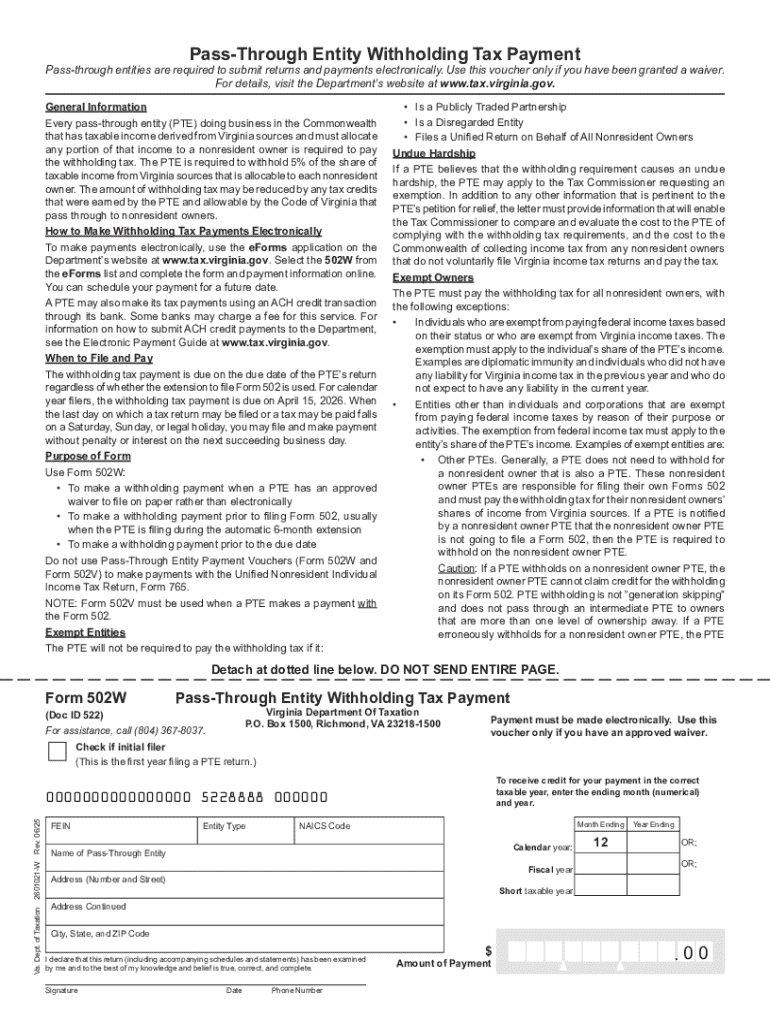

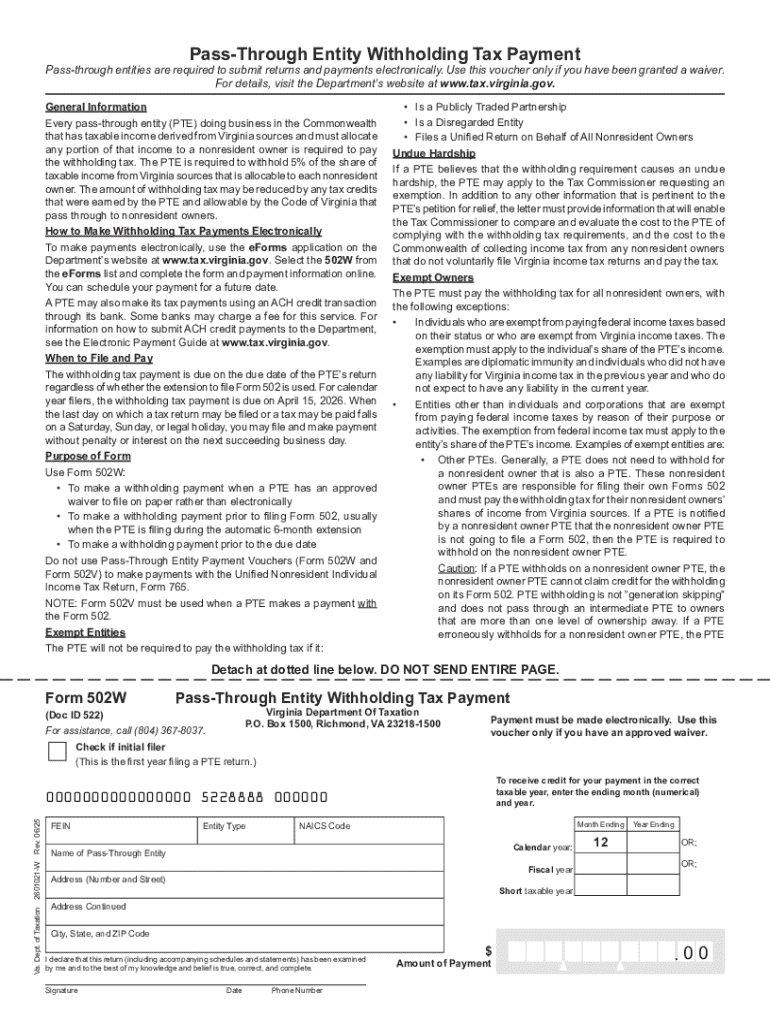

Get the free 2025 Form 502W - Pass-Through Entity Withholding Tax Payment

Get, Create, Make and Sign 2025 form 502w

How to edit 2025 form 502w online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 form 502w

How to fill out 2025 form 502w

Who needs 2025 form 502w?

2025 Form 502W Form - How-to Guide Long-Read

Understanding the 2025 Form 502W

The 2025 Form 502W is a crucial document designed for reporting various aspects of income and fiscal responsibility for both individuals and businesses. This form assists tax authorities in assessing correct tax liabilities, ensuring compliance with tax regulations. Utilizing the 2025 Form 502W is not only essential for adherence to legal requirements but also serves to identify potential credits and deductions applicable to the taxpayer’s situation.

Key deadlines for submitting the 2025 Form 502W are typically aligned with federal and state tax deadlines, often falling around mid-April each year. Failure to submit this form on time can lead to financial penalties. Therefore, it is vital that users remain aware of these deadlines and fulfill their submission obligations as required.

Who needs to use the 2025 Form 502W?

Various individuals and businesses may find themselves required to use the 2025 Form 502W. For individuals, it is especially relevant for those who have earned income that needs to be reported to the IRS. Furthermore, small business owners can leverage this form to accurately report profits, losses, and applicable deductions. Additionally, special scenarios, such as those involving rental income or self-employment, often necessitate the completion of this form to ensure correct tax calculations.

Identifying whether you need this form can depend on your financial activities over the tax year. Users who have complex financial situations, such as multiple income sources or significant deductions, are strongly encouraged to utilize the 2025 Form 502W to ensure accuracy in their reporting.

Preparing to fill out the 2025 Form 502W

Before diving into the intricacies of the 2025 Form 502W, it is crucial to gather all necessary documents and information to streamline the process. Essential documents include W-2 forms from employers, 1099 forms for other income sources, and records of any deductible expenses. Having these documents organized enhances accuracy and facilitates easier review.

It’s equally important to avoid common pitfalls during preparation. A frequent error involves failing to keep accurate records throughout the year, which can lead to misreporting income. Double-checking that all income sources and deductions are accounted for prior to starting the form helps mitigate errors.

Setting up your pdfFiller account

Using pdfFiller can dramatically simplify the process of filling out the 2025 Form 502W. To begin, creating a pdfFiller account is straightforward. Visit their website and select the ‘Sign Up’ option. From there, follow the prompts to input your email and create a password, granting you access to a wealth of document management tools.

Having a pdfFiller account offers numerous benefits, including easy access to fillable templates, document edits, and electronic signatures. This ensures that not only can you fill out the form effectively, but also collaborate with others who may be involved in your tax situation.

Step-by-step instructions for filling out the 2025 Form 502W

Filling out the 2025 Form 502W can feel daunting at first; however, breaking it down section by section makes the task manageable. The first section typically requires your personal information such as name, address, and Social Security number. Ensure that all names are spelled correctly, and contact information is current to avoid delays in processing.

The next critical part of the form focuses on income details. It is essential to report income accurately to prevent issues that could arise from underreporting or miscalculation. Follow the guidelines provided on the form carefully, as this section must reflect all sources of income comprehensively.

There may be additional sections containing special instructions that require careful attention. These instructions often pertain to nuances specific to the taxpayer's situation, making it vital to read thoroughly before submitting your form.

In case you make mistakes while completing the 2025 Form 502W, it’s important to understand how to safely edit and revise your form. Using pdfFiller's editing tools allows you to make necessary corrections without having to restart the process, thus saving time and effort.

Editing and customizing your 2025 Form 502W with pdfFiller

pdfFiller's editing tools are instrumental in customizing the 2025 Form 502W to fit your needs. Annotations and markups can be added seamlessly, allowing for clearer communication when collaborating with others. Additionally, the ability to add or remove sections based on your unique situation can make a significant difference in the clarity and precision of your submission.

If you are part of a team, pdfFiller's collaborative features allow for easy engagement with team members for feedback and input. By sharing the document securely within the platform, you can ensure that everyone involved is on the same page, which can be crucial for accuracy and compliance.

eSigning the 2025 Form 502W

The importance of signatures on the 2025 Form 502W cannot be overstated. Electronic signatures are legally binding, and utilizing them through pdfFiller's eSigning capabilities ensures compliance with legal requirements while saving time. Moreover, eSigning streamlines the submission process, helping you avoid delays.

To add your digital signature in pdfFiller, simply navigate to the eSigning feature, select 'Sign,' and follow the prompts to draw, upload, or type your signature. If multiple signees are involved, pdfFiller provides options to include them seamlessly.

Submitting your 2025 Form 502W

To submit the 2025 Form 502W electronically via pdfFiller, follow the detailed instructions provided on the platform. When you submit electronically, you can track your submission status, providing peace of mind that your form has been received and is being processed. This feature is paramount for ensuring compliance and staying informed.

Should you choose to submit via mail, ensure that you print the completed form clearly and securely. Prepare an envelope marked with the correct destination address as detailed on the form and check that all required documents are included before sending. This method may take longer, but it remains a viable option for those who prefer traditional methods.

Frequently asked questions (FAQs) about the 2025 Form 502W

It’s common for users to have queries and concerns about the 2025 Form 502W. Some frequently asked questions revolve around deadlines, specific documentation required, and common mistakes. By addressing these topics, users can have a better understanding of not only how to fill out the form but the implications and responsibilities associated with it.

Clarifying legal and compliance issues is another critical aspect of the FAQs. It is essential that submissions meet all regulatory standards, which can vary by state and situation, to avoid any potential legal repercussions.

Useful web resources for the 2025 Form 502W

To ensure users have access to the most reliable information, numerous official websites and tools are available to assist with the 2025 Form 502W. These include IRS resources, state tax websites, and community forums dedicated to tax preparation. Engaging with these resources can supplement the insights gathered from pdfFiller.

Additionally, interactive tools like calculators, tax estimators, and fillable PDFs can further simplify the process, providing a more user-friendly experience throughout your tax preparation.

Connect with us

For users seeking personalized help with the 2025 Form 502W, pdfFiller offers robust customer support. You can reach out for assistance via their support channels, where dedicated representatives are available to help clarify any questions you may have.

Engagement through community forums and user groups can foster collaboration, enabling users to share tips, experiences, and advice about navigating the 2025 Form 502W successfully. Such interactions can lead to invaluable insights that enhance your understanding and confidence in handling tax-related documents.

Pagination

For an enhanced user experience while filling out your 2025 Form 502W on pdfFiller, utilize the pagination feature. This helps users navigate through sections easily, allowing for better focus and organization as you complete each part of the form. Effective pagination is particularly beneficial when dealing with complex forms requiring extensive detail.

It’s essential to make use of these navigation tools to find the information you need quickly and efficiently, ultimately improving your form-filling experience. By breaking down the pages, users can approach each section methodically, reducing the chance of errors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2025 form 502w without leaving Google Drive?

How do I execute 2025 form 502w online?

How do I fill out the 2025 form 502w form on my smartphone?

What is 2025 form 502w?

Who is required to file 2025 form 502w?

How to fill out 2025 form 502w?

What is the purpose of 2025 form 502w?

What information must be reported on 2025 form 502w?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.