Form 433-A OIC SP. One common inquiry is what to do if a mistake is made on the form. If errors are discovered post-submission, it's advisable to contact the IRS promptly to address the oversight. Transparency is key.

Another frequent question centers on processing time. Typically, it may take the IRS several months to process an OIC application. In emergencies, taxpayers have asked whether they can withdraw their OIC after submission. The good news is that it is possible to withdraw your offer if circumstances change or if it no longer serves your interests.

Using pdfFiller for your Form 433-A OIC SP needs

pdfFiller provides an efficient solution for managing Form 433-A OIC SP and other documentation needs. Its platform allows users to easily edit and fill forms online, facilitating a smoother submission process. The ability to eSign documents eliminates the cumbersome task of printing and scanning, making document management streamlined and user-friendly.

Moreover, pdfFiller offers document management tools that enable better tracking and collaboration among team members involved in the OIC submission. Accessible from anywhere, pdfFiller empowers users to have all their files organized and secure in one online location.

Tips for managing your document workflow with pdfFiller

Utilizing a cloud-based document solution like pdfFiller can drastically improve your document workflow. One fundamental tip is to make use of its collaborative capabilities, allowing team members to work together on form preparation. This feature can enhance the accuracy of your submission, minimizing the risk for mistakes.

Furthermore, always prioritize the security of your sensitive financial information. pdfFiller employs advanced security measures to ensure your documents remain protected during the completion process. This vigilance not only helps you comply with necessary guidelines but also fosters trust among all parties involved in your OIC application.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 433-a oic sp?

Can I create an electronic signature for signing my form 433-a oic sp in Gmail?

How do I edit form 433-a oic sp straight from my smartphone?

What is form 433-a oic sp?

Who is required to file form 433-a oic sp?

How to fill out form 433-a oic sp?

What is the purpose of form 433-a oic sp?

What information must be reported on form 433-a oic sp?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.