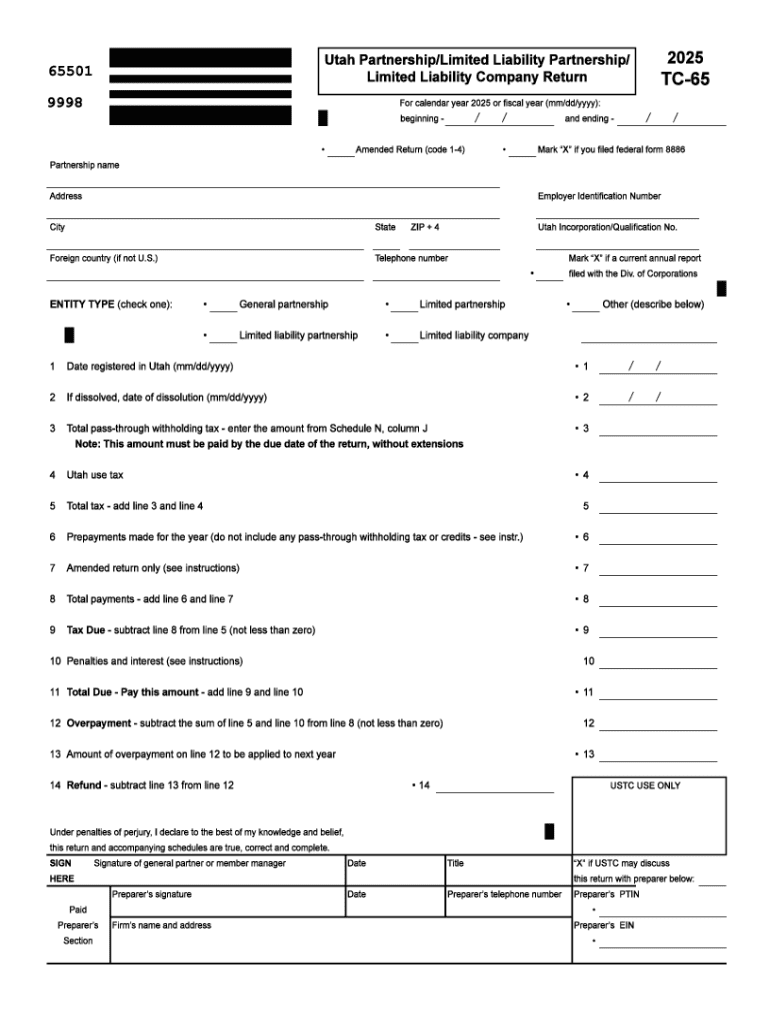

Get the free TC-65, Utah Partnership/LLP/LLC Return

Get, Create, Make and Sign tc-65 utah partnershipllpllc return

Editing tc-65 utah partnershipllpllc return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tc-65 utah partnershipllpllc return

How to fill out tc-65 utah partnershipllpllc return

Who needs tc-65 utah partnershipllpllc return?

Understanding TC-65 Utah Partnership Return Form

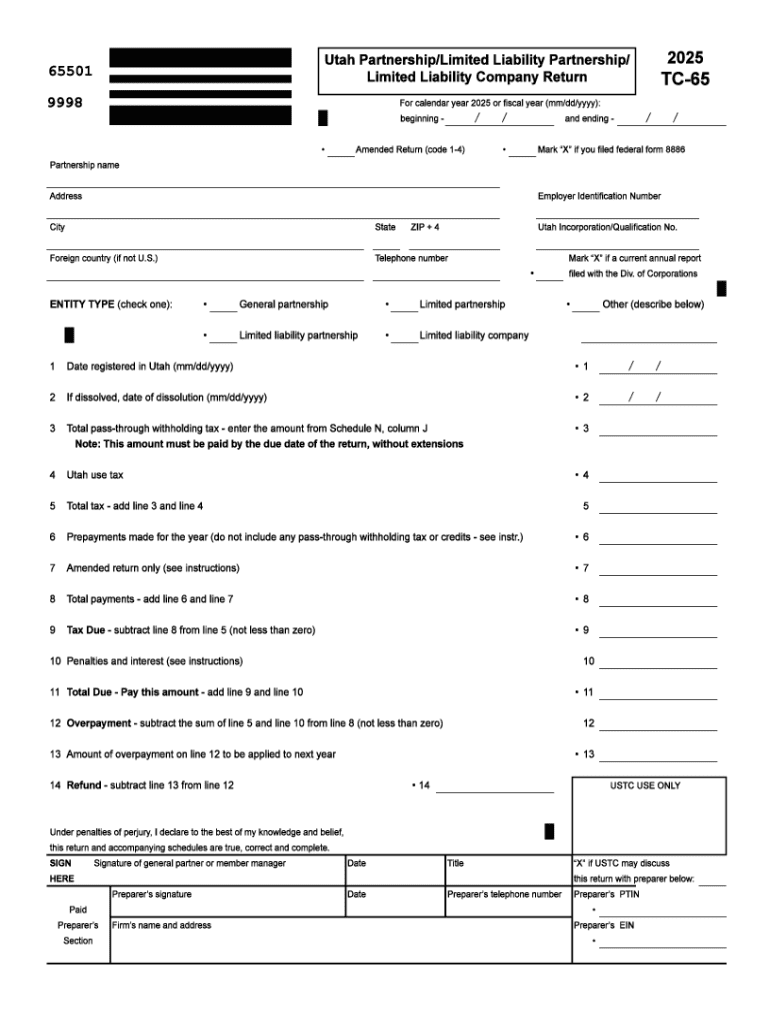

Overview of form TC-65

The TC-65 form is a crucial document for partnerships and LLCs operating in Utah, as it serves as the official return for income tax purposes. This form enables partnerships and limited liability companies (LLCs) to report their income, deductions, and tax obligations effectively to the state. Filing the TC-65 ensures compliance with Utah tax laws and provides a transparent account of the entity's financial activities for the tax year.

The importance of the TC-65 cannot be overstated, as it is not just a legal obligation but also a reflection of the entity’s financial health. For many partnerships and LLCs, accurate reporting through this form can influence future financing, investment opportunities, and business decisions.

Who needs to file TC-65?

The eligibility to file the TC-65 is typically designated for partnerships and LLCs that generate taxable income within Utah. This can include a variety of entities ranging from small businesses to larger partnerships. Generally, if your partnership or LLC conducts regular business activities and earns income in Utah, you are required to submit this return.

Step-by-step instructions for completing TC-65

Completing the TC-65 form can seem daunting at first, but breaking it down into sections can simplify the process. The form usually consists of three main sections: Basic Information, Income and Deductions, and Tax Calculation.

Section 1: Basic Information

The first section requires essential information about the partnership or LLC. This includes the legal name of the entity, its Federal Employer Identification Number (FEIN), and the complete business address with contact details. Filling this information accurately is crucial as it distinguishes your entity in the state’s records.

Section 2: Income and deductions

In this section, you will report the total income your partnership or LLC generated during the tax year. It's essential to include all relevant income sources, including sales revenue, interest payments, and dividends. Common types of deductible expenses also need to be accounted for, such as operational costs, employee wages, and office supplies.

Section 3: Tax calculation

This section is critical as it calculates the tax owed by the partnership or LLC. The applicable tax rates may vary, so it’s essential to refer to the latest tax rate schedule provided by the Utah state tax authority. Accuracy is vital to ensure that you pay the correct amount and avoid any penalties.

Filing procedures

Once you complete the TC-65 form, you will need to submit it to the Utah state tax authority. There are a couple of submission methods available. First, for convenience, online submission via the Utah state tax website is available, making it easy to ensure your form is filed on time. Alternatively, businesses can opt for the traditional paper submission process by mailing the completed form to the designated tax office.

Filing deadlines

It is important to keep track of the filing deadlines to avoid penalties. Generally, the TC-65 form is due on the 15th day of the fourth month after the end of your entity’s tax year. Late filings can incur penalties, and interest may apply to any unpaid taxes.

Confirmation of receipt

To ensure that your TC-65 form was received by the state, you can utilize the confirmation features available during online submission, or you may request a confirmation receipt if filing by mail. Keeping a copy of your submitted form and any confirmation documents is advisable for your records.

Frequently asked questions (FAQ)

What if can’t complete the form on my own?

If completing the TC-65 form feels overwhelming, consider hiring a tax professional who specializes in partnership or LLC tax filings. They can assist you in accurately completing the form and ensuring compliance with Utah tax laws.

How do estimated income taxes relate to the TC-65 filing?

Estimated income taxes are typically paid on a quarterly basis and relate directly to the anticipated income that will be reported on the TC-65. If a partnership or LLC has provided accurate estimates, this can help in measuring tax liabilities more efficiently.

What should do if made an error on my TC-65?

If you discover an error after filing your TC-65, it is crucial to amend the return as soon as possible. This can usually be done by filling out the amended form and clearly marking it as such before submitting it to the tax authority.

How to amend your TC-65 form if necessary?

To amend your TC-65 form, you will need to fill out a new TC-65, indicating the changes made and providing an explanation for the amendments. Be sure to submit it under the appropriate guidelines provided by the Utah state tax authority.

Resources for additional help

Several resources are available online, including detailed instructions from the Utah state tax website and tax professional directories, which can guide individuals and entities through the process of filing the TC-65 effectively.

Additional resources and tools

Managing documents like the TC-65 is made easier with modern tools. For example, utilizing platforms such as pdfFiller facilitates not just the completion but also the editing and signing of tax forms. These cloud-based solutions allow for dynamic document management, ensuring that businesses can collaborate seamlessly regardless of physical location.

Interactive tools for document management

An interactive tool like pdfFiller enables users to manage their documents efficiently, editing PDFs, eSigning, and collaborating with team members all within the same platform. This approach saves time and minimizes errors in document handling.

Linked topics

There are various tax obligations that partnerships and LLCs in Utah must adhere to. Understanding the differences between the TC-65 and other tax forms, such as the TC-20 for corporations, is essential to ensure comprehensive compliance.

Related documents

For comprehensive tax filing, it’s vital to familiarize yourself with other forms necessary for partnerships and LLCs. This includes forms for estimated taxes and any requisite licenses. Access to downloadable forms and detailed instructions can often be found directly on the state tax authority's website.

Final remarks

Utilizing tools like pdfFiller enhances the managing of the TC-65 and related documents. The platform’s cloud-based nature allows for seamless collaboration, secure storage, and easy access from any location, all of which are essential for busy professionals managing their partnerships or LLCs.

In conclusion, understanding the TC-65 Utah Partnership LLC Return Form is critical for tax compliance and maximizing your business's potential. By leveraging digital tools for the tax filing process, businesses can streamline their operations, improving accuracy and efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tc-65 utah partnershipllpllc return directly from Gmail?

How do I make edits in tc-65 utah partnershipllpllc return without leaving Chrome?

How do I complete tc-65 utah partnershipllpllc return on an Android device?

What is tc-65 utah partnershipllpllc return?

Who is required to file tc-65 utah partnershipllpllc return?

How to fill out tc-65 utah partnershipllpllc return?

What is the purpose of tc-65 utah partnershipllpllc return?

What information must be reported on tc-65 utah partnershipllpllc return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.